[ad_1]

Gold Price (XAU/USD), Chart, and Analysis

- Central bank buying of gold is underpinning the move higher.

- A bullish ‘golden cross’ fuels sentiment further.

Recommended by Nick Cawley

Download our brand new Gold forecast

Most Read Gold Fundamental Price Outlook – XAU/USD Primed for the Next Leg Higher

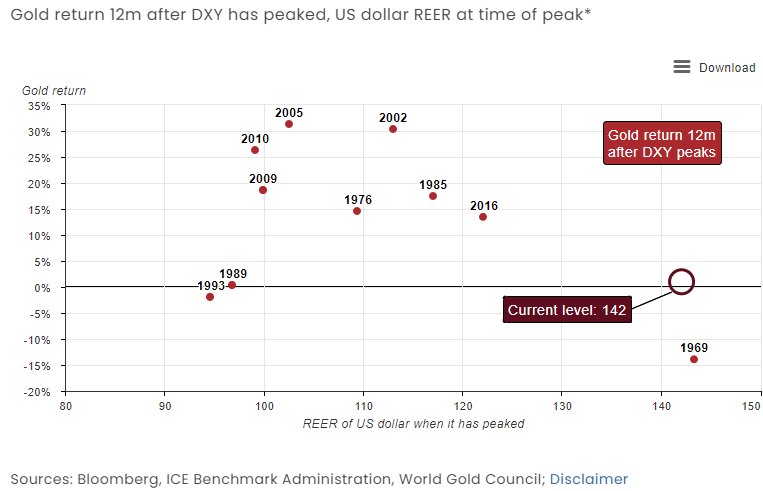

A recent report from the World Gold Council highlighted a weaker US dollar and heavy central bank buying of gold as drivers behind the recent move higher in the precious metal. Their 2023 Gold Outlook also highlighted how gold performs well during a recession with the precious metal ‘delivering positive returns in five out of the last seven recessions’. The report also emphasized gold’s positive performance 12 months after the US dollar (DXY) peaked, something that occurred in late September last year.

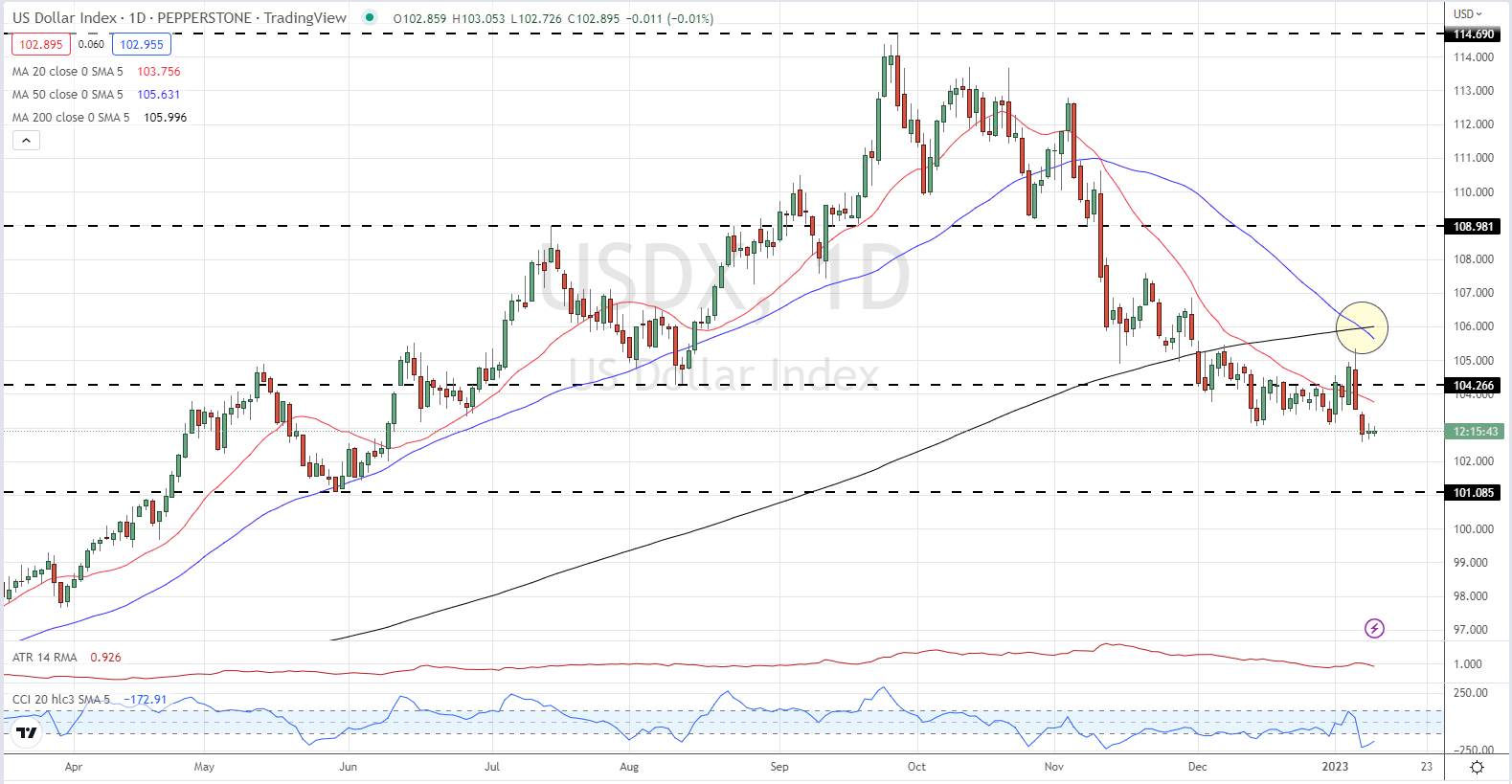

The daily DXY chart shows the topping out in late September 2022 and a more recent ‘death cross’ formation, a negative for the US dollar.

Moving Averages – A Complete Trader’s Guide

US Dollar Index (DXY) Daily Chart – January 11, 2023

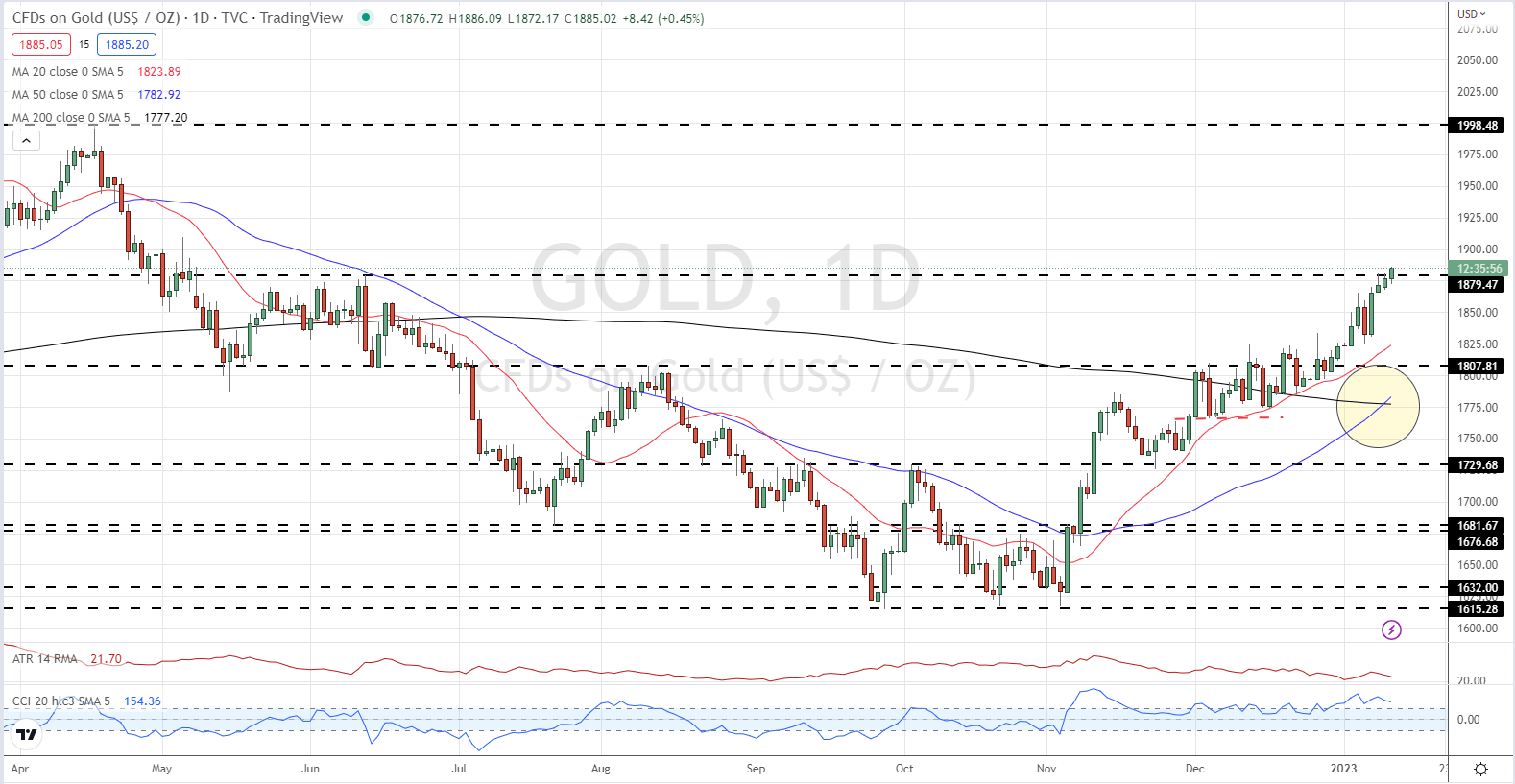

The daily gold chart remains positive and suggests further gains ahead. The multi-month level of resistance around $1,880/oz. has been broken, but not convincingly yet, while the recent formation of a ‘golden cross’ will boost bullish sentiment. Looking ahead, the next level of psychological resistance at $1,900/oz. will offer little in the way of a barrier for gold, leaving gold bulls looking at just under $2,000/oz. as their longer-term target.

Gold Daily Price Chart – January 11, 2023

Charts via TradingView

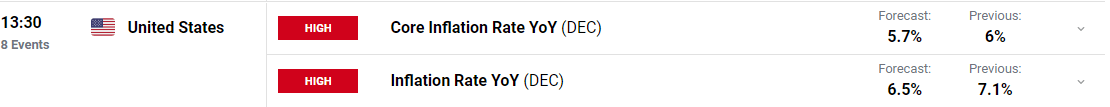

The latest US inflation data is released on Thursday and this report will be the driver of price action in the short term. Any beat or miss from the current market forecast will steer gold going into the weekend.

For all important economic data and events, see the real-time DailyFX Calendar.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -4% | 2% |

| Weekly | 6% | 15% | 9% |

Retail Trade Data is Mixed

Retail trader data show 59.68% of traders are net-long with the ratio of traders long to short at 1.48 to 1.The number of traders net-long is 4.06% higher than yesterday and 0.30% lower from last week, while the number of traders net-short is 0.40% lower than yesterday and 15.33% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]