[ad_1]

FTSE 100, DAX 40, Russell 2000 – Analysis and Charts

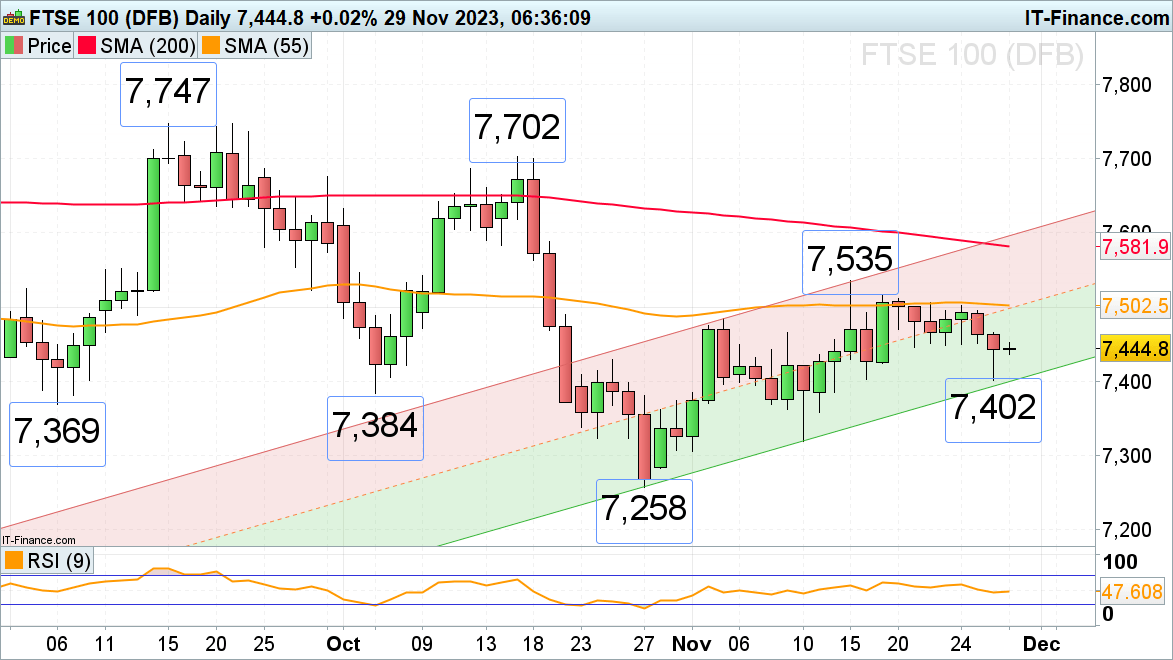

FTSE 100 remains under pressure

The FTSE 100 slid to 7,402 on Tuesday despite stocks like Rolls-Royce rising by +6.2% after setting more ambitious targets for cash flow and return on capital by 2027. Together with the October-to-November uptrend channel support line at 7,400, Tuesday’s low offers support. A slip through it could lead to the early September and early October lows at 7,384 to 7,369 being reached, though.

For the bulls to re-assert control, even on a short-term basis, a rise and daily chart close above Tuesday’s high at 7,465 needs to be seen. Further potential resistance can be found along the 55-day simple moving average (SMA) at 7,502.

FTSE100 Daily Chart

Retail trader data shows 72.46% of traders are net-long with the ratio of traders long to short at 2.63 to 1. The number of traders net-long is 2.23% higher than yesterday and 11.06% higher than last week, while the number of traders net-short is 1.07% lower than yesterday and 13.28% lower than last week.

See How Daily and WeeklyChanges Affect Price Action

| Change in | Longs | Shorts | OI |

| Daily | -1% | 4% | 0% |

| Weekly | 10% | -12% | 3% |

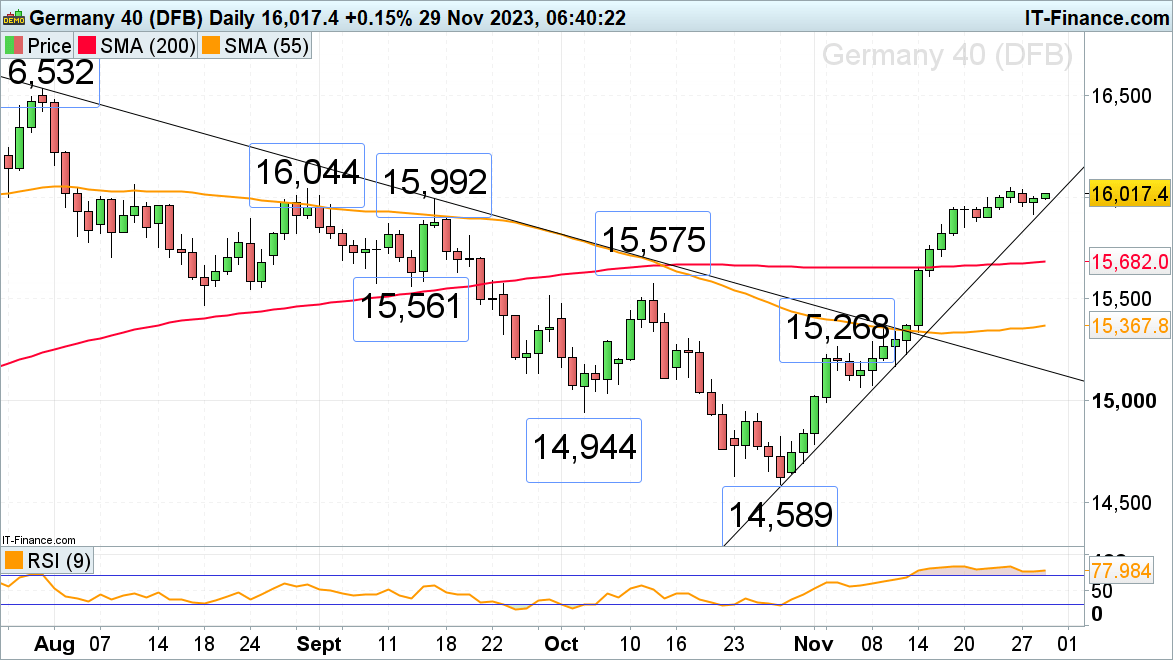

DAX 40 trades back above the 16,000 mark

The DAX 40 has risen back above the psychological 16,000 mark despite German consumer morale remaining weak ahead of Germany’s consumer price index, out on Wednesday.The August and September highs at 15,992 to 16,044 represent a short-term resistance zone. If exceeded, the early and mid-July highs at 16,187 to 16,211 would be next in line.

Minor support is seen along the October-to-November uptrend line at 15,946 and at Tuesday’s 15,913 low. While it underpins, the steep medium-term uptrend remains intact.

DAX 40 Daily Chart

Recommended by Nick Cawley

Top Trading Lessons

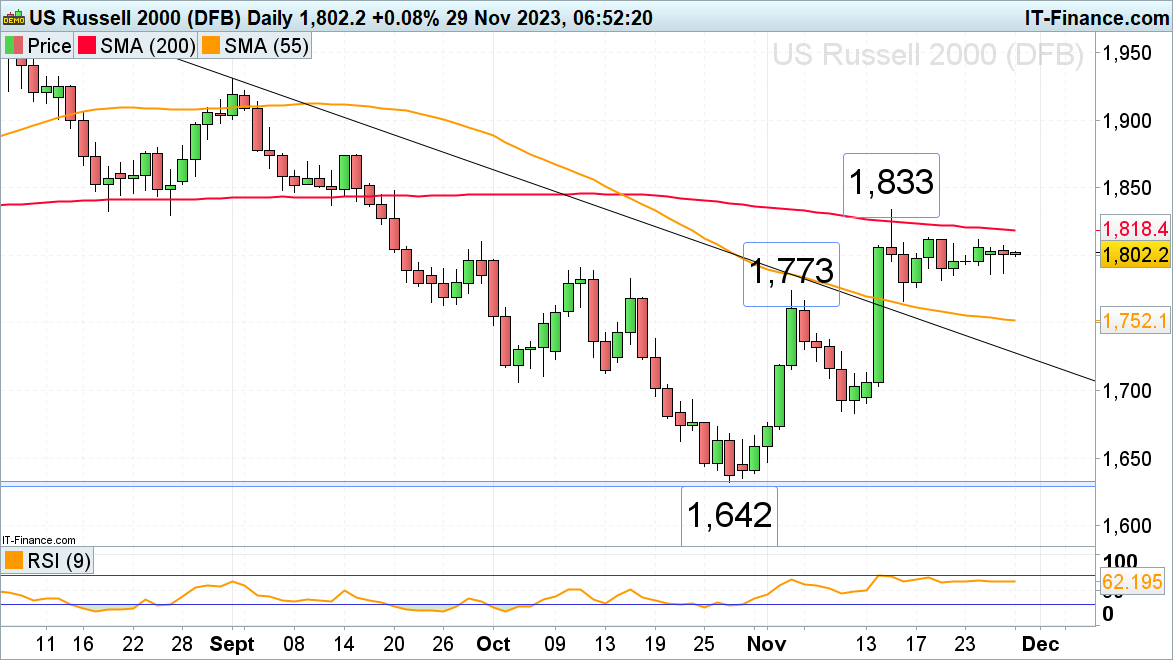

Russell 2000 still range trades below its 1,833 current November high

The Russell 2000, the great underperformer of US stock indices with only a 2.4% positive performance year-to-date, has been trading in a tight sideways range below its 200-day simple moving average (SMA) and the mid-November high at 1,818 to 1,833 for the past couple of weeks. While Thursday the 21 low at 1,767 underpins, the October-to-November uptrend remains intact. If slipped through, though, a drop towards the 55-day simple moving average (SMA) at 1,752 may ensue.

Immediate resistance can be seen at Fridays and the week before 1,811 to 1,813 highs. A rise above the current 1,833 November high would engage the mid-September high at 1,874.

Russell 2000 Daily Chart

[ad_2]