[ad_1]

Australian Dollar Forecast: Bearish

- The Australian Dollar remains susceptible to a US Dollar pirouette

- Rate hikes have come and gone but the rhetoric is just ramping up

- Sentiment continues to sway as recession fears grow. Where to for AUD/USD?

{{TRADE THE NEWS|}}

The Australian Dollar was crunched last week after the US Dollar put on a stellar rally amid rising recession fears. The Federal Reserve hiked by 50 basis points to target 4.25% – 4.50% on Wednesday. The move was widely anticipated despite a softish US CPI the day prior.

The Australian unemployment rate remains at multi-generational lows of 3.4% after 64k jobs were added in November. This comes on top of a burgeoning trade surplus from the week before.

The rest of the fundamental picture is a bit mixed going into the end of the year with building approvals and retail sales data underwhelming. RBA rate hikes appear to have had an impact on those figures.

Nominal GDP remains robust at 5.9% year-on-year but when adjusted for inflation, real GDP is less impressive.

The big moves of last week came about in the aftermath of Fed Chair Jerome Powell and ECB President Christine Lagarde reminding markets that they remain committed to fighting inflation rather than focusing on promoting economic growth.

This stance from the world’s two largest central banks is in contrast to the previous decades, where they have been supportive of growth at the risk of high inflation.

Long-term prosperity for an economy depends on price stability. The market doesn’t appear to be fully cognizant of this.

Looking at the week ahead, there isn’t any Australian data of note, and the US will see mostly see second-tier economic indicators. This could leave AUD/USD vulnerable to sways in risk sentiment, particularly around any remarks from the RBA and the Fed.

{{HOW TO TRADE AUDUSD|}}

AUD/USD TECHNICAL ANALYSIS

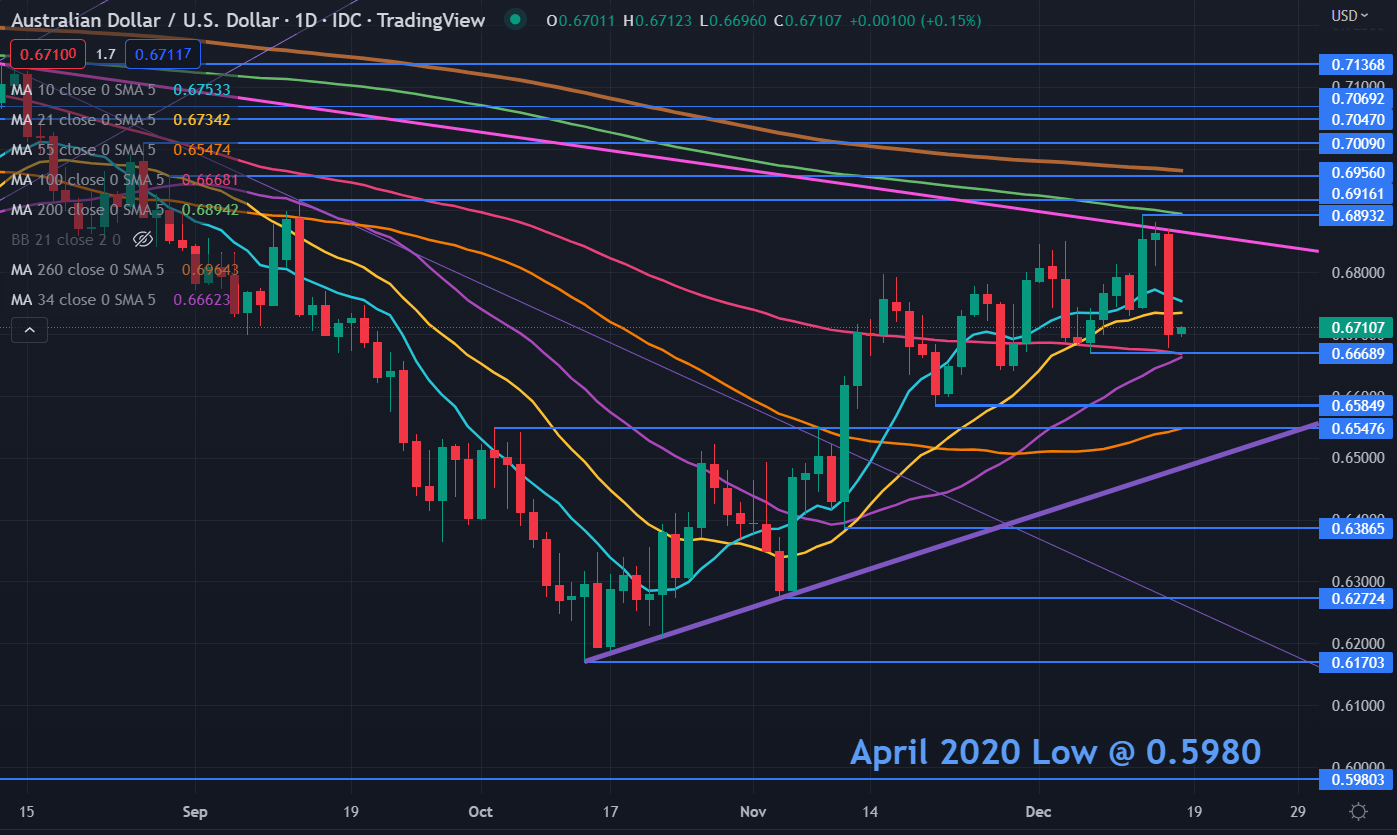

After visiting a 3-month high last week, AUD/USD capitulated lower toward this month’s low of 0.6669 but was unable to move below there and it may continue to provide support.

The 34- and 100-day Simple Moving Averages (SMA) are also near that level and might add weight to it.

The prior peaks of 0.6893 and 0.6956 are also near the 200- and 260-day SMAs respectively and these levels might offer resistance. In between is a previous high of 0.6916 that may offer resistance.

On the downside, support may lie at the previous lows of 0.6585, 0.6387, 0.6272 or 0.6170. A breakpoint at 0.6548 is also a potential support level.

An ascending trendline might provide support, currently intersecting at 0.6490.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]