[ad_1]

EUR/USD ANALYSIS

- EZ and U.S. factors align to bring about bullish support for EUR/USD.

- U.S. CPI the focus for the week.

- Rectangle breakout potential on daily chart.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro continues its upward trajectory after last weeks U.S. economic data prints (Non-Farm Payroll (NFP) and ISM) hurt the U.S. dollar. Attention was given to falling wage pressures in the U.S. which has been a major factor to elevated inflation via the U.S. services sector. Many market participants are now forecasting a follow through to the upcoming U.S. CPI release and could cement a 25bps interest rate hike for the February Fed meeting, exposing EUR/USD to further upside.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

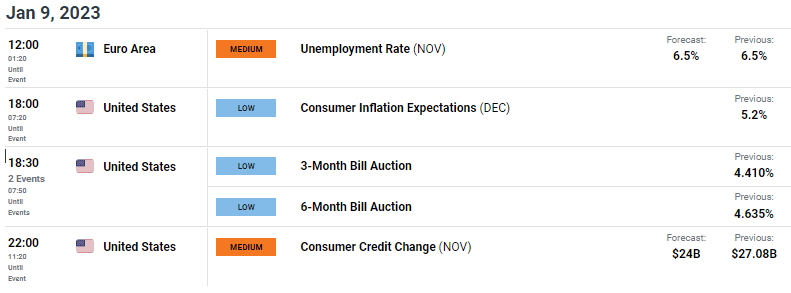

From a eurozone perspective, rising core inflation supplemented the preference for the euro while today’s unemployment rate (see economic calendar below) could reinforce the tight labor conditions in the region. Unemployment has been trending lower with November’s print hitting yearly lows at 6.5%. Lower gas prices are also contributing to euro optimism and the greater economic outlook for the eurozone but the main driver for the euro seems to be the dollar sell-off with flow moving into risk assets.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

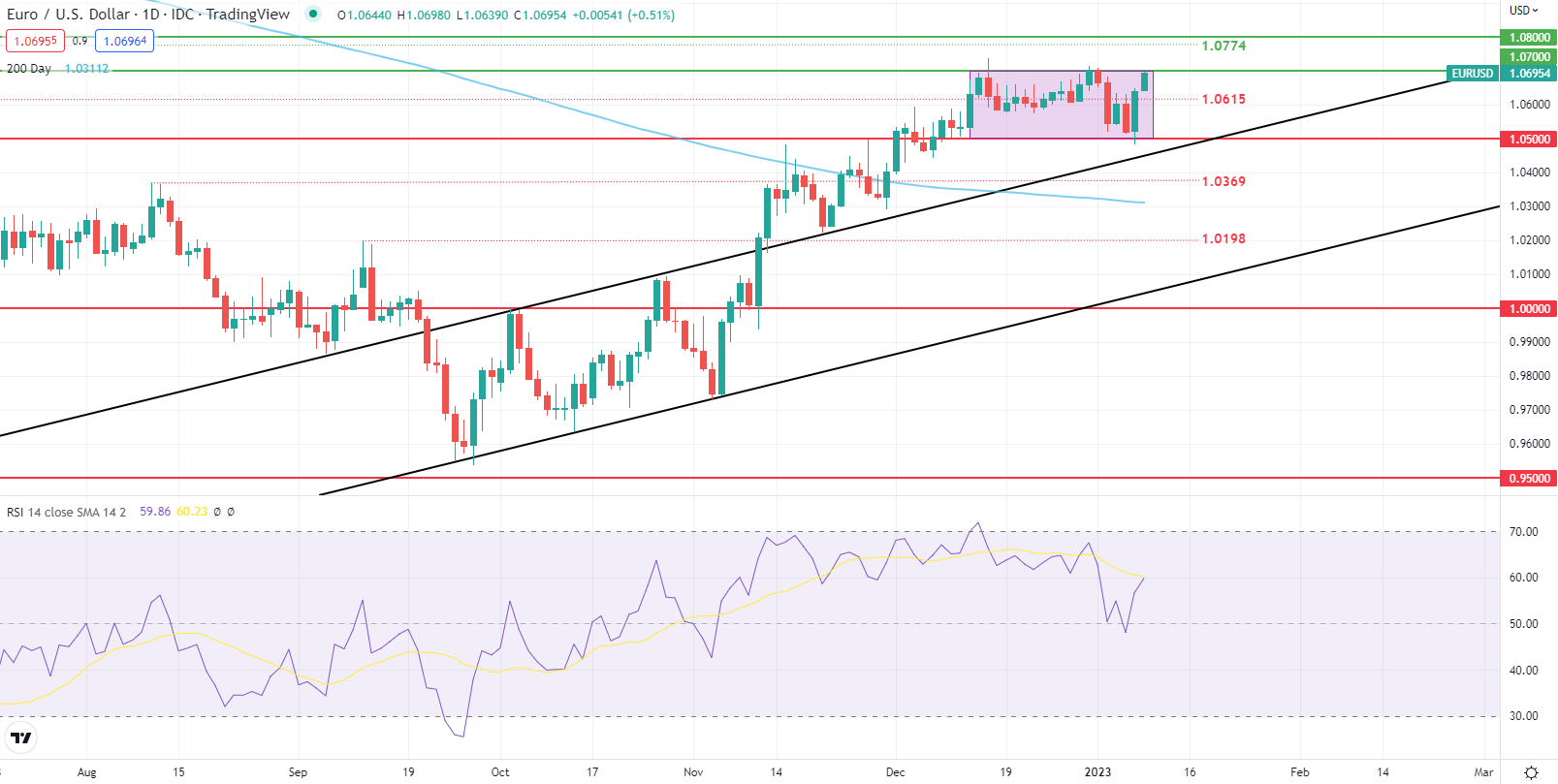

The EUR/USD daily chart shows the pair trading roughly 0.53% higher today but is not enough to breakout from the developing rectangle pattern (pink), finding resistance at the 1.0700 psychological level for now. A candle close above this handle could prompt a move higher towards the 1.0774 swing high but markets may decide to exercise some caution ahead of the U.S. CPI statistic to confirm softening inflation expectations before taking out current resistance.

Resistance levels:

- 1.0774

- 1.0700

Support levels:

- 1.0615

- 1.0500

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 67% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term bullish bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]