[ad_1]

S&P 500, SPX, NASDAQ 100, NDX – OUTLOOK:

- The S&P 500 index and the Nasdaq 100 index have rebounded from vital support area.

- However, the upside could be capped for now.

- What are the outlook and the key levels to watch in the S&P 500 and the Nasdaq 100 index?

Recommended by Manish Jaradi

Traits of Successful Traders

US indices may have rebounded in recent days, thanks to earnings and the retreat in US yields. But the deep decline since last month has left a scar on the broader uptrend, one that could be hard to fill soon.

The S&P 500 index’s peak-to-trough decline of 6% since July and the Nasdaq 100 index’s drop of 8% is the deepest since the rally began in March – a risk pointed out in the recent updates. See “US Indices Rally Beginning to Crack? S&P 500, Nasdaq Price Setups,” published August 3. See “S&P 500, Nasdaq 100 Forecast: Overly Optimistic Sentiment Poses a Minor Setback Risk,” published July 23.

Overbought conditions, extreme optimism, and the belief that the US economy is soft landing have been some of the positive catalysts. However, with real yields rising, valuations well above historical averages, and full-year EPS projections yet to turn materially higher, the bar for equities to outperform some of the other asset classes is now higher. This implies that the rebound in recent days may not necessarily be “business-as-usual”, and the upside could be capped for now.

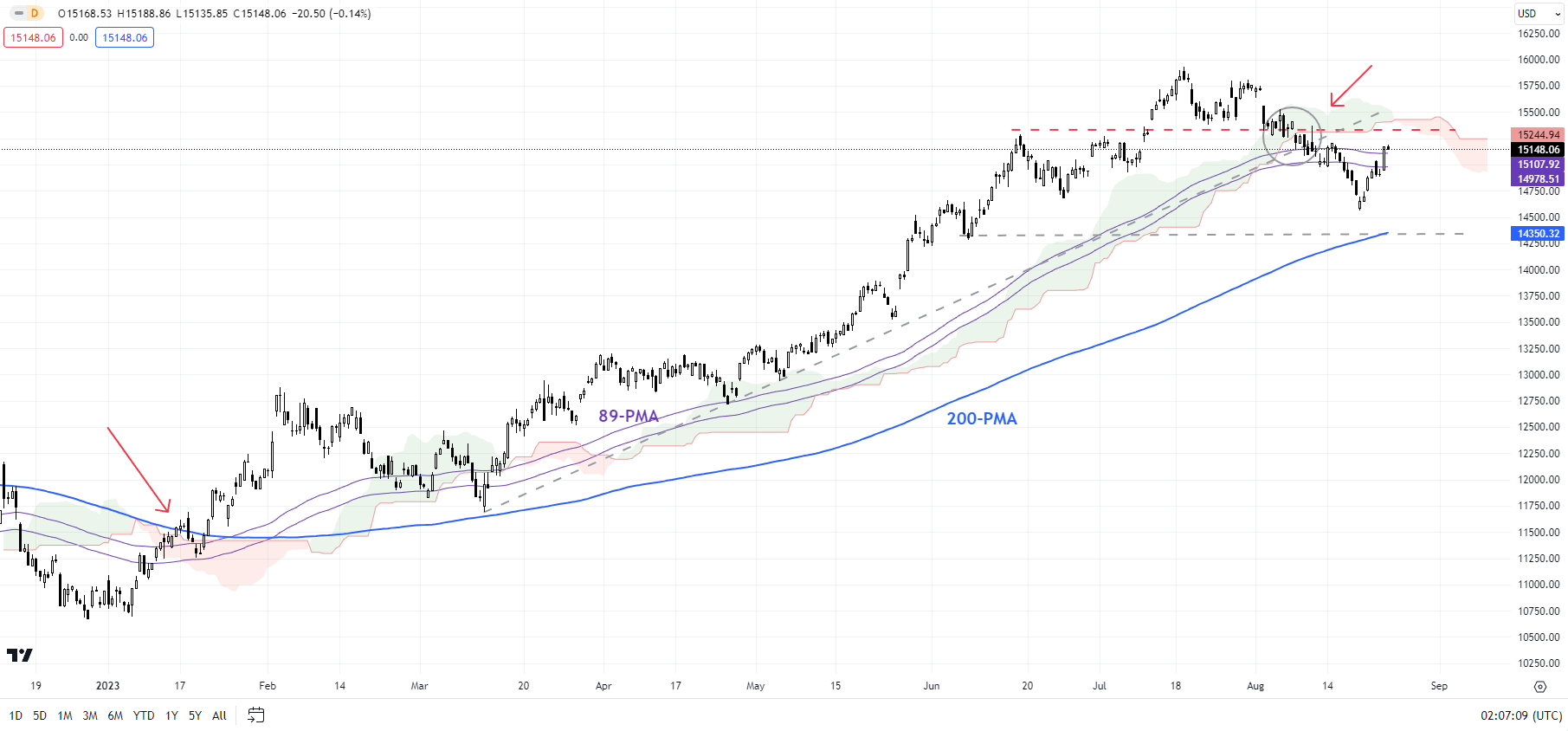

Nasdaq 100 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Nasdaq 100: Holding above the crucial cushion

On technical charts, the Nasdaq 100 index’s slide appears to have stalled at the vital cushion area, including the 89-day moving average, the lower edge of the Ichimoku cloud on the daily chart, and the June low of 14700. Importantly, the index’s fall below the 89-period moving average and the lower edge of the Ichimoku cloud on the 240-minute charts – for the first time since the rally began earlier this year – is a signal that the broader bullish pressure could be easing.

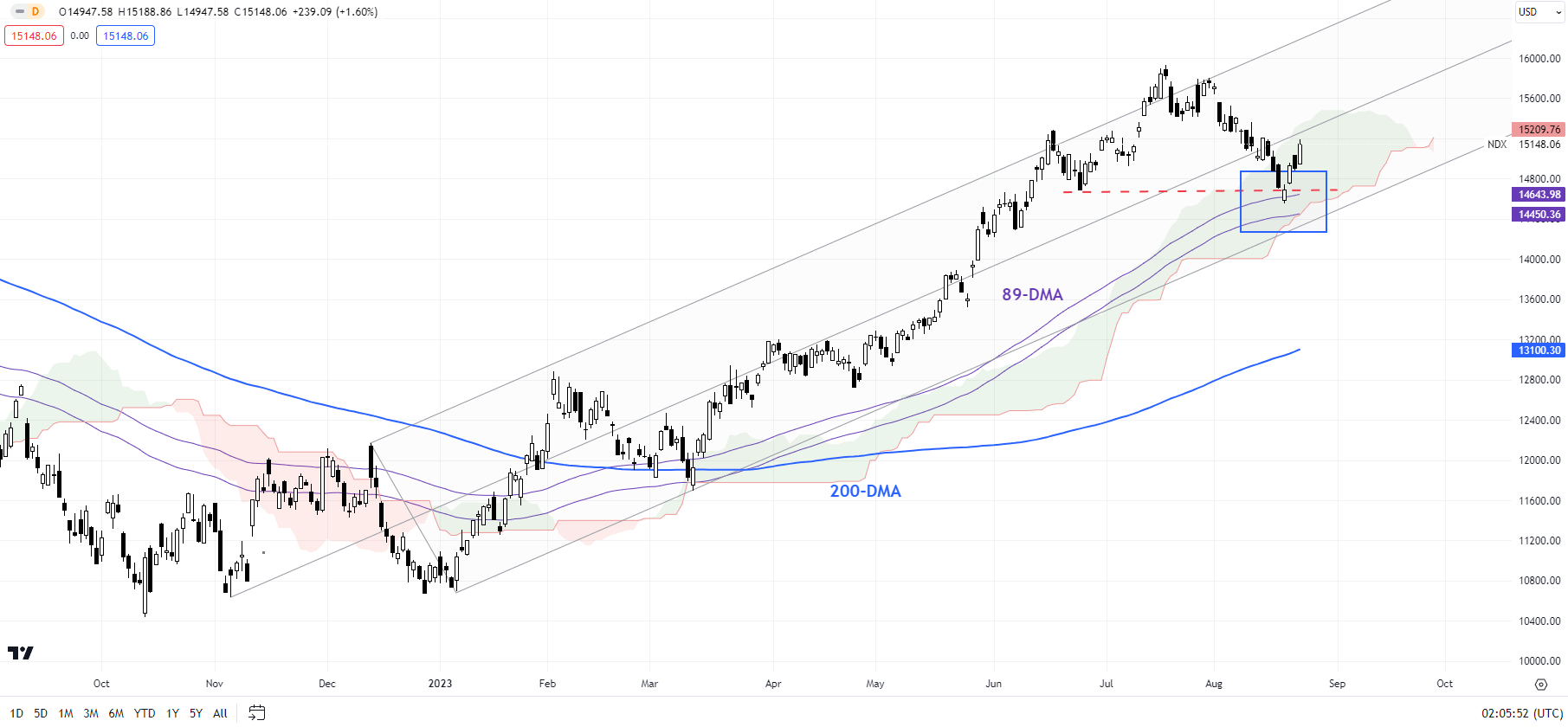

Nasdaq 100 Daily Chart

Chart Created by Manish Jaradi Using TradingView

Moreover, as noted in arecent update, monthly charts have been feeble compared with the 50% rally since October (see the monthly chart), raising the risk of a gradual weakening pattern in gold in recent months. For more discussion, see “Is Nasdaq Following Gold’s Footsteps? NDX, XAU/USD Price Setups,” published August 14. For the immediate softness to fade, the index would clear past resistance at 15400. Stronger resistance is at the July high of 15900.

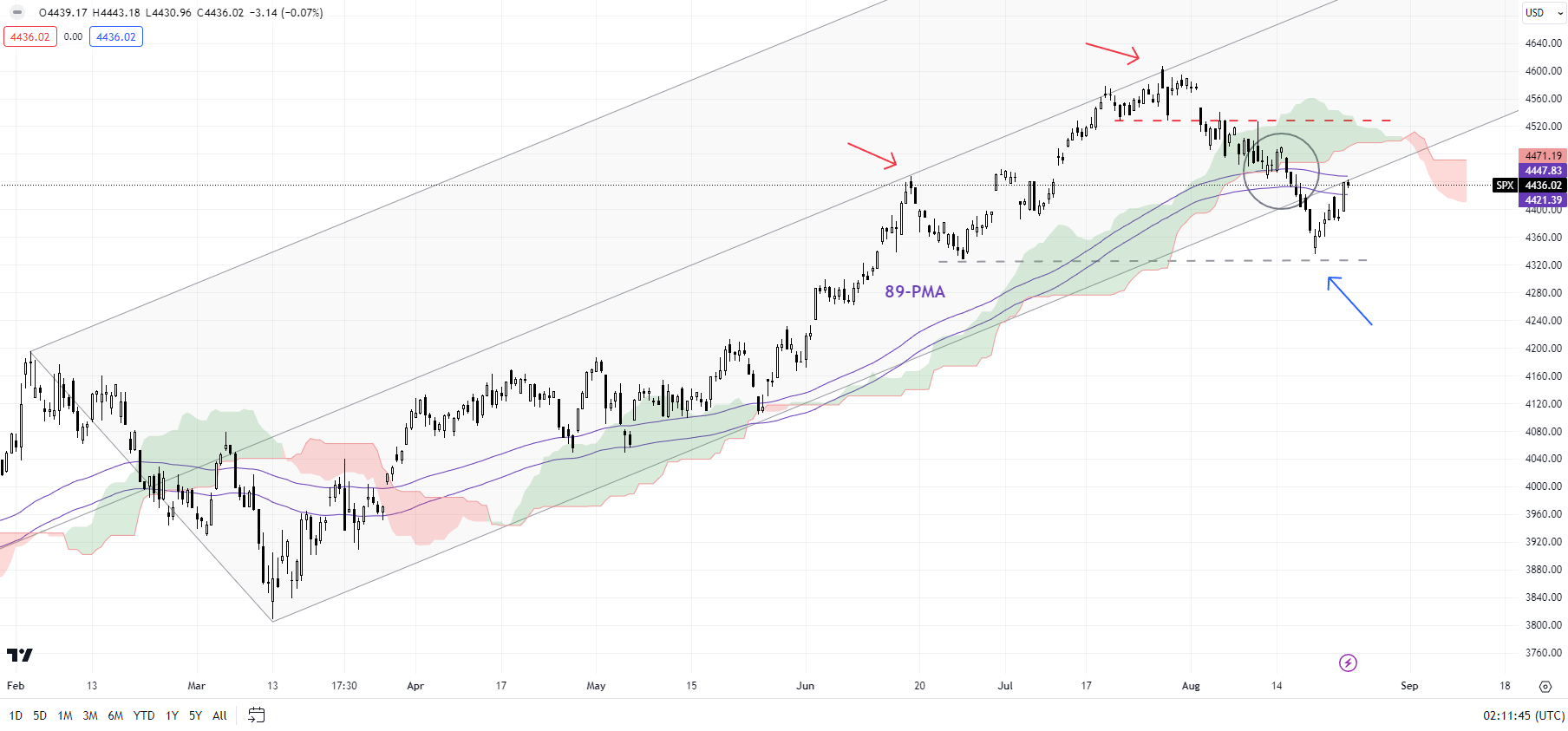

S&P 500 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView.

S&P 500: Upward pressure has eased

As highlighted in an update in July, the S&P 500 index’s fall below minor support at the late-July low of 4550 has confirmed that the short-term upward pressure has faded – a risk pointed out in July. See “S&P 500, Nasdaq 100 Forecast: Overly Optimistic Sentiment Poses a Minor Setback Risk,” published July 23.

S&P 500 Weekly Chart

Chart Created by Manish Jaradi Using TradingView

The recent retreat follows a failure to rise past converged resistance on the upper edge of a rising pitchfork channel from the end of 2022 and the April 2022 high of 4637. For now, though, the index has managed to find support at the June low of 4325, slightly below the lower edge of a rising pitchfork since early 2023. The broader index could need to clear past the support-turned-resistance at 4550 for the downside risks to dissipate.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]