[ad_1]

US NFP Data for October

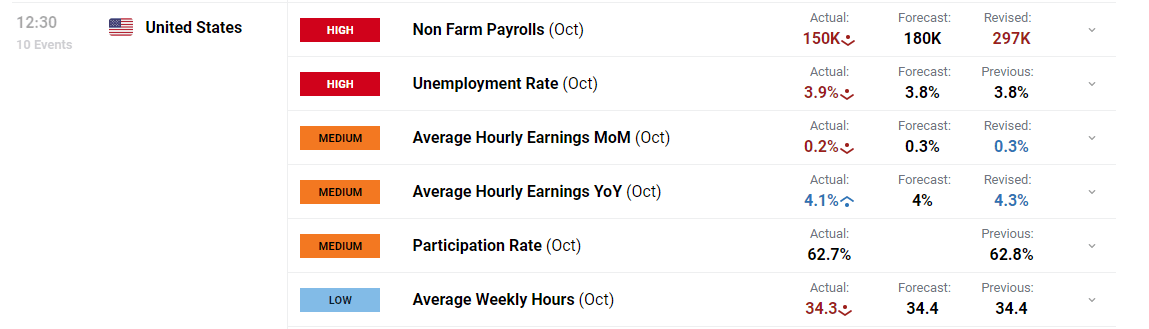

- NFP 150k vs 180k estimate, September’s 336k print revised lower to 297k. Unemployment rate 3.9% vs 3.8% exp

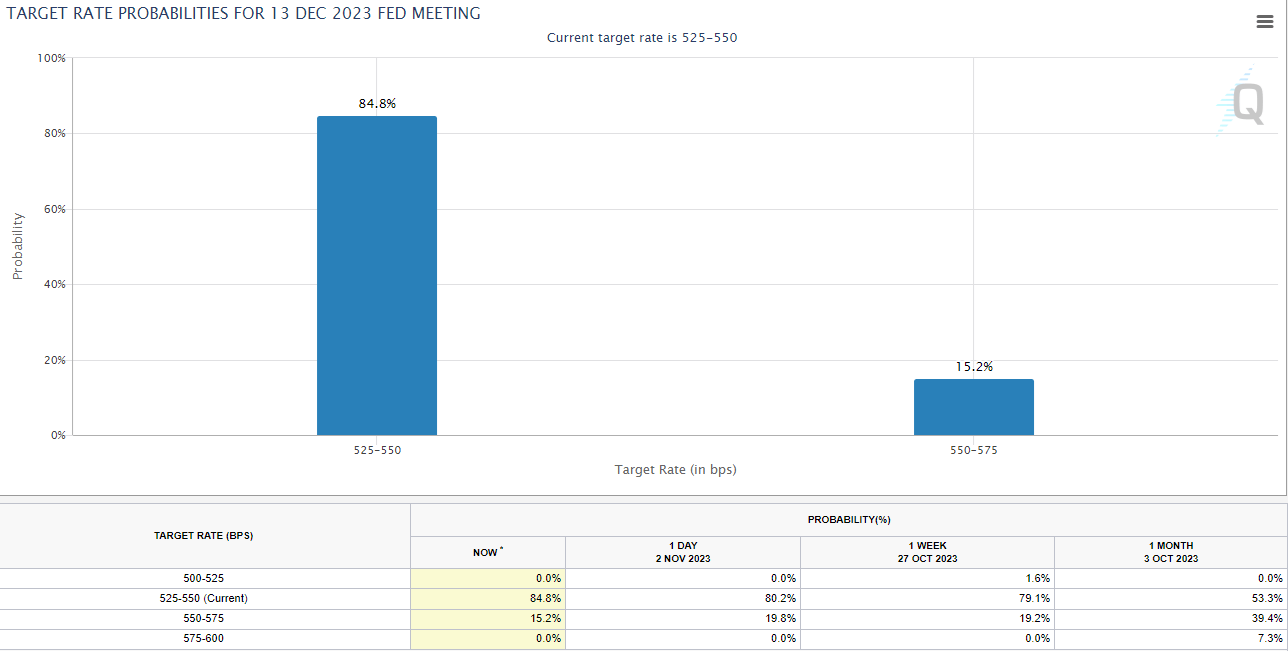

- Fed funds futures lower estimates of another Fed hike this year

- Immediate market reaction: USD, yields drop while gold rises

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

NFP Prints at 150k vs 180k and September’s Figure Revised Down to 297k

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Trading Forex News: The Strategy

Non-farm payroll data for October disappointed estimates of a 180,000 coming in at a 150,000. In addition the unemployment rate rose slightly from 3.8% to 3.9% while average hourly earnings posted mixed figures, rising year on year but cooling slightly month on month.

The data comes after the FOMC meeting earlier this week where the Fed maintained its hawkish stance but sprinkled in Dovish concerns around the ongoing tightening (via elevated US yields) and the potential for a change in economic fortunes into year end.

Earlier this week other labour data like ADP employment change and the jolts report revealed a miss versus the estimate and little change in job openings respectively. The Fed has been calling for a period of below trend growth and a moderate rise in unemployment to help calm inflation, something that could very well be underway.

The recent sell off in the bond market may well have seen its peak as treasury yields and the dollar move steadily lower. in addition fed funds futures suggest an even lower probability of another rate hike before the end of the year with potential rate cuts creeping slightly closer. Markets will be scrutinizing future economic data for any signs of weakness that would strengthen the viewpoint that interest rates in the US may have already peaked.

FedWatch Tool Showing Implied Probabilities of the Fed Funds Rate in December

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]