[ad_1]

Swiss Franc, USD/CHF, Credit Suisse, SNB, ECB, RBA, NZD/USD – Talking Points

- The Swiss Franc steadied today after the Swiss National Bank stepped in

- Markets are left guessing where the blowtorch will next be applied

- If risk aversion takes hold, will it change the central banks tightening cycle?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Swiss Franc is caught in a vortex between a banking crisis and a risk-off event as markets are asking questions of what the ramifications of the failure of three US banks will be.

Credit Suisse has been bailed out by the Swiss National Bank (SNB) today. They will provide up to CHF 50 billion of liquidity to the embattled investment bank and Credit Suisse will buy CHF 3 billion of their own debt.

Going into today, Credit Suisse’s 1-year credit default swaps, (CDS) the cost of insuring the banks’ debt, went from under 5% to 37%. The share price remains well below CHF 2. The high above CHF 80 in 2007 is but a distant memory.

The Franc is often seen as a haven in times of uncertainty, but currency traders are conflicted with a Swiss bank in the centre of the current crisis of confidence.

The emerging banking woes are less than a week old but the path ahead for rates has pivoted dramatically. The terminal rate for the Federal Reserve is now around 4.85%, a long way from over 5.90% seen last week.

Recommended by Daniel McCarthy

Traits of Successful Traders

The Australian unemployment rate hit a multi-generational low today, but despite the tight labour market and record high inflation, the futures market is now pricing in a cut as the next move from the RBA in a few months. The bank has hiked at each of the last nine meetings.

For the record, the unemployment rate dipped to 3.5% in February against the 3.6% anticipated and 3.7% prior. 64.6k Australian jobs were added in the month, which was above the 50k anticipated and -10.9k previously.

New Zealand GDP came in lower than anticipated today and opens the probability of the island nation going into recession.

Fourth quarter GDP was -0.6% quarter-on-quarter rather than -0.2% forecast and 2% prior. The year-on-year read was 2.2%, well below the 3.3% anticipated and 6.4% previously. The first quarter of this year saw devasting cyclones and flooding hit the country and appears likely to undermine GDP for Q1. The Kiwi dipped under o.6140 but has since recovered.

Treasury yields continued to collapse going into the North American close with the front end of the curve down over 30 bp out to 5 years. Not surprisingly, the MOVE index, a measure of Treasury market volatility, is at its highest since the global financial crisis in 2009.

All this drama comes ahead of today’s European Central Bank (ECB) monetary policy decision. A Bloomberg survey of economists is looking for a 50 bp hike but the interest rate market is pricing in a 25 bp lift in light of recent events.

APAC equities are a sea of red with the risk-off vibe permeating sentiment. Futures are hinting at a slight uptick for the Wall Street open. Banking stocks globally have been hit the hardest.

Crude oil tanked yesterday, and it continues to languish today with the WTI futures contract under US$ 69 bbl while the Brent contract is below US$ 75 bbl. Gold has managed to mostly hold onto recent gains, trading above US$ 1,900.

The full economic calendar can be viewed here.

USD/CHF TECHNICAL ANALYSIS

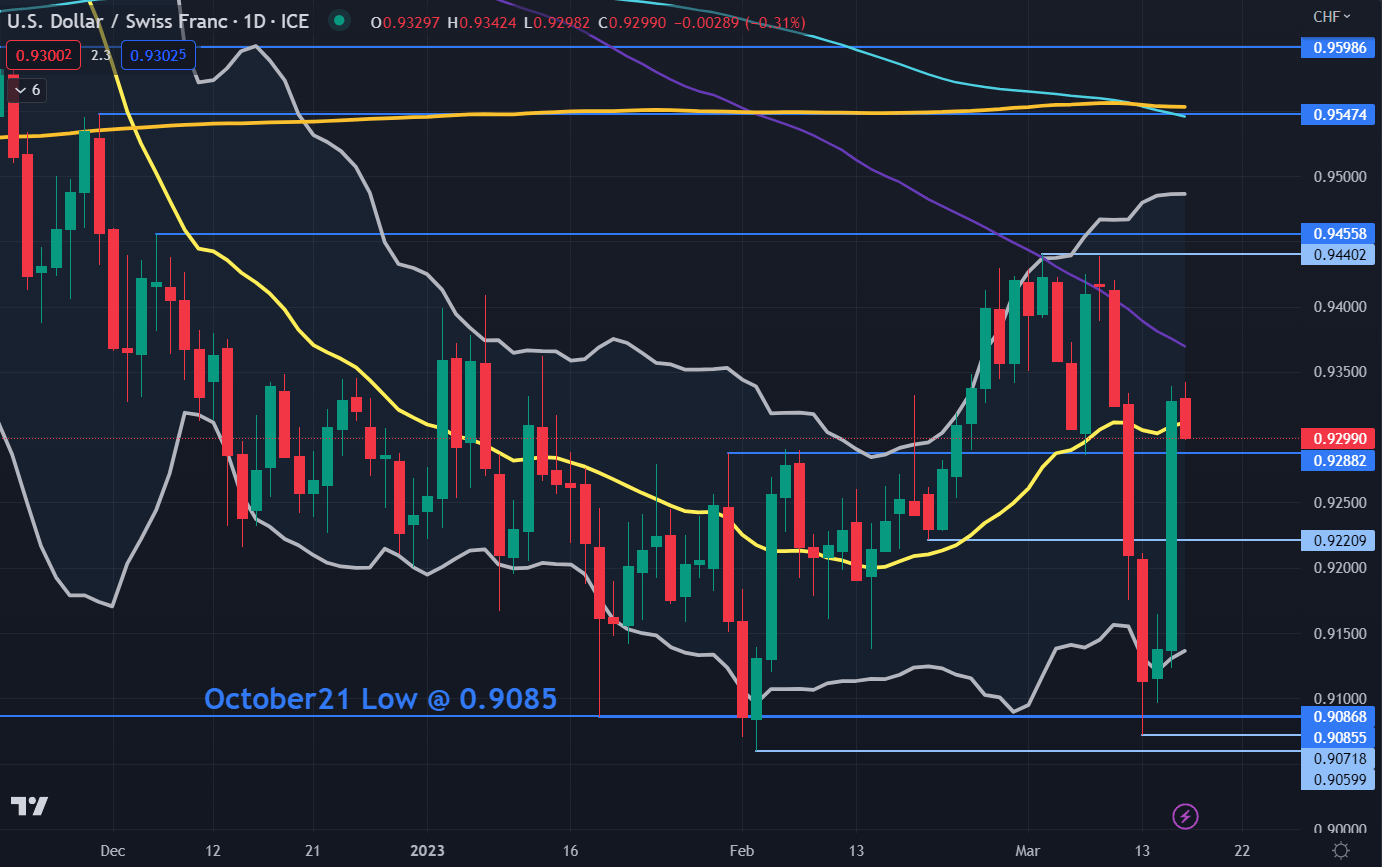

USD/CHF closed outside the lower band of the 21-day Simple Moving Average (SMA) based Bollinger Band earlier this week before closing back inside it to set up yesterday’s rally.

Resistance could be at the prior peaks of 0.9440, 0.9455 and 0.9550. The latter also currently intersects near the 200- and 260-day SMAs, which may lend resistance.

Support may lie at the breakpoints of 0.9288, 0.9220 and 0.9085 or the previous lows of 0.9070 and 0.9060.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]