[ad_1]

Inflation, Deflation, Monetary Policy, Ukraine, Covid—Talking Points

- Inflation has returned as a significant economic headwind after decades of docility

- This is a huge turnaround from the days when deflation was the major worry

- Both are crippling, especially if they become entrenched

Recommended by David Cottle

Top Trading Lessons

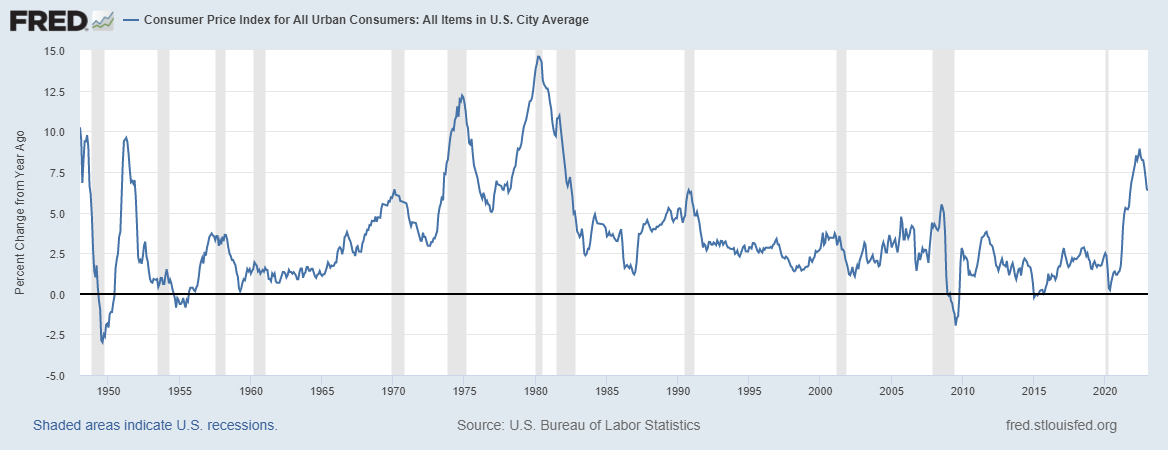

Elusive for decades, inflation is now hard to miss across the global economy. Percentage price rises run to double digits in Europe. Even where they are more restrained, in the United States, say, or Australia and New Zealand, official data regularly print multi-decade highs. Moreover, they come in at multiples of what most investors used to think the norm.

The reasons behind this cost-of-living shock are threefold. First comes Russia’s invasion of Ukraine. Knock-on effects in regional food and energy markets largely account for Europe’s disproportionate inflation hit, but the effects can be seen worldwide.

Second comes Covid, and its ravaging of supply chains.

Last, and perhaps most durable, is a global rethink of supply security – a rollback of the globalization which characterized the last three decades. As countries opt for security of supply, rather than hunting down simple best value, prices rise.

The Death of Inflation Was Overstated

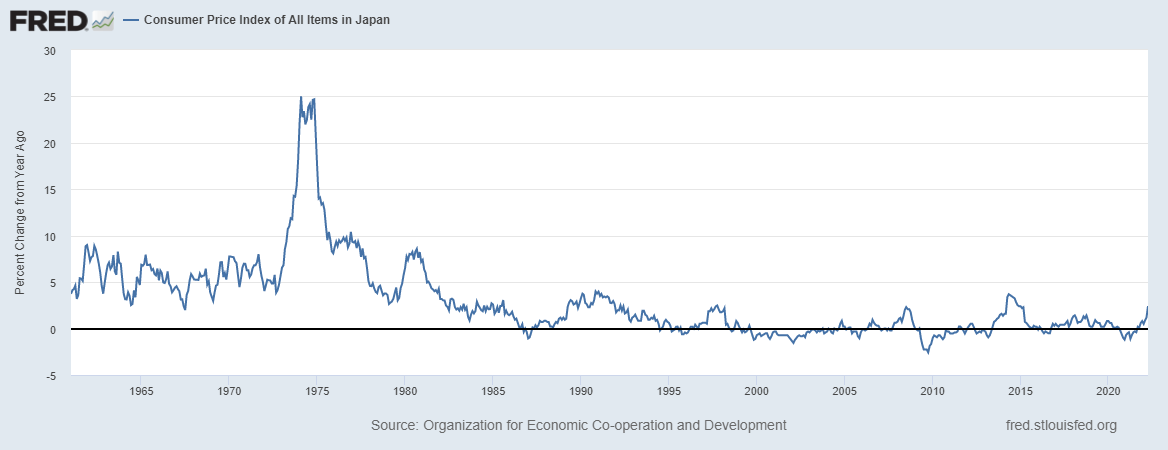

It is hard to believe from this viewpoint that, not so long ago, the prevailing belief in global markets was that inflation was dead and that the key priority was, rather, the avoidance of deflation – a battle that Japan in particular had been waging for years. And, by way of recap, the death of inflation was hardly a ridiculous belief. The official US consumer price index didn’t rise by more than 2.7% annualized between 2000 and 2021.

So maybe now is a pertinent time to take a look at both inflation and deflation and try to assess which is worse for an economy.

At first glance, it’s hard to see what’s wrong with deflation. We don’t usually mind very much when things we buy get cheaper, after all.

So, what’s not to like? Well, on the most basic level we may be delighted when what we buy costs less, but we’re not so fond of it when what we sell does too. General deflation hits the prices of both goods and services, leaving everyone worse off. After all, it’s very difficult to justify pay rises when the cost of living is heading south.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by David Cottle

But, to probe a little more deeply, deflation causes a much deeper malaise, one that sucks the fundamental life out of economies where it takes hold. If consumers and businesses think prices will keep heading lower, they’ll put off their spending and investment decisions. Why wouldn’t they? If they’re going to get a better bargain next year, why buy anything now?

This can lead to the sort of economic stagnation visible in Japan in the last couple of decades. It can also be extremely difficult to escape. Savers are increasingly penalized by the permanently low rates of interest needed to boost activity and stimulate some pricing power.

Continued deflation is fatal for an economy. If prices keep dropping and economic agents keep postponing decisions to spend, goods go unsold and workers are laid off. This in turn leads to a spiral of bad debts and weakening lenders. The banks in turn lend less, reinforcing the downward spiral of reduced liquidity and collapsing economic activity.

No wonder the authorities do their best to get pricing power back into the mix wherever deflation appears.

The problems caused by inflation are naturally far more obvious. Higher prices mean even basic necessities can be beyond the poorest in society. Even those further up the income ladder can start to struggle. Wage demands become more strident, which can lead to yet another vicious circle as producers are forced to increase prices once again to cover their own higher costs. Political stability can come under grave threat.

Inflation also eats away at the value of your money, whether it be your paycheck or your savings. If, as now, we face comparatively low interest rates and rising prices, the process accelerates as savings accounts fail to keep pace with the effects of rising prices.

Then There’s Hyperinflation…

Worst of all, unchecked inflation can lead to the ruinous phenomenon of ‘hyperinflation.’ This means prices run utterly out of control. They effectively double over spans of just a few hours in the most egregious historical cases, with annualized rate rises measured in hundreds of percent or more. Germany’s Weimer Republic of the 1920s is probably the most famous example but there have been more recent ones, notably Zimbabwe in 2008.

But inflation doesn’t have to enter ‘hyper’ territory to be a serious problem. Indeed, so difficult did rising prices prove in the post-war world that the entire framework of monetary policy was angled toward ensuring that it would remain restrained. The period between 1965 and 1982 became known as ‘the great inflation’ thanks to a toxic mix of easy money and at least two major oil-price shocks.

In the aftermath, central banks were given very modest inflation targets and empowered to use all the monetary tools at their disposal to hit them.

And, until recently, this worked extremely well. Moderate inflation, of the order of around 2% annually, was held to be the balance point. That means the level at which firms can raise prices over time without necessarily front-loading economic activity or forcing unworkable wage settlements on employers. This approach was so successful that it fostered the idea that inflation was beaten for good.

Wishful thinking that may have been, but the approach endures. Central bankers and investors alike hope that the factors behind current price rises will prove temporary and that a return to more modest, targeted inflation will be possible. In the range of pricing possibilities that’s clearly much the lesser evil.

–By David Cottle for DailyFX

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

[ad_2]