[ad_1]

Gold Price (XAU/USD), Chart, and Analysis

- Gold moves lower as contagion fears recede.

- US Treasury yields move higher as market attention returns to inflation.

Recommended by Nick Cawley

How to Trade Gold

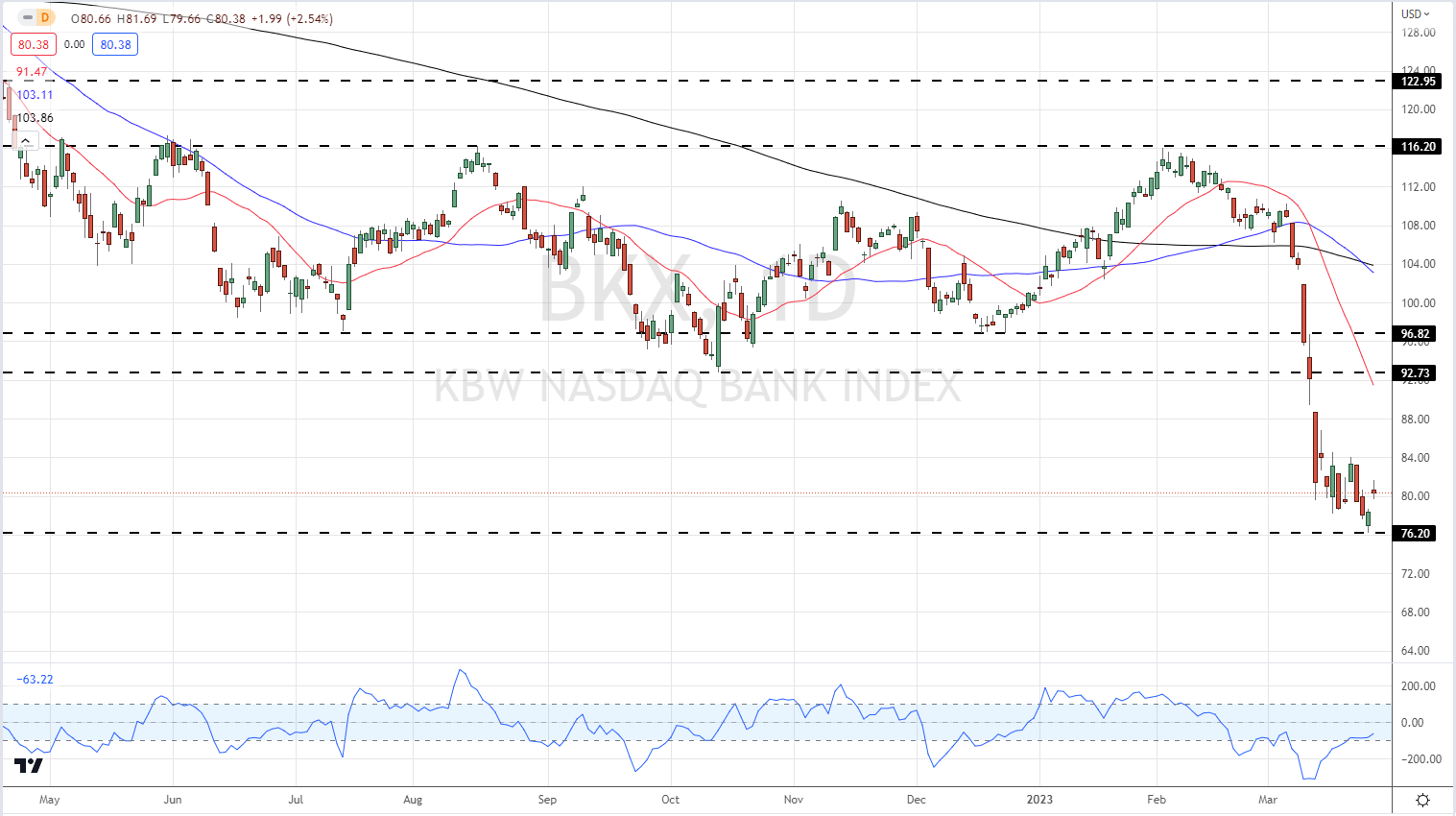

Risk markets are flat to marginally higher in quiet trade Tuesday as traders try and look past the recent banking turbulence. The First Citizen partial takeover of SVB over the weekend and the seemingly unlimited amounts of US dollar liquidity that have been made available have calmed markets and traders are now looking ahead to important US growth and inflation data later this week. While the banking sector has stabilized, the rebound is tepid, and the space as a whole continues to nurse sizeable losses since the sell-off accelerated earlier this month.

KBW US Bank Index (BKX) Daily Chart

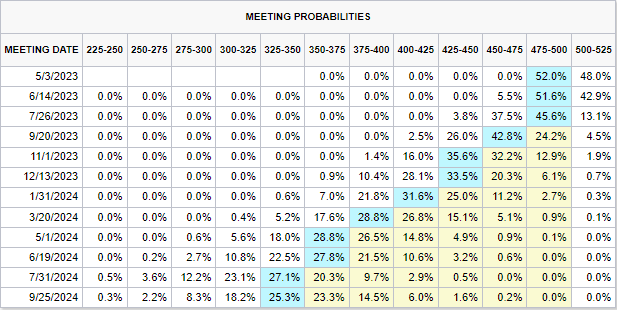

US Treasury yields have moved higher over the last few days after last week’s flight-to-safety saw US bond yields along the curve crumble. Current US rate probabilities are around 50/50 for one 25bp rate hike at the May meeting before a pause. Markets are now pricing in two 25bp US rate cuts by the end of the year and at least another four quarter-point cuts in 2024.

The latest look at US inflation – core PCE – will be released on Friday at 13:30 GMT. Core PCE y/y is expected to stay the same at 4.7%, while the month/month figure is forecast to fall to 0.4% from 0.6% in January.

For all market-moving data releases and events, see the DailyFX Economic Calendar

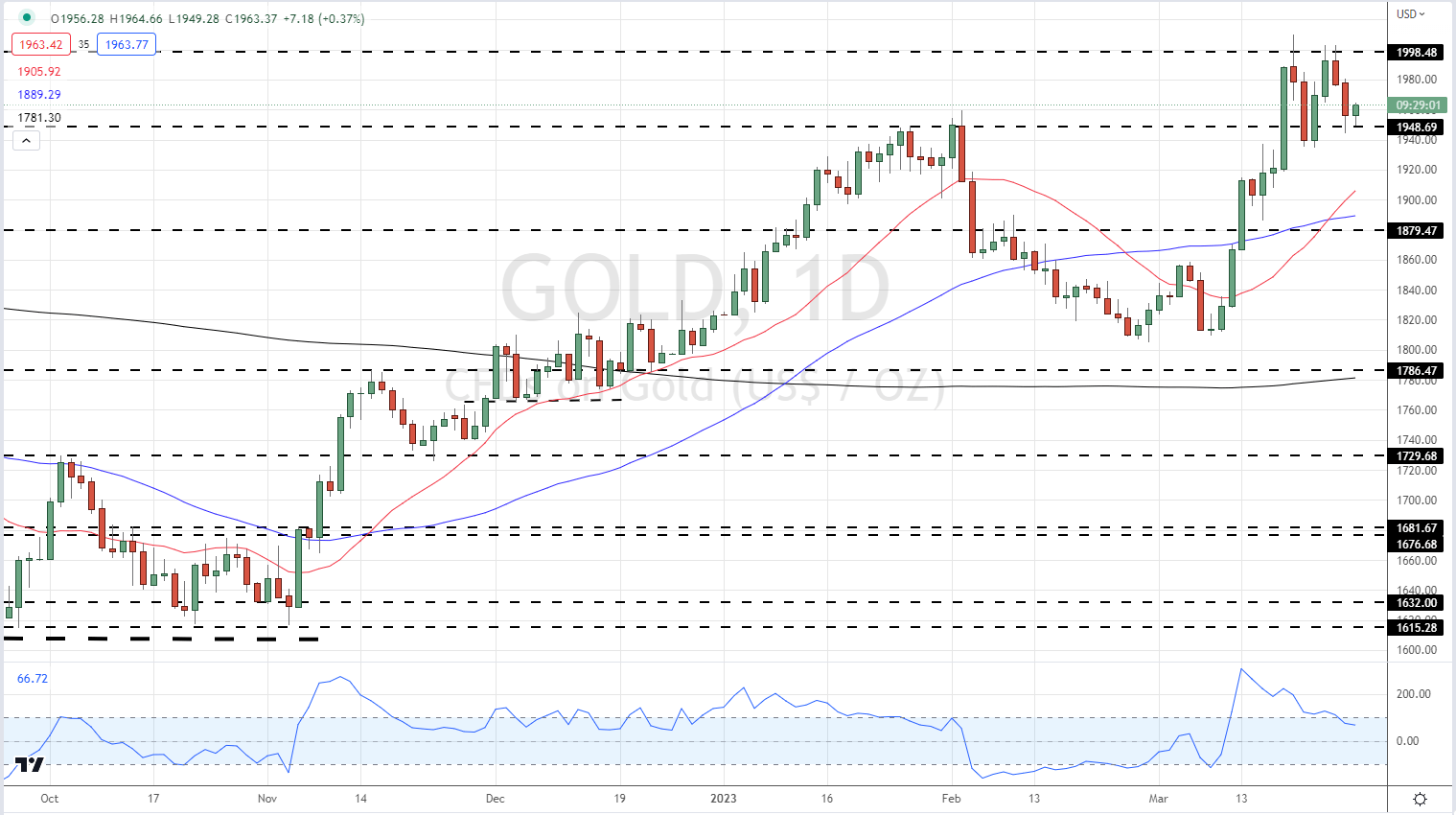

Gold is struggling against the current backdrop and is trading around the $1,960/oz. level. Support for the precious metal is seen at $1,948/oz. and then $1,935/oz. while resistance is seen on either side of $2,000/oz. before the recent one-year high at $2,010/oz.

Gold Price Daily Chart – March 28, 2023

All Charts via TradingView

Retail Traders Build Net-Longs

Retail trader data show 59.23% of traders are net-long with the ratio of traders long to short at 1.45 to 1.The number of traders net-long is 11.40% higher than yesterday and 13.82% higher from last week, while the number of traders net-short is 5.12% lower than yesterday and 9.47% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]