[ad_1]

US Dollar Talking Points:

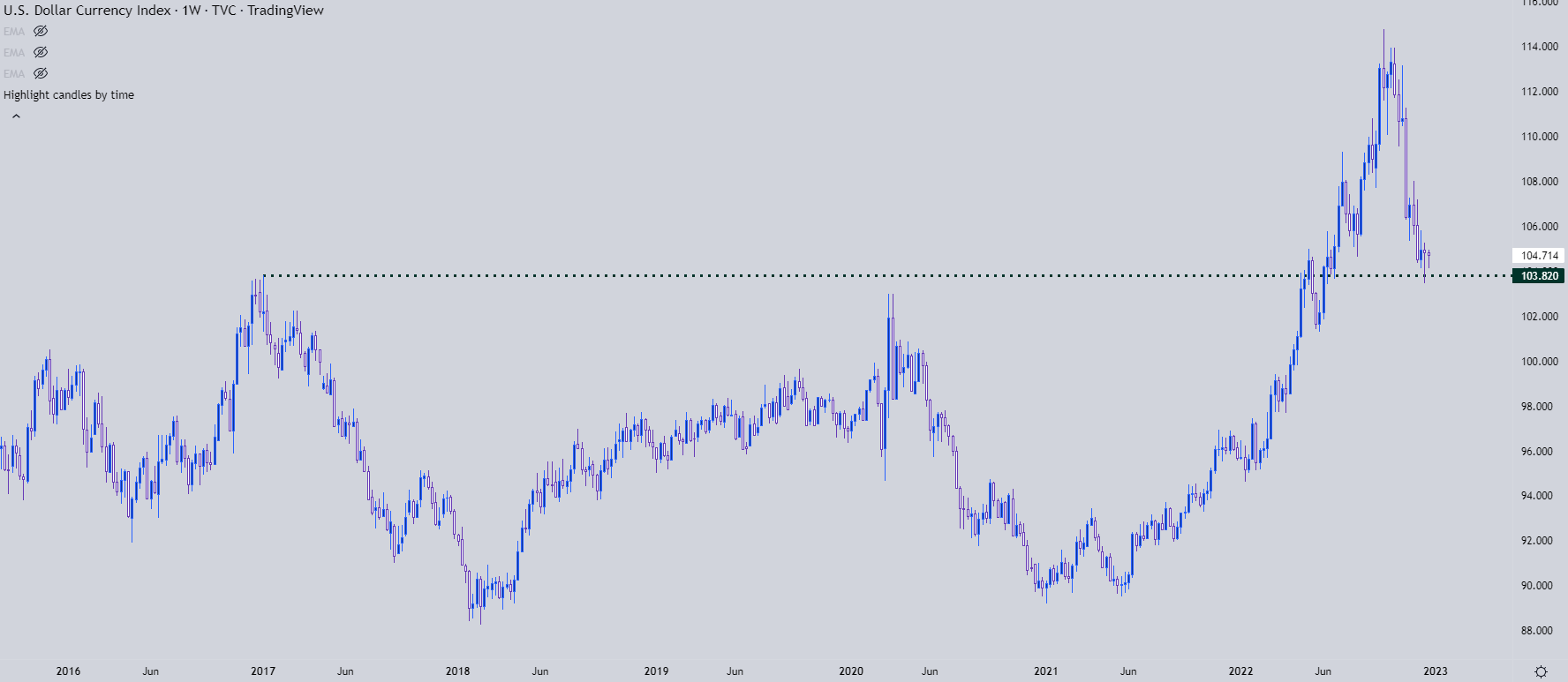

- The US Dollar printed a doji last week after running into a key spot of support at 103.82, which was the 2017 high in DXY.

- EUR/USD started to test a key spot of support today, along with a similar observation in GBP/USD. Commodity currencies have been beset by weakness of late, as illustrated in bullish breakout potential in USD/CAD and bearish breakdown potential in AUD/USD.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Recommended by James Stanley

Get Your Free USD Forecast

We have but two weeks left in the year and this week, despite being the lead-in to the Christmas holiday set for this Sunday, still has some high-impact US data for traders to work with. Friday brings the release of PCE which is the Fed’s preferred inflation gauge. After last week’s FOMC rate decision, the emphasis remains on inflation data as markets try to read just how far the Fed will hike rates. And the answer to that question is likely related to how long inflation remains stubbornly above target.

While markets had started to price-in possible rate cuts for next year, there’s been a quick change as Powell did not sound very dovish last week and since that rate decision, the S&P 500 has been down while selling-off every day since. And really, we can span the weakness in US stocks back to the Tuesday before the FOMC, when a strong reversal showed in equities on the back of a CPI print. Initially price action jumped on the back of that announcement but mere minutes later sellers had went on the attack. Almost a week later and they’re still on the prowl in the S&P.

In the US Dollar, however, matters haven’t been as loud on the reversal front. Price ran into that spot of support as taken from the 2017 swing high at 103.82. I looked at that price last Wednesday, just after the Fed. And while it hasn’t exactly spurred a massively bullish response yet, it did help to build a doji for last week’s DXY candle after a strong sell-off pushed prices down to fresh five-month-lows.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

US Dollar Shorter-Term

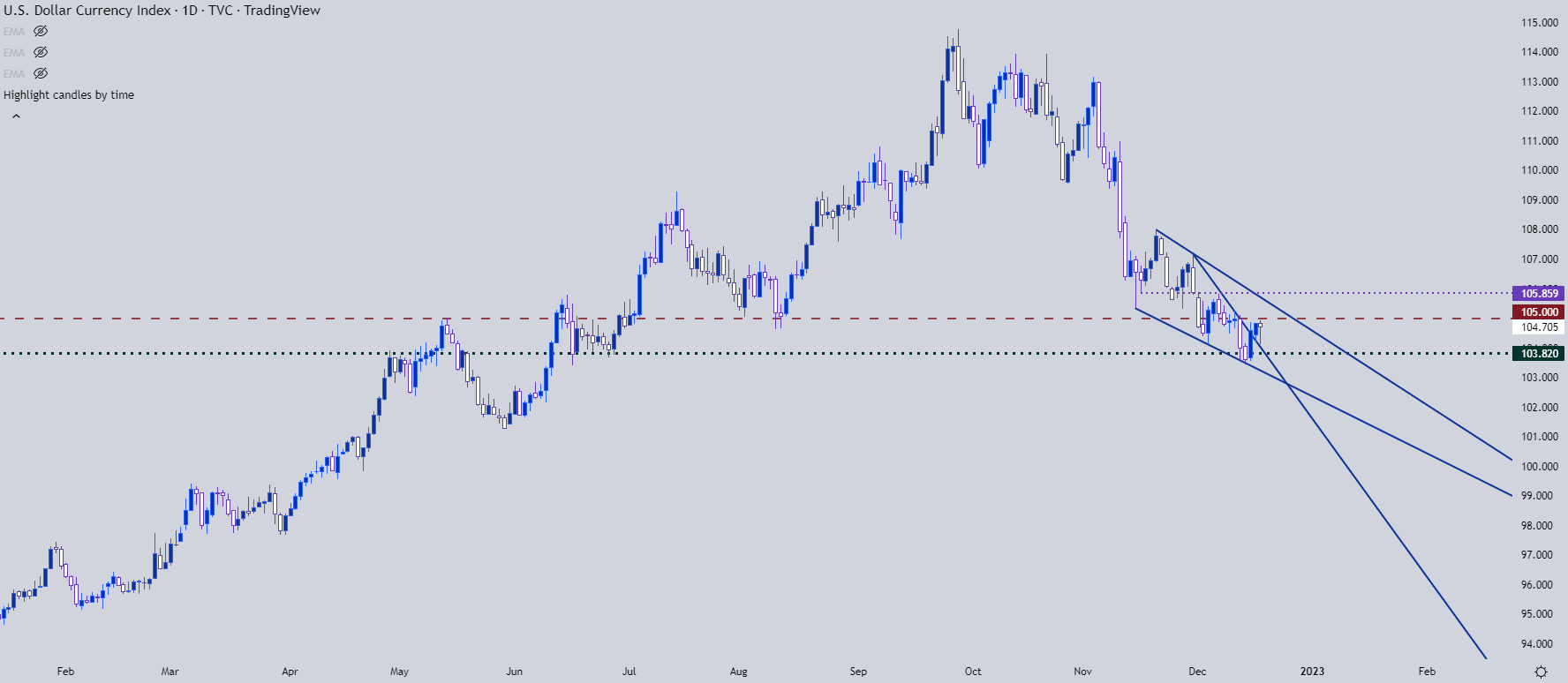

When a trend nears equilibrium, price will have a tendency to slow the trending move. This can be exhibited in the form of a wedge, as a support level helps to bring in buyers that could buffer the run at the lows while bears still continue to attack at highs or upon tests of resistance. As such, wedges are often tracked with aim of counter-trend price action, read from that very same deduction that sellers slowing their approach at the lows could, eventually, lead to a pullback or possibly a reversal.

From the daily chart of DXY, we can see where there’s actually two falling wedges that have been in-play, with some run after that support hit at 103.82 last week. The 105 psychological level remains as key resistance for now, and above that another key level sits at 105.86. This is a spot of support-turned-resistance but it’s also confluent with the top-side of that longer-term falling wedge formation. A break-above that opens the door for USD-strength scenarios into the end of the year.

US Dollar Daily Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

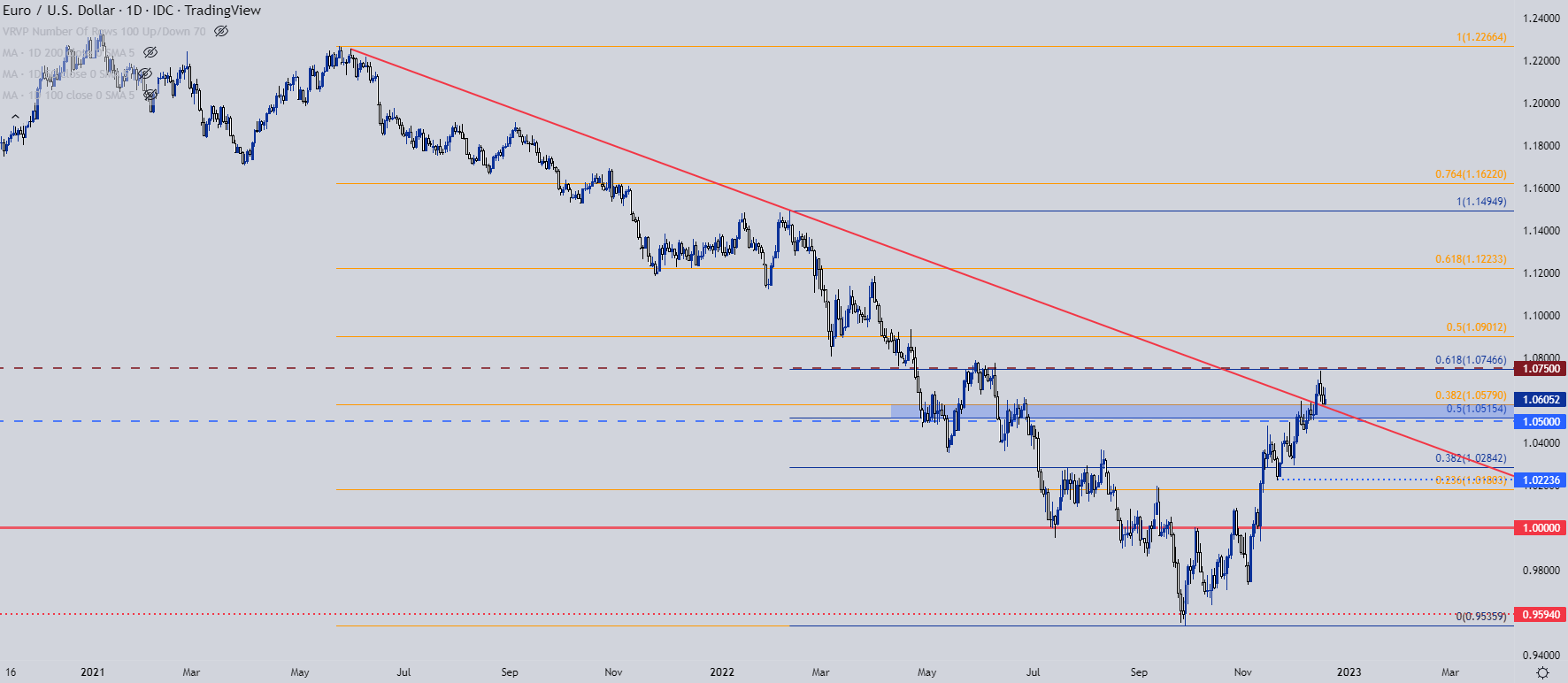

EUR/USD

If USD is going to stage a reversal – it’s probably going to need some help from EUR/USD to make it happen. And the possibility of bearish EUR/USD scenarios is there after the bearish engulfing candlestick that printed on ECB Thursday. That move had follow-through on Friday with price action testing a key spot of confluent support around 1.0579. This is the 38.2% Fibonacci retracement of the May 2021 -Sept 2022 major move and it’s also a spot of prior resistance that’s come back in as support. There’s also a trendline projection in here, taken from the highs in May of 2021 and connected to the February swing-high.

It’s not all free running below that level, however, as there’s another Fibonacci level at 1.0515 and then the psychological level at 1.0500. This raises the possibility of false downside breakouts, so for those with a longer-term vantage point, they’re likely going to want to see prices first test below the 1.0500 big figure before confidently saying that the top may be in.

Recommended by James Stanley

Get Your Free EUR Forecast

EUR/USD Daily Chart

Chart prepared by James Stanley; EURUSD on Tradingview

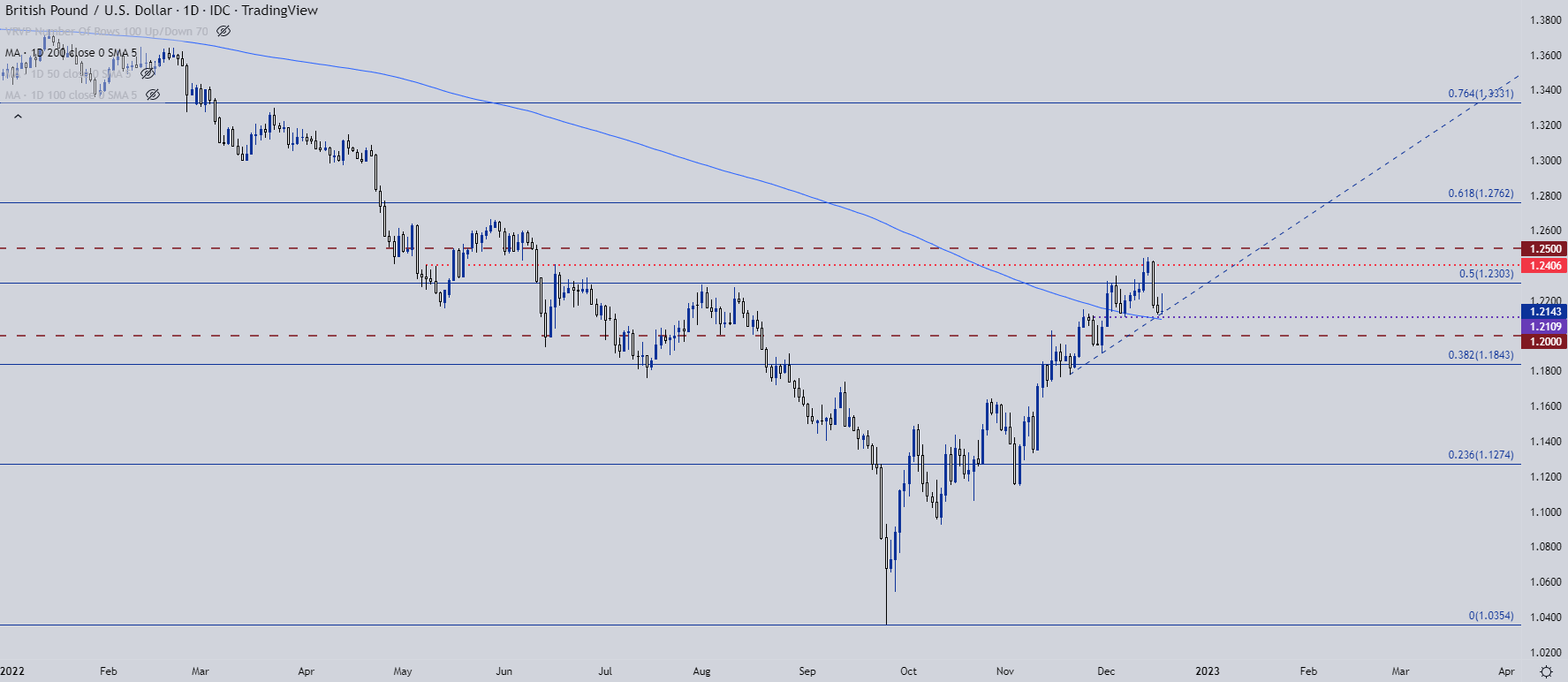

GBP/USD

Cable carries a very similar dynamic as EUR/USD above. Both pairs remain very near to recent highs and carry a backdrop that could be conducive for reversals. But, with that said, there’s also a similar spot of support that’s held the lows through a couple of different tests already, and would first need to give way for sellers to begin to re-take control.

At this point, there’s a spot of support around the 1.2100 handle, which is confluent with the 200 day moving average. If sellers can force a breach below that, the door opens for a breakdown into the 1.2000 psychological level. The big question there is whether sellers can do much beyond that point.

GBP/USD Daily Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

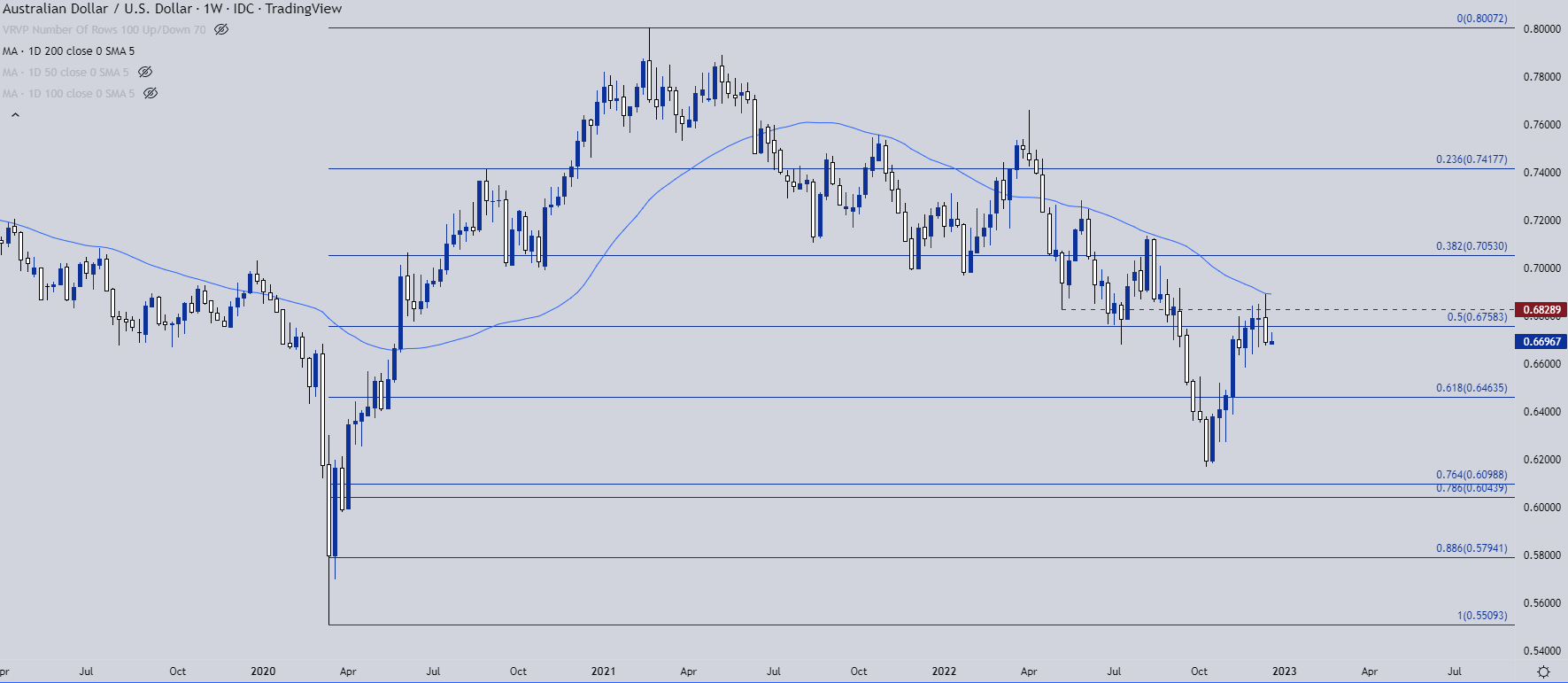

AUD/USD

Aussie held up fairly well through the FOMC rate decision last week, printing a doji at resistance on Fed day last Wednesday. The following Thursday saw a strong sell-off develop and that helped to form a bearish weekly bar on the heels of a doji printing in the prior week.

AUD/USD Weekly Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

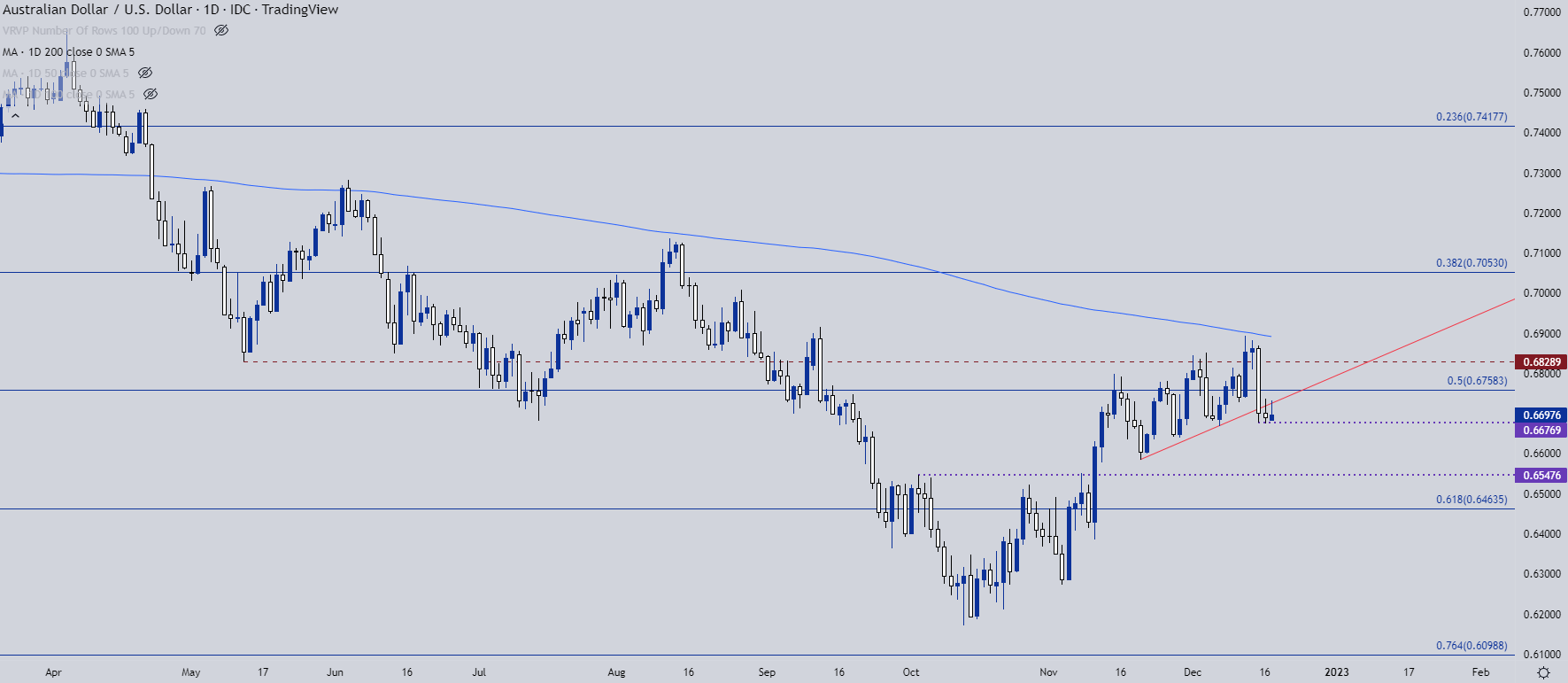

AUD/USD Shorter-Term

That big outing on Thursday led into a doji on Friday, which kept the door open for a bounce into a morning star pattern to start this week. AUD/USD bulls haven’t been able to do much, however, and this keeps near-term support lodged just below current price at .6677. Near-term resistance is playing in from a trendline projection taken from late-November and early-December swing-lows.

The next spot of key support is an area of prior resistance, plotted at .6548.

Recommended by James Stanley

How to Trade AUD/USD

AUD/USD Daily Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

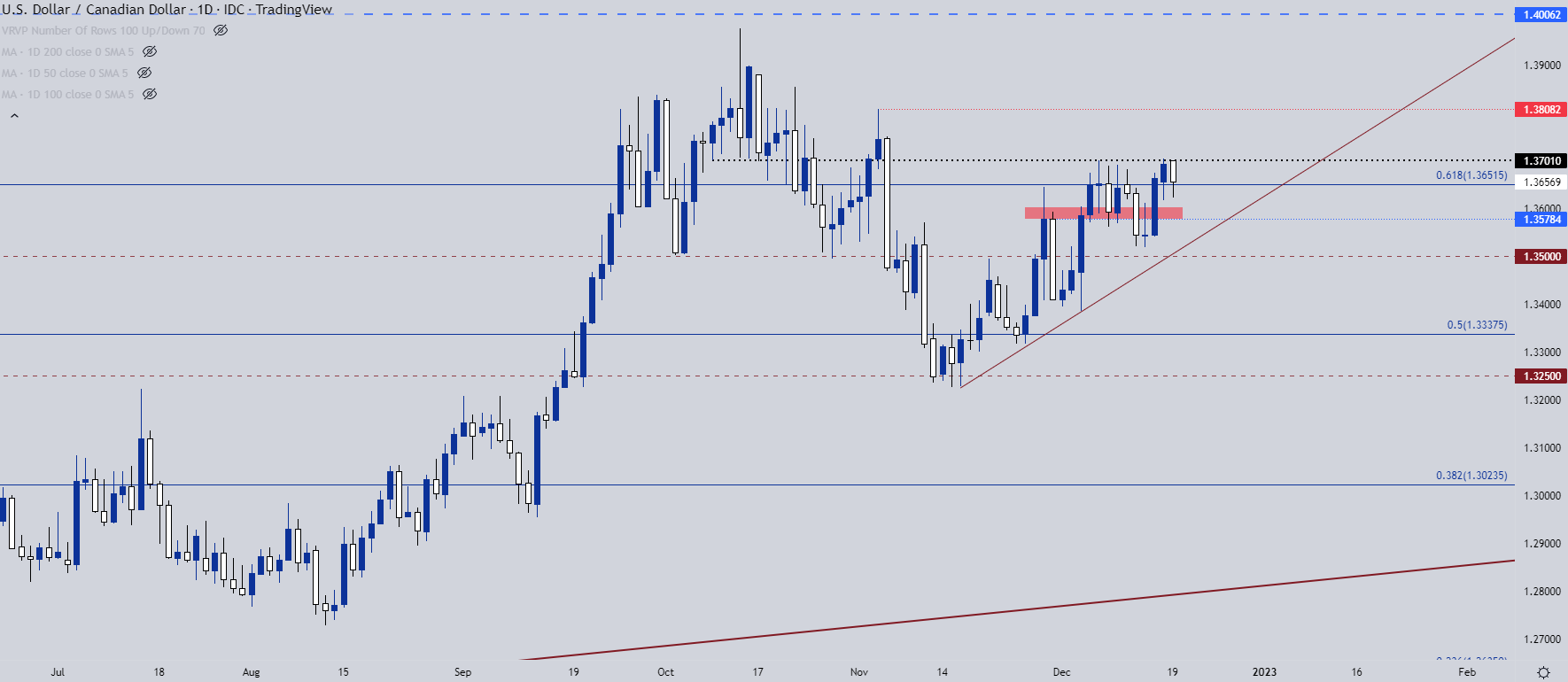

USD/CAD

The Canadian Dollar has remained very weak and for USD bulls, USD/CAD may be one of the more compelling markets to follow as oncoming USD-strength could be meshed with an already weak CAD. A quick comparison between DXY and USD/CAD since the middle of last month highlights that deviation well, as DXY has continued falling even as USD/CAD has remained fairly bullish. And at this point, the same 1.3700 level remains as resistance, with short-term support now showing at 1.3652 which was previously helping to provide resistance.

This keeps the door open for breakout potential although bulls likely want to focus in on the daily lows. So far, today’s daily candle has held above the swing-low from Friday. And given that both days had resistance at 1.3700, the failure over a two-day-period is not a bullish factor and can keep the door open for a larger pullback. The next spot of support on my chart is around 1.3579 after which the 1.3500 psychological level comes into the picture.

Recommended by James Stanley

Building Confidence in Trading

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

— Written by James Stanley

Contact and follow James on Twitter: @JStanleyFX

[ad_2]