[ad_1]

GBP/USD Talking Points

- GBP/USD slides from major resistance as bullish momentum subsides.

- Pound Dollar faces technical headwinds in anticipation of next week’s event risk.

- FOMC and BoE (Bank of England) brace for further rate hikes with any surprises adding as a potential catalyst for price action.

Recommended by Tammy Da Costa

How to Trade GBP/USD

GBP/USD Technical Analysis

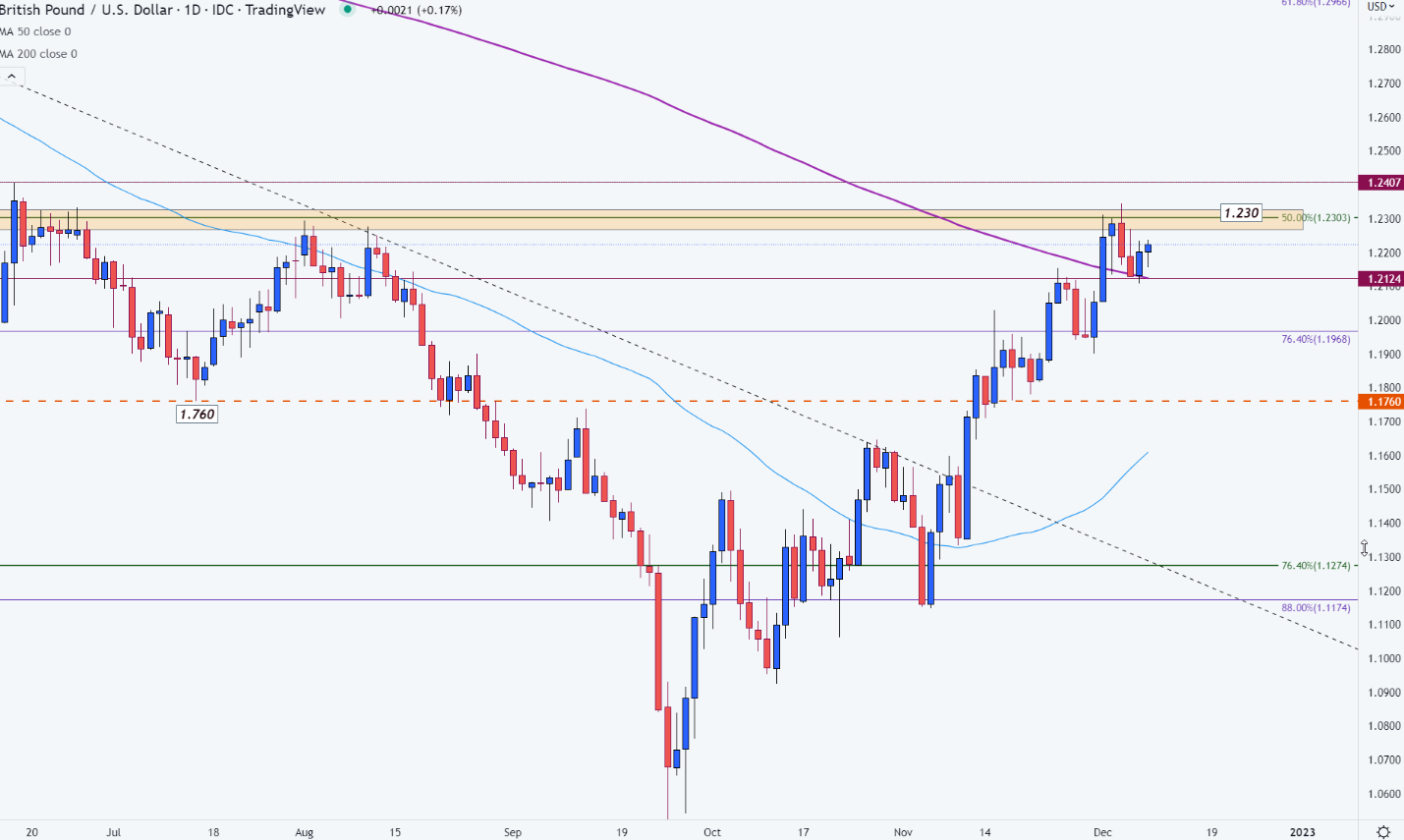

The British Pound is starting to show signs of weakness against its Dollar counterpart as upside momentum subsides. With bulls driving GBP/USD into a wall of resistance around 1.230, the midpoint of the 2021 – 2022 remains key for the imminent move.

After reaching a high of 1.2345 earlier this week, failure to hold above this level allowed bears to step in, driving prices lower. As price action falls into a narrow range of technical significance, the 200-day MA (moving average) is providing support at 1.212.

GBP/USD Daily Chart

Chart prepared by Tammy Da Costa using TradingView

With the major currency pair currently trading around the key psychological level of 1.220, a break of current support or resistance could drive the short-term move.

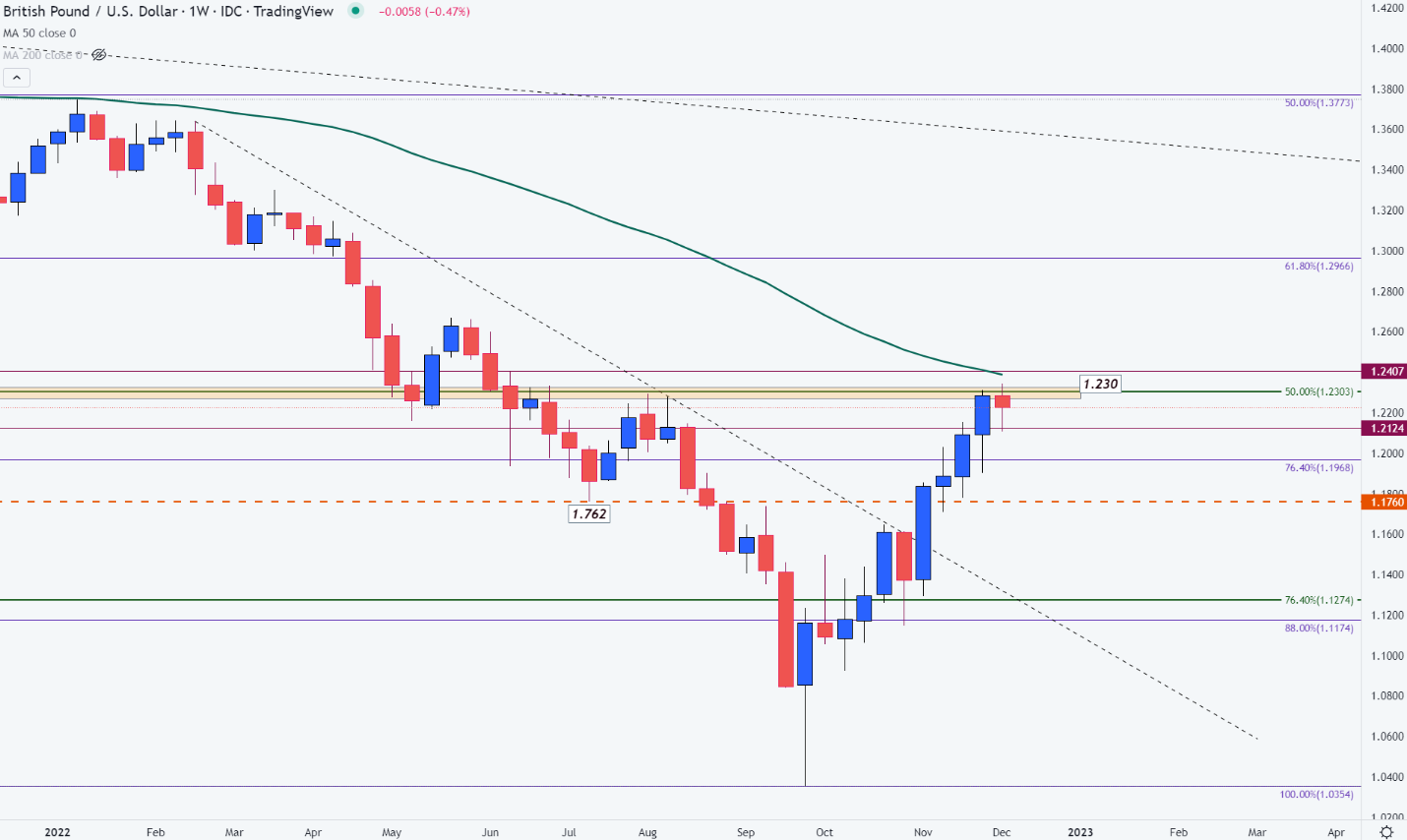

While the weekly chart illustrates how the 1.23 handle has provided support and resistance for historical moves, the 50-week MA (moving average) rests just above around 1.240.

Recommended by Tammy Da Costa

Building Confidence in Trading

GBP/USD Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

For bulls to continue to drive a broader recovery, a break of 1.23 and 1.24 could see prices rising back to the next key psychological level of 1.250.

However, if prices fall below 1.22, additional selling pressure and a move below 1.121 could fuel downside momentum back towards 1.200.

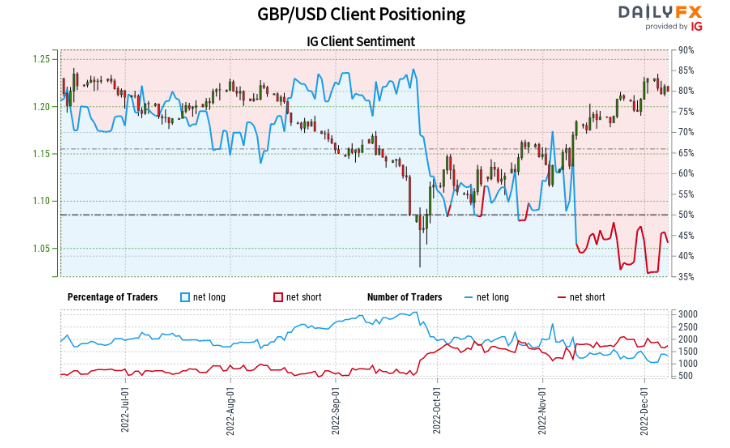

GBP/USD Client Sentiment

IG client sentiment provides real-time data on retail trader positioning which could highlight potential extremes in crowd behavior.

At the time of writing, retail trader data shows 44.57% of traders are net-long with the ratio of traders short to long at 1.24 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -1% | 1% |

| Weekly | 24% | -13% | 0% |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]