[ad_1]

USD/JPY, Nikkei News and Analysis

- Japanese officials consider all options amid evidence of currency speculation

- USD/JPY rises on dollar bid, nervously eying the psychological 150 mark

- Nikkei on track for fifth consecutive day of gains, bull flag provides optimism

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade USD/JPY

Japanese Officials consider all options Amid Currency Speculation

Japan’s top currency diplomat Masato Kanda provided the latest warning that Tokyo has seen evidence of undesirable moves in the FX market and maintains that such moves cannot be explained by fundamentals.

The well-known carry trade, which takes advantage of interest rate differentials of two currencies, has played out for some time now and markets still anticipate the probability of a final 25-bps hike from the Fed before bringing the rate hiking cycle to an end.

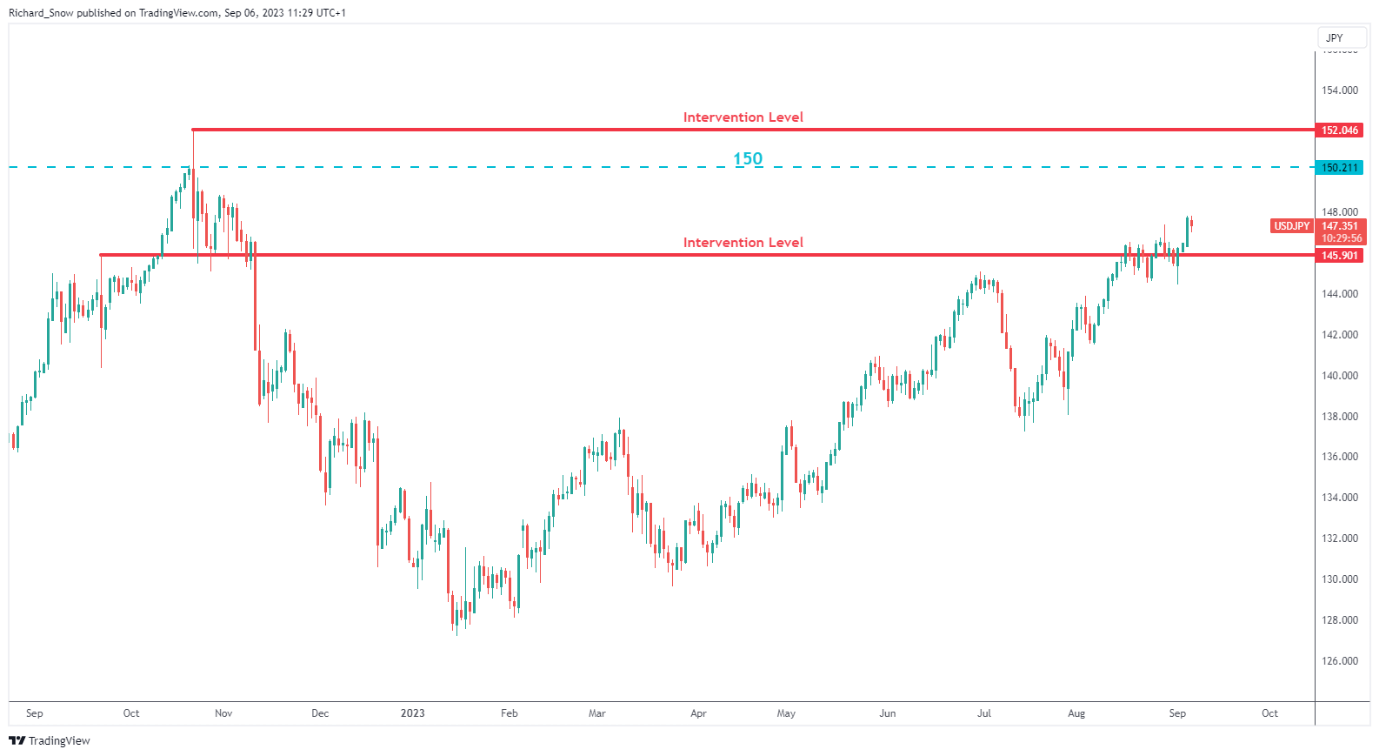

The warnings from Tokyo reveal a greater urgency and displeasure with recent moves, resulting in some looking to 150 as the line in the sand for USD/JPY. The pair has passed the first level of intervention experienced in 2022, with the second still a long way away – just under 152.

USD/JPY Daily Chart With Prior Intervention Levels

Source: TradingView, prepared by Richard Snow

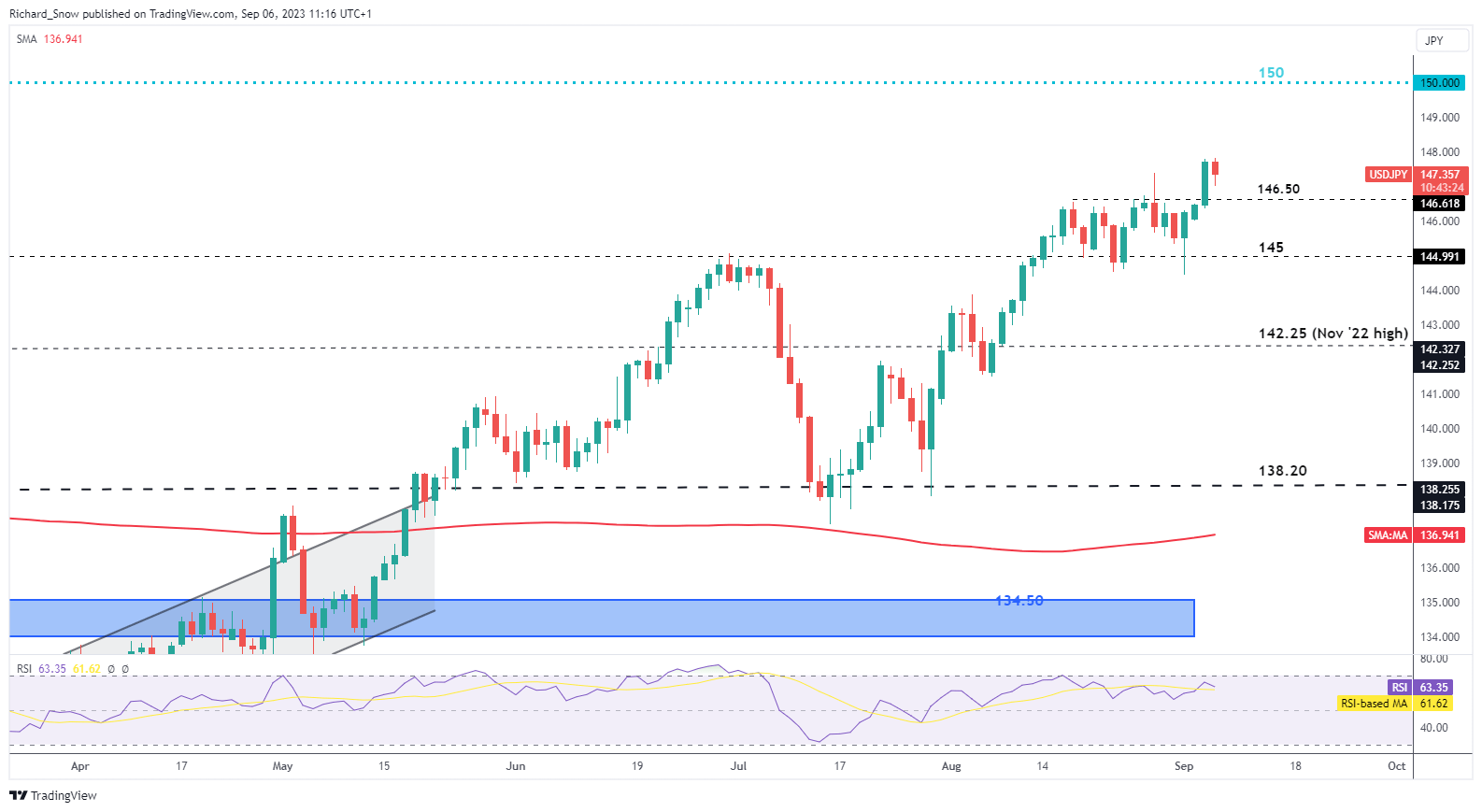

USD/JPY rises above the recent swing high, building on the longer-term bullish trend. 146.50 could come into play as the pair backs off from the high after intervention comments from Japanese officials.

US services PMI data later today may provide another bullish catalyst if the US economy continues to fire on all fronts however, last months PMI data revealed a dip in business activity, new orders and employment – which may cool US optimism after Q2 GDP figures had to be revised lower. Resistance remains at 150 with support back down at 146.50

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -12% | 7% | 2% |

| Weekly | -7% | 8% | 4% |

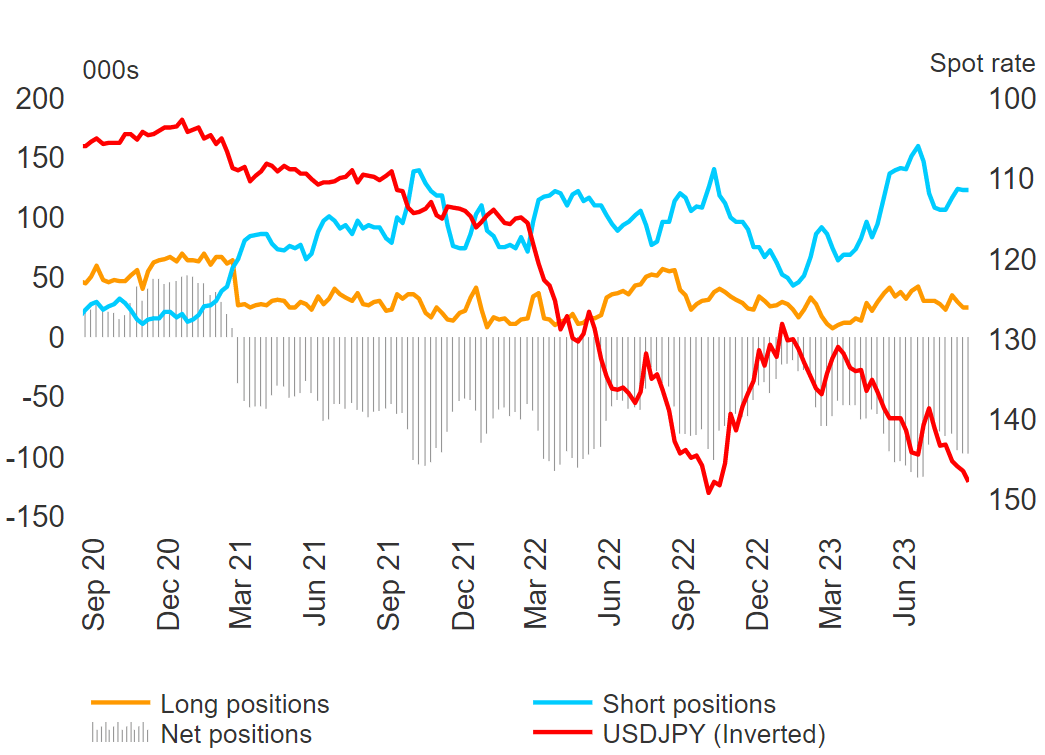

Speculative data from large speculators (hedge funds and money managers) continues to show the bearish view on the yen, as net longs outweigh net shorts by some margin. If the BoJ is to intervene under instruction by the Japanese Government, the gap is likely to narrow.

Yen data from the Commitment of Traders Report

Source: Refinitiv, prepared by Richard Snow

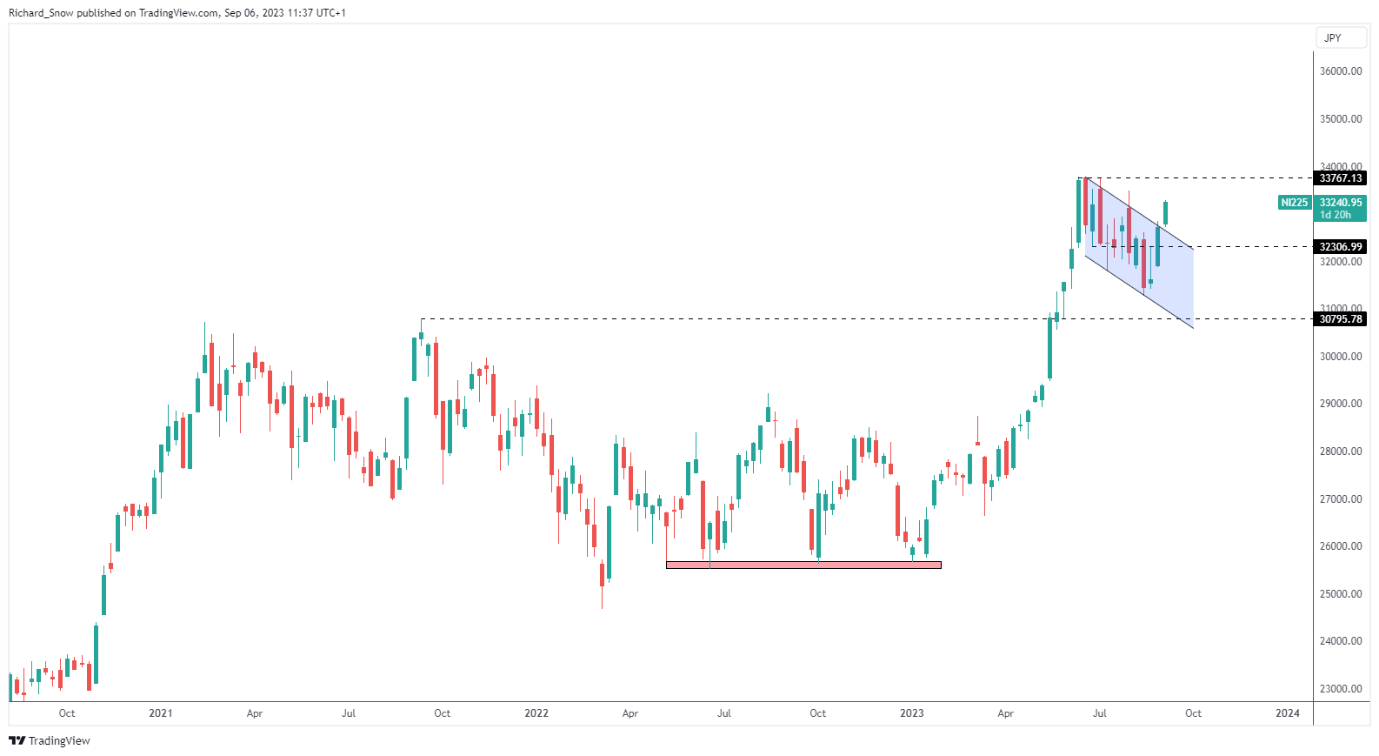

The yen depreciation benefits exporters, which has helped boost the value of Japan’s local stock exchange, the Nikkei. The Nikkei has shown resilience and remains one of the better performing indices of 2023 thus far. In addition, rising pay and inflation coupled with improved local consumption and signs of a shift away from a deeply entrenched deflationary mindset, are contributing to the rosy economic outlook.

Nikkei Weekly Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]