[ad_1]

Euro News and Analysis

Recommended by Richard Snow

How to Trade EUR/USD

EUR/USD Breaks Long-Term Pattern – Downside Risks Accrue

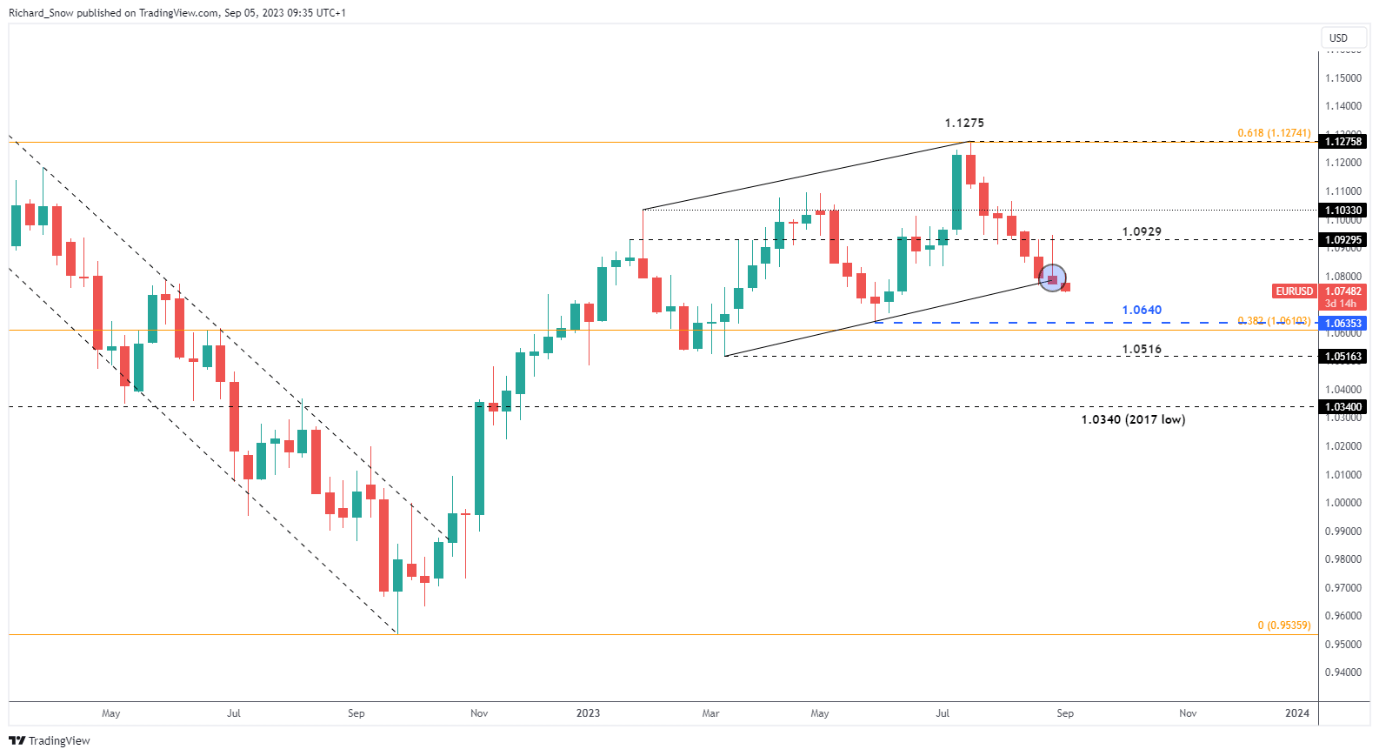

EUR/USD price action over the last two weeks has highlighted the longer-term ascending channel that has recently come under pressure during the shorter-term selloff. The long upper wick on last week’s candle reveals a solid rejection of higher prices, turning the focus to possible breakdown potential.

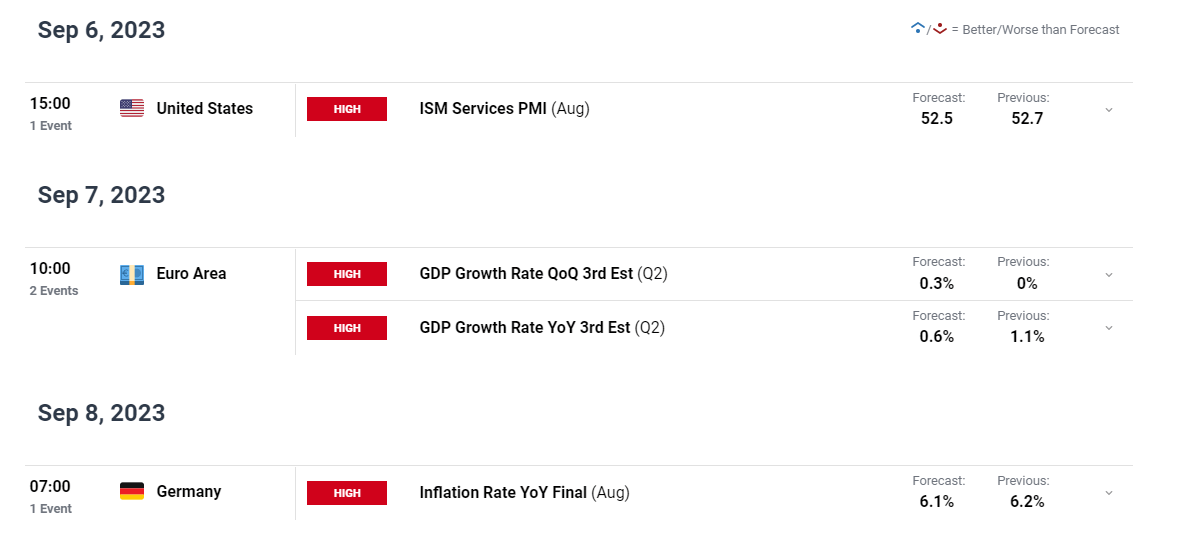

This week, prices continue to head lower, where a weekly close below channel support leaves the pair vulnerable to an extended move lower. The dollar appears to be the beneficiary of worsening European and Chinese data, highlighting the relative resilience of the US economy. Something to note since the sizeable downward revision in US Q2 GDP data is that incoming US data may signal early signs of slowing down. Next up on the calendar is US services PMI data.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

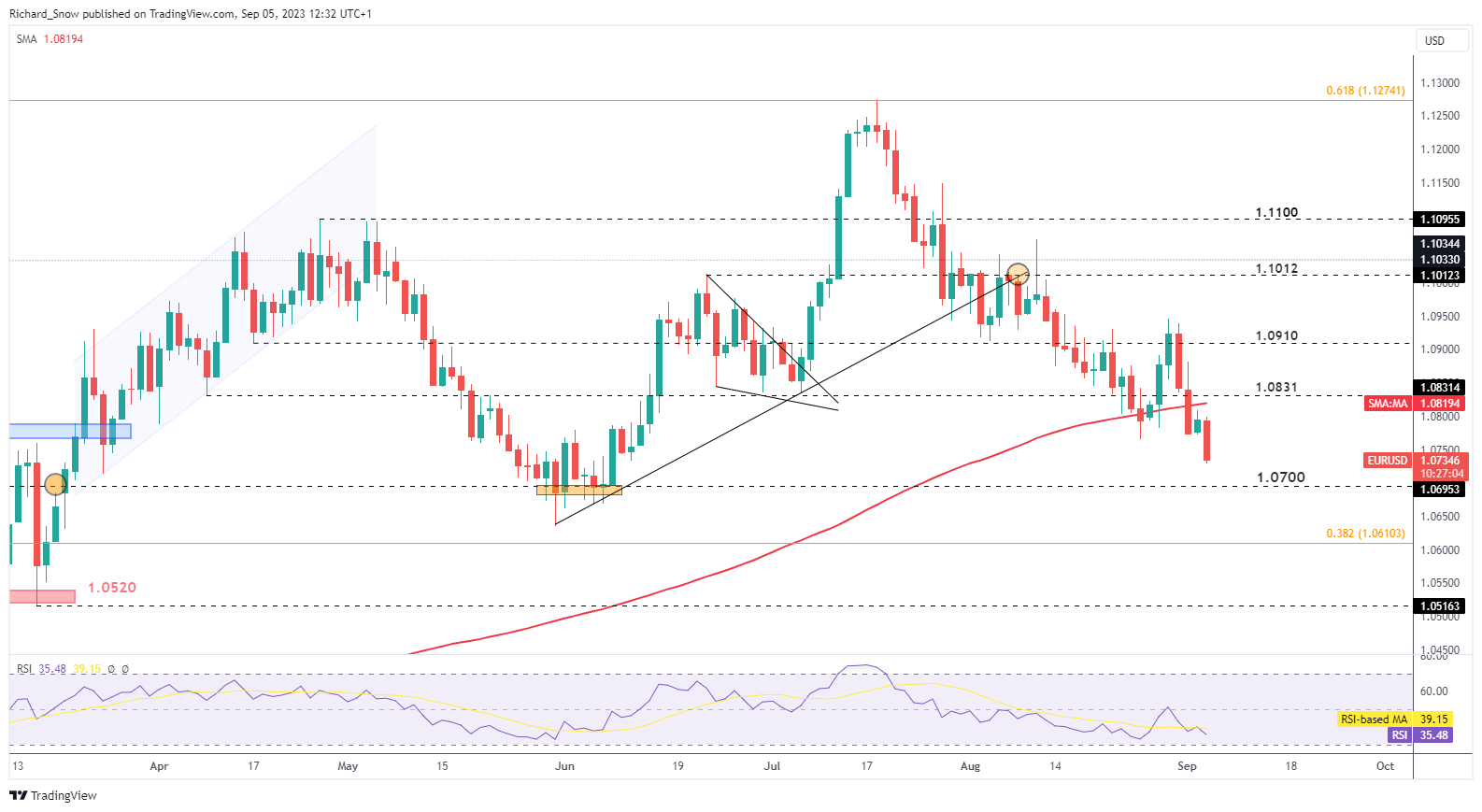

The daily EUR/USD chart reveals a continuation of the bearish move after closing below the 200-day simple moving average (SMA). The psychological 1.0700 level is next up for EUR/USD bears – a level that came into play as support in March and June. With prices not yet dipping into oversold territory there could still be some selling pressure to come. Resistance appears at the 200 SMA with 1.0830 thereafter.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -6% | 12% | -1% |

| Weekly | 14% | -18% | 1% |

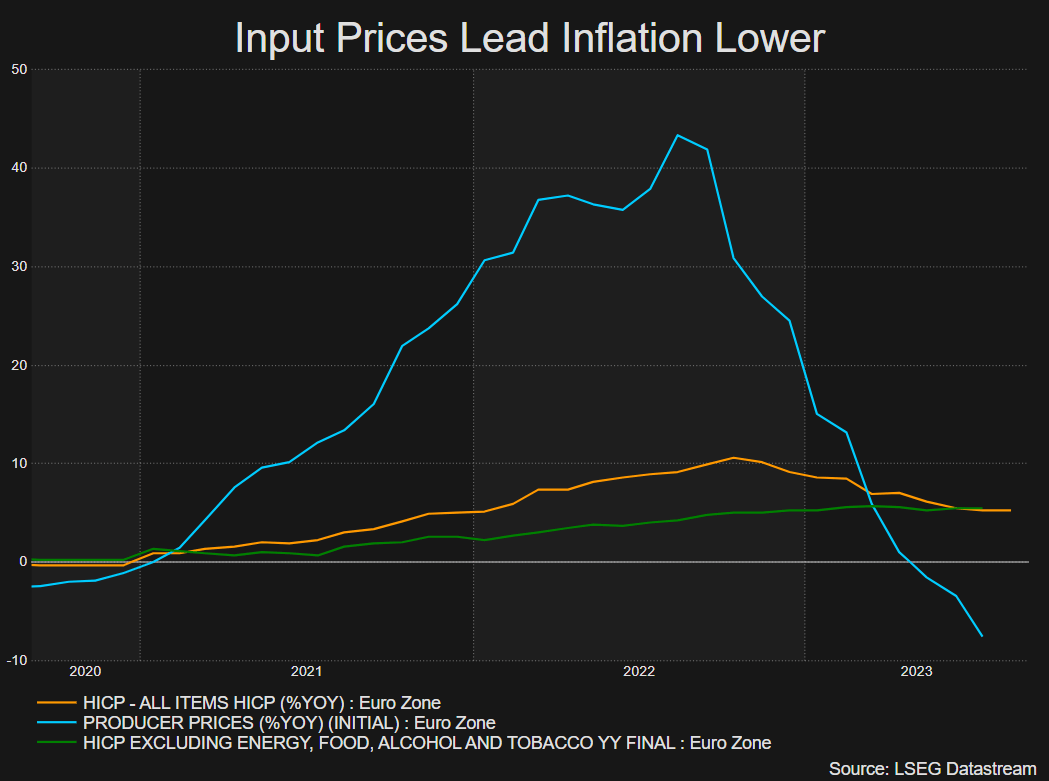

Today EU Producer Price Index (PPI) data revealed a drop in prices to -7.7% in July compared to July of last year, continuing a worrying downtrend. Prices paid at factory gates filter down to the end consumer over time and if deflationary pressures exist at the top of the chain, it could present a challenge for wholesalers when it comes to their margins.

Headline inflation has flattened out in a similar fashion to core inflation but PPI data acts as a leading indicator here and suggests further easing is likely to come into year end. PPI has been lagged by 6-months in the chart below as it tends to be a leading indicator of broader inflation.

EU Inflation Evolution

Source: TradingView, prepared by Richard Snow

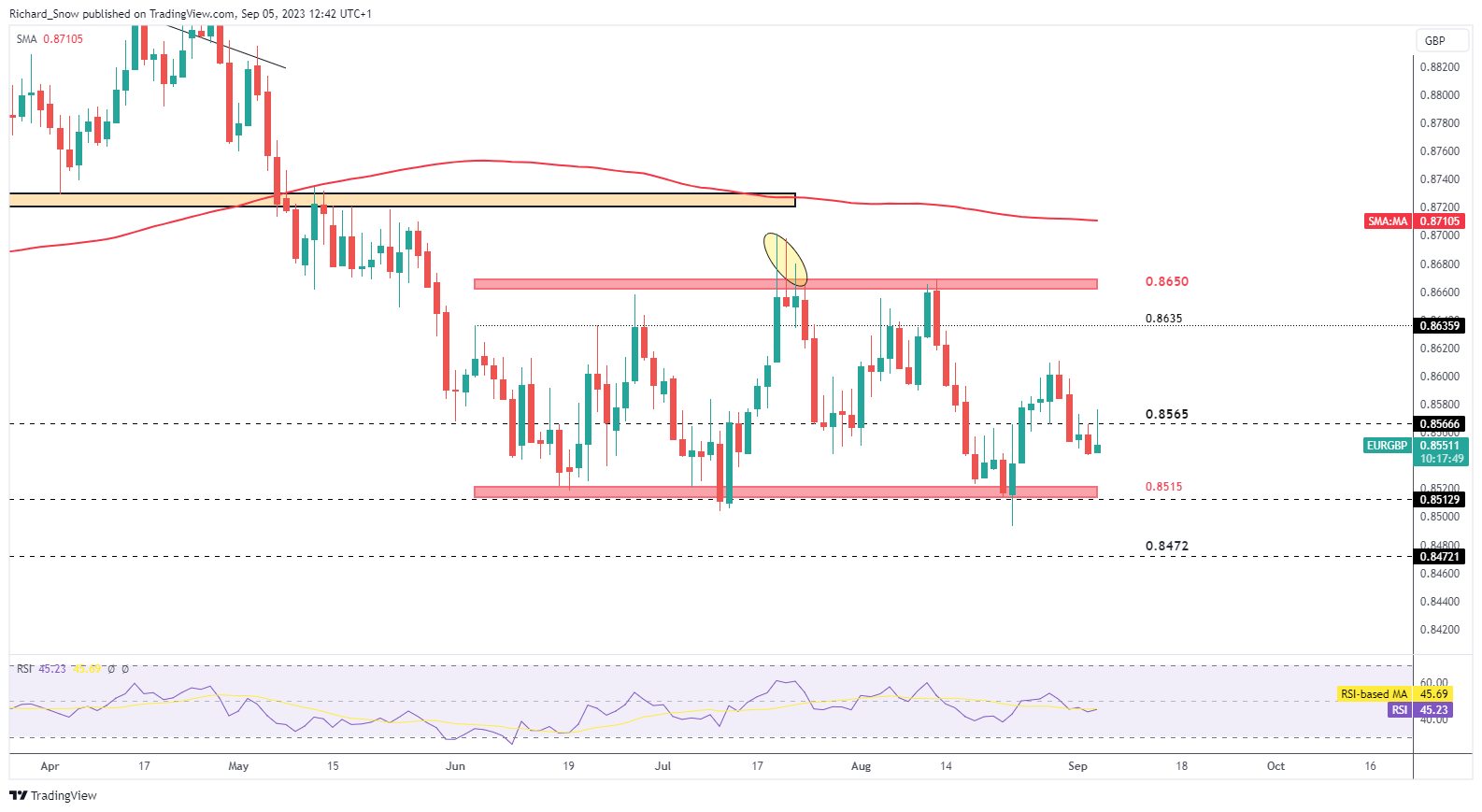

EUR/GBP Paints a Perfect Picture of the Dilemma Faced by Both Central Banks

This month the ECB and BoE will decide whether to hike interest rates again. Ever since Lagarde’s Jackson Hole appearance, sentiment within the governing council appears to be more cautious owing to a more pessimistic economic outlook. On the other hand, the Bank of England is still expected to go ahead with another 25-bps hike but markets have revised the terminal rate to around 5.7%, down from over 6% as inflation abates but remains higher than its peers.

EUR/GBP rose unexpectedly this morning after final European PMI data disappointed while the UK equivalent exceeded expectations in a rather positive spin. Since then, price action has pared most of today’s gains as the pair eyes 0.8515 – channel support. Resistance remains at 0.8565.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Major Event Risks into the Weekend

US services PMI data is anticipated to ease after last month’s print highlighted potential vulnerabilities in new orders and general business activity. The subcomponent dealing with prices also rose – elevating inflation concerns within the services sector which is keeping core inflation from seeing greater progress.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]