[ad_1]

GBP/USD – Prices, Charts, and Analysis

- Friday’s US data could add a dose of volatility ahead of the Christmas break.

- Cable remains in a very narrow trading range this week.

Recommended by Nick Cawley

Traits of Successful Traders

Most Read: British Pound Forecast – GBP Pummelled by BoE Rate Split and Strikes

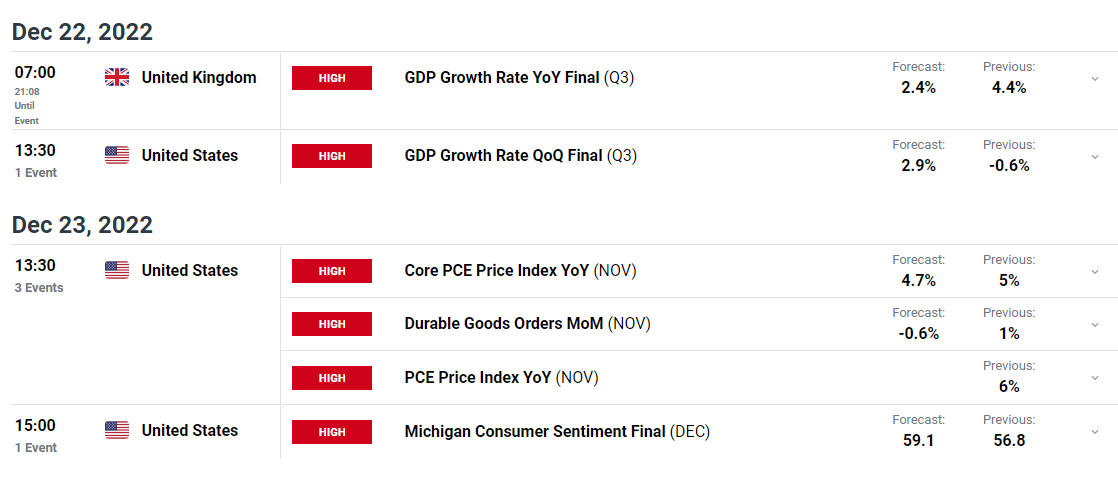

The US economic docket looks set to decide the market direction for a range of US-dollar pairs this week before the Christmas break sets in. Aside from a sharp bout of volatility in the Japanese Yen on Tuesday, overall the foreign exchange market has been quiet this week as traders put their trading books away for the seasonal break. There may be one last burst of volatility on Friday however when the latest US inflation data, core PCE, and Michigan Consumer sentiment report are released.

For all central bank policy decision dates see the DailyFX Central Bank Calendar

Recommended by Nick Cawley

How to Trade GBP/USD

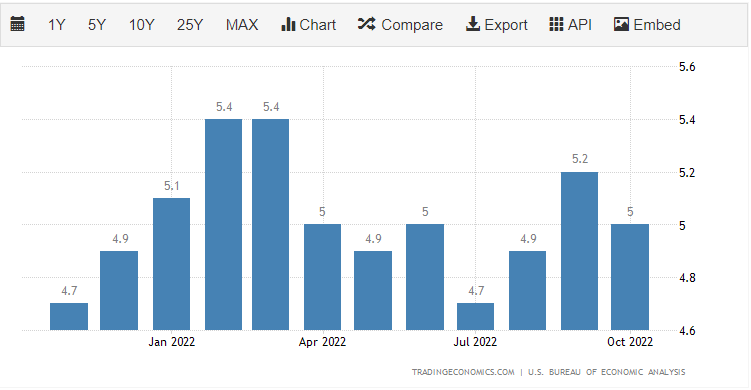

The inflation numbers for November will be closely parsed to see if price pressures in the US can fall for the third month in a row. Markets are currently looking at a reading of 4.7%, a level last seen in June 2022 and November 2021. A confirmation, or beat, of this number should send risk markets into Christmas in a positive mood.

The recent GBP/USD sell-off sees cable sitting in an interesting spot, just below the 20-day sma, just above the 200-day sma, and on the recent uptrend, with 1.2100 big figure support also in the mix. With all these technical factors in play, a break lower may gather momentum, while on the flip side a hold and break higher may see 1.2300+ in short order. With turnover slowing down, a 50/50 call on cable is not worth the risk/reward and it may be better to look at any new position at the start of next year.

GBP/USD Daily Price Chart – December 21, 2022

Chart via TradingView

Retail Trader Bias Is Mixed

{{SENTIMENT|GBPUSD}}

Retail trader data show 48.73% of traders are net-long with the ratio of traders short to long at 1.05 to 1.The number of traders net-long is 2.29% higher than yesterday and 21.90% higher from last week, while the number of traders net-short is 7.33% higher than yesterday and 10.19% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]