[ad_1]

Market Week Ahead: Gold Pops, US Dollar Drops, GBP/USD and EIR/USD Rally

For all market-moving economic data and events, see the DailyFX Calendar

Recommended by Nick Cawley

Building Confidence in Trading

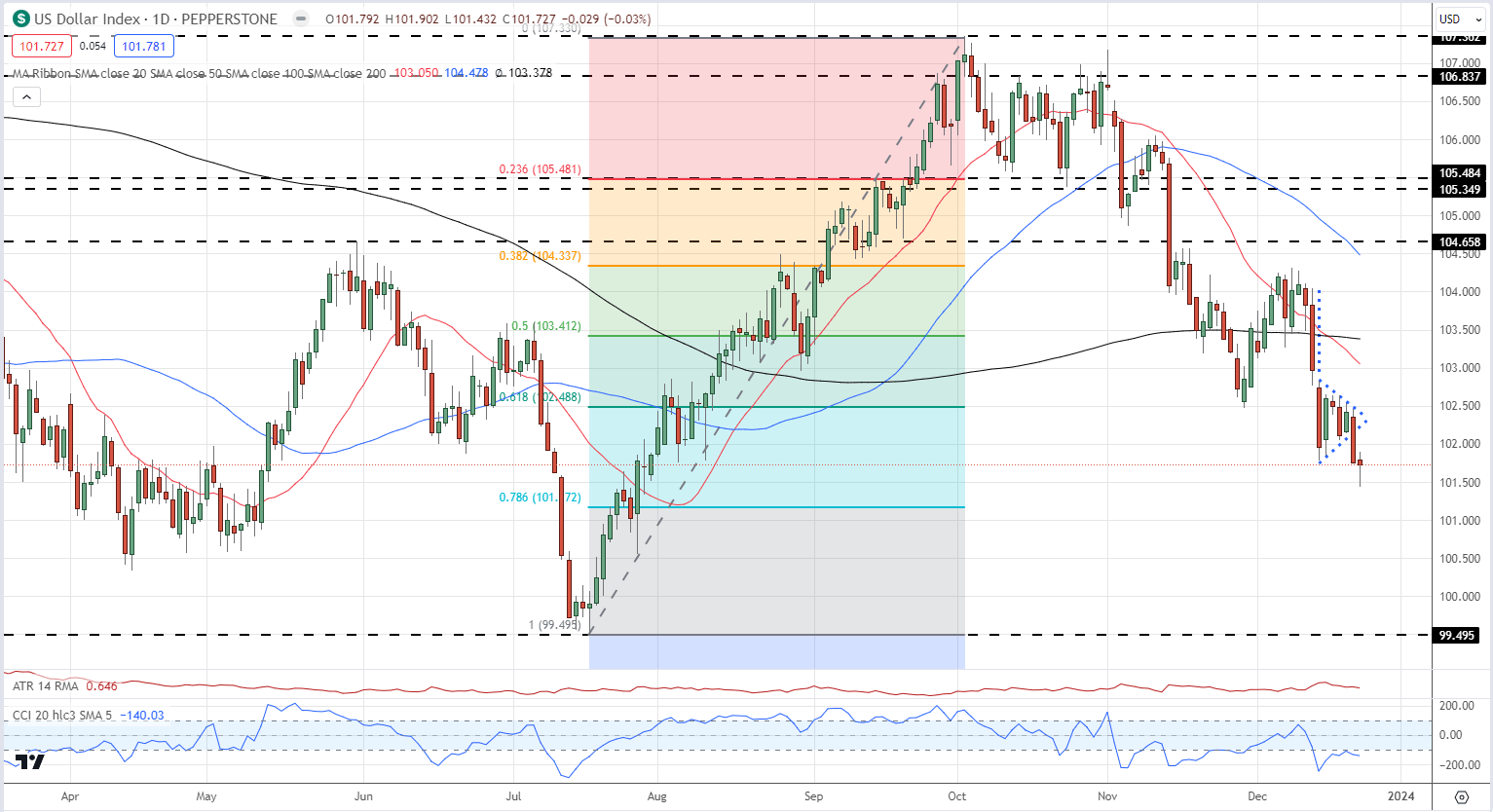

The US dollar continues its move as traders price in an aggressive series of rate cuts next year. US Treasury yields are falling, leaving the US dollar at risk against a range of other currencies. Thursday’s US GDP figures missed expectations, as did Friday’s core PCE readings. Both of these releases underpinned the US dollar move lower.

US Q3 GDP Revised Lower Dragging the Dollar Index Along, Gold Rises

US PCE Price Index Declines Adding Further Pressure on the DXY as Gold Rises to $2,070/oz.

US Dollar Index with Bearish Pennant Formation

Gold picked up after both US data releases and touched $2,070/oz. on Friday before giving back some gains. A weaker US dollar and lower US Treasury yields boost gold’s allure and a fresh attempt at the December 4th spike high at $2,147/oz. is on the cards in early 2024.

Retail trader data shows 59.65% of traders are net-long with the ratio of traders long to short at 1.48 to 1.The number of traders net-long is 6.22% lower than yesterday and 1.59% higher than last week, while the number of traders net-short is 2.46% higher than yesterday and 5.68% higher than last week.

See what daily and weekly sentiment changes mean for gold’s outlook.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 0% | 0% |

| Weekly | -1% | 12% | 4% |

US equity markets continue to ride the risk-on move and ended Friday a fraction below recent multi-year highs. Sentiment remains positive in the equity space and a fresh push higher by arrange of indices is seen when trading return at the start of January.

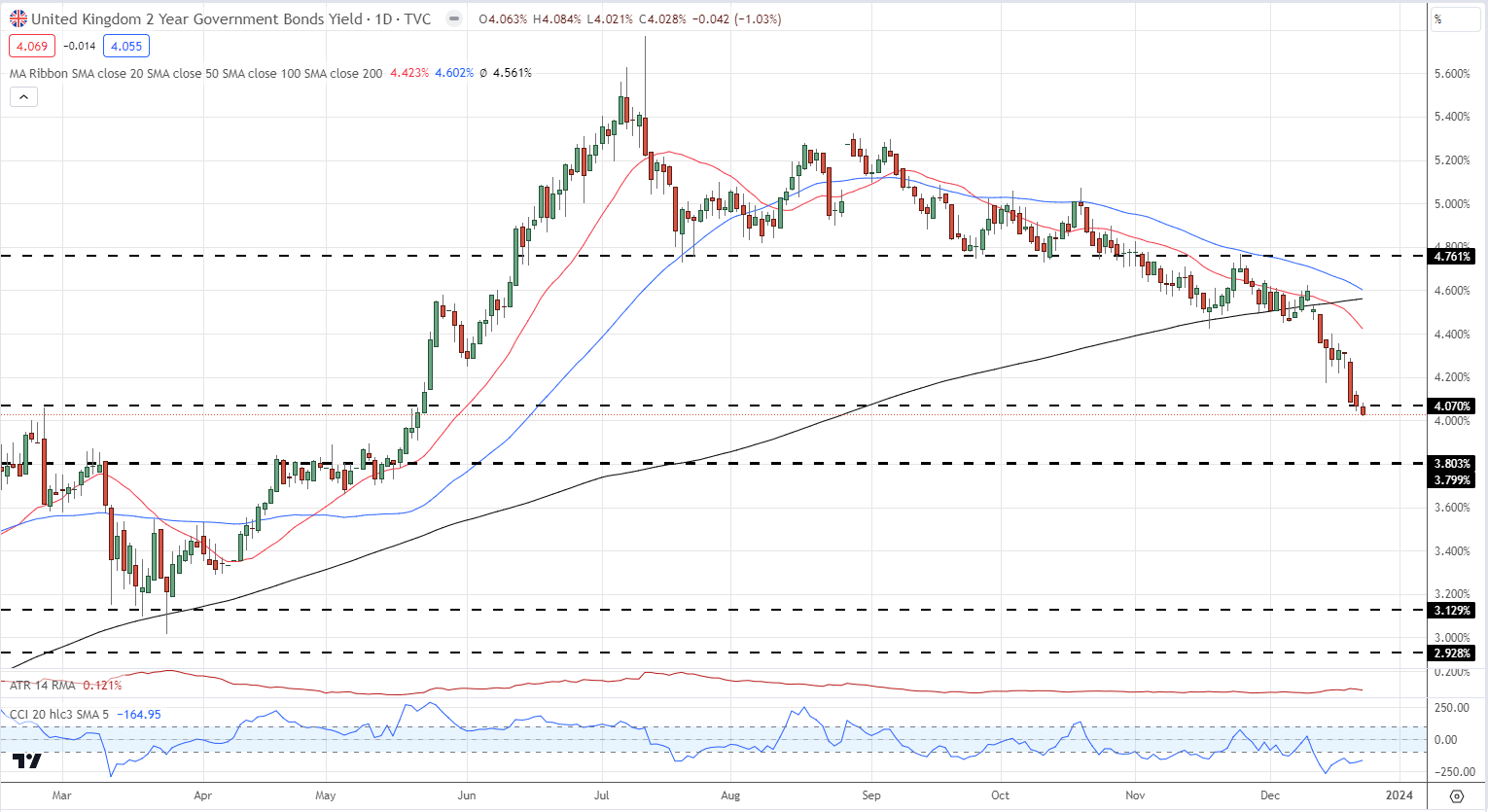

Chart of the Week – 2-Year Gilt Yields – Good News for UK Mortgages

Technical and Fundamental Forecasts – w/c December 25th

British Pound Forecast: GBP/USD Pushing Higher Despite Growing Rate Cut Calls

Global government bond yields are competing in a race to the bottom as central bankers prime the markets for a series of interest rate cuts in 2024.

Euro Weekly Forecast: EUR/USD, EUR/JPY Face a Slow Week in the Absence of Data and Thin Liquidity

EUR/USD breached the psychological 1.1000 level before the weekend, but thoughts of further gains may not materialize until the New Year is in swing.

Gold Weekly Forecast: XAU/USD Propelled by Softer US Inflation Outlook

Gold prices extend their upside rally ahead of the last trading week of 2023 which isn’t expected to provide too much in terms of volatility. XAU/USD looks to hold above $2050.

US Dollar on Thin Ice, Setups on EUR/USD, USD/JPY, GBP/USD for Final Days of 2023

This article zooms in on the technical outlook for EUR/USD, USD/JPY, and GBP/USD, analyzing essential price thresholds to monitor in the final trading sessions of 2023.

Learn How to Trade Forex with DailyFX

Recommended by Nick Cawley

Forex for Beginners

All Articles Written by DailyFX Analysts and Strategists

[ad_2]