POUND STERLING ANALYSIS & TALKING POINTS

- BoE sentiments keep downward pressure on sterling.

- Fed officials will be the primary focal point for today’s US trading session.

- GBP/USD pullback may be short-lived.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

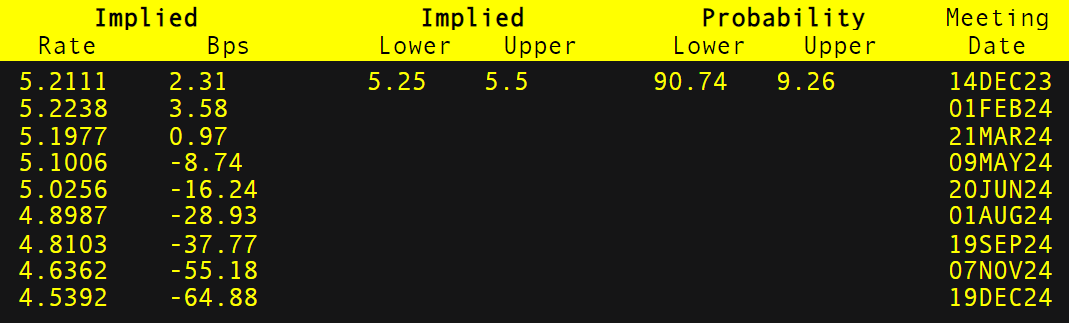

The British pound was not helped by Bank of England (BoE) Governor Andrew Bailey today as he reiterated the sentiments stated by the BoE Chief Economist Huw Pill that inflation is expected to fall sharply – as seen with the Euro area earlier today. That being said, the Governor stuck to a ‘higher for longer’ message with forecasts of 2% inflation estimated around the two year mark. Overall, money markets have been ‘dovishly’ repriced with no further hikes and an increase in cumulative interest rate cuts to 65bps by December 2024 up from 50bps just a week ago (refer to table below).

BoE Governor Bailey:

“It’s really too early to be talking about cutting rates.”

“The basic message is that we believe policy will need to be restrictive for an extended period, though there are upside risks.”

“We think policy is now restrictive, economic growth is very subdued.”

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

The rest of the trading day will be US centric (see economic calendar below) with Fed speak in focus. Certain Fed officials have maintained a hawkish narrative but markets will emphasizes the message delivered by Fed Chair Jerome Powell. While little is expected from Mr. Powell around monetary policy today, tomorrow’s address will likely carry more weight. Other Fed officials will be scattered throughout and will give investors an overall picture of the Fed’s vision. I expect the broader rhetoric to remain on the hawkish side thus limiting GBP upside.

Weak Chinese data has supplemented a weaker pound and will be a key component to monitor moving forward.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

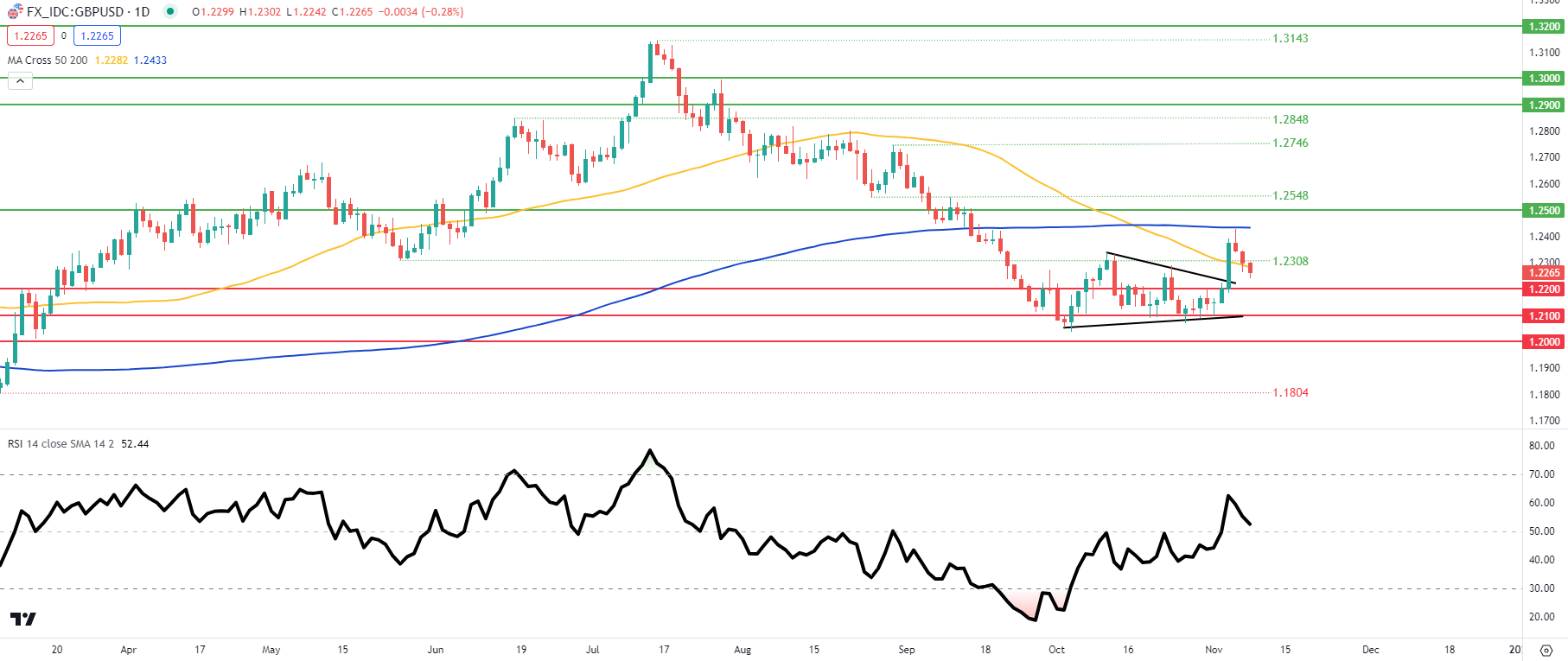

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

GBP/USD price action above shows the significance of the 200-day moving average (blue) and the long upper wick candle formation respectively. Cable has since dropped below the 50-day MA (yellow) and could head towards the 1.2200 psychological handle. The medium-term bias (based on my analysis) stays in favor of more downside to come should market conditions stay relatively consistent.

Key resistance levels:

- 200-day MA (blue)

- 1.2308/50-day MA (yellow)

Key support levels:

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 65% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas