[ad_1]

GOLD ANALYSIS & OUTLOOK

- Markets respectful of Fed’s hawkish language, USD bid.

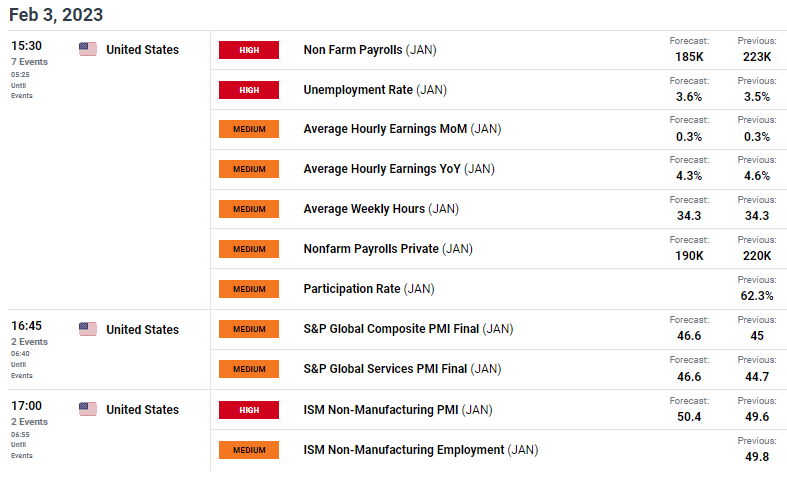

- NFP and ISM Non-Manufacturing data in focus later today.

- XAU/USD daily close key for near term directional bias.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Gold prices fell yesterday after the U.S. dollar rebounded post-ECB and stronger than expected initial jobless claims data. The jobs market is becoming increasingly more important to the overall Federal Reserve picture as inflation continues to soften. The robust employment numbers play a role in bolstering hawkish support. From an ECB perspective (EUR being a large component of the Dollar Index), markets did not get behind the euro leaving the greenback room to rally. Naturally, gold slipped but with key U.S. economic data ahead including Non-Farm Payroll (NFP) and ISM services data (see economic calendar below), short-term price action is dependent on the outcomes of the data.

After a strong jobless claims report, markets will look to NFP numbers in support which could further extend dollar upside and thus lower gold prices. The same is true for ISM services (U.S. is primarily a services driven economy) data which fell into contractionary territory for the December period but is expected to move back into the expansionary zone once more.

Recommended by Warren Venketas

Get Your Free USD Forecast

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Real yields continue to consolidate with no real conviction in either direction which should keep gold prices relatively contained for now. The Fed’s guidance had some hawkish undercurrents earlier this week and may keep gold limited should this rhetoric be maintained (gold prices tends to decline with higher interest rates as this raises the opportunity cost of holding gold).

U.S. 10-YEAR TIPS (YIELD)

Source: Refinitiv

TECHNICAL ANALYSIS

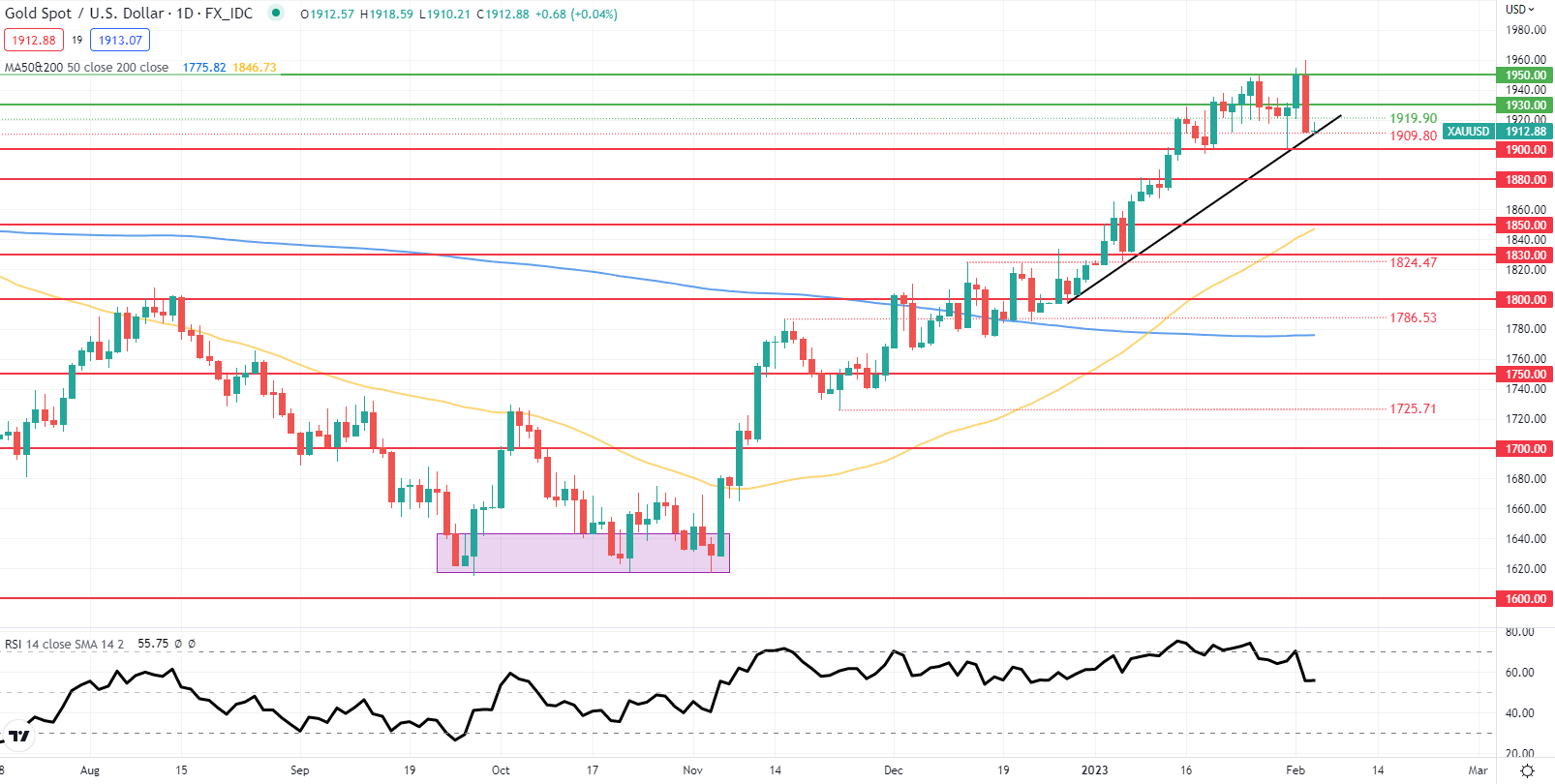

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily spot gold price action shows XAU/USD hovering around the medium-term trendline support (black) as well as the key area of confluence at 1909.80. A break below this support zone could fuel a leg lower towards 1900.00 psychological handle and beyond while a candle close above should keep gold upside trending.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 60% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]