[ad_1]

USD/JPY Price, Chart, and Analysis

- USD/JPY has seen modest gains in January

- They’ve taken it through a previously dominant downtrend

- However it’s still quite close to the market and may reassert itself

Recommended by David Cottle

Get Your Free JPY Forecast

USD/JPY naturally joins all other major currency pairs on central bank watch this week, with the United States Federal Reserve’s monetary policy announcement on Wednesday topping the bill. Dollar bulls look to have the upper hand from a technical perspective and may reassert themselves once the Fed wait is over.

Monday did see a bit of action from the ‘JPY’ side. The Japanese unit staged a brief rally when a rumored candidate for deputy governorship at the Bank of Japan was seen on an influential panel calling for changes to that central bank’s policy remit and, perhaps, changes to the way it controls yields on government debt.

Japan Research Institute Chair Yuri Okina is reportedly considered in the running to become the BoJ’s first female deputy governor. The prospect of a BoJ less wedded to ultra-loose policy saw the currency post gains, but they proved short-lived.

On Tuesday Japan found itself on top of major industrial nations in the International Monetary Fund’s 2023 growth forecasts. The IMF thinks Japan will manage a 1.8^ Gross Domestic Product expansion, well ahead of its call for all major rivals.

Still, in the near term what matters is the Fed. The US central bank is expected to raise interest rates yet again to take the fight against inflation. However, there do seem to be increasing worries that a recession may be the price of victory here. For the moment, investors seem content to believe that, if it comes, it will be mild, but assets such as Treasuries are seeing an increased bid even as stocks stay up. Reuters reported that US equity funds have seen outflows for ten straight weeks, even as the market has risen.

USD/JPY Technical Analysis

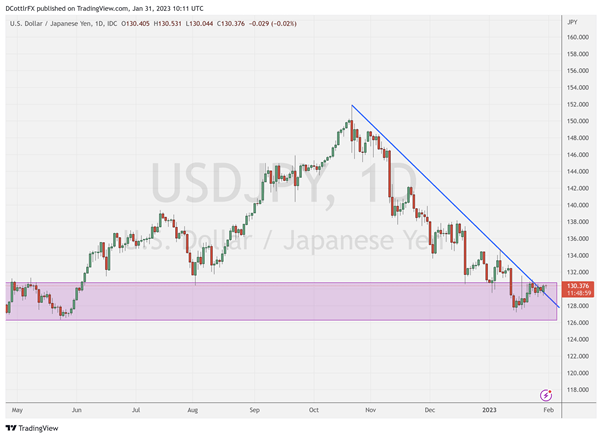

USD/JPY has broken through a key downtrend resistance line on the daily chart, one which had previously capped the market since October 24.

Chart Compiled by David Cottle Using TradingView

Admittedly the break is hardly conclusive at this stage, and Dollar bulls will likely have to consolidate their gains back above December’s 28 peak of 134.36 before the market will be convinced that they’ve done enough to banish it for good.

If they can’t do that, the downtrend line now offers support at 129.481, which is perhaps still uncomfortably close.

Current levels form the upper limit of a trading band which was last in play back in April of 2022. The lower bound comes in around 126.00 and an attempt down to this level could presage more serious falls. It guards the way down to the lows of March at the 114.00 handle.

Feeling around the pair is mildly bearish, with 57% of IG respondents looking for a move lower compared with 43% who are looking for further rises. Should this balance endure, it doesn’t seem likely that the uptrend break will stick and focus may return rather quickly to the near-term low, January 16’s 127.17.

–By David Cottle For DailyFX

[ad_2]