JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

- Yen Gets Temporaray Boost on Rumors of BoJ Increase in Inflationary Forecasts.

- BoJ Threats of Intervention are Starting to Become a Regular Occurrence. How Long Before it Loses its Shine?

- IG Client Sentiment Shows an Overwhelming Number of Traders are Currently Holding Short Positions.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Bitcoin Spikes to a High of $29900 on False ETF Approval News

USD/JPY, GBP/JPY FUNDAMENTAL BACKDROP

The Japanese Yen had a brief period of strength today which in typical fashion for 2023 failed to last. The Yen received a short-term boost on news that the BoJ may increase their inflation forecasts for 2023 and 2024 according to Bloomberg. The report stated the BoJ is expected to increase its 2023 forecast closer to 3% with the 2024 figure expected to be adjusted to 2% plus. The news was seen as a sign that the BoJ is growing in confidence that the wage growth targets the Central Bank has may be achieved sooner than expected.

Elevate your trading skills and gain a competitive edge. Get your hands on the Japanese Yen Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free JPY Forecast

The idea is the sooner the wage growth target is met the quicker we may see policy pivot toward normalization. Japan’s Top currency diplomat Masato Kanda has been in the news of late with comments around FX moves following comments over the past two weeks warning of the potential for imminent FX intervention. As we have discussed of late Japanese authorities appear to be using comments as a mild form of intervention without actually committing to full on FX intervention as we had in 2022. This does appear to be working as Yen pairs have remined rangebound of late.

The ongoing Geopolitical tensions may be helping as well given the historic safe haven appeal of the Japanese Yen something which Kanda himself stated remain intact. Moving forward now the question I am left with is how much longer will the threat of intervention deliver the desired results?

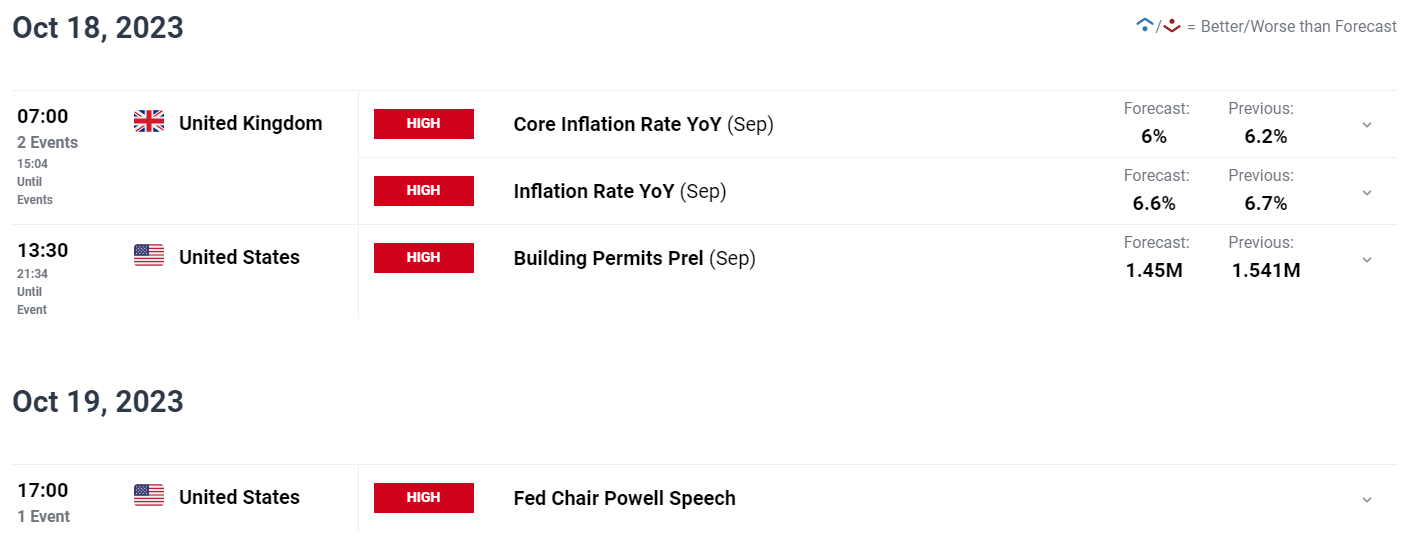

RISK EVENTS AHEAD

The economic calendar is not as packed as it has been of late and despite that we still do have a few economic data releases which could impact Yen pairs. US data in the form of building permits and a of course a host of Federal Reserve policymakers may stoke volatility where USDJPY is concerned. The UK inflation data this week could prove key for GBPJPY as the GBP has been struggling of late. Will the UK inflation print reignite some GBP buying pressure?

For all market-moving economic releases and events, see the DailyFX Calendar

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

PRICE ACTION AND POTENTIAL SETUPS

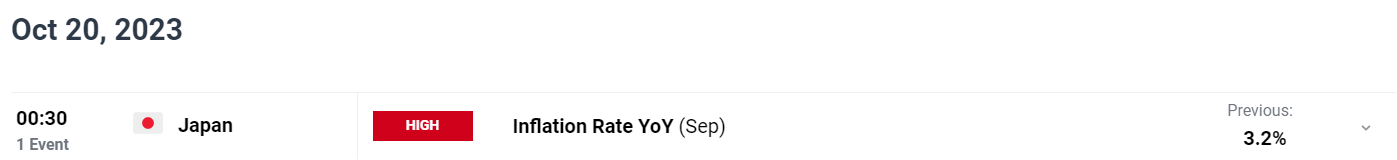

GBPJPY

GBPJPY remains choppy from a price action perspective with higher highs followed up by lower lows. Much like USDJPY both bulls and bears seem to lack conviction at this stage with the descending trendline growing more vulnerable with each retest.

As its stands and barring any intervention a break above the trendline is growing more and likely as the 100-day MA provides support to the downside. resting around the 181.774 mark.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

GBP/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

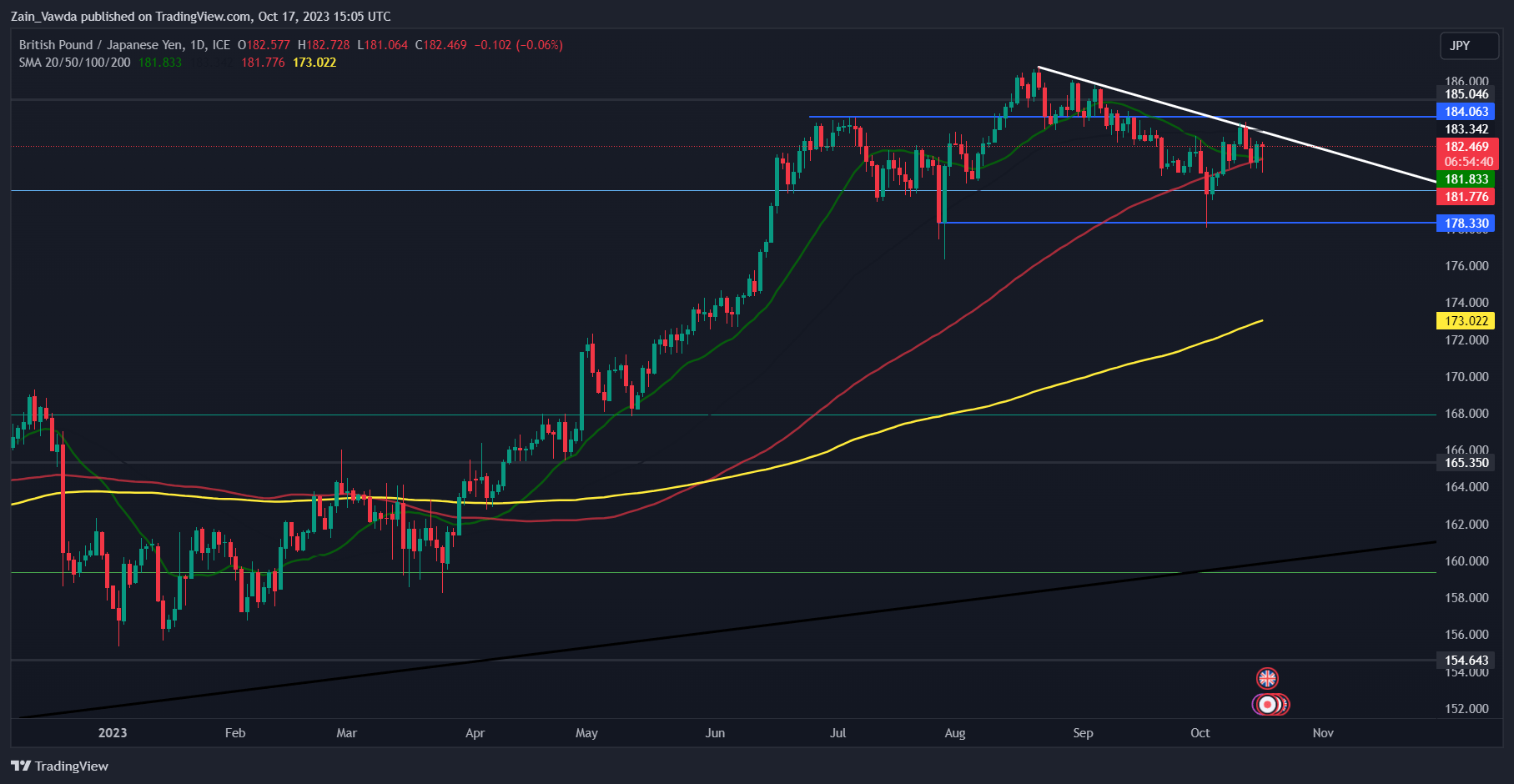

USDJPY

USDJPY from a technical perspective has not changed much over the past couple of weeks. Both bulls and bears failing to take control as the pair has settled into a period of consolidative price action trading in a 150-160 pip range, between the 148.30 and 149.90 areas.

A break on either side of the range however does not guarantee follow through as we have witnessed of late. This makes the current environment challenging and leaves range trading opportunities at the forefront for market participants at present. This seems to be the prevailing theory for most JPY pairs at this stage.

Key Levels to Keep an Eye On:

Support levels:

- 148.30

- 146.69 (50-day MA)

- 145.00

Resistance levels:

- 150.00 (Psychological level)

- 152.00 (2022 Highs)

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 85% net-short on USDJPY. Given the contrarian view adopted here at DailyFX, is USDJPY destined to rise above the 150.00 handle?

For tips and tricks regarding the use of client sentiment data, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -13% | 1% | -1% |

| Weekly | -17% | 8% | 3% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda