Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

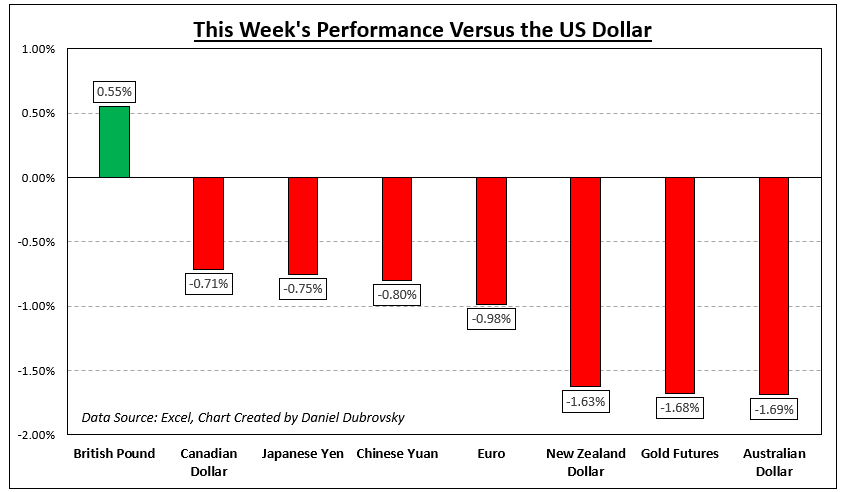

The US Dollar mostly outperformed its major counterparts this past week. Gold prices were particularly hit hard as Treasury yields on the longer-term spectrum soared. This was likely to due financial markets pricing in a higher terminal rate from the Federal Reserve amid still-solid economic data.

In fact, this dynamic also took its toll on equity markets which succumbed to volatility. Tech stocks were hit particularly badly with the Nasdaq 100 on course for the worst month since December, down over 7 percent this month so far. While the Dow Jones and S&P 500 also underperformed, they were not hit as hard.

A slowing China was another focus this week amid lackluster economic data which inherently caused the Yuan to depreciate further. In response, the People’s Bank of China had to step in to help cool the selloff. Meanwhile, Evergrande Group, a key local property giant, filed for U.S. bankruptcy amid a wobbly housing market.

Overall, this is leaving financial markets in a precarious state going into the new trading week. Key event risks from the US ahead include the Federal Reserve’s Jackson Hole Economic Policy Symposium where Chair Powell and ECB President Christine Lagarde will be speaking. What else will be in store for markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – Week of 8/14

Forecasts:

British Pound (GBP) Latest: GBP/USD Arm Wrestle Continues, Jackson Hole Nears

Sterling remains above 1.2700 despite ongoing US dollar strength, while EUR/GBP nears multi-week support. A central bank bonanza lies ahead next week at the Jackson Hole Symposium.

Euro Forecast: EUR/USD at the Mercy of the Dollar, EUR/JPY Pulls Back

The euro has taken a back seat amid scarce high importance data. In the coming week EU PMI data will help inform eurozone prospects after slightly better Q2 growth.

Japanese Yen Outlook: USD/JPY, GBP/JPY Remain Focused Higher as Resistance Breaks

The Japanese Yen continues to see little love from traders, with USD/JPY and GBP/JPY achieving notable upside breakouts last week. What are key levels to watch in the week ahead?

US Crude Oil Weekly Forecast: China, US Demand Worries To Weigh

Crude Oil prices have snapped a seven-week winning streak with investors now focused on the clear possibility of reduced energy demand, rather than the certainty of tightening supply.

US Dollar Forecast: Will Fed Chair Powell Inject Further Momentum at Jackson Hole?

The Dollar Index (DXY) continued its impressive run as risk-off sentiment, upbeat data and hawkish Fed minutes provided support. Will Jerome Powell inject further bullish momentum at Jackson Hole?

XAU/USD Price Forecast: Is the Tide Turning for Gold?

Gold prices looks to a big data week that includes the Jackson Hole Economic Symposium as XAU/USD bulls look to find some respite.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members