[ad_1]

EUR/USD ANALYSIS & TALKING POINTS

- U.S. dollar strength develops in early trading.

- EZ retail sales and ECB’s Lagarde in focus today.

- Markets bet on 5% Fed peak rate once more.

- Weekly long wick candle could suggest more pressure on euro in the medium-term.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro really suffered at the hands of the USD last week post-Non-Farm Payrolls (NFP) which showed a significant rise in jobs (517000) for January over the expected figure (188000) thus reinforcing the tight labor market in the U.S..

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

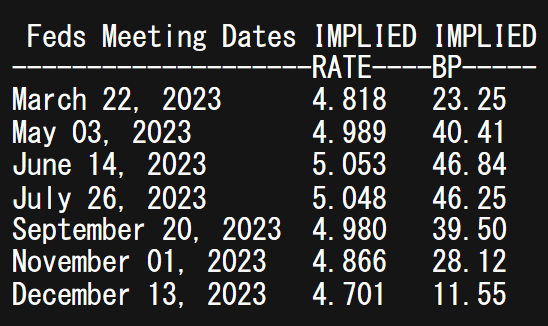

Money markets have already pushed the 2023 Fed terminal rate up above 5% for the first time in many weeks (see table below), now underpinning what the Fed has been saying all this time? Leading up to the Fed’s interest rate decision last week, guidance from the majority of Fed officials have been rather hawkish with frequent reference to the 5% mark however, at the time markets had dismissed any such counsel leaving upbeat releases on data points open to large upward swings in the greenback.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

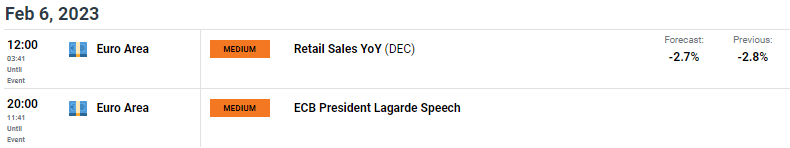

The day ahead looks to be centered around the eurozone with retail sales data and yet another address from the ECB’s President Christine Lagarde. It is likely we will receive more aggressive talk from Lagarde citing higher core inflation and growth(GDP) forecasts within the region but it could be too early to impact a surging dollar.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

Throughout the week, attention will be largely directed to Fed officials who are scheduled to speak throughout. Hawks will surely come out in force but it will be interesting to see how less aggressive individuals react to the recent data.

This Monday also involves a hint of risk-off sentiment stemming from U.S.-China tensions after the U.S. shot down an alleged Chinese spy balloon so it will be important to monitor the situation closely as any further escalation could bolster the greenback.

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

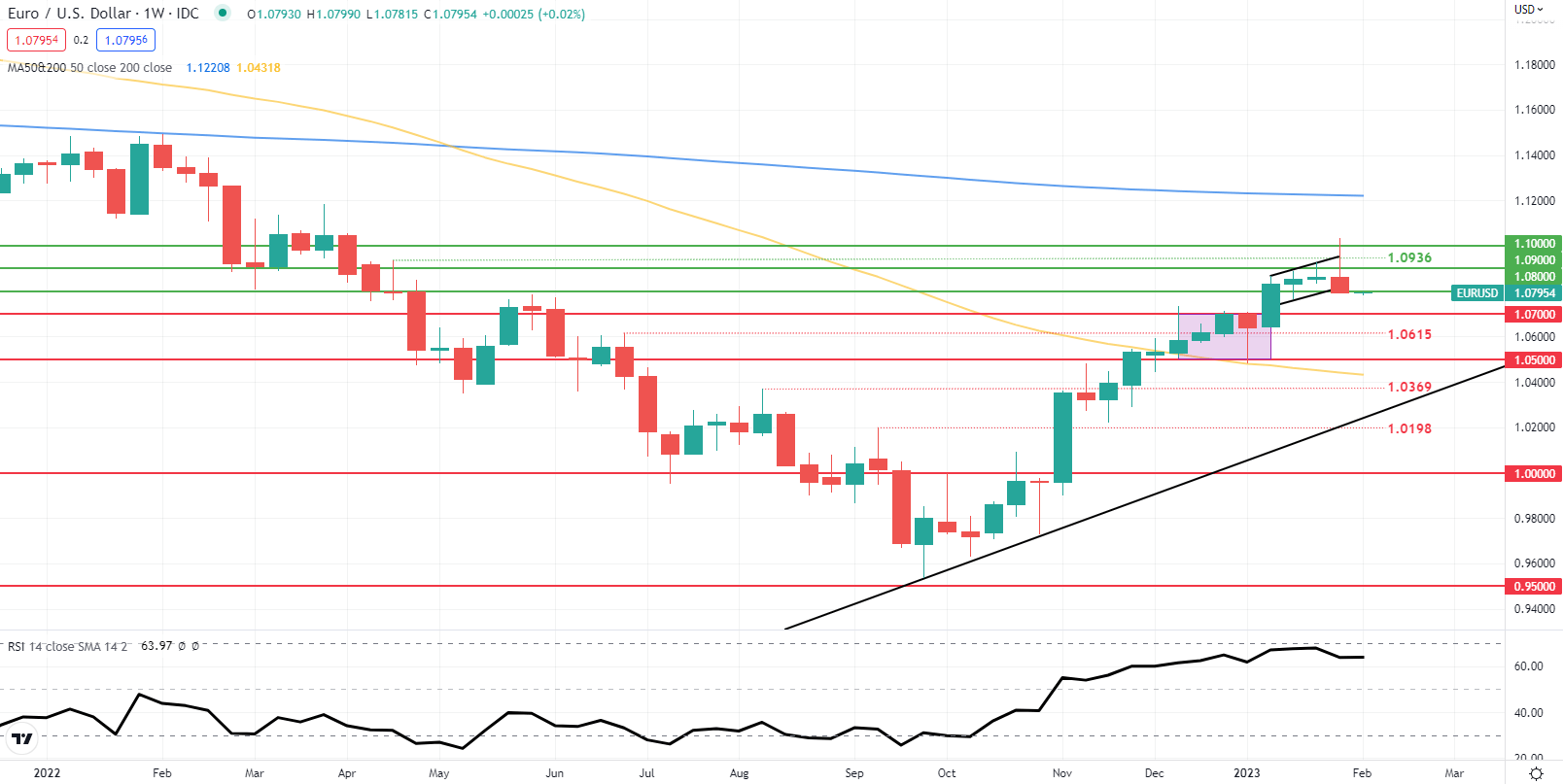

EUR/USD WEEKLY CHART

Chart prepared by Warren Venketas, IG

The EUR/USD weekly chart above shows price action hovering around overbought territory as indicated by the Relative Strength Index (RSI). Last week’s candle closed with a long upper wick that traditionally points to subsequent downside leaving support zones in danger of being breached.

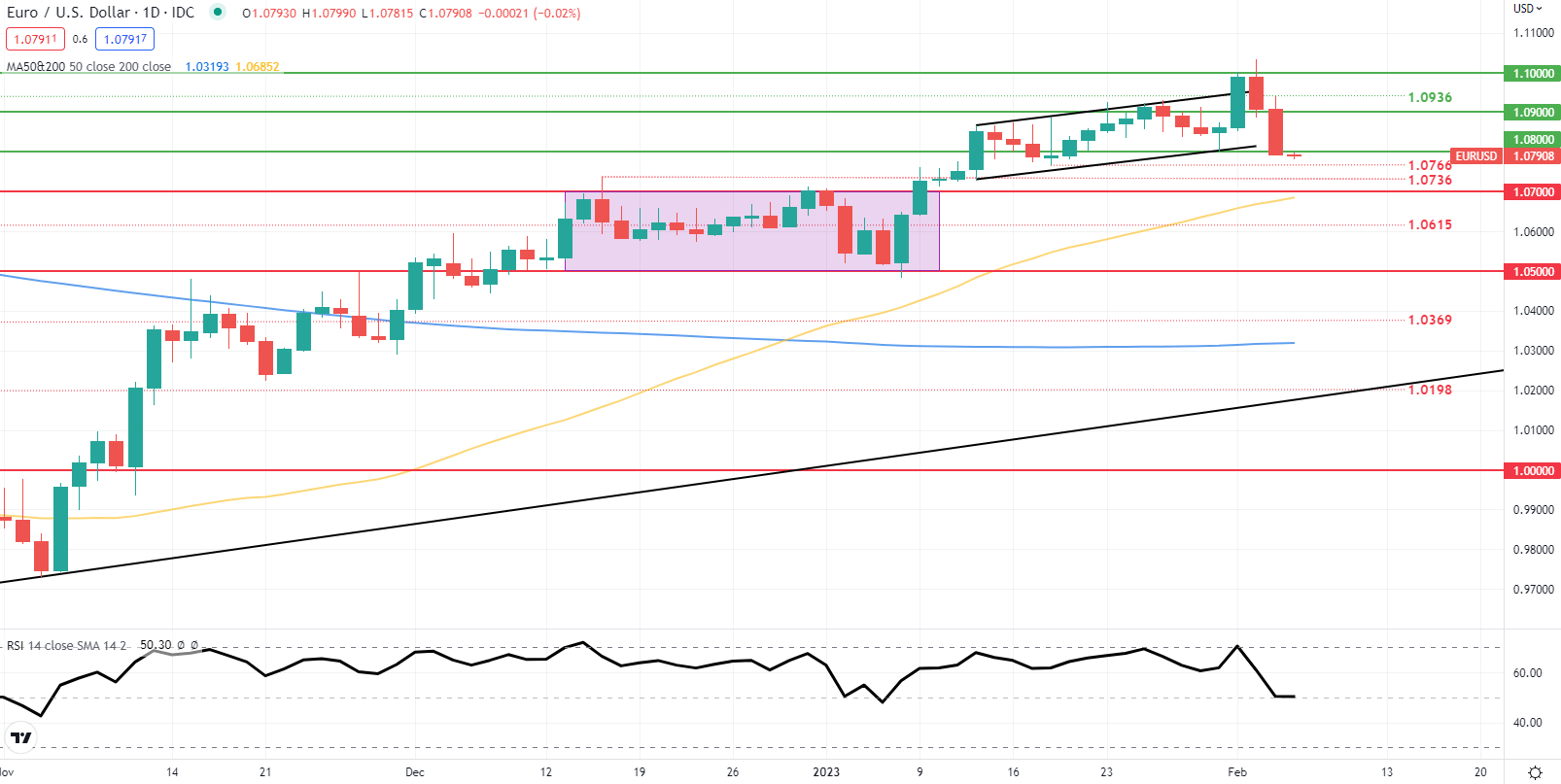

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The shorter-term daily chart emphasizes the recent break below the 1.0800 psychological handle and today’s candle close could point to a near-term directional bias. A close below 1.0800 could find the euro slipping down towards 1.0700 and possibly testing the 50-day SMA as well (yellow).

Resistance levels:

Support levels:

- 1.0766

- 1.0736

- 1.0700

- 50-day SMA

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently LONG on EUR/USD, with 51% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]