[ad_1]

US DOLLAR FORECAST:

- The U.S. economy added 236,000 jobs in March, slightly below consensus estimates. Meanwhile, average hourly earnings cooled more than expected, easing to 4.2% y-o-y.

- The labor market report, however, may not entirely capture the fallout from the collapse of SVB and SBNY

- Despite the market reaction on Friday, the path of least resistance is likely to be lower for the U.S. dollar

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Most Read: US Dollar Q2 Technical Forecast – Sellers Take Hold of Steering Wheel for Now

The U.S. dollar edged modestly higher heading into the long weekend following the release of the March U.S. nonfarm payrolls report in a session characterized by lower liquidity because of the Good Friday holiday. For context, U.S. employers added 236,000 workers last month, slightly below expectations for a gain of 239,000 positions. Meanwhile, average hourly earnings cooled more than anticipated, clocking in at 4.2% y-o-y, the lowest level since May 2021.

Although employment growth remained robust by historical standards, it is possible that the latest employment survey did not fully capture the fallout from the collapse of Silicon Valley Bank and Signature Bank of New York given the timing of when the BLS collected responses. This means that hiring may be overstating strength by only reflecting trends from earlier in the month when the banking sector turmoil had not yet manifested itself.

To err on the side of caution and buy more time to assess the economic outlook in the wake of recent financial system stress and turbulence, the Federal Reserve may forgo raising borrowing costs at its May meeting, putting its tightening campaign effectively on hold. This scenario could reinforce the U.S. dollar’s downward correction by leading traders to discount with greater conviction interest rate cuts for the second half of the year.

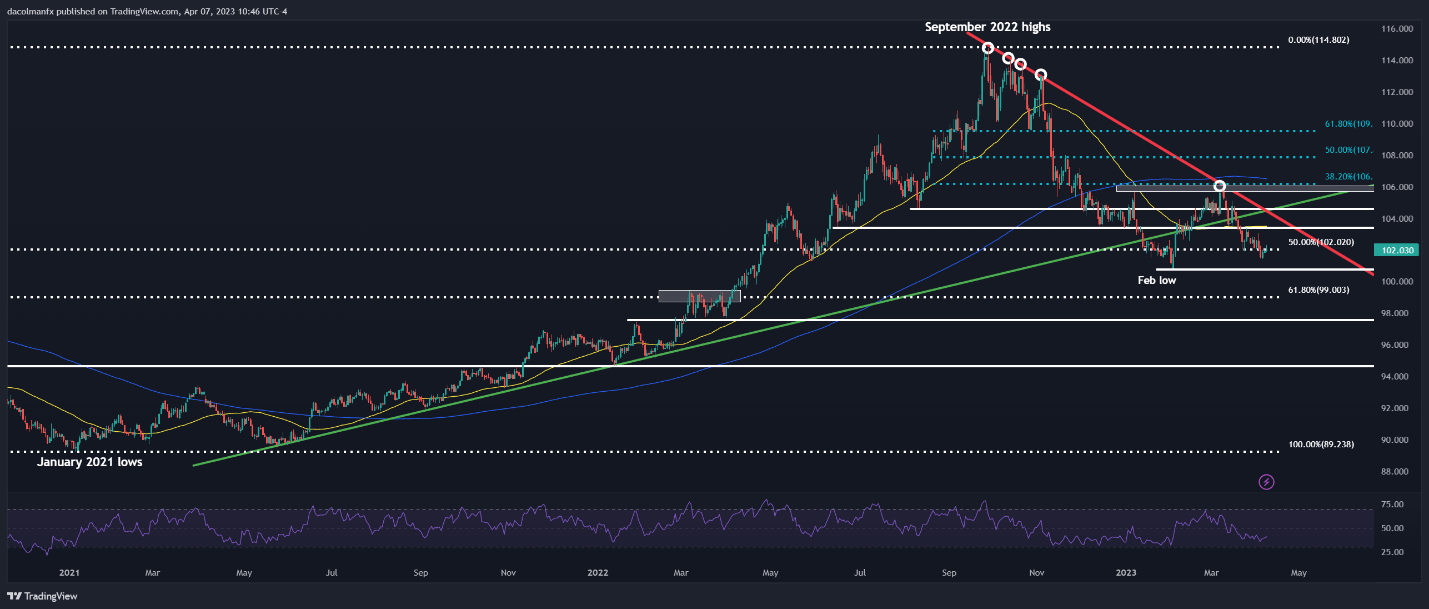

In terms of technical analysis, the U.S. dollar, as measured by the DXY index, continues to trade above key support near the 102.00 handle, which corresponds to the 50% Fib retracement of the January 2021/September 2022 advance. If prices manage to breach this floor decisively in the coming days, sellers could launch an attack on the February lows at 100.82. On further weakness, the focus shifts to 99.00, the 61.8% Fib retracement of the previous move discussed above.

On the flip side, if the DXY index surprises and begins to rebound meaningfully, initial resistance appears at 103.40, just a touch below the 50-day simple moving average. If this ceiling is taken out, however, we can’t rule out a rally toward trendline resistance at 104.50. The bullish scenario, however, seems far-fetched at this point, given the negative sentiment surrounding the U.S. dollar.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

US DOLLAR (DXY) TECHNICAL CHART

[ad_2]