[ad_1]

US Dollar, Euro, Mexican Peso Vs Japanese Yen – Price Action:

- USD/JPY’s rally is showing signs of fatigue.

- EUR/JPY risks a minor double top.

- MXN/JPY may have started to consolidate finally.

Recommended by Manish Jaradi

How to Trade USD/JPY

The retreat in US Treasury yields amid a scaling back in US Federal Reserve rate hike expectations this year appears to have put a lid on USD/JPY.But unless the pair breaks below key technical support, the path of least resistance remains sideways to up.

US PCE price index rose 0.2% on-month in July, in line with June. On a year-on-year basis, the index rose 3.3% from 3.0% in June. The US unemployment rate rose more than expected in August, along with a slowing in average hourly wage growth, boosting hopes that the jobs market could be starting to cool. Employers added 187k jobs last month Vs 170k expected. Markets see almost no chance of a Fed rate hike in September, while the odds of a November move have scaled back to 35% from 50% a week ago.

Meanwhile, Japan’s finance minister on Friday stopped short of offering any sign of intervention even as USD/JPY surpassed levels that triggered intervention last year. BOJ Governor Kazuo Ueda’s assessment that inflation remains below BOJ’s 2% target possibly rules out any premature tightening, and that the cost of waiting for underlying price pressure to increase is not too high.

Moreover, the deteriorating growth outlook outside of the US implies that the Japanese central bank may not rush into making further changes to its yield curve control (YCC) in the foreseeable future. This implies that it may be premature to assume that USD/JPY’s broader uptrend is changing. Indeed, for USD/JPY’s bull run to reverse, US interest rates may need to peak.

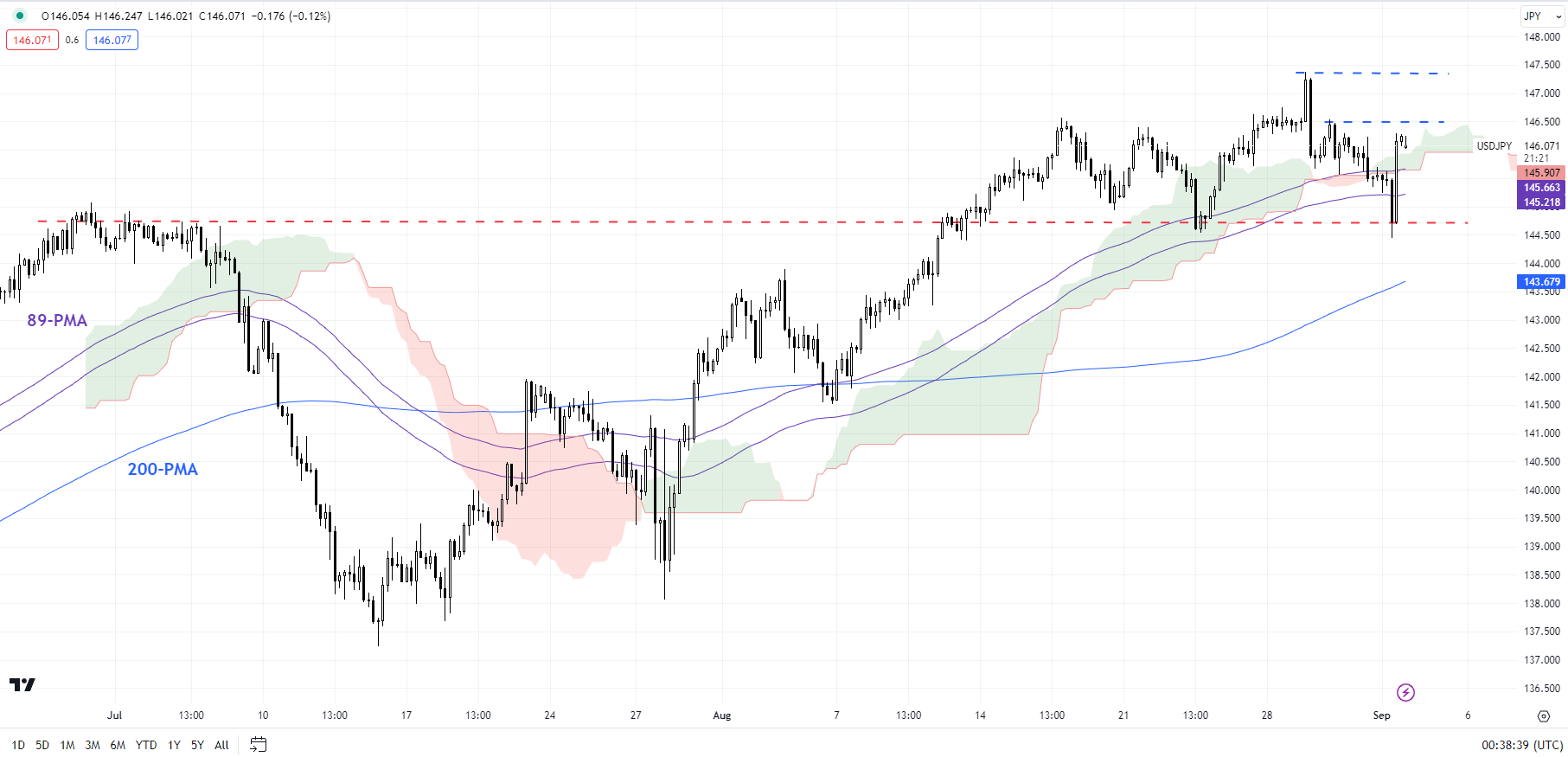

USD/JPY 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

USD/JPY: Early signs of fatigue

On technical charts, USD/JPY’s failure last month to decisively break above the August high of 146.50 is a sign of exhaustion following the one-month-long rally. So far, the pair is holding above vital converged support on a horizontal trendline since June (at about 144.50), near the 200-period moving average. However, any break below would be a confirmation that the uptrend from July had changed.

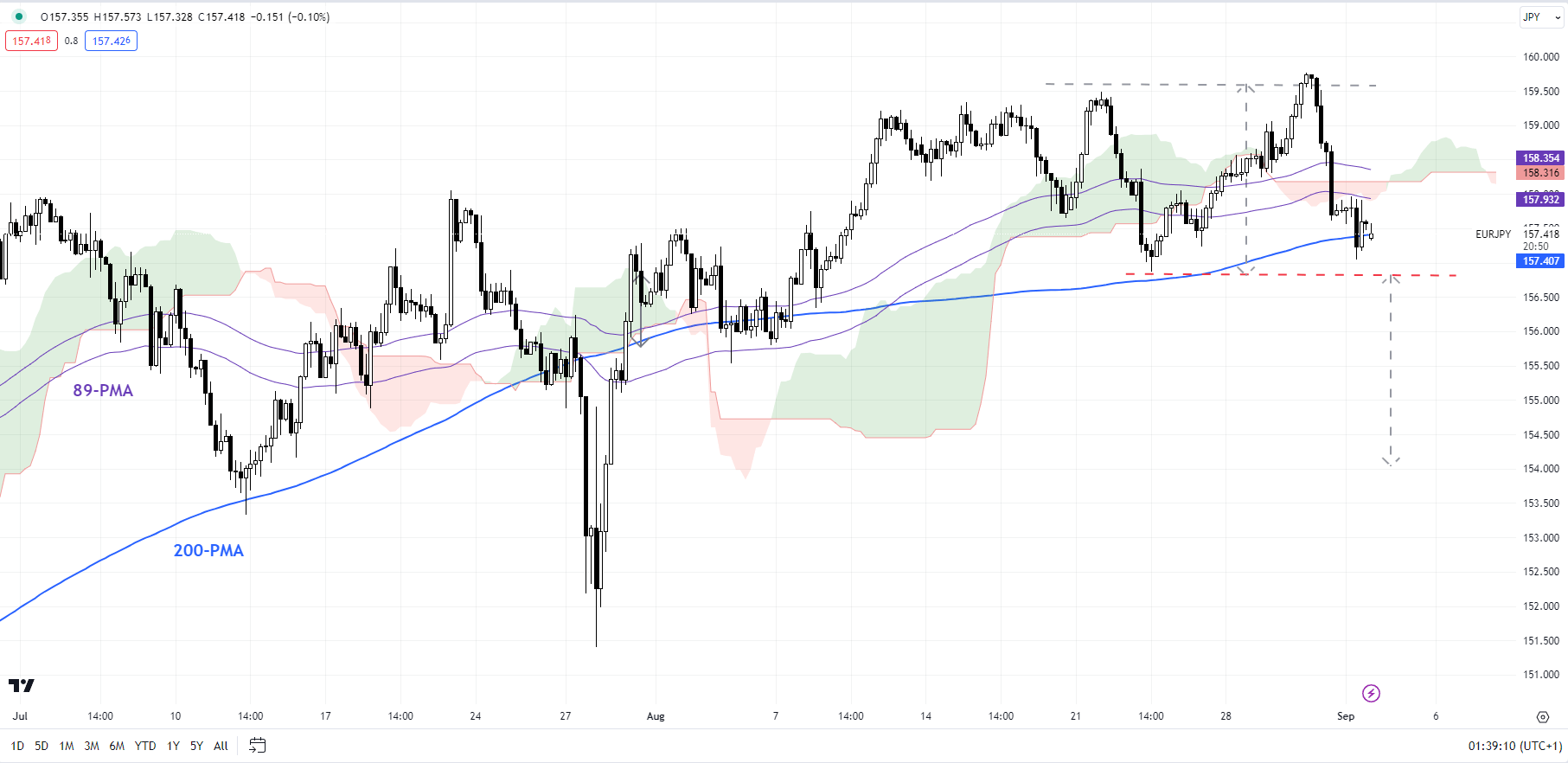

EUR/JPY 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

EUR/JPY: Risks a minor double top

EUR/JPY is testing crucial support at the late-August low of 156.85, coinciding with the 200-period moving average on the 240-minute charts. Any break below would trigger a double top (the August highs), with a potential price objective of around 154.00. Having said that, any retreat is unlikely to pose a threat to the broader EUR/JPY uptrend while the cross holds above the July low of 151.50.

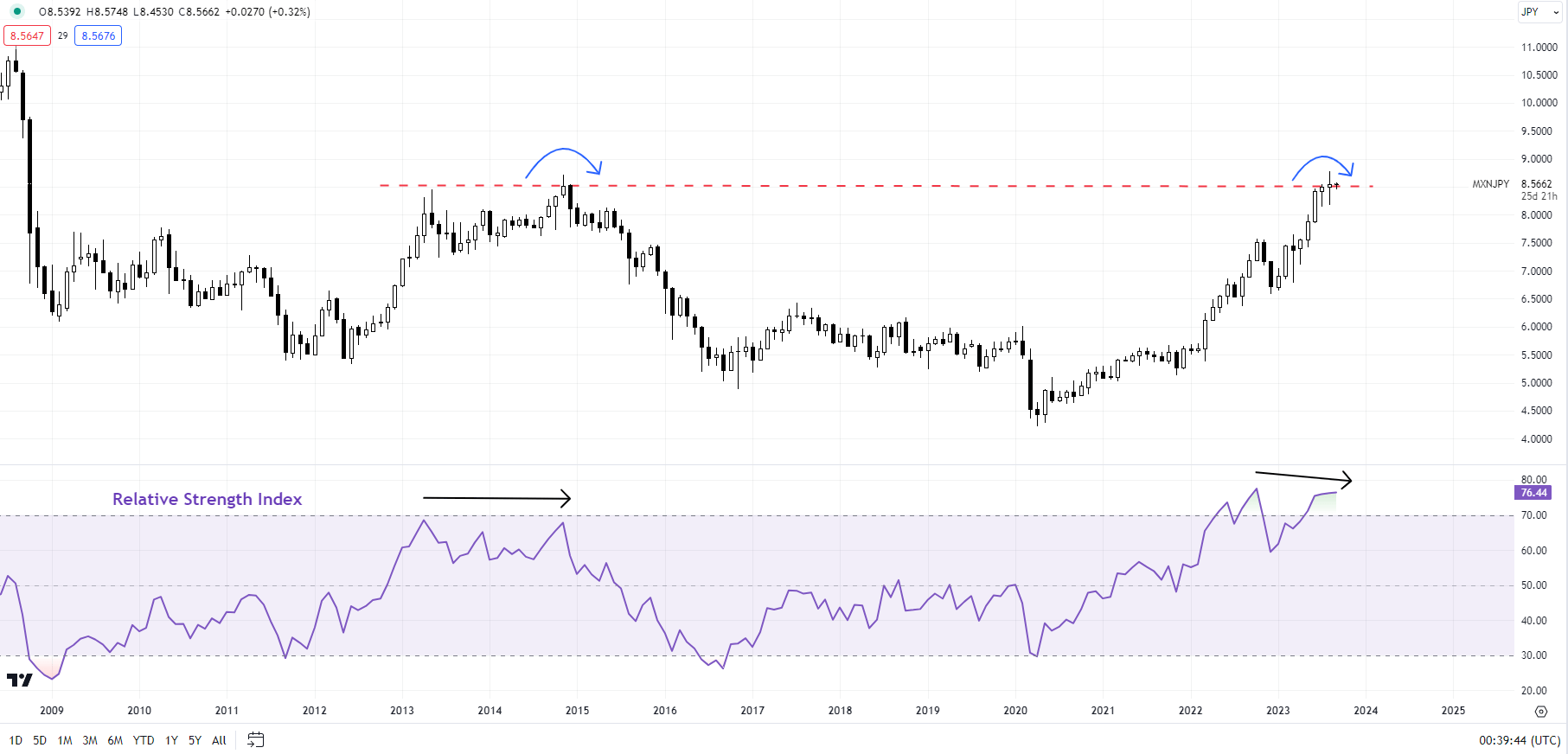

MXN/JPY Monthly Chart

Chart Created by Manish Jaradi Using TradingView

MXN/JPY: Consolidation may have started

Cracks in the 3.5-year rally appear to be finally emerging on MXN/JPY charts. A doji candlestick pattern and a potential negative divergence on the monthly charts suggest the cross rally is losing steam as it faces major resistance at the 2014 high of 8.72. The fall below minor support at the end-August low of 8.65 on the 240-minute charts is a sign that the upward pressure is fading. Any fall below the 200-period moving average on the 240-minute chart could pave the way toward strong support at the July low of 8.05.

Recommended by Manish Jaradi

The Fundamentals of Range Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]