[ad_1]

SP 500 & NAS100 PRICE FORECAST:

- SPX and NAS 100 Continue to Advance, Now Up 4.7% and 5.7% Since the Recent Lows.

- Market Participants Buoyed on Belief that the Central Bank Hiking Cycles are Over Which Could Keep US Equities Supported.

- Apple Earnings Are Due After Market Close Today as US Jobs Data Tomorrow Could Set the Tone for What Comes Next.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Oil Price Forecast: 100-Day MA Provides Support to WTI but Will it Last?

US Indices are enjoying a stellar recovery this week with the SPX up around 4.7% and the NAS 100 up around 5.7%. This is in stark contrast of the recent slide which had put the SPX and the Nasdaq in correction territory following 10% of losses from the recent highs printed in mid-July.

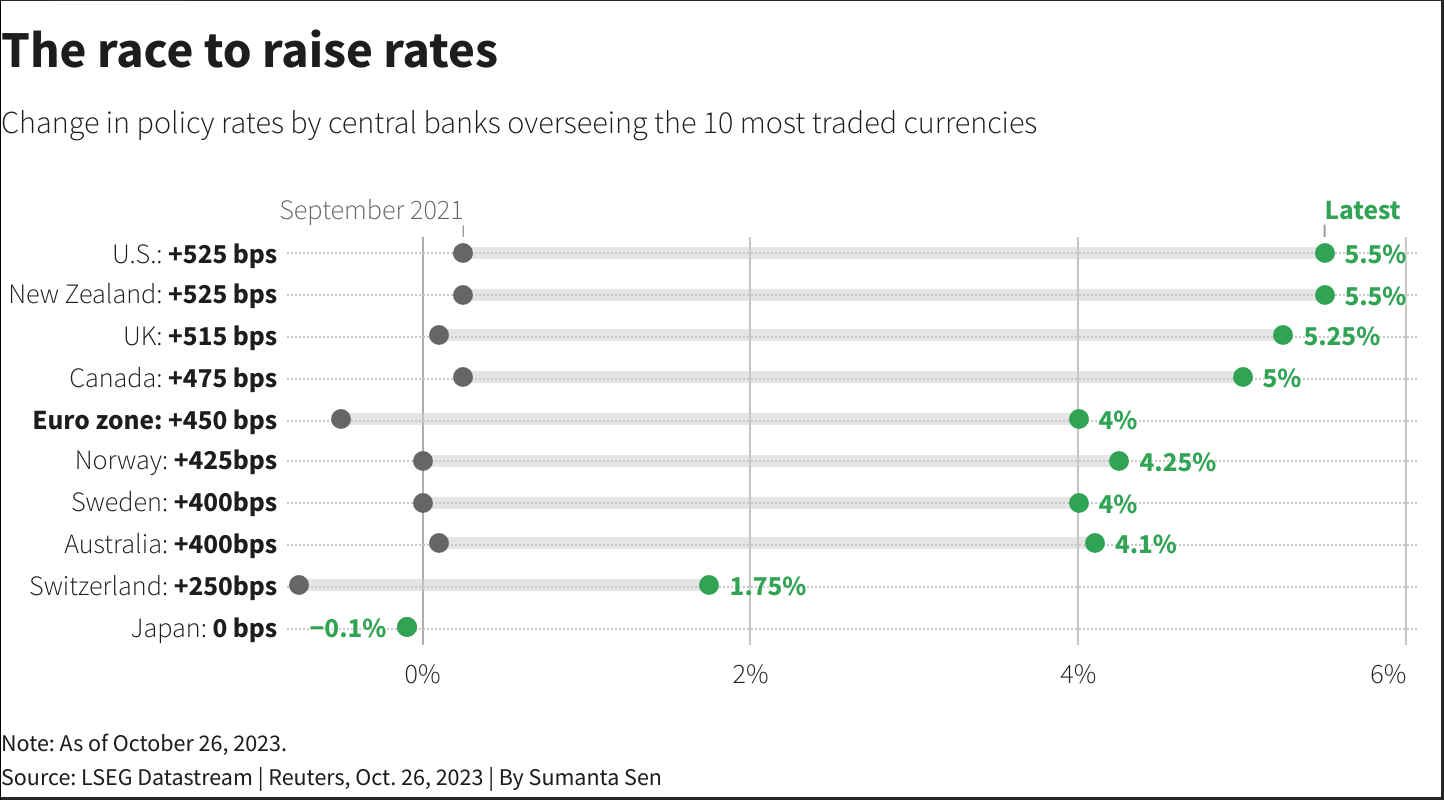

The rally received a further boost the lack of certainty provided by Federal Reserve and the Bank of England (BoE) had market participants betting that peak rates have been reached. Neither Central Bank openly saying as much, however, market participants are apparently seeing light at the end of the tunnel.

Source: Refinitiv

Fed Chair Powell reiterated his commitment to the 2% inflation target saying that he believes current policy should get the Fed to target but leaving the door open for the Fed to tighten should the need arise. The probability for rate cut in June 2024 have risen to a high of 70% following the FOMC meeting and could in part explain the upbeat mood we are seeing today.

EARNINGS AND MORE US DATA AHEAD

Today after market close, we get one of the most hotly anticipated earnings report as Apple will report on its quarterly performance. Expectations are for a 1% decrease in quarterly revenue, and this could hold some extra importance as Apple is a bellweather for consumer demand and the tech sector. This report and any hints at what to expect for Q4 could be intriguing given recent murmurs around poor sales in China for recent Apple product releases.

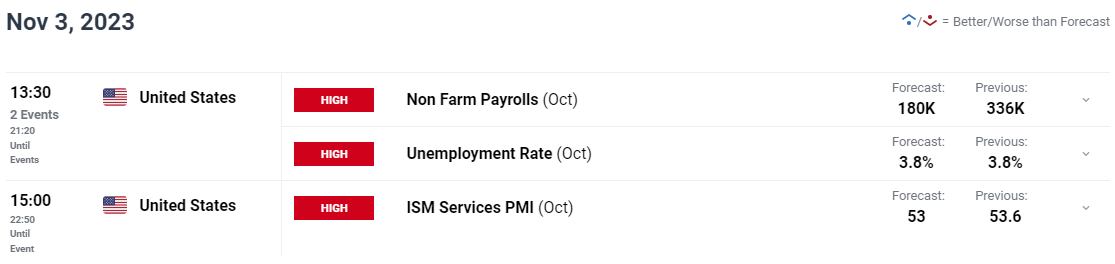

Tomorrow and all eyes will be focused on the US employment data with NFP, the unemployment rate and of course the all-important average earnings number. Any sign of labor market softening and a drop in average earnings could further embolden bulls and result in gains for the SPX, NAS 100 and risk assets as a whole.

For all market-moving economic releases and events, see theDailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

The SPX rally to the upside has been gaining traction throughout the week and breaking through some key areas of resistance. Despite the excellent gains this week the index is still in a downtrend until the 4399 swing high isn’t broken.

However, there is a key confluence area approaching before the previous swing high can be reached and this may prove a stumbling block for the S&P. The 4325 level which is a resistance area lines up perfectly with the descending trendline and we also have the 50-day MA just above this level adding a further layer of resistance. My hesitance about this level also stems from the fact that the weekend is approaching and following the size of the rally this week we could see some profit taking ahead of the weekend which could see the SPX experience a retracement tomorrow. The middle east tension has seen market participants unwilling to hold positions open over the weekend and I think this will continue for a while longer.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

S&P 500 November 2, 2023

Source: TradingView, Chart Prepared by Zain Vawda

The NAS100 has been on a similar tear as the SPX but has gained about 1% more. The charts look very similar with the Nasdaq also facing a key confluence area up ahead. The 15000-15100 area promises to be key for the Nasdaq if the bullish momentum is set to continue as this confluence area has the 100-day MA as well as the descending trendline. Above this area we have another resistance area around 15300.

A rejection here will bring immediate support around the 14740 mark into focus before 14540 and then the recent lows may come into focus. As I mentioned with the SPX, we could see market participants do some profit taking ahead of the weekend and this could keep the Nasdaq under pressure tomorrow assuming US data doesn’t throw any upbeat surprises on the labor market data release.

NAS100 November 2, 2023

Source: TradingView, Chart Prepared by Zain Vawda

Recommended by Zain Vawda

The Fundamentals of Trend Trading

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]