[ad_1]

KEY POINTS:

Recommended by Zain Vawda

Get Your Free Gold Forecast

MOST READ: USD Breaking News: Consumer Confidence Beats Estimates for December, DXY Edges Lower

Gold (XAU/USD) FUNDAMENTAL BACKDROP

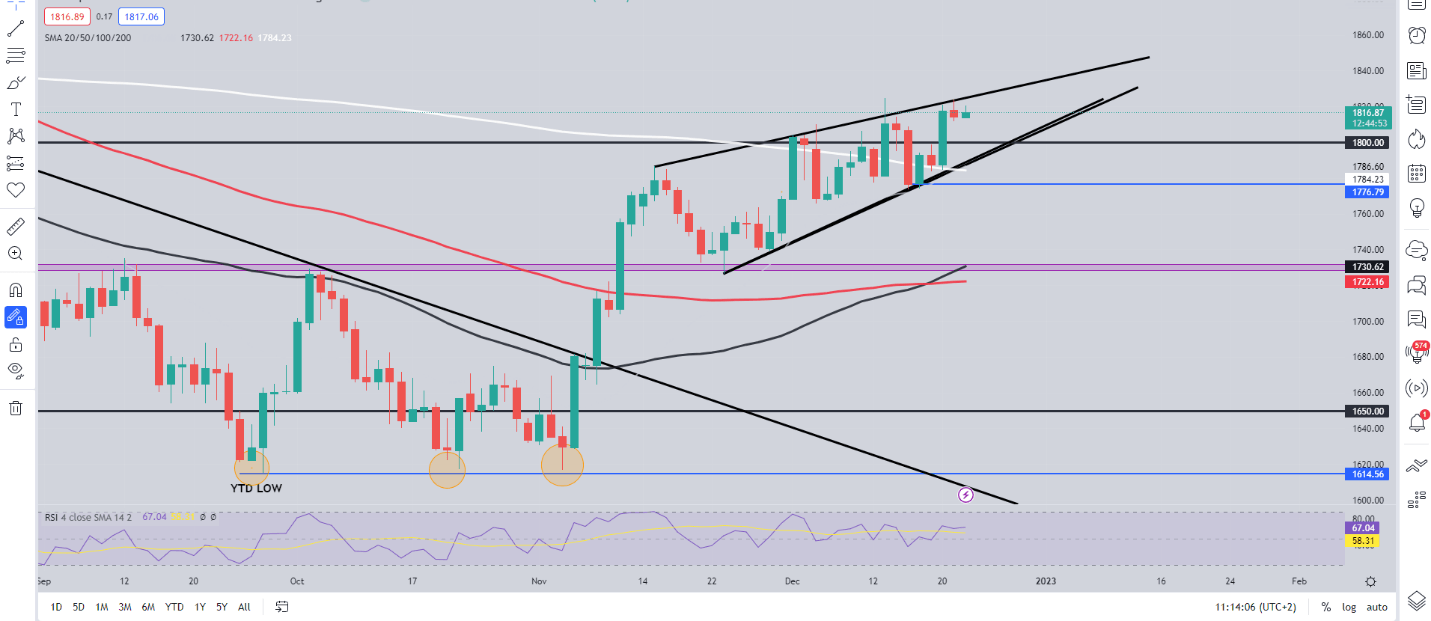

Gold has bounced this morning following yesterday’s decline from one-week highs. The precious metal remains within the wedge pattern formation which served as resistance while the US dollar index continued its decline.

The dollar index has continued its seasonal trend of losses in December as the greenback eyes a recovery in the new year. The greenback has been strong in January recording gains in each of the last 4 years. On Wednesday we saw the index attract some buyers near its weekly low as US CB consumer confidence beat estimates while a decrease in US existing home sales capped further gains. US Treasuries continue to retreat keeping gold prices supported and downside on the precious metal limited as markets digest the BoJ policy shift as well as China’s readiness for more stimulus.

Recommended by Zain Vawda

How to Trade Gold

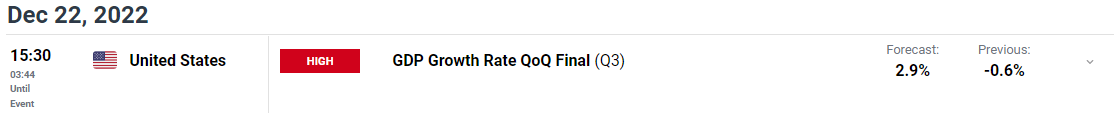

Gold looks on course to continue its grind higher for the rest of 2022 with the technicals lining up as well. We do have some data releases heading toward the new year with Michigan Consumer Sentiment, Final US GDP data and Core PCE (Fed’s preferred gauge of inflation) due out before the end of the week. Markets could experience a spike in volatility, but I do not believe any of these events will have a material impact on the gold price with bullish momentum continuing to build. My only question is whether gold bulls will be able to facilitate an upside breakout before the New Year? Given the US dollars performance in January (historically) we are likely to see a return of dollar bulls which could see the precious metal begin 2023 on the back foot.

For all market-moving economic releases and events, see the DailyFX Calendar

From a technical perspective, Gold printed a shooting star candle close yesterday off the top of the wedge channel hinting at further downside. Further supporting this narrative is recent price action, which failed to create a new higher high during Tuesday’s rally to the upside. Fundamental factors continue to support an upside break while continued consolidation above the $1800 mark will likely give bulls more confidence as well with the $1850 handle the next significant area of resistance.

Alternatively, a push lower from here will bring support at $1800 into play with a daily candle close below opening up a retest of the ascending trendline as well as the 200-day MA. Key days lie ahead for the gold, and it will no doubt be interesting to see if we will break higher or remain confined to the wedge pattern until the New Year.

Gold (XAU/USD) Daily Chart – December 22, 2022

Source: TradingView

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on XAU/USD, with 65% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment and the fact that traders are LONG suggests that XAU/USD may fall.

Discover what kind of forex trader you are

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]