[ad_1]

US Dollar Vs Euro, British Pound, Canadian Dollar – Price Setups:

- The US dollar index is struggling at key resistance, raising the prospect of a retreat.

- EUR/USD and GBP/USD are around key support levels.

- What is the outlook and key levels to watch in select USD pairs?

Recommended by Manish Jaradi

Introduction to Forex News Trading

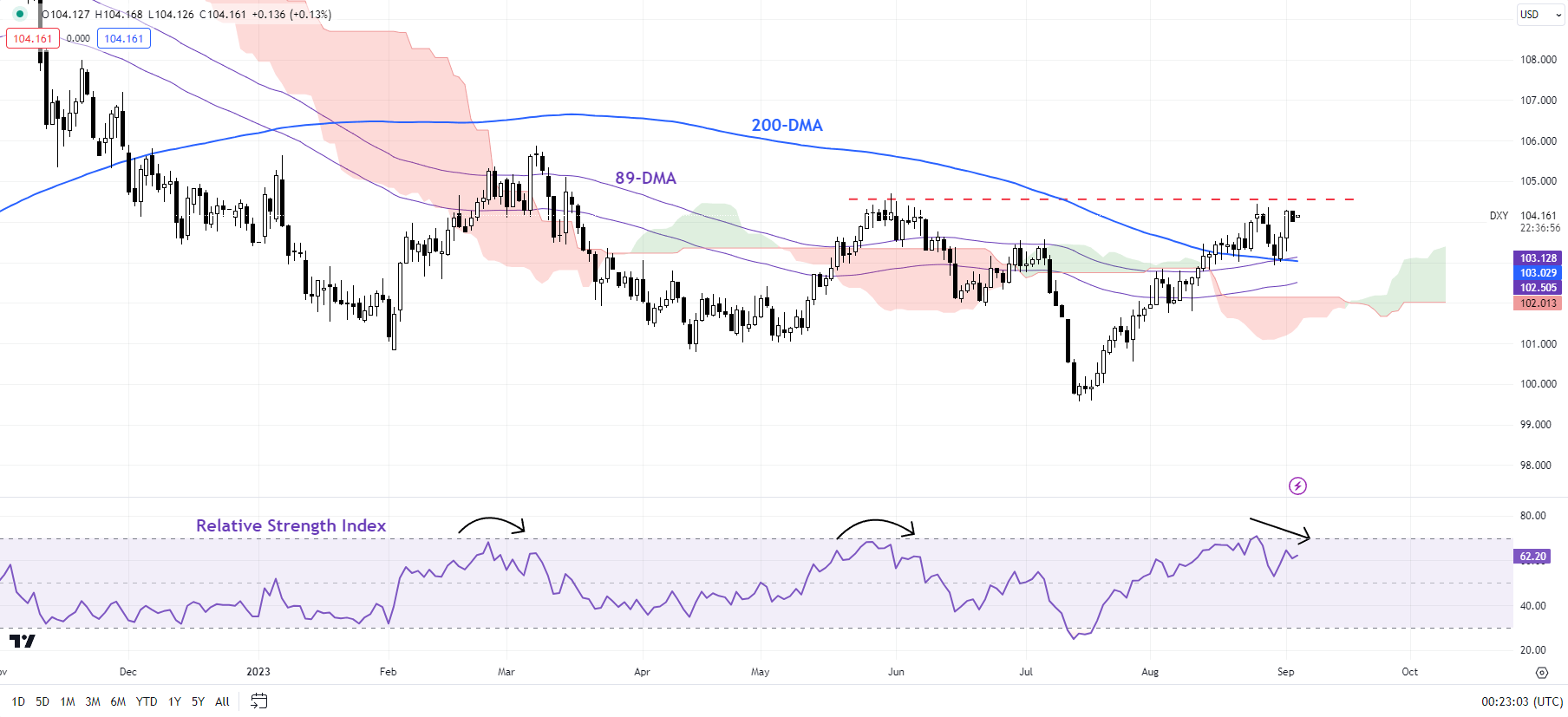

The recent struggle at key resistance reinforces the view that the US dollar’s (DXY Index) rally is losing steam as recent data eases concerns that the US economy is resurging.

The US Economic Surprise Index has rolled over from two-year highs in a sign that much of the optimism could be in the price. The ongoing disinflation coupled with early signs that the labor market could be cooling (unemployment jumped in August) has capped expectations of further tightening by the US Federal Reserve. Markets are now pricing in a more than 90% chance that the Fed will keep interest rates on hold when it meets later this month, with around 60% chance of no more rate hikes this year.

Moreover, the rapid support measures in recent months by China to revive the economy are providing a floor to sentiment, at least for now, weighing on the greenback. Having said that, the DXY Index would need to fall below 102.50 103.00 for the uptrend to reverse. For more discussion, see the previous update “US Dollar Looks Tired Ahead of Jackson Hole: EUR/USD, GBP/USD, USD/JPY Price Setups,” published August 22.

DXY Index (USD) Daily Chart

Chart Created by Manish Jaradi Using TradingView

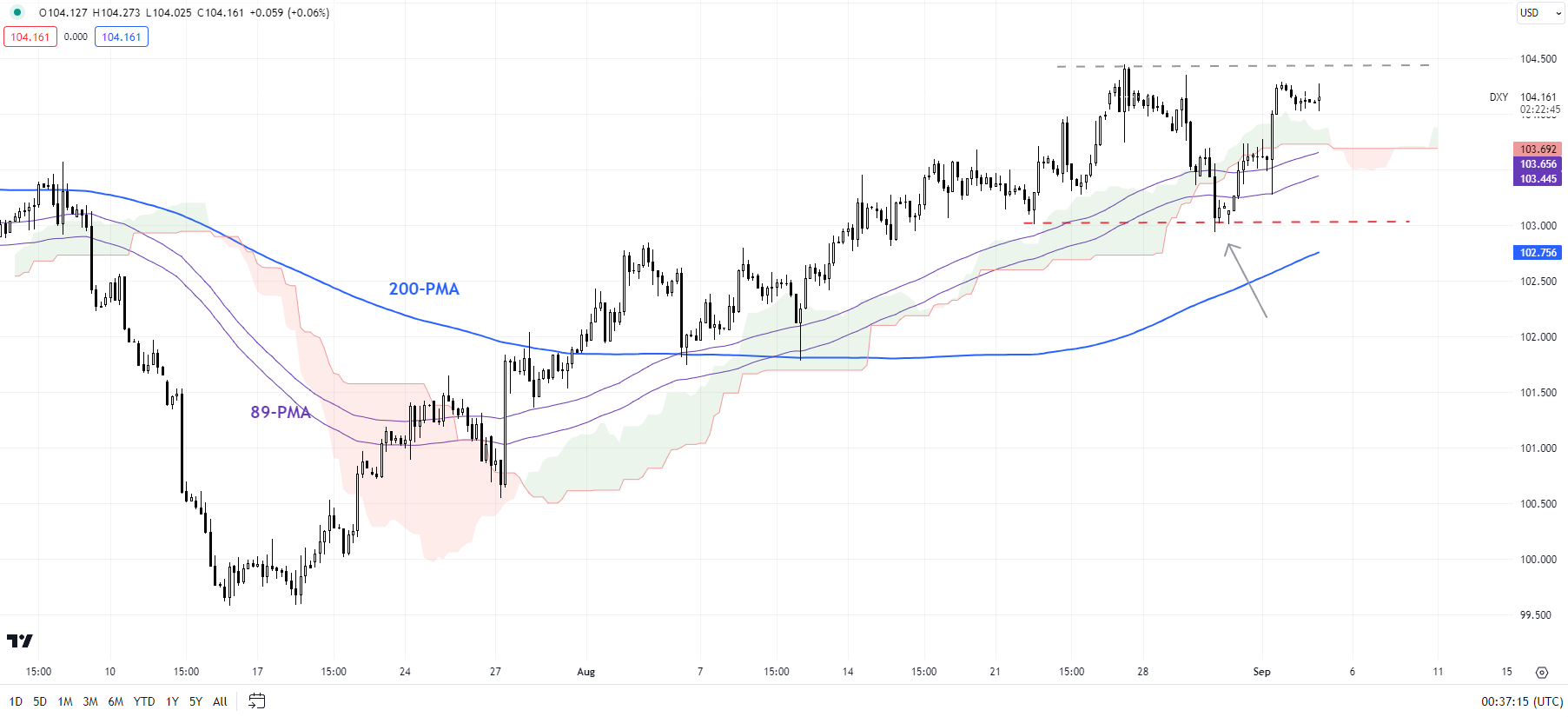

On technical charts, the short-term bullish pressure remains intact after the DXY Index (USD index) rebounded last week from quite a strong converged floor at 102.50-1.0300, including the 89-period moving average and the lower edge of the Ichimoku cloud on the 240-minute charts. As highlighted in a recent update, the index needs to fall below the support for the uptrend to change. See “US Dollar Toppish Ahead of Powell; EUR/USD, AUD/USD, GBP/USD Price Setups,” published August 24.

DXY Index (USD) 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Zooming out, the index has been struggling to clear past a tough barrier at the May high of 104.70, slightly above the 200-day moving average. Negative divergence on the daily charts (declining momentum associated with flat index levels) is a sign that the index lacks the strength to break past the barrier, raising the risk of a retreat. For more discussion, see “US Dollar Flirts with Resistance After Powell; EUR/USD, GBP/USD, AUD/USD Price Action,” published August 28.

Recommended by Manish Jaradi

Traits of Successful Traders

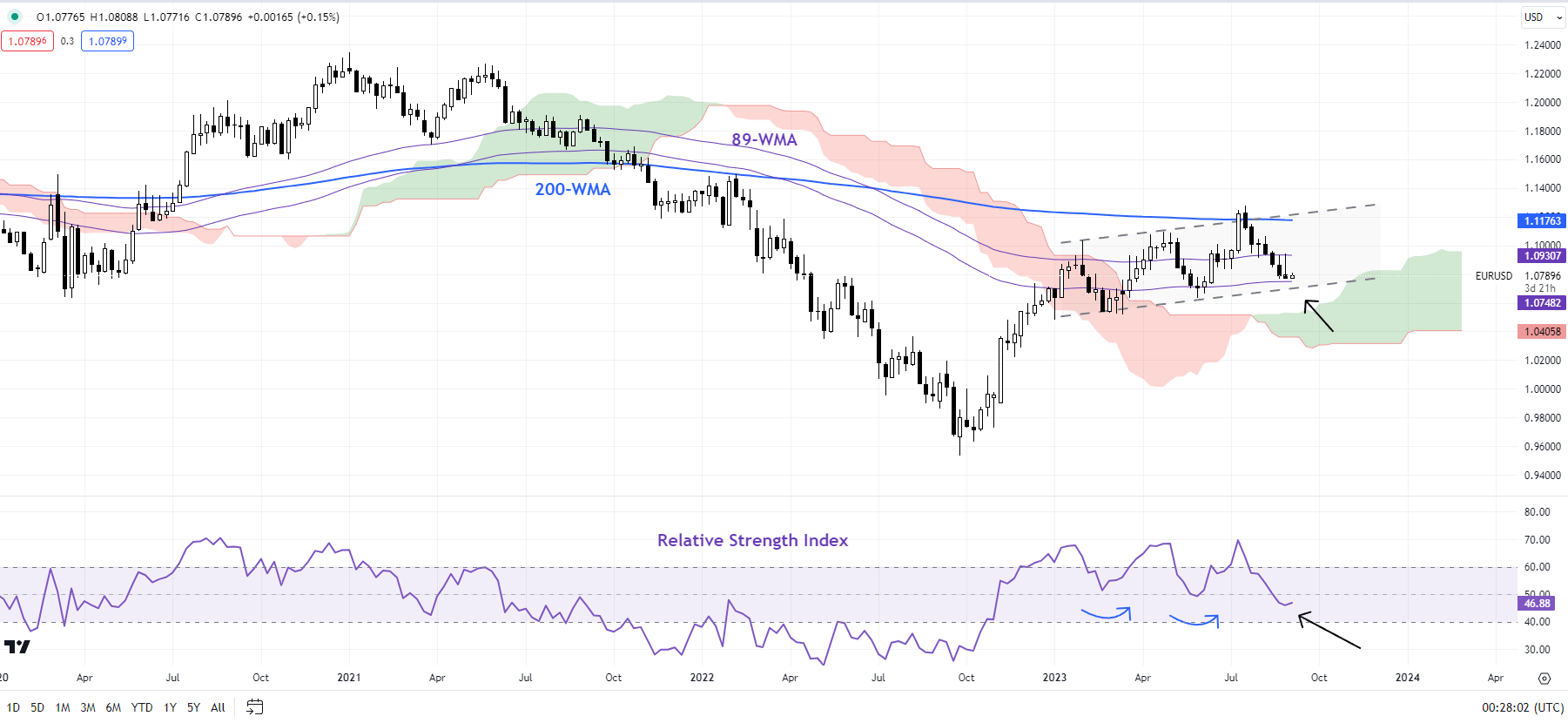

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Awaiting confirmation of a low

EUR/USD is near a fairly strong cushion on the 200-day moving average, coinciding with the lower edge of an upward-sloping channel, and the 89-week moving average. Despite the choppy price action since the beginning of 2023, the pair hasn’t made a lower low since late last year, suggesting that the broader bias remains up. However, any fall below 1.0500-1.0600 could threaten the uptrend. Meanwhile, EUR/USD is looking oversold, raising the prospect of a rebound. For any rebound to be material, the pair would need to cross above last week’s high of 1.0950.

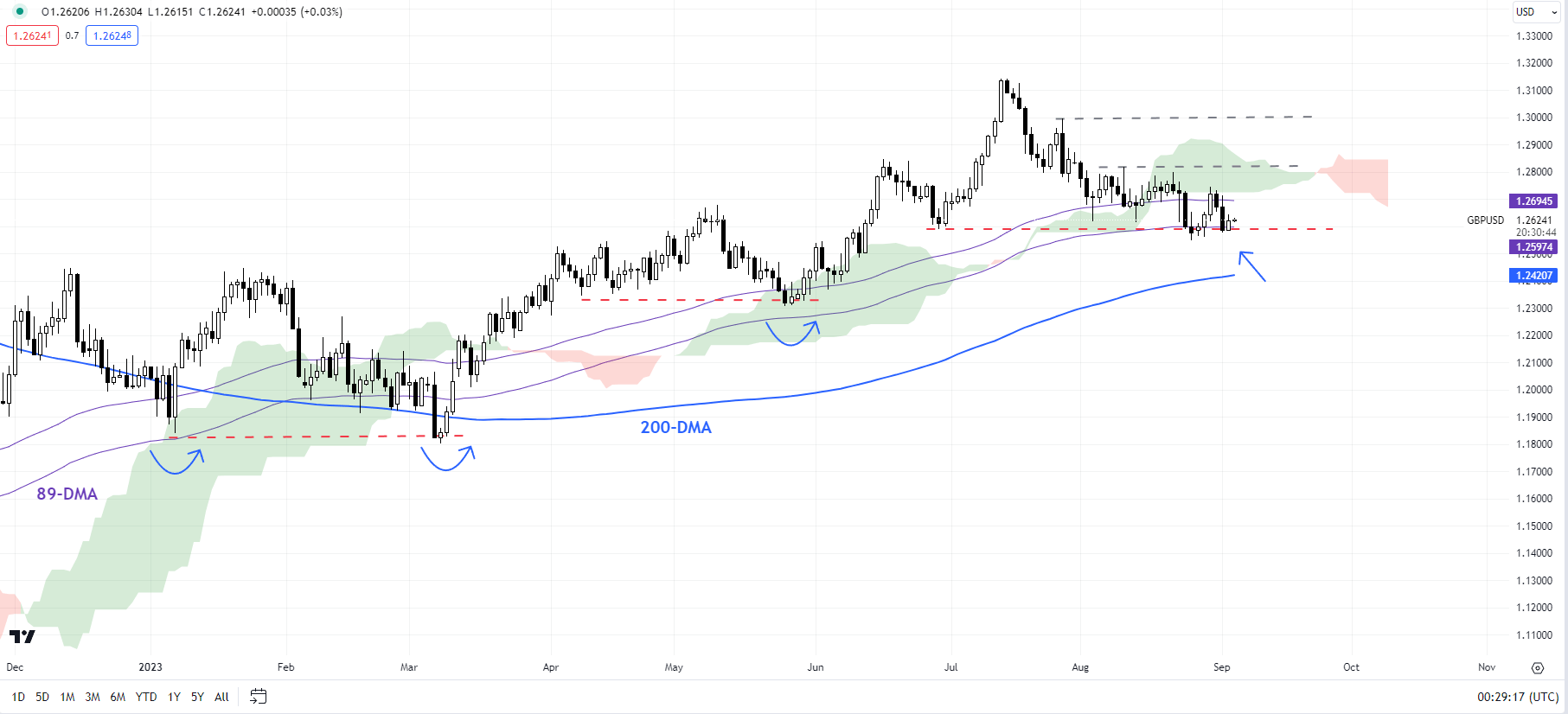

GBP/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

GBPUSD: Settles in a range

GBP/USD continues to be weighed by important immediate resistance at the August 10 high of 1.2820, slightly below another barrier at the xx high of xxx, reinforcing the bigger-picture consolidation. For more discussion, see “Pound’s Resilience Masks Broader Fatigue: GBP/USD, EUR/GBP, GBP/JPY Setups,” published August 23. So far, the pair is holding above quite strong converged support at the end-June low of 1.2600, a shade above the 200-day moving average. Only a break below the May low of 1.2300 would disrupt the higher-low-higher-high sequence since late 2022. Until then, the trend could be sideways at best.

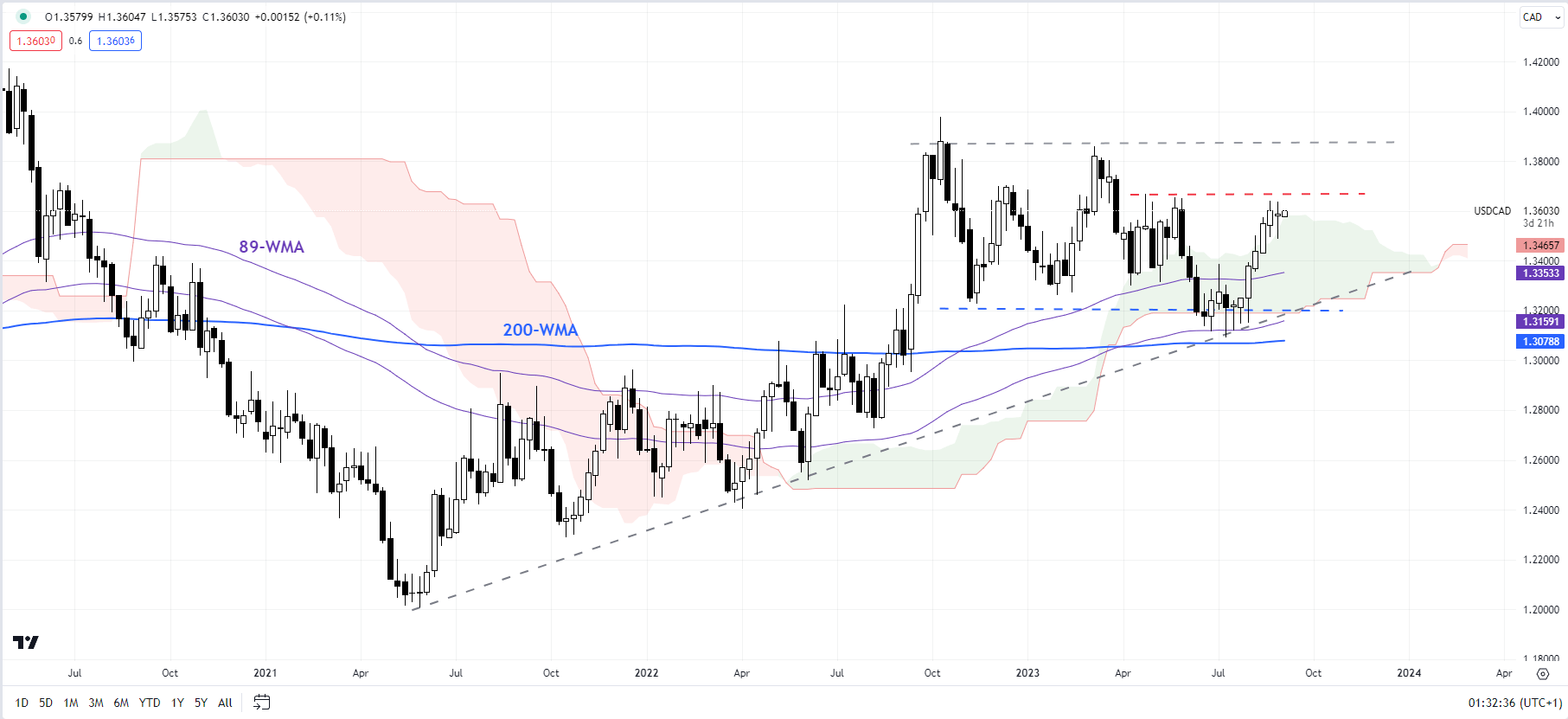

USD/CAD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

USD/CAD: At a key threshold

USD/CAD is testing a crucial resistance at the Q2-2023 high of 1.3650. For the broader downward bias to remain intact, the pair needs to hold below this resistance. This follows a rebound in July from near-strong converged support on the 200-week moving average and the 89-week moving average. However, any break below last week’s low of 1.3500 would confirm that the short-term upward pressure had faded.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]