[ad_1]

Gold, XAU/USD, Fedspeak, Technical Analysis – Briefing:

- Gold prices extend losses during Friday APAC hours

- Hawkish Fedspeak continues pushing up bond yields

- XAU/USD remains biased lower from a technical view

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold prices were little changed by the end of Thursday’s trading session, but the yellow metal extend its recent losing streak during Friday’s Asia-Pacific trading session. The anti-fiat yellow metal is now on course to sink over 2 percent this week. In fact, the 5.25% drop so far in February is shaping up to be the worst month since June 2021.

This week in particular, prices have been wobbly since the aftermath of Tuesday’s US inflation report. For January, the country saw unexpectedly higher CPI data, opening the door to a still-hawkish Federal Reserve. The reason why this matters is that markets have been slowly unwinding expectations of a rate cut pivot towards the end of this year.

On Thursday, risk aversion struck Wall Street. It was revealed that two Fed policymakers, Loretta Mester and James Bullard – presidents of the Cleveland and St. Louis branches, respectively – were still open to another round of 50-basis point rate hikes. As a result, markets continued selling Treasury yields as bond prices dipped and yields rose. The 10-year rate has breached notable technical levels and faces resistance.

Heading into the remaining 24 hours, the economic docket notably dies down before the weekend starts. Federal Reserve Bank of Richmond President Thomas Barkin is making a speech at 13:30 GMT. If he reiterates similar hawkish rhetoric from other policymakers, gold could experience quite a volatility day as markets continue to align themselves with the reality the central bank is trying to project.

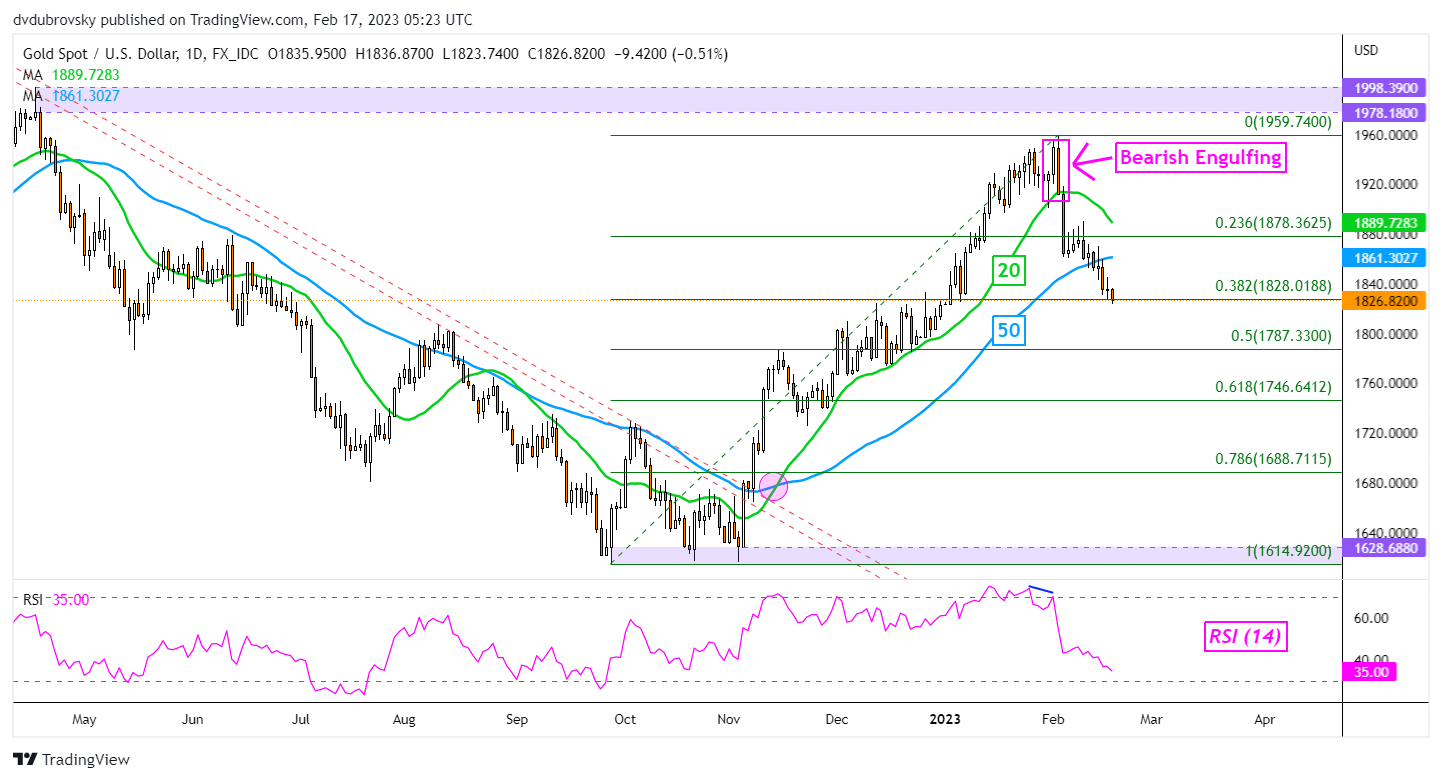

XAU/USD Daily Chart

XAU/USD continues to decline after confirming a breakout under the 20- and 50-day Simple Moving Averages (SMA). That is setting up prices for further losses as the 38.2% Fibonacci retracement level at 1828 is being tested. Falling under the latter exposes the midpoint at 1787. Otherwise, a turn higher has immediate support as the 50-day SMA.

Recommended by Daniel Dubrovsky

How to Trade Gold

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]