[ad_1]

OIL AND GOLD PRICES FORECAST:

- Oil prices advance despite China’s lower-than-expected economic growth target

- Meanwhile, gold prices lack conviction as traders await clear monetary policy signals from Fed chair Powell

- Powell’s congressional testimony on Tuesday and Wednesday will steal the limelight

Recommended by Diego Colman

Get Your Free Oil Forecast

Most Read: US Dollar Subdued ahead of Powell’s Testimony. What Should Forex Traders Expect?

Major commodities were mixed at the start of the week as different narratives competed for dominance on Wall Street. First, gold (XAU/USD) wobbled, oscillating between small gains and losses around the $1,855 mark as traders avoided taking large directional positions as a precautionary measure ahead of Fed Chairman Powell’s testimony in Washington. Powell is expected to appear before Congress on Tuesday and Wednesday to deliver the central bank’s semiannual monetary policy report and comment on the broad outlook, an event that could spark volatility.

If Powell embraces a hawkish posture in response to sticky inflationary pressures, traders are likely to reprice higher the path of the ongoing tightening cycle, creating headwinds for rate-sensitive assets, including precious metals. This scenario could undermine gold prices in the near term.

Elsewhere, oil prices, as measured by one-month WTI futures contracts, managed to rise for the fifth consecutive day, up about 1% to $80.50 per barrel, but the advance was limited as news that China set a lower-than-forecast gross domestic product target for the year dented appetite for some commodities. For context, the Chinese government adopted a goal of around 5% GDP growth for 2023 versus 6.0% expected, the lowest in decades, as domestic and global challenges continue to pose risks to the Asian economy.

China’s disappointing economic growth objective indicates that the authorities are unlikely to ramp up aggressive stimulus measures in the near term to bolster the post-pandemic recovery, a situation that could cap the upside in energy markets considering that the country is the world’s second-largest consumer of fossil fuels. This suggests that any upward movement in oil will not follow a straight line despite supply and demand imbalances.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 8% | 4% |

| Weekly | -23% | 75% | -2% |

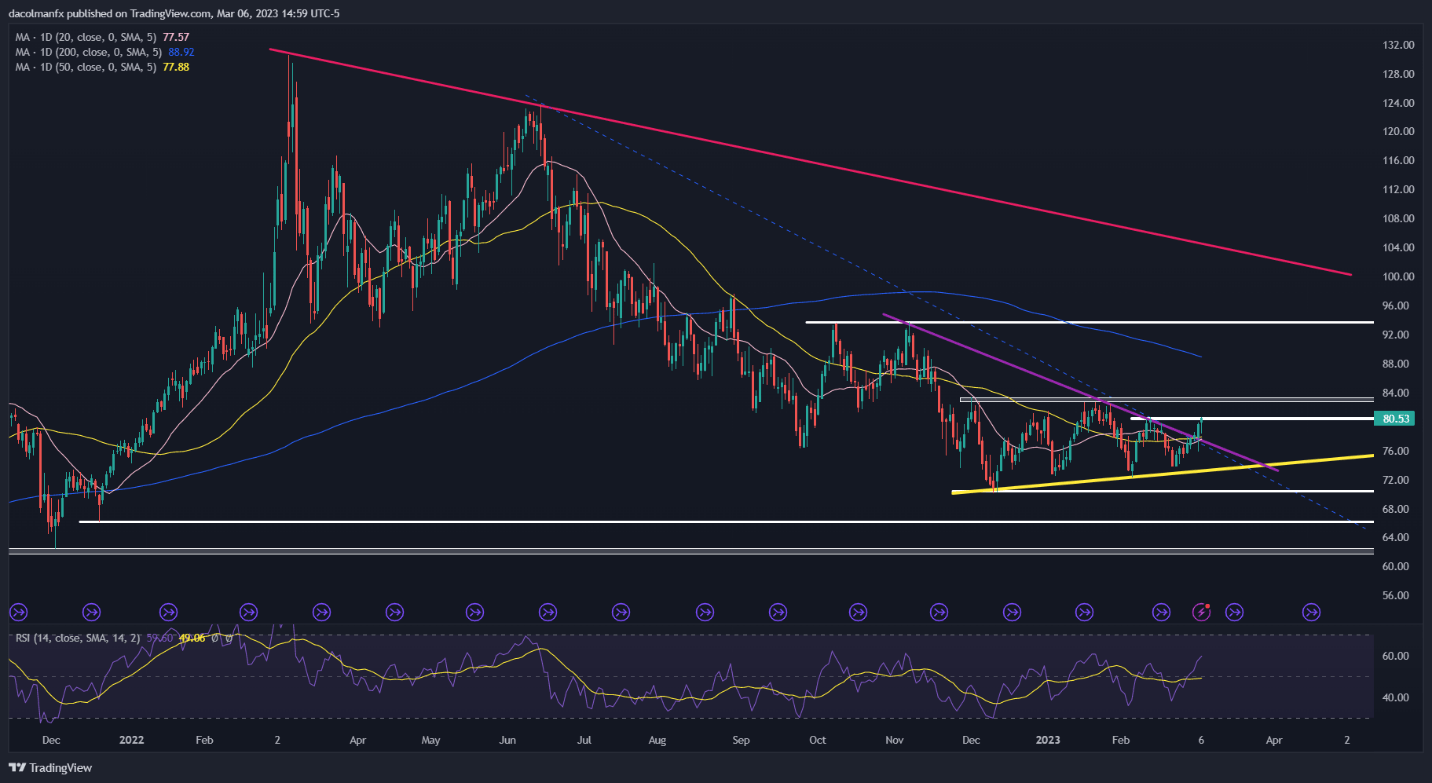

OIL PRICES TECHNICAL ANALYSIS

After recent gains, oil is trading near a key technical resistance in the $80.60 area, a ceiling created by February’s swing high. If bulls manage to drive prices above that barrier, buying interest could pick up momentum, setting the stage for a sprint toward the psychological $83.00 level. On the flip side, if sellers return and trigger a bearish reversal, initial support lies at $77.50. On further weakness, the focus shifts to a short-term rising trendline crossing the $73.60 region.

OIL PRICE (WTI FUTURES) TECHNICAL CHART

Oil Chart Prepared Using TradingView

Recommended by Diego Colman

Get Your Free Gold Forecast

[ad_2]