[ad_1]

US DOLLAR FORECAST:

- U.S. dollar begins the week on the back foot as risk assets leap higher

- All eyes are on the Fed’s Semiannual Monetary Policy Report to Congress

- Powell is expected to appear before Congress on Tuesday and Wednesday. If the central bank’s chief embraces a hawkish stance, the dollar is likely to resume its recovery

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: S&P 500, Nasdaq 100 Forecast – Speculative Frenzy at Risk ahead of Key US Jobs Report

The U.S. dollar, as measured by the DXY index, weakened slightly on Monday, down about 0.25% to 104.24, dragged lower by a small pullback in Treasury yields and positive sentiment on Wall Street. In early trading, bond rates remained somewhat subdued, while the Nasdaq 100 rose sharply, up nearly 1%, boosting riskier assets.

However, the U.S. dollar’s retreat could be temporary, as there are several catalysts on this week’s economic calendar that could trigger a bullish turnaround in the FX space. One of them is the Federal Reserve’s semi-annual monetary policy report to Congress.

Fed Chairman Jerome Powell is scheduled to speak in Washington on Tuesday and Wednesday to discuss recent economic developments and prospects for the future. In his testimony, Powell is likely to take a hawkish stance, laying the groundwork for a higher peak rate in response to upside inflation risks.

Economic data from late 2022 made investors believe that price pressures were abating rapidly, but recent reports have shown the opposite: inflationary forces remain stubbornly strong and may be regaining momentum amid resilient consumer spending and incredibly tight labor markets.

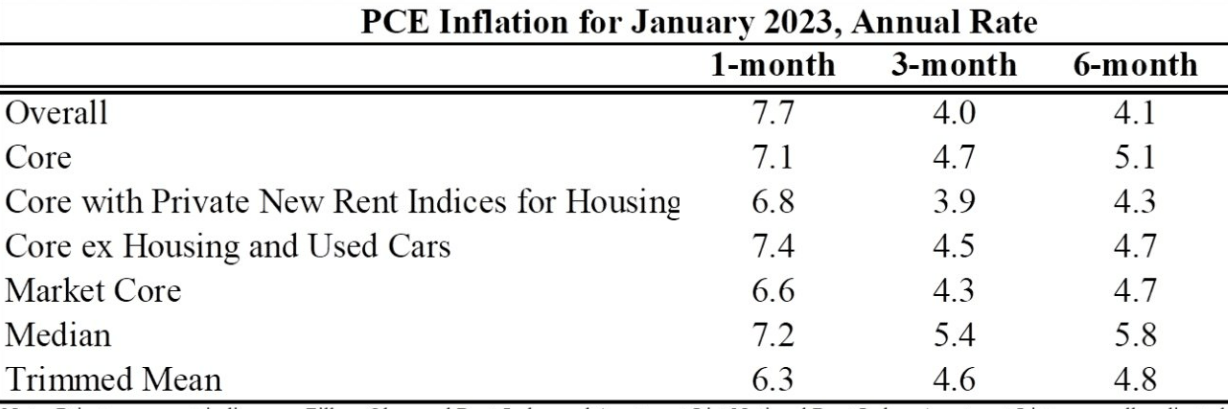

Focusing on the outlook, several measures of PCE (price indices) over different time horizons paint a worrying picture and signals the central bank will not be able to achieve its 2% inflation target for the foreseeable future, especially if the economy fails to slow down materially and wage growth keep services costs elevated.

Source: Jason Furman

For the previous reason, it wouldn’t be surprising if Powell opens the door to returning to bigger hikes, as long as incoming data continues to support the case for a more front-loaded policy response. This could help cement calls for the Fed to raise borrowing costs by 50 basis points at its March meeting, while pushing expectations for the terminal rate closer to 6.0% from the current 5.45%. This scenario could be quite bullish for the U.S. dollar.

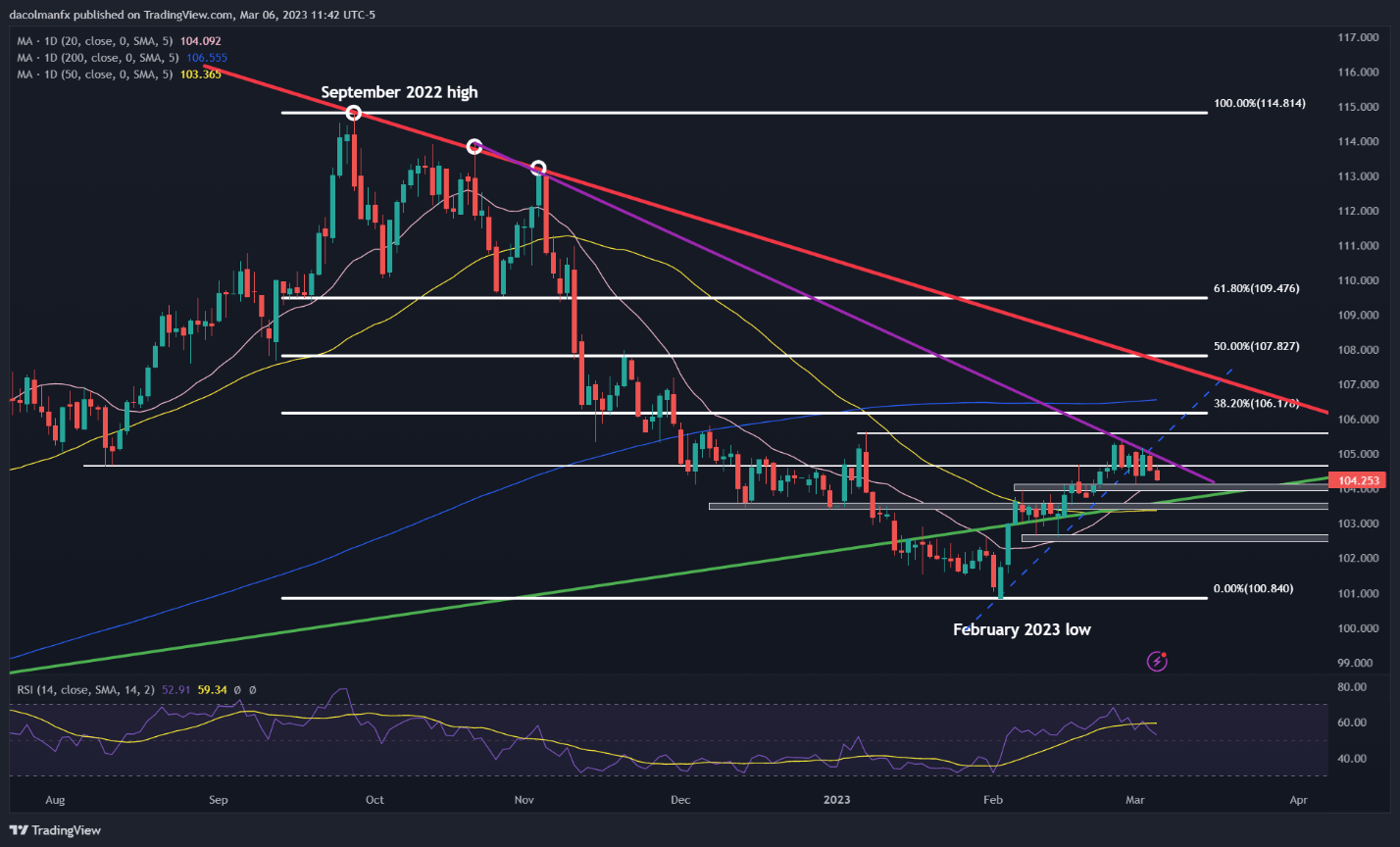

In terms of technical analysis, the U.S. dollar (DXY index) is hovering above a key support near 104.00 after its latest decline. If this floor is breached on the downside, sellers could launch an assault on 103.50, followed by 102.60. On the flip side, if bulls regain control of the market and trigger a meaningful rebound from current levels, initial resistance appears at 104.90, a technical barrier created by a descending trendline extended off the October 2022 highs. If this ceiling is taken out, we could see a retest of the 2023 highs, followed by a move towards 106.18, the 38.2% Fib retracement of the September 2022/February 2023 slump.

Recommended by Diego Colman

Forex for Beginners

US DOLLAR TECHNICAL CHART

[ad_2]