[ad_1]

Silver Talking Points:

Recommended by James Stanley

Get Your Free Top Trading Opportunities Forecast

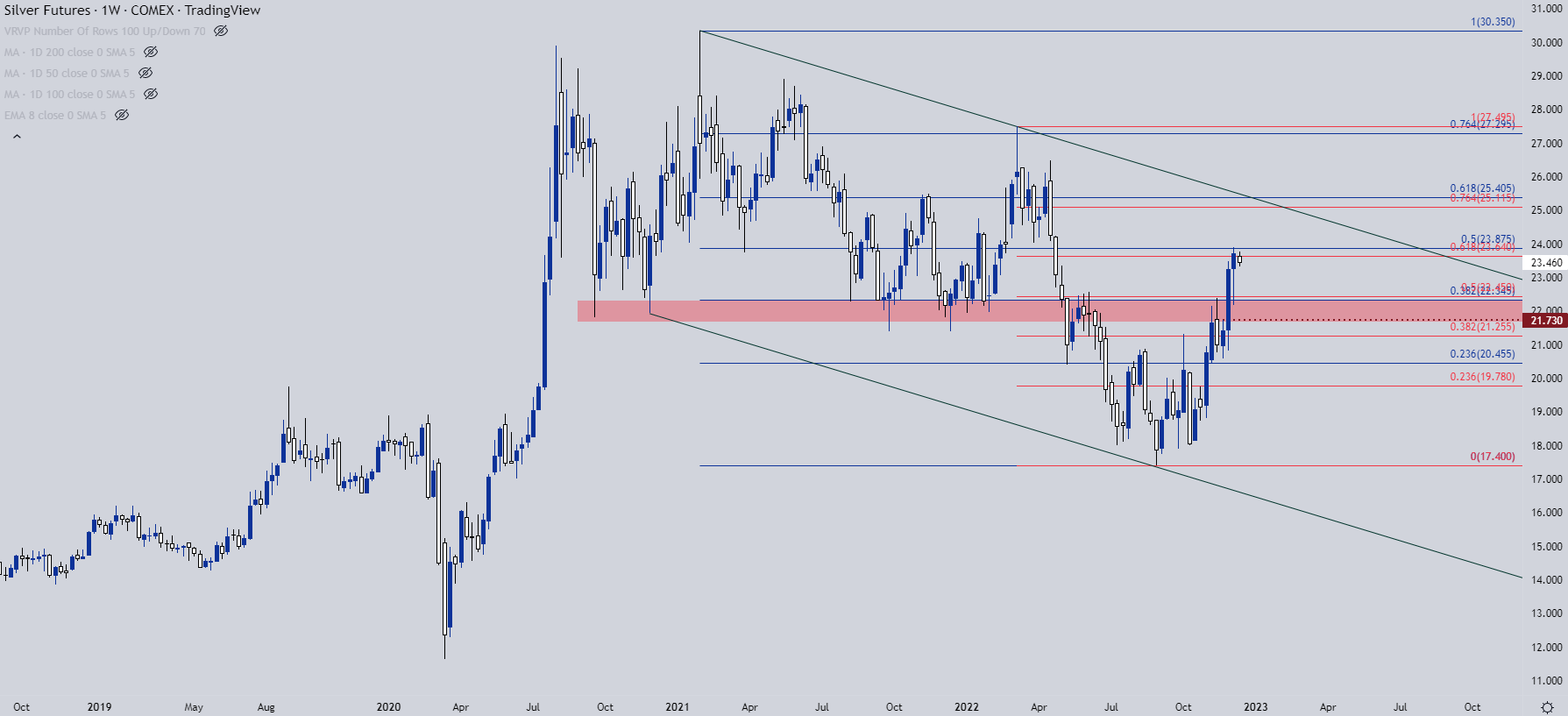

Silver prices set a fresh seven-month-high on Friday, finding resistance at a key Fibonacci level that plots at the price of 23.88. This is the 50% mark of the 2020-2022 sell-off and there’s also some prior price action reference, as this same level had helped to set a swing low a couple of years ago.

I had looked into Silver prices last week, highlighting a long-term zone of support that ended up helping to carve out last week’s lows. This runs from the 21.73 area up to around 22.35, and this was an area of support through 2021 trade until coming in as resistance in May and then again in November, just before prices staged a breakout to the fresh seven-month-highs that printed last week.

Silver Weekly Price Chart

Chart prepared by James Stanley; Silver on Tradingview

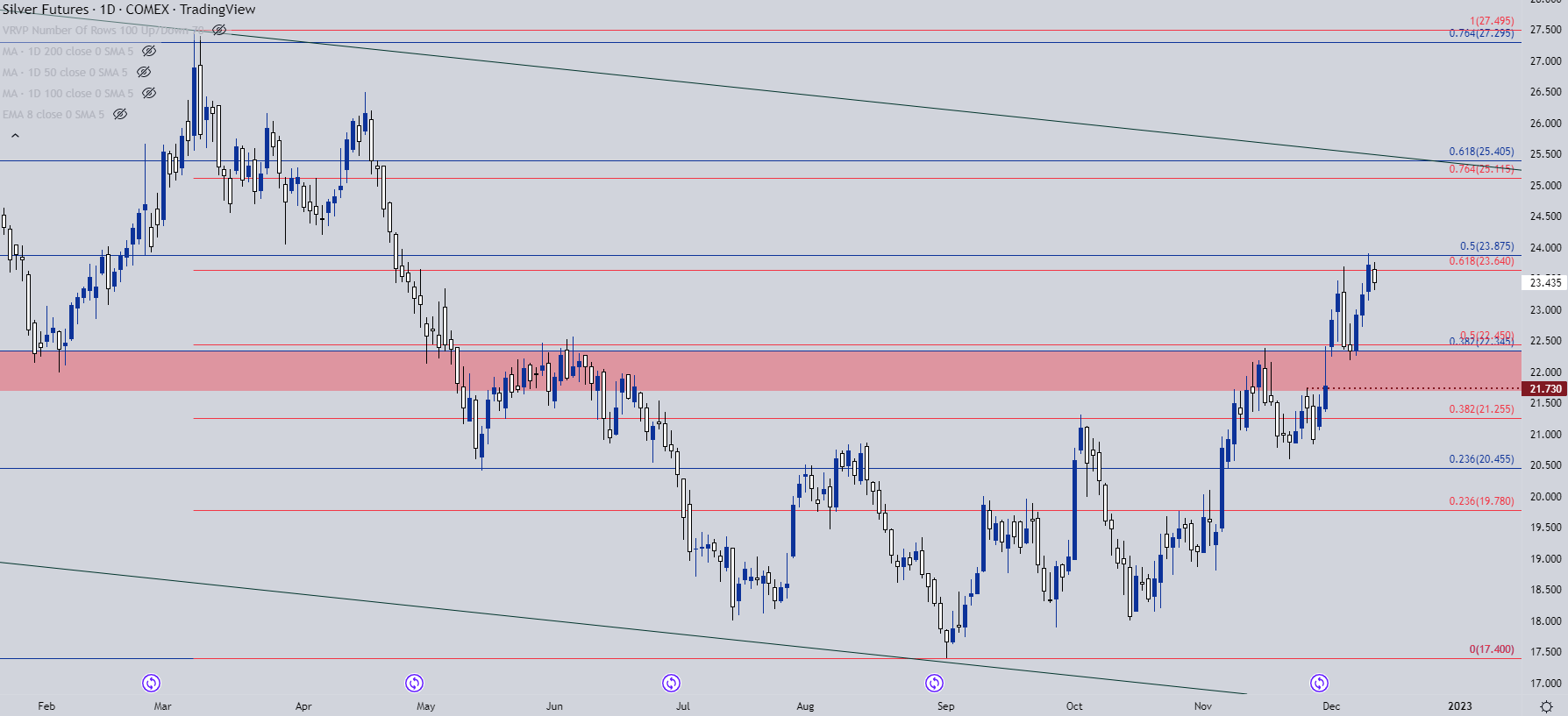

From the daily, we can see that support pullback that showed up last week, with the lows carving out around the 38.2% Fibonacci retracement of the same major move from which the 50% marker set the highs. There’s some additional reference here, as well, taken from the Fibonacci retracement covering the 2022 major move, from the high set in March down the same September low that was helping to set the prior retracement.

This highlights another level of resistance that’s at-play, taken from around 23.64 and collectively, with the 23.88 level, this creates a resistance zone that buyers will have to contend with if the breakout is to continue. But, a recent higher-high combined with last week’s higher-low keeps the door open for bulls.

Recommended by James Stanley

Traits of Successful Traders

Silver Daily Chart

Chart prepared by James Stanley; Silver on Tradingview

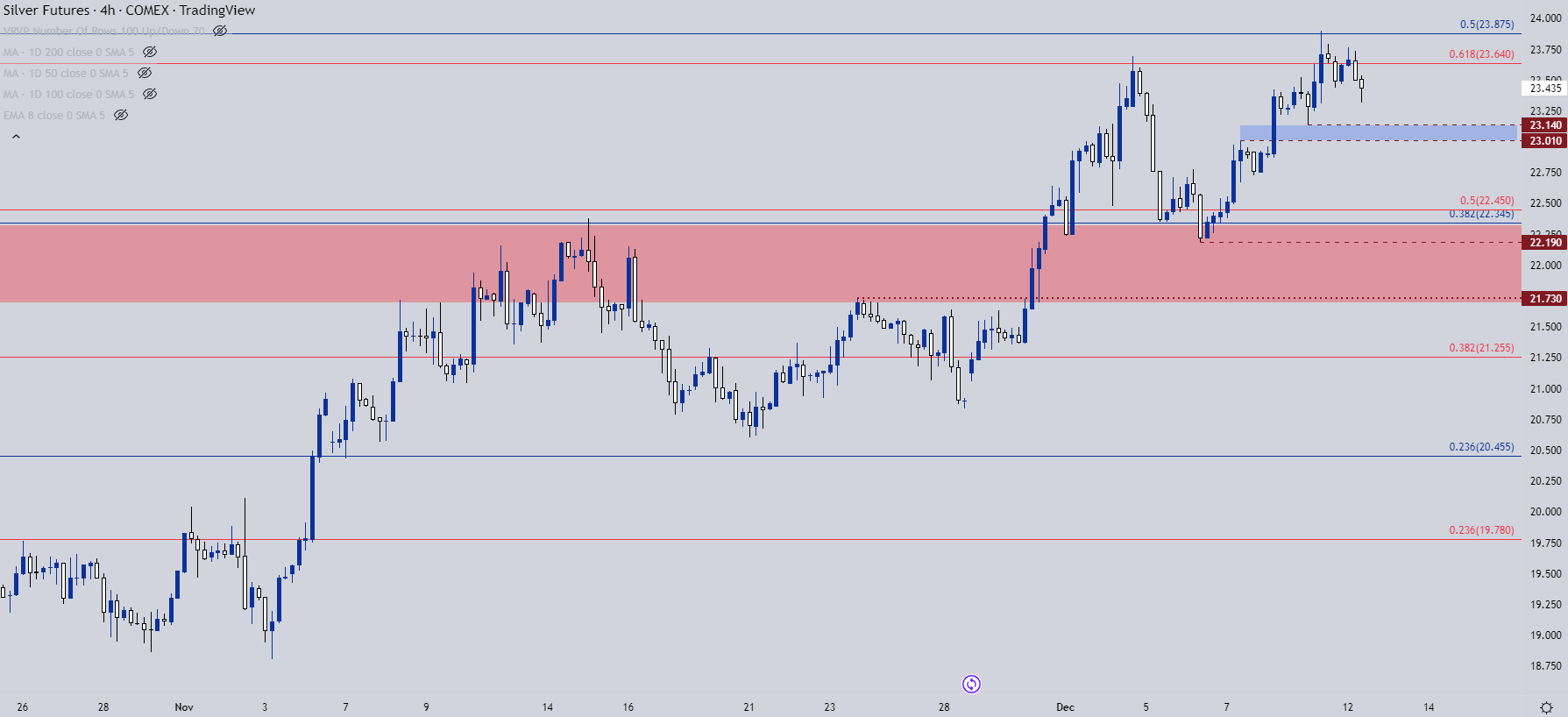

Silver Shorter-Term

Silver carries bullish potential given the recent higher-high to go along with a higher-low, but the big question is where that next higher-low might appear.

Last week’s swing-low is at 22.19, so buyers will need to step-in to offer support above that price. From recent price action, there’s some potential for such around the 23 handle, running up to around 23.14 which was last Friday’s swing-low just before the push up to Fibonacci resistance.

Recommended by James Stanley

The Fundamentals of Trend Trading

Silver Four-Hour Chart

Chart prepared by James Stanley; Silver on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Education

Contact and follow James on Twitter: @JStanleyFX

[ad_2]