[ad_1]

Japanese Yen, USD/JPY, US Dollar, BoJ, China PMI, Crude Oil, Gold – Talking Points

- The Japanese Yen sustained support today as the US Dollar slides

- BoJ monetary policy has a way to go in catching up with global peers

- China is walking a Covid tightrope as markets weigh the possibilities

Recommended by Daniel McCarthy

Get Your Free JPY Forecast

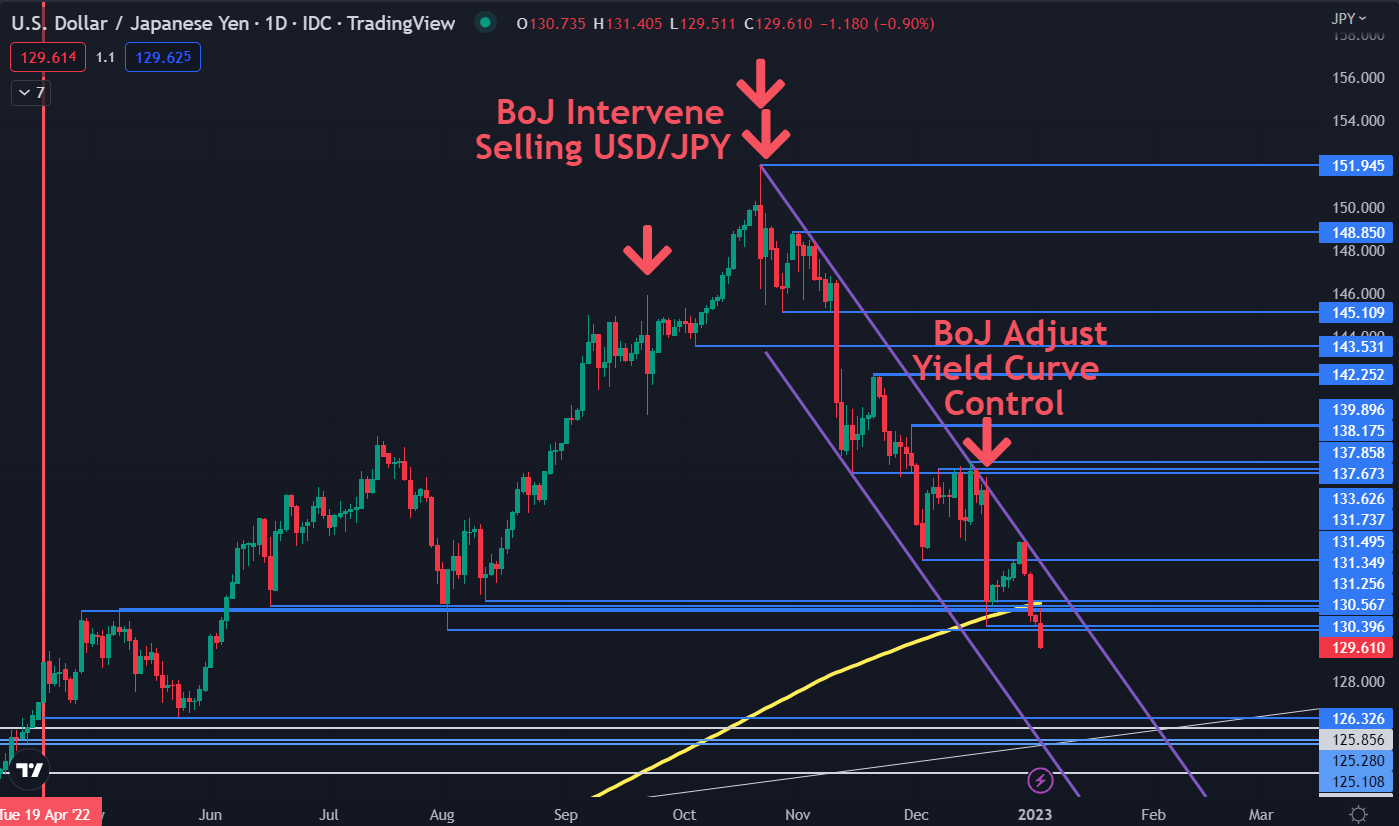

The Japanese Yen has continued to strengthen today with USD/JPY dipping below 130 for the first time since June last year.

The Bank of Japan’s pivot on policy in December has led to speculation of further potential tightening in 2023. Japan is on holiday today and the domestic reaction to the moves so far this week might be noteworthy.

The US Dollar is weaker against most other currencies, reversing Monday’s moves. US Treasury yields have had a mixed day across the curve with the backend from the 10-year note adding a few basis points but the mid part of the curve losing a few.

Over the weekend, IMF Director Kristalina Georgieva warned that a third of the world will face a recession this year, highlighting that the US China and EU are slowing simultaneously.

The market appears to be struggling with how to interpret China’s change of tack in dealing with Covid-19. On the one hand, it is anticipated to possibly free up the world’s second-largest economy and associated supply chains.

On the other hand, the potential for a rapid spread of the virus threatens to disrupt the economic recovery. President Xi Jinping acknowledged these challenges yesterday.

Chinese data remains soft with the Caixin manufacturing PMI released today coming in with a small miss. It was 49.0 for December, rather than 49.1 forecasts and 49.4 previously.

It comes on the back of a larger miss in yesterday’s official manufacturing PMI printing at 47.0 instead of 47.8 anticipated and 48.0 prior.

China has indicated a desire for better US relations after their foreign minister said that they will look for more open lines of communication. Chinese equities are steady with slight gains, but the other APAC stock indices are mostly in the red.

The WTI futures contract is near US$ 80 bbl while the Brent contract is a touch above US$ 86.50 bbl at the time of going to print. Gold and silver have [posted decent gains through the Asian session.

Looking ahead, Germany will a slew of inflation data and jobs data today. Then the US and Canada will get PMI numbers later.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade USD/JPY

USD/JPY TECHNICAL ANALYSIS

USD/JPY has broken below a crust of historical lows and breakpoints. At the same time, it has moved below the 260-day simple moving average (SMA) and it may indicate that bearish momentum is unfolding.

The previous support levels might now offer resistance up to the 260-day SMA that is currently near 131.60.

On the downside, there could be a gap in support levels until a prior low at 126.32

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]