[ad_1]

Indices Talking Points:

- All of the S&P 500, Nasdaq 100 and Dow Jones ran into key supports to start this week and after indecision yesterday, a strong bounce developed today.

- While we’re late in the month of December and it’s been a hard road thus far, there does remain the possibility of a Santa Rally, particularly considering the prospect of window-dressing going into the end of 2022. The S&P 500 current all-time-high was set in the first week of 2022 trade, might a related dynamic be in play for 2023?

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Recommended by James Stanley

Get Your Free Equities Forecast

Last week was a brutal outing for equities and coming into this week, bears had a full head of steam. That even lasted through Monday trade until some key supports started to come into play for each of the S&P 500, Nasdaq and Dow Jones. Those supports held yesterday and led into a bounce today, which now begs the question as to whether we may still see a Santa rally into the end of the year.

To be sure, up to this point, those seasonal patterns haven’t really seemed to be in-play and given the brutal reaction to CPI last Tuesday and then the Fed on Wednesday, hope had started to fade as it looked more and more like the same looming bearish behavior had reared its ugly head again. And there is bearish potential going into next year largely on the basis of a still-hawkish Fed and inflation that remains far too high.

But, as we saw through 2022, markets are not linear and as we move into the end of the year, the question remains as to whether we’ll see longer-term short positions unwind as we open the door into 2023. This is, after all, how the 2022 open played out, with the S&P 500 topping on January 4th and then starting a bearish trend that still remains in-effect.

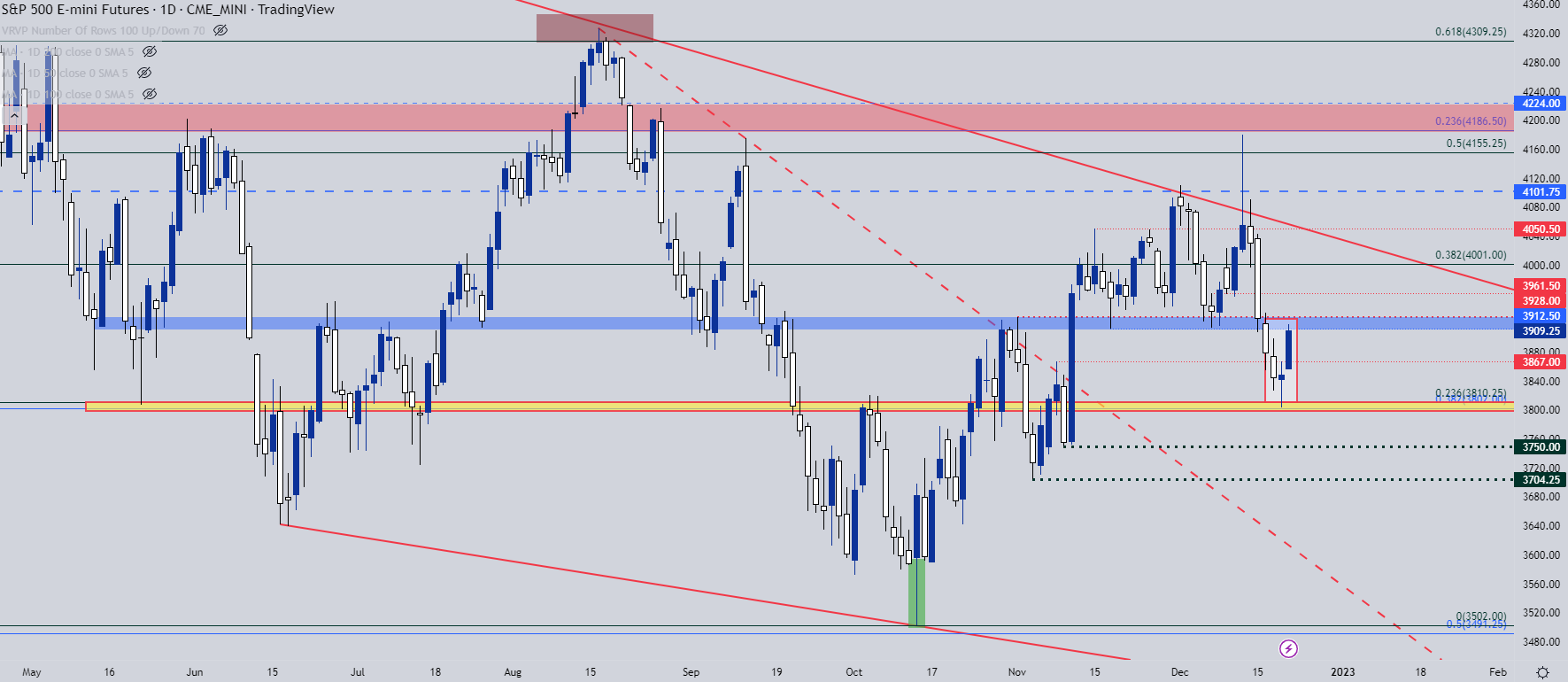

S&P 500

The S&P 500 is now testing resistance at prior support and that prior support area was a stubborn spot, running from 3912-3928. This same area had held the highs in late-October only to become support a few weeks later, holding multiple tests until eventually getting taken-out last week.

Sellers drove all the way down to another key spot of support – located around 3802-3810, both of which are Fibonacci levels, and that helped to form a doji yesterday. That doji from yesterday led to a strong bullish response today which makes for a morning star formation.

Morning stars are bullish reversal formations and price now has to contend with resistance at 3912-3928; but if buyers can budge above that, next resistance targets show at 3960 and then the 4k psychological level.

S&P 500 Daily Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

Nasdaq

If looking to track bearish approaches on US equities, I remain of the mind that the Nasdaq could be more attractive, and not just from a fundamental perspective. Technically speaking, the bullish theme has been less-developed here and even today’s bounce was less-expressive than what showed in the S&P above.

There’s also the missing proximity from resistance at prior support, as the prior support zone in the Nasdaq is around 11,470 which hasn’t yet come into play.

The support level of note in the Nasdaq is the same that came into help hold the June lows at 11,069. This level was tested yesterday which led to a similar build of a doji, followed by today’s strength which makes for a morning star here, too.

If we get extension beyond today’s high, that 11,470 level remains as resistance potential for those looking at possible manners of fading that strength.

Nasdaq Daily Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

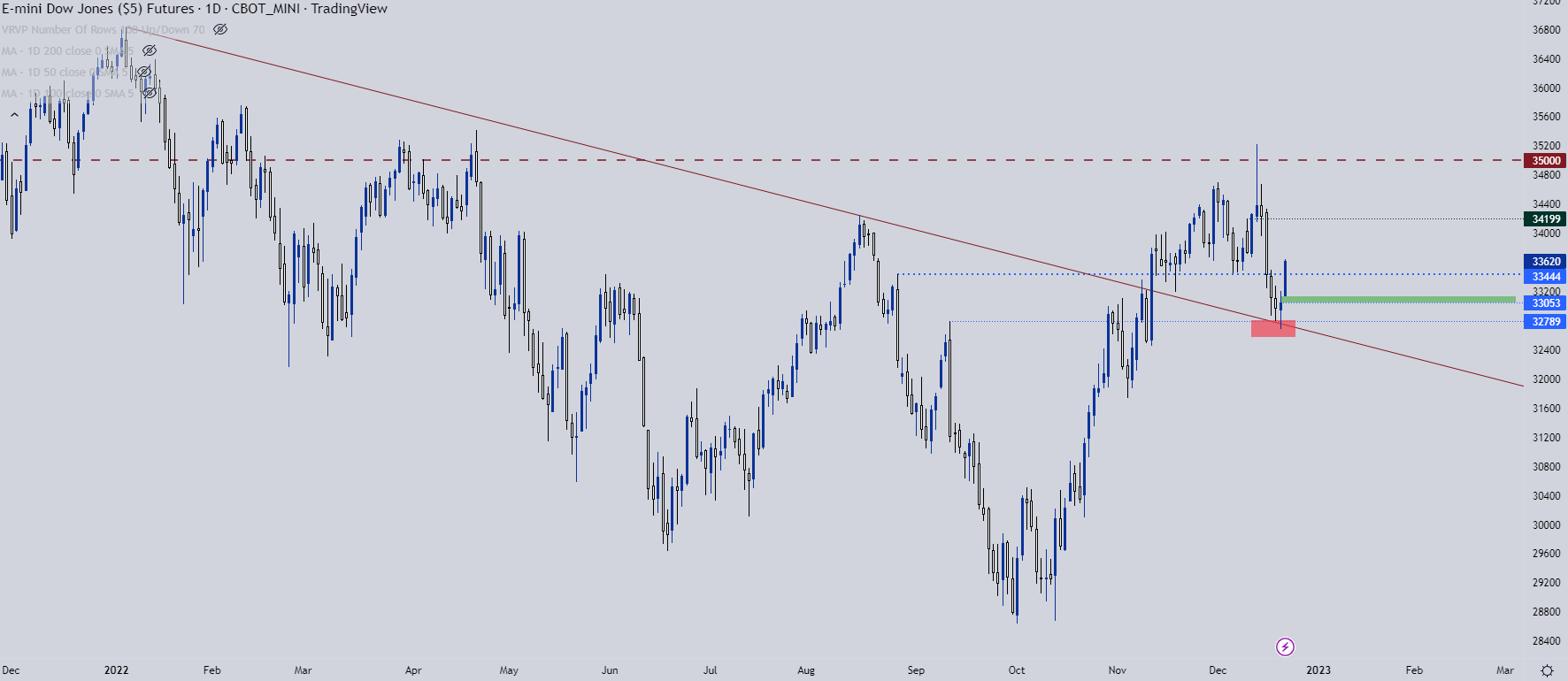

Dow Jones

If the Nasdaq is more attractive for bearish equity pushes, the Dow remains as a more attractive venue for bullish pushes. I discussed this in this week’s technical forecast as the Dow had started to get close to a key support test. And in the interest of apples-to-apples comparisons, while both the Nasdaq and S&P 500 remain below their 2022 bearish trendlines, the Dow not only remains above its own, but it caught support off of that level on Monday before a strong response showed today.

Price crossed an important level today and this can now serve as short-term support potential, plotted around 33,444, and there’s also some gap that remains in Dow futures, right around the 33,053 swing that could also function as a spot of support for bullish continuation scenarios.

Recommended by James Stanley

Building Confidence in Trading

Dow Jones Daily Price Chart

Chart prepared by James Stanley; Dow Jones on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Education

Contact and follow James on Twitter: @JStanleyFX

[ad_2]