[ad_1]

Pound Sterling (GBP/USD, EUR/GBP, GBP/JPY) Analysis

Pound Sterling Takes a Back Seat as US, EU Data Directs ST Moves

Markets continue to exhibit enhanced sensitivity to news flow this week. Earlier US jobs data (JOLTs, ADP) sent the US dollar lower over the last 3 trading days and today’s EU inflation data has seen a response in the euro, trading lower as core inflation eased in August as expected. UK-focused data has been rather scarce meaning sterling has been starved of a decent catalyst that would prompt a volatility revival.

GBP/USD: Lack of momentum and a changing US economic landscape drives cable

As mentioned earlier, UK data has been few and far between this week, with markets very focused on the potentially changing economic landscape in the US, as early signs of a softer jobs market add up. There are fewer people quitting and job openings have declined to the lowest level in almost two and a half years. On top of that, the ADP estimate of private job creation in August missed estimates of 195k, coming in at 177k. The print also represents a massive decline from July which suggested that 371k jobs had been added in the month.

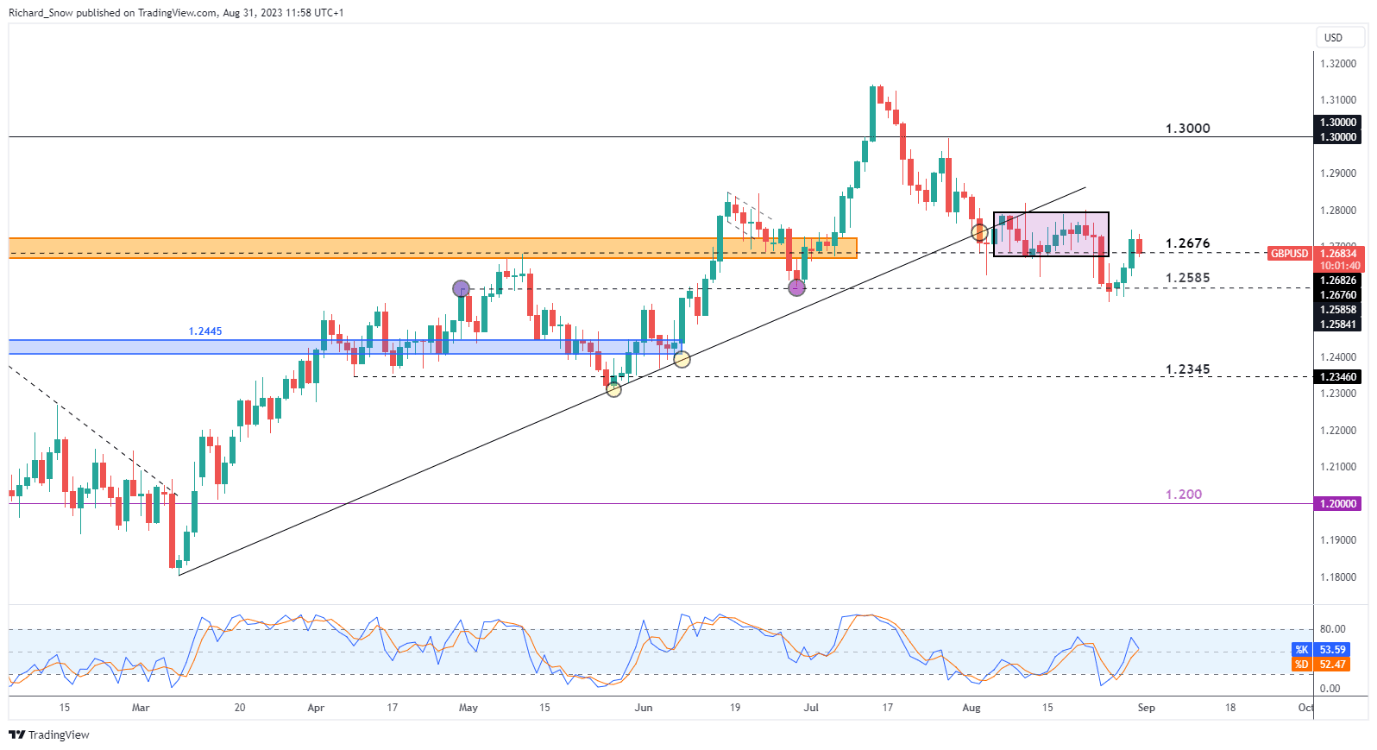

Cable is slightly lower today however, as markets look ahead to US PCE at 13:30 and NFP tomorrow. Do not discount the effect of a higher PCE print resulting in a stronger dollar, unwinding some of the losses throughout this week thus far. GBP/USD has traded below 1.2676 – the September 2020 spike low – with the next level of support around 1.2585. Choppy price action has ensued ever since the downside breakdown of the prior long-term trend, highlighting the sensitivity to incoming news and lack of trend bias. In these types of market conditions, trading ranges can develop with significant horizontal levels playing a more prominent role.

Upside levels of not include the high of the prior channel of consolidation at 1.2800 before the psychologically important 1.3000 comes into focus.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

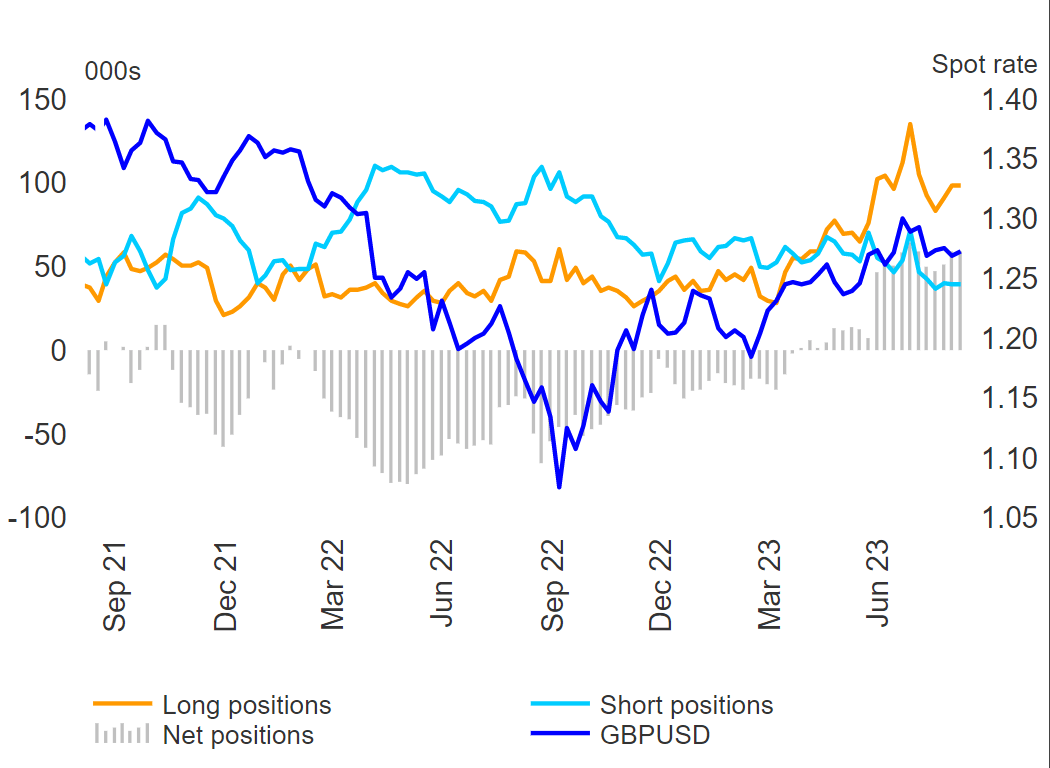

Institutional money continues to favour cable upside, with net-longs continuing to hold. According to the most recent commitment of traders data, net-longs outnumber net-short positions in sterling as interest rate expectations keep the pound elevated. Earlier today BoE economist Huw Pill signaled that he favoured maintaining rates at elevated levels rather than hiking – seeing some GBP weakness in the interim.

Pound (longs and shorts) with GBP/USD

Source: Commitment of traders report, CFTC, prepared by Richard Snow

EUR/GBP: Price action Paused and Dipped Mid-Range – Euro Lower

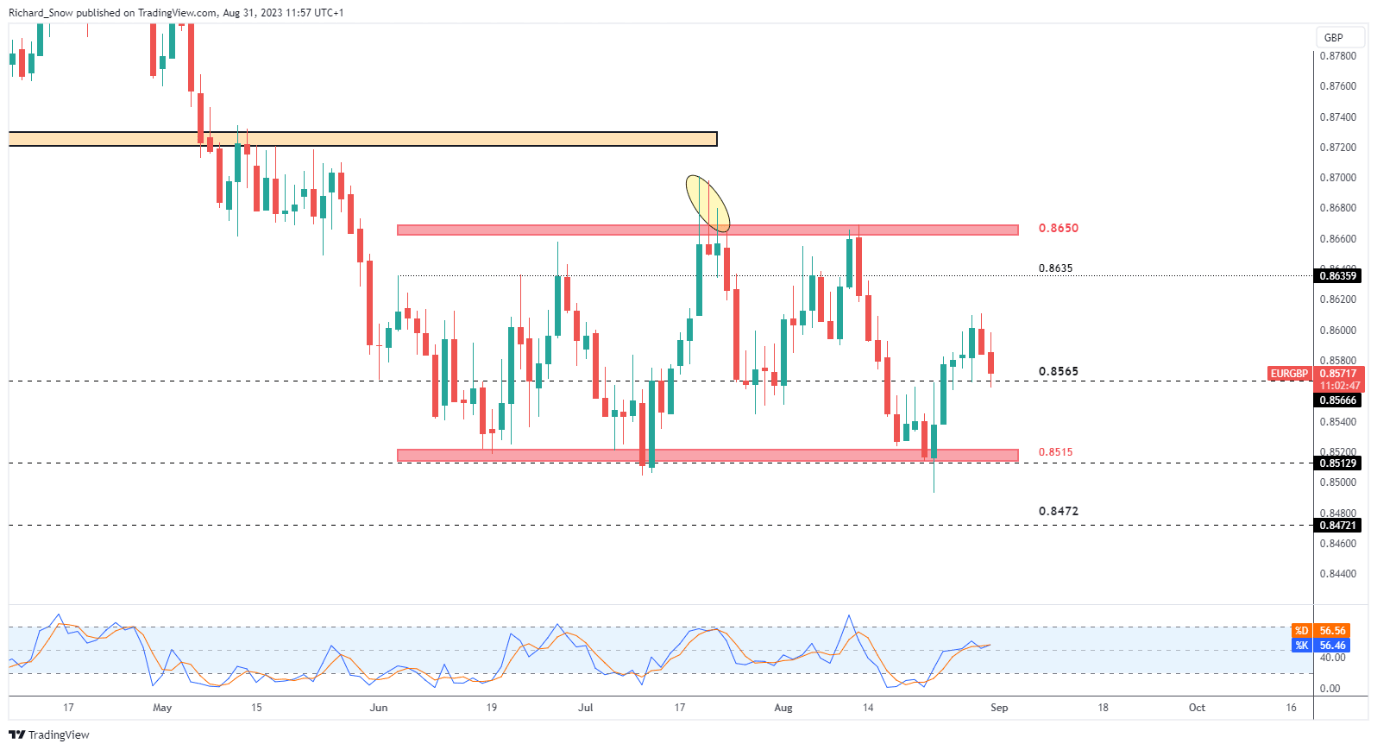

EUR/GBP headed lower this morning after EU inflation data revealed a cooler core but hotter headline measure of inflation than what was expected. Markets appeared to focus mainly on the core print, resulting in the euro selling off, building on yesterday’s decline.

Price action appears to have turned mid-way through the broader range (0.8515 – 0.8650), currently testing support at 0.8565. Adding to the euro selloff is the fact that markets earlier priced in a 70% change of no change in the interest rate next month when the ECB rate setting committee next meet, this is up from the 50/50 split observed earlier in the week. Furthermore, ECB ‘sources’ ahead of ECB President Christine Lagarde’s Jackson Hole address, hinted that the committee is adopting a more dovish view on additional rate hikes.

Support at 0.8565 is the current level being tested with 0.8515 potentially the next level of focus. Should euro bulls find value at current levels, a move higher brings 0.8635 and 0.8650 back on the radar, but given recent inflation dynamics and an apparent dovish lean from within the ECB, the bullish outcome appears less likely for now.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]