[ad_1]

US DOLLAR OUTLOOK: BULLISH

- The U.S. dollar, as measured by the DXY index, rallies and closes the week at its best level since early January

- The greenback’s gains are driven by surging U.S. Treasury yields following hotter-than-expected PCE results

- ISM data will be in focus in the coming days, but the DXY heads into the new week with strong upside momentum.

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: EUR/USD Subdued as US Dollar Retains Upper Hand, Gold Can’t Shake Off the Blues

The U.S. dollar, as measured by the DXY index, rose this past week for the fourth consecutive week, notching to its best close since January (~105.2), supported by the surge in U.S. bond yields. The recent move in the fixed income space has been driven by a hawkish repricing of the Fed’s tightening path in response to a string of hotter-than-expected economic reports.

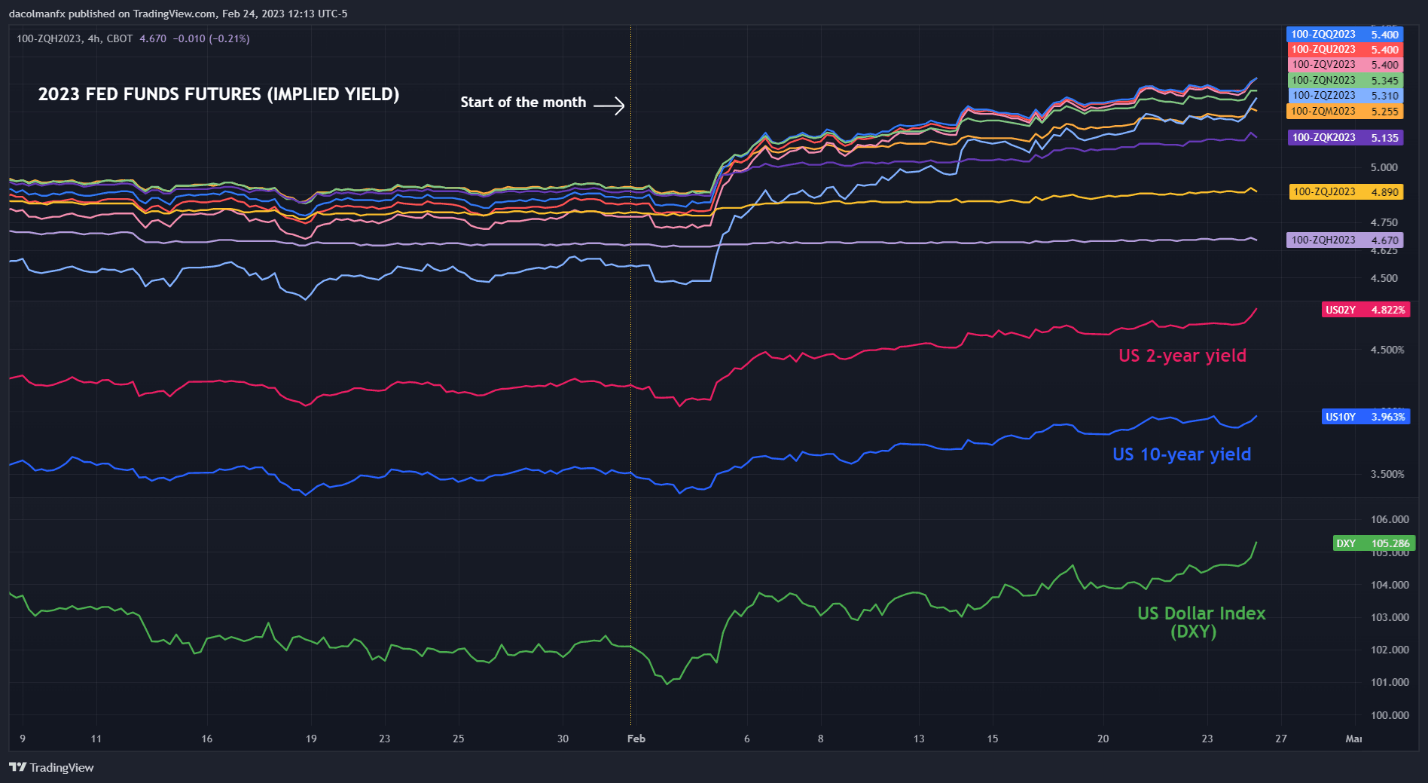

Strong labor market data, in concert with persistently elevated price pressures, have boosted expectations for the Fed’s terminal rate, lifting it to 5.39% at the time of this writing, a figure that implies about three additional 25 basis point hikes through the summer.

The higher peak for borrowing costs envisioned by Wall Street has bolstered Treasury yields across the curve, especially those at the front end, catapulting the 2-year note to fresh cycle highs above 4.82%, a level not seen since 2007. This has been an upside catalyst for the U.S. dollar.

2023 FED FUNDS FUTURES IMPLIED YIELD CHART

Source: TradingView

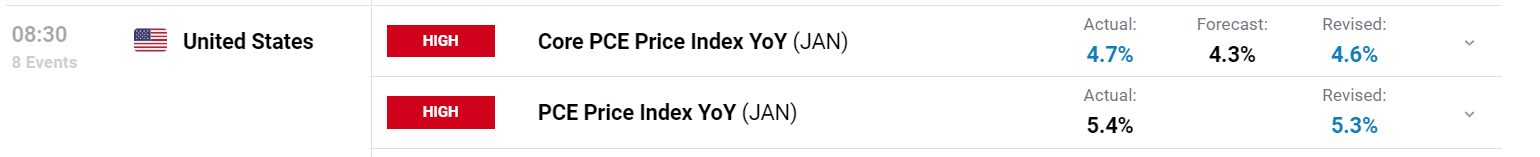

The current dynamic is not likely to change any time soon. In fact, the January PCE numbers released on Friday, which showed an unexpected acceleration in the Fed’s favorite inflation gauge, suggest that policymakers will have no choice but to maintain an aggressive stance for longer, indefinitely delaying a monetary policy pivot (Core PCE clocked in at 4.7% y-o-y versus 4.3% y-o-y expected).

Source: DailyFX Calendar

Overall, the stars appear to be aligning for a continuation of the bullish U.S. dollar impetus observed since the beginning of the month, especially if incoming data continue to point to extreme economic resilience.

We’ll have more insight into how business activity evolved in February next week when the Institute for Supply Management publishes its manufacturing PMI and services PMI reports, so traders should closely watch both surveys. That said, any economic strength in macro statistics will be positive for the U.S. dollar, while weakness should slow its advance, capping future gains.

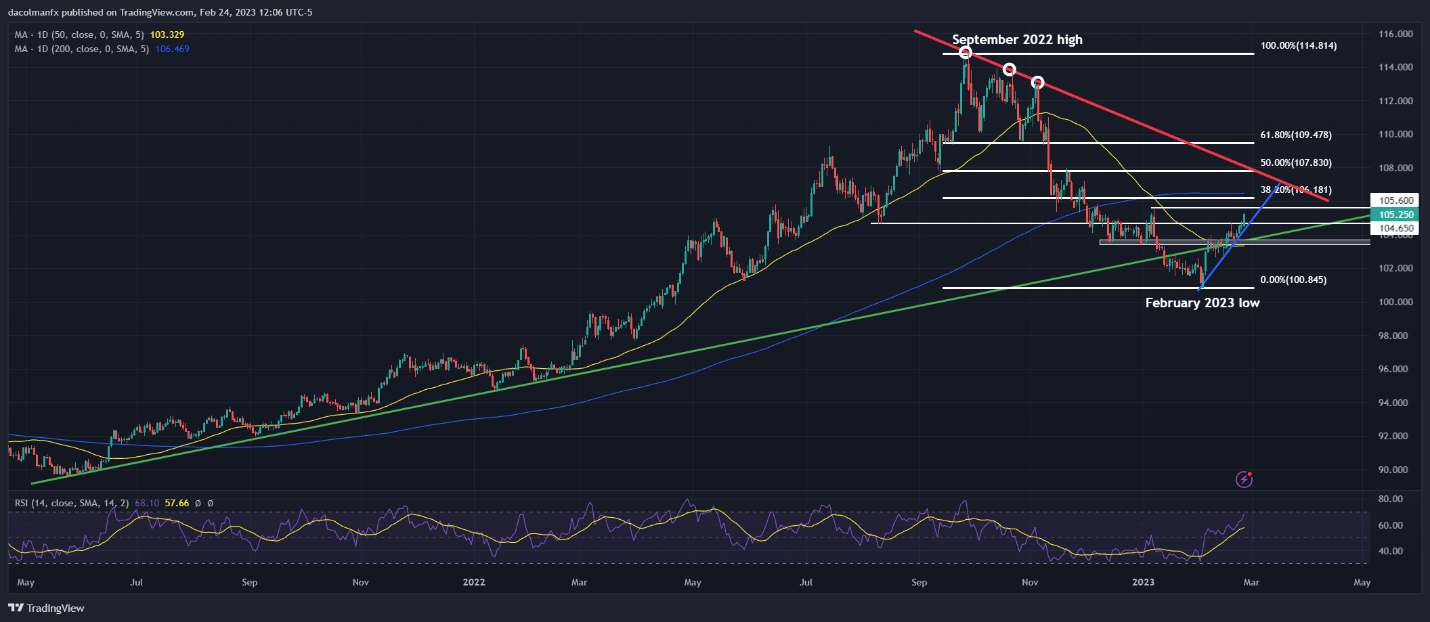

In terms of technical analysis, the DXY index cleared a key resistance near 104.70 heading into the weekend, reinforcing its constructive near-term outlook.

In any case, with upward momentum on its side, the U.S. dollar could be on track to retest the 2023 high in the coming sessions. Around that peak, market reaction will be key, but a topside breakout could set the stage for a sprint towards 106.18, the 38.2% Fib retracement of the September 2022/February 2023 correction. Conversely, a bearish rejection could lead to price action consolidation and a possible retrenchment towards 104.70.

Recommended by Diego Colman

Introduction to Forex News Trading

US DOLLAR INDEX (DXY) TECHNICAL CHART

US Dollar Index Chart Prepared Using TradingView

Written by Diego Colman, Contributing Strategist

[ad_2]