[ad_1]

The markets and assets that do well when price growth is cowed might not be such great investments when it is more vigorous.

- Long-term inflation forecasts are elevated by recent standards, but they remain historically low

- All the same, some neglected assets are likely to see renewed focus

- And those long-term forecasts may be a little hopeful anyway

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Inflation is back. After decades of such docility that some declared it dead for good, prices are up everywhere, crushing consumers and ruining politicians’ days (good luck getting anyone to vote for you when their cost of living spirals upward).

The reasons for its return are many. Covid put the global economic brakes on and smashed complex world-spanning supply chains that kept goods cheap. They’ve yet to be put together and, indeed, probably won’t return in their pre-virus forms. Many, inured to globalization, wondered as they stared out of their locked-down windows whether the process had gone too far. Perhaps dependency on others for, say, critical medicine, had its drawbacks. Perhaps paying a little more for domestic capacity made more sense. And if that’s true for medicine, what about other essentials? Well, you get the picture.

Russia’s assault on Ukraine only sharpened inflation’s claws, as well it might have, given the former’s prominence in energy supply and the latter’s key position as agricultural exporter. And, as prices rose, pay claims began to follow them and, well, here we are, with inflation still hugely above previous norms all over the world.

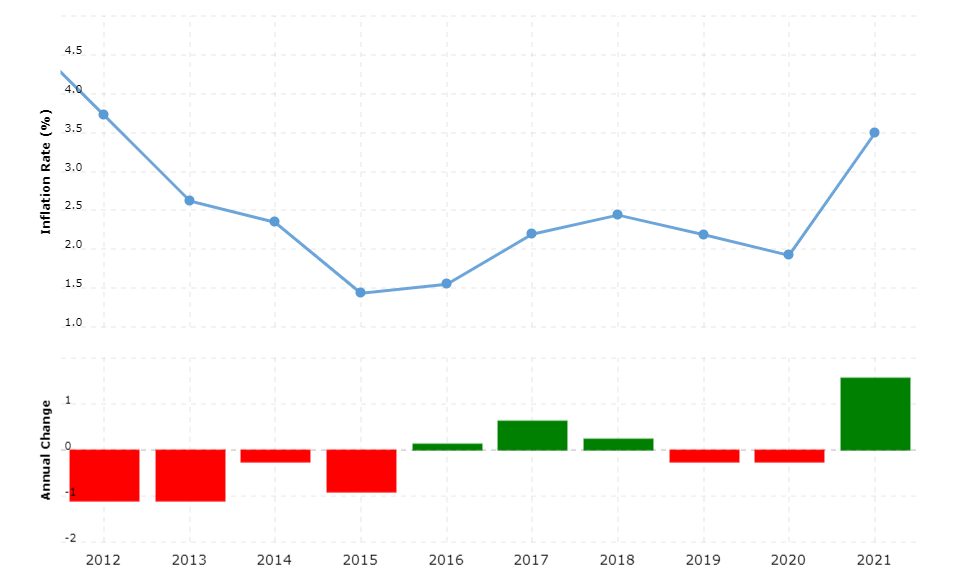

World Inflation Rate (%)

Source: World Bank, Macrotrends

2% Inflation Remains the Broad Target

Of course, the monetary authorities mandated to fight it haven’t been idle. The United States Federal Reserve has been raising interest rates steadily since early 2022, having previously left them entirely alone for nearly two years. US borrowing costs are at their highest since 2007, and look set to rise further. Other central banks have been taking similar action.

However, getting annualized inflation back into the ‘2% or so’ box targeted by central bankers is going to be tough. And it looks like it’s going to take a major and prolonged monetary tightening to do it.

The world hasn’t been used to that for decades. A more inflationary environment will change investment and trading patterns.

At the most basic and obvious level, assets offering explicit inflation protection have as you would expect come back into vogue. Bonds whose payout is guaranteed to be a set amount above the national inflation level are now eagerly sought again. Think, Treasury Inflation Protected Securities (TIPS) in the US, index-linked gilts in the United Kingdom, and so on.

Commodity markets also tend to gain (oil is a notable outperformer in inflationary times according to a study last year by Wells Fargo), as they increase in price along with the finished goods such raw material inputs are used to make.

Holding cash was a favored pre-occupation of corporations and investors in the low-inflation era. That makes far less sense now that rising prices are eroding the spending power of that cash at a much higher rate, month by month.

We can expect to see an increased appetite for other, real assets, from real estate and land through to fine art and wines. Anything but cash, essentially.

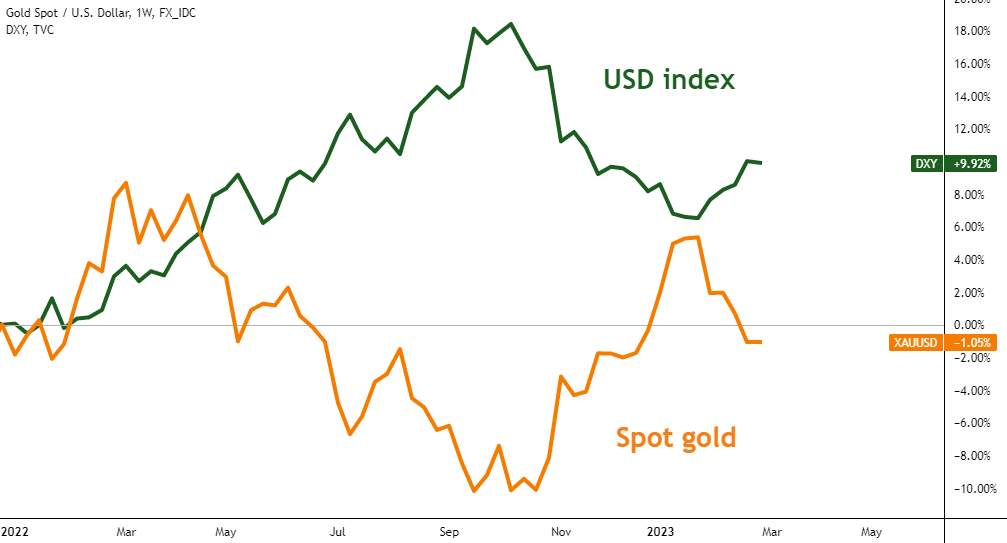

Spot Gold vs. US Dollar Index – 2022 to Date (% Change)

Source: TradingView

Can Gold Really Help?

Gold is often touted as a fine inflation hedge, but it pays to be cautious with the oldest asset of them all. Gold famously yields nothing, and you’d certainly have been better off holding US Dollars last year, despite inflation. As price rises spiked, investors moved out of gold and into US assets seeking the higher returns sure to come with higher interest rates.

Gold certainly has a role in an inflation-hedging portfolio, and the widespread belief that it is an effective hedge usually sees it do well when prices rise.

On the stocks front, consumer staples and real estate tend to be favored, as they’re likely to see demand hold up even if prices do rise. The luxury goods sector tends to fade out as consumers focus on the essentials.

Inflation trading is subtly different from inflation investing of course. Inflation investors may well opt to hold physical gold if they fear buoyant price growth, for example, whereas inflation traders are much more likely to take positions in gold derivatives and gold indexes to take advantage of an expected increase in physical demand. An inflation trade will generally be one aimed at profiting from future price rises. Bets on a rising US Dollar against other currencies are also likely parts of an inflation trade.

It’s important for traders and investors to keep inflation in perspective, however. It may be rampant now, but central bank mandates to get it down remain in place, and long-term forecasts for US inflation tend to settle around the 2-2.5% mark. That might be higher than we’ve been used to, perhaps, but by historical standards it’s still very low. For as long as this thesis can be defended, investments are likely to be tweaked, rather than ripped apart wholesale.

Recommended by David Cottle

How to Trade Gold

Will Inflation Roll Over?

The trouble is that, for now inflation remains significantly above that point in the US. At 6.4% in January, it’s still alarmingly close to forty-year highs, despite all those rate hikes. And the US authorities are doing comparatively well in the inflation fight. Eurozone prices were rising by 9.2% in the most recent data. In the UK it’s 10.5%. Of course, there is a time lag between interest rates rising and prices coming back into line.

But what will make matters more interesting is if inflation fails to behave itself as markets now, perhaps wishfully, think that it will. There’s also a broad consensus that, although the higher interest rates needed to fight inflation will be painful to debt-sodden economies used to very low borrowing costs, any recessions they bring will be mild. If the data don’t behave as expected, and rates keep rising, expect to see inflation come more and more into vogue.

Watch the monthly data round very closely.

— by David Cottle for DailyFX

[ad_2]