[ad_1]

US Dollar Vs Euro, British Pound, Australian Dollar – Outlook:

- The DXY Index (USD index) is testing key resistance after Powell warned of more tightening.

- Broader picture of USD rally fatigue remains intact ahead of key US data this week.

- What is the outlook and the key levels to watch for EUR/USD, GBP/USD, and AUD/USD?

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

The US dollar is holding gains against its peers after US Federal Reserve Chair Jerome Powell warned of more tightening to bring down inflation to the 2% target, especially if the recent uptick in activity exerts upward pressure on prices.

At the annual Jackson Hole Economic Policy Symposium, US Federal Reserve Chair Jerome Powell on balance stuck with a slightly hawkish tone, warning of additional rate hikes as inflation remains too high. However, Powell acknowledged the moderation in price pressure and said the Fed proceed carefully on whether to tighten further.

Powell said above trend growth could put further progress on inflation at risk and could warrant further tightening. US economic data have overwhelmed in recent months, with the Economic Surprise Index just off more than a two-year high. The recent upbeat industrial production, retail sales, and housing starts suggest activity in the current quarter has picked up. For more discussion see “US Dollar Toppish Ahead of Powell; EUR/USD, AUD/USD, GBP/USD Price Setups,” published August 24. Markets are now pricing in around 50% chance of a 25 basis points hike by the Fed at its November meeting, up from 33% a week ago.

The key focus is now on US manufacturing and services activity, US core PCE, and jobs data. Any signs of moderation in activity or price pressures could trigger a scale back in November rate hike expectations.

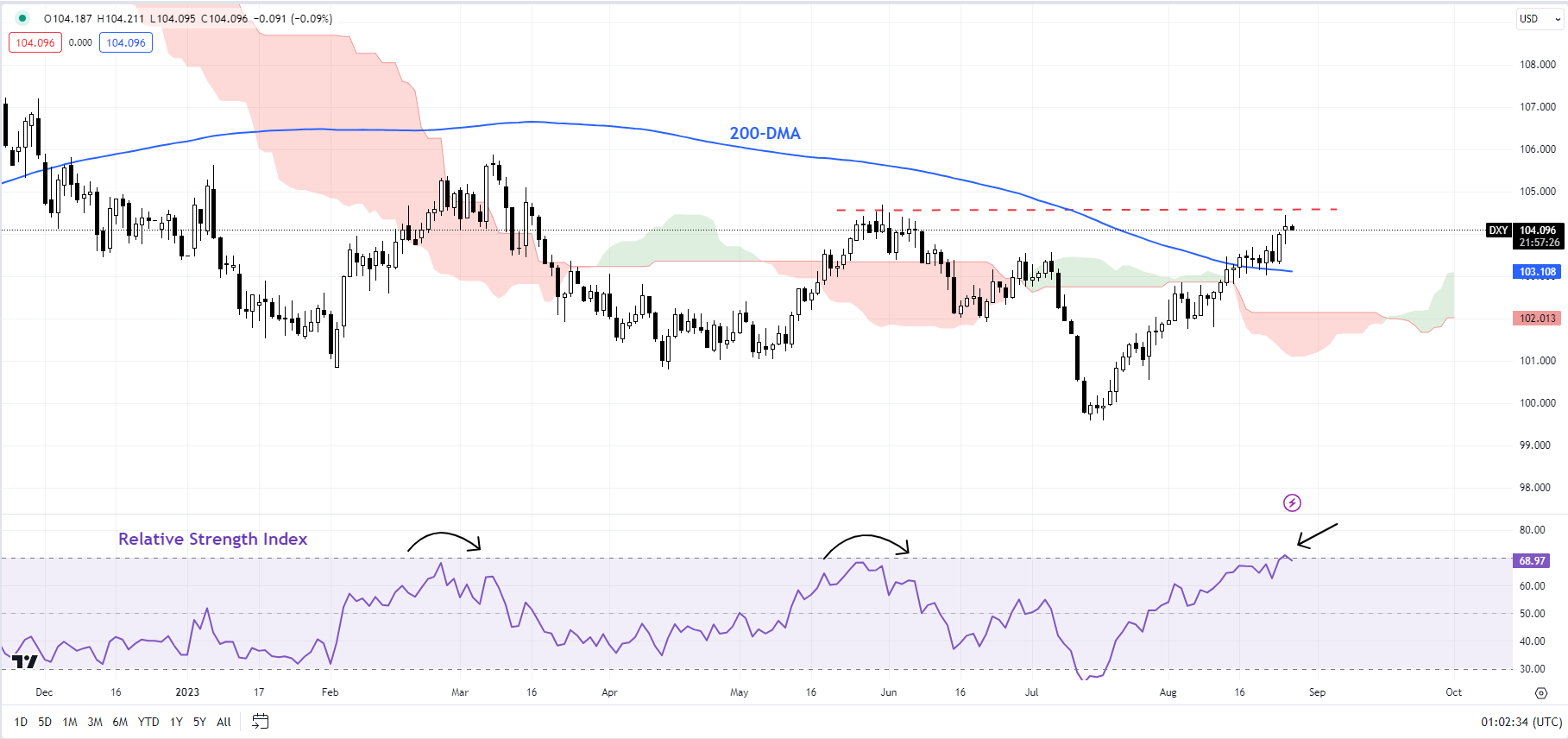

DXY Index Daily Chart

Chart Created by Manish Jaradi Using TradingView

On technical charts, the DXY Index (USD index) posted a doji candlestick pattern on the daily chart on Friday at vital resistance at the May high of 104.70, reflecting indecision. The 14-day Relative Strength Index is around 70 – the area that triggered a retreat on two occasions since the beginning of 2023. Having said that, the index would need to break below immediate support at last week’s low of 103.00 for the upward pressure to dissipate.

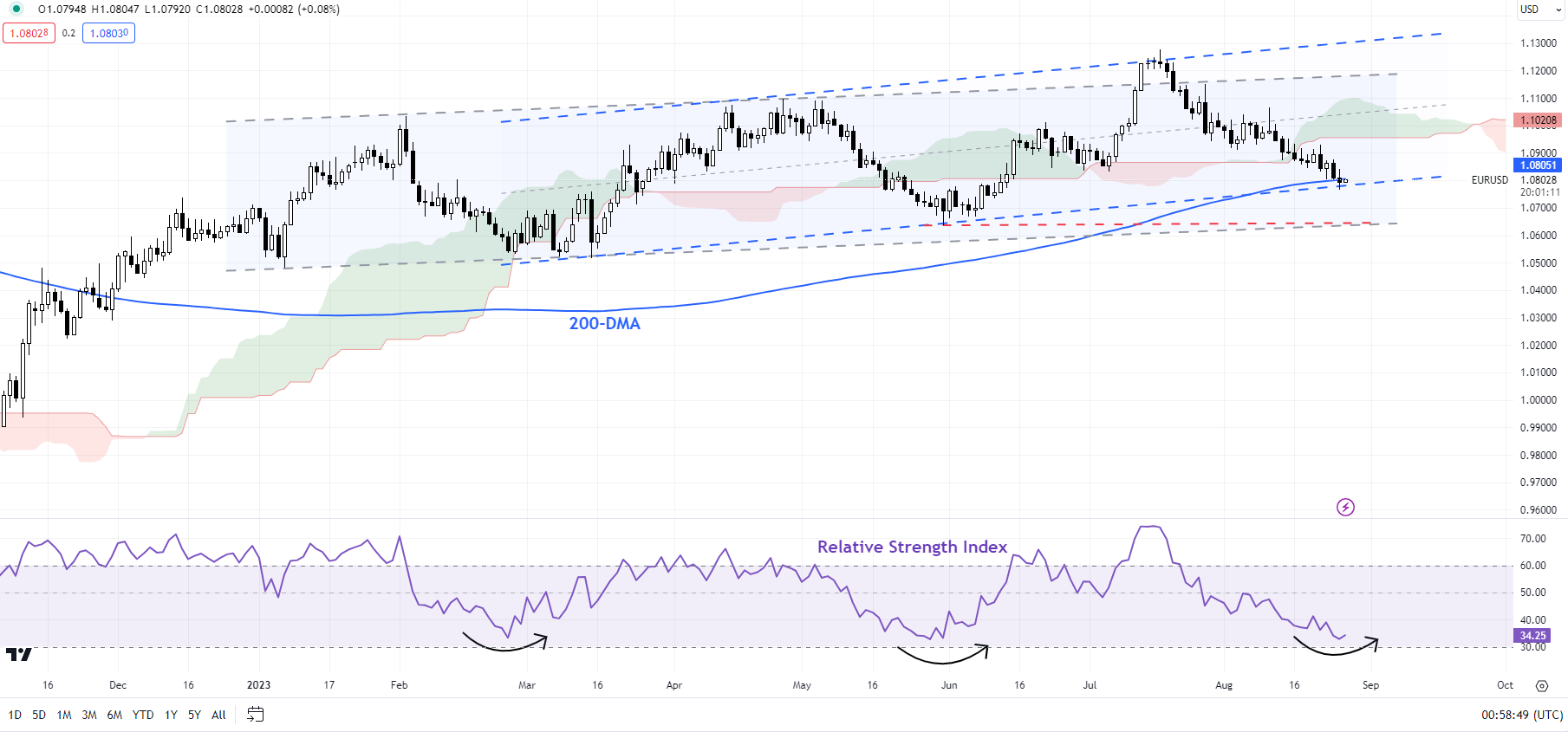

EUR/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Testing fairly strong support area

EUR/USD is flirting with fairly strong support on the 200-day moving average, coinciding with the lower edge of an upward-sloping channel, and slightly above the May low of 1.0630. The pair needs to hold above 1.0600-1.0800 for the broader upward pressure to remain intact. The 14-day Relative Strength Index is around levels that have been associated with a rebound in the past. Nevertheless, as highlighted in theprevious update, EUR/USD would need to rise above the initial resistance at 1.0900-1.0950 for the immediate downside risks to fade.

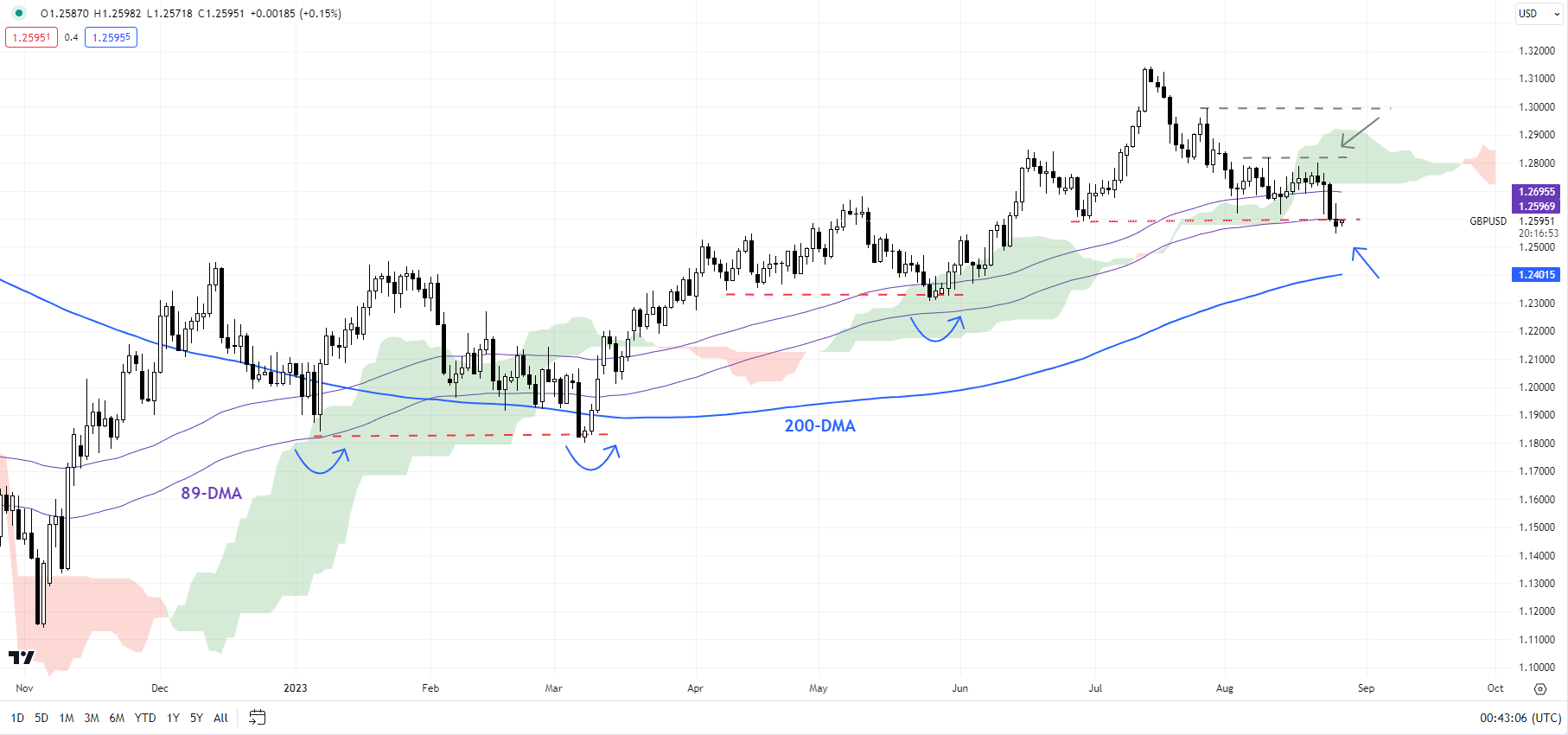

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

GBPUSD: Testing the line in the sand

GBP/USD’s failed attempt last week to clear important resistance at the August 10 high of 1.2820 is a sign of broader fatigue within the multi-month uptrend. For more discussion see “Pound’s Resilience Masks Broader Fatigue: GBP/USD, EUR/GBP, GBP/JPY Setups,” published August 23.

The pair is now testing the lower end of this month’s range of 1.2600-1.2800. The lower edge also coincides with the 89-day moving average, the lower edge of the Ichimoku cloud on the daily chart, and the end-June low of 1.2600. Below that, there is support on the 200-day moving average and the May low of 1.2300. Only a break below 1.2300 would pose a threat to the broader bullish phase.

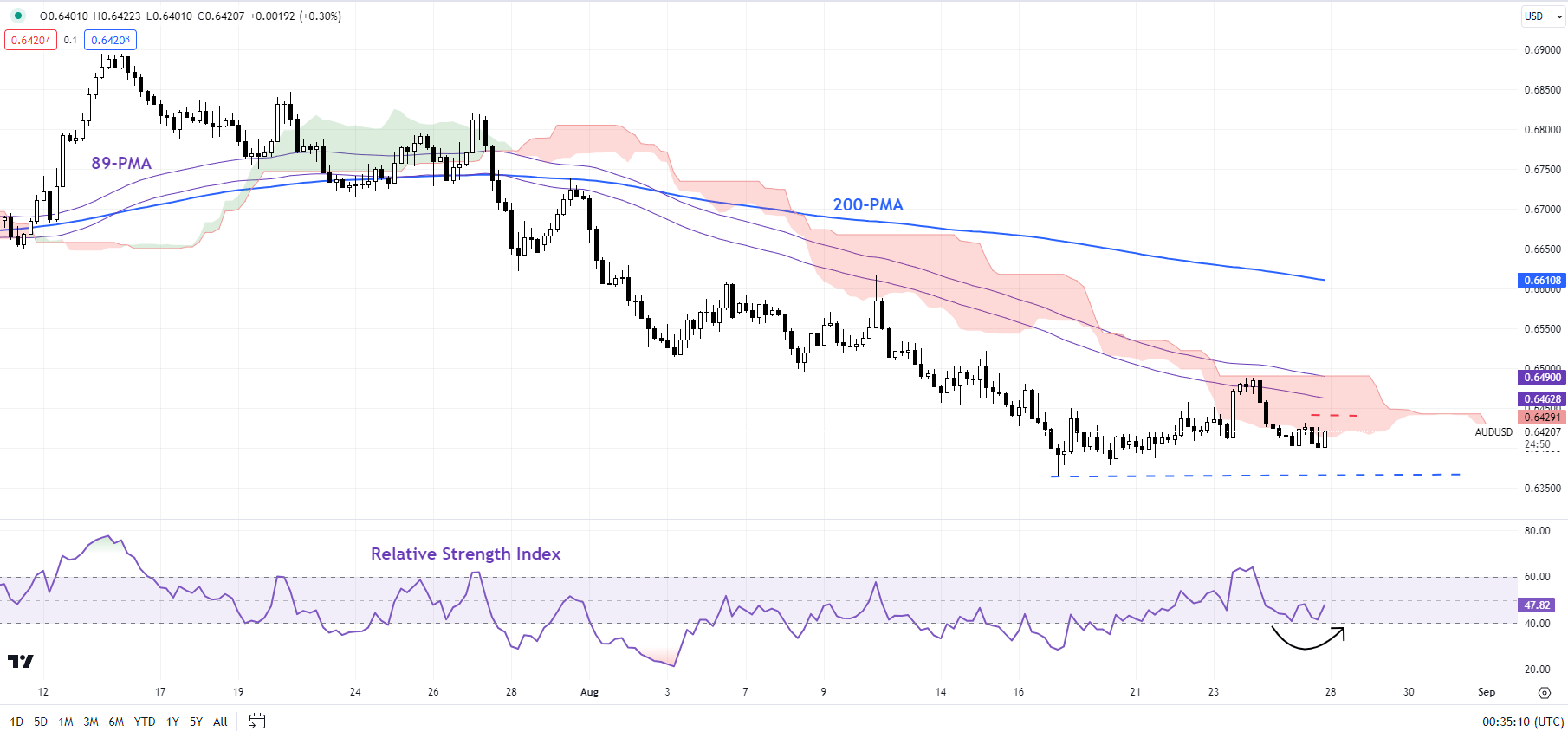

AUD/USD 240-minutes Chart

Chart Created by Manish Jaradi Using TradingView

AUD/USD: Signs of downtrend fatigue

AUD/USD continues to hold above vital converged support on the median line of a declining pitchfork channel since June and a downtrend line from the end of 2023. Any break above Friday’s high of 0.6440 could pave the way toward last week’s high of 0.6590. A break above 0.6590-0.6600 is needed for the immediate downward pressure to fade. Such a break could clear the path toward the 200-period moving average on the 240-minute chart. (now at about 0.6600).

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]