[ad_1]

OIL PRICE FORECAST:

- Oil Slips on Demand Fears as US Exports and Imports are on a Steady Decline.

- Middle East Tensions Ease but Geopolitical Risk Remains and Will Keep Markets on Edge Moving Forward.

- IG Client Sentiment Shows Traders are 76% Net-Long on WTI at Present.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices have fallen today on resurgent demand fears which for now appear to be overshadowing the tensions in the Middle East. There appears to be growing belief that the US may be able to avert a full-scale military operation on the ground in Gaza which seems to have allayed fears of further escalation, even if it may prove temporary. At the moment this continued shift in sentiment is making it hard to predict future movements from a technical standpoint.

Recommended by Zain Vawda

How to Trade Oil

US OIL IMORTS AND EXPORTS ON A STEADY DECLINE

A report today looking into flows data and analysis of Oil revealed that US have seen waterborne imports of Crude Oil from OPEC+ members decline steadily over the past 12 months. Total US Crude imports for October 2023 are set to average 2.47 million barrels down from the 2.92 million barrels a day in September. Analysts have attributed a part of the fall to the end of the summer period in the US which tends to see a decline in demand but the other factors are a bit more concerning. There is a belief that the drop in barrels from Saudi Arabia are a sign that the Kingdom is looking to have a greater influence on Oil prices. All of this comes at a time when the US SPR is at multi decade lows with the US last week announcing its intention to replenish the reserves heading into the end of 2023.

Looking at the export numbers from the US and it tells a similar story of a slowdown with the US exporting less Oil to Europe. Crude exports to Europe fell to 1.86 million barrels a day in September, down from the 2.01 million barrels a day in July.

The drop doesn’t appear to have been influenced by the reason US-Venezuela deal as a spike in supply. As we discussed in my previous articles Venezuela needs significant investment into its Oil infrastructure before any meaningful supply will return to markets.

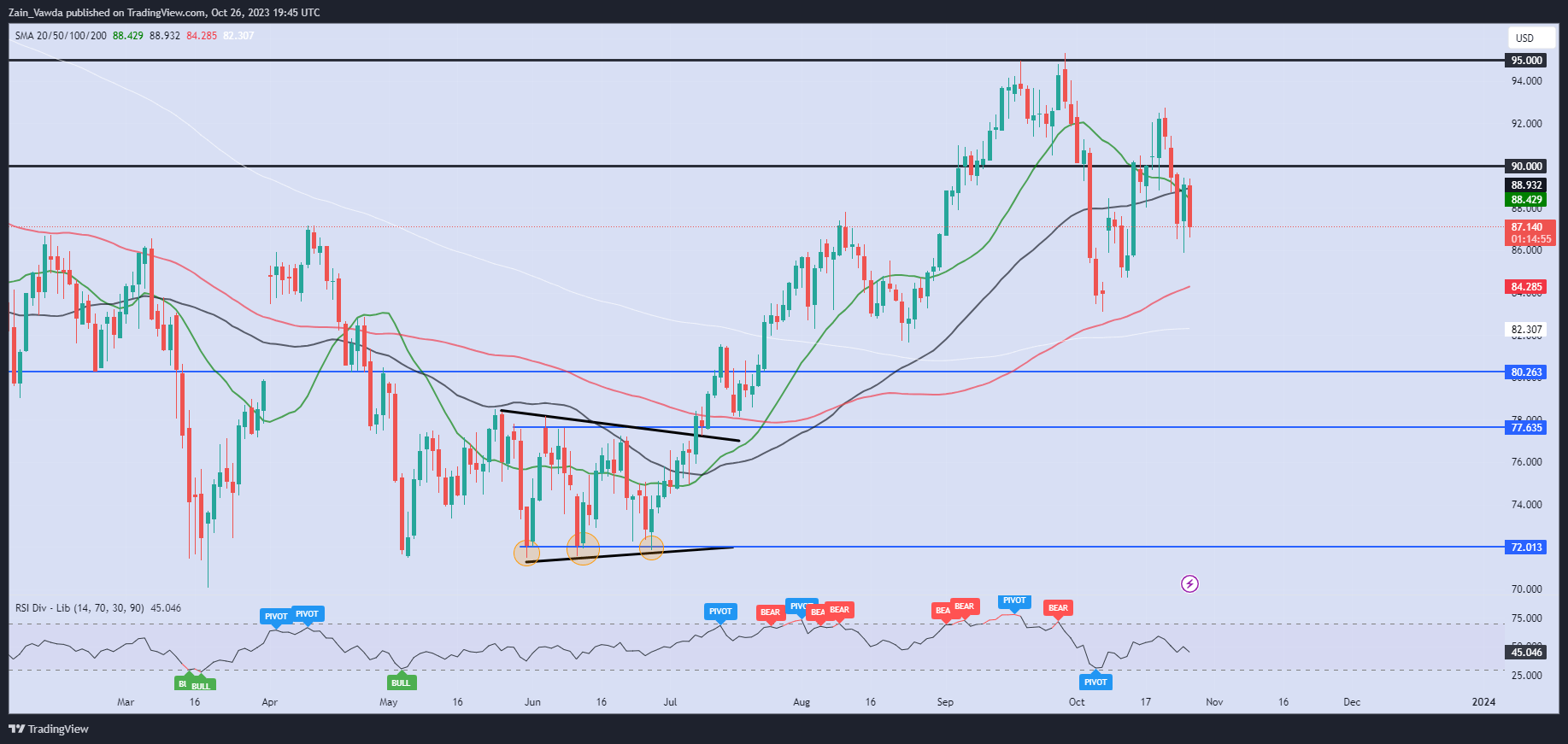

US GDP data and durable goods orders were released today pointing to a strong economy but Q4 may prove more challenging and could be adding to the uncertainty and lack of commitment from Market Participants.

For all market-moving economic releases and events, see the DailyFX Calendar

This coupled with the uncertainties in the Middle East at the moment is likely to see a lot of choppy price action in the days ahead. Next week brings the US FOMC meeting and other high impact data events which could stoke volatility.

As one analyst put it “We are one headline away from a big rally in the market”, and it is likely that concern that is currently keeping both bulls and bears from committing to a directional bias at this stage.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

TECHNICAL OUTLOOK AND FINAL THOUGHTS

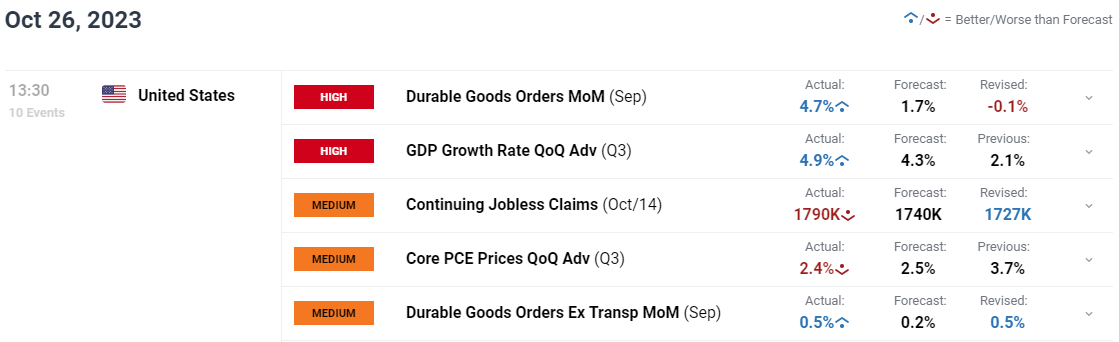

From a technical perspective WTI enjoyed a bounce off support yesterday with a hammer candle close off support hinting at further upside. Today however, we have remained rangebound, struggling to take out the high or low from yesterday. A sign of the cautious approach we are seeing in many asset classes today as we approach the weekend and next week’s Central Bank meetings.

A daily candle close below the 83.00 mark can finally open up a possible return to the 80.00 psychological level. There are some hurdles however with the 100-day MA resting at the 80.86 while he previous swing low at 81.50 may provide a challenge as well.

I know this may make me sound like a broken record given the amount of times this has been mentioned in the past two weeks, but the Geopolitical developments remain a risk. Any signs of escalation could renew buying pressure as mentioned above, we are one headline away from a potential rally in Oil prices.

WTI Crude Oil Daily Chart – October 26, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

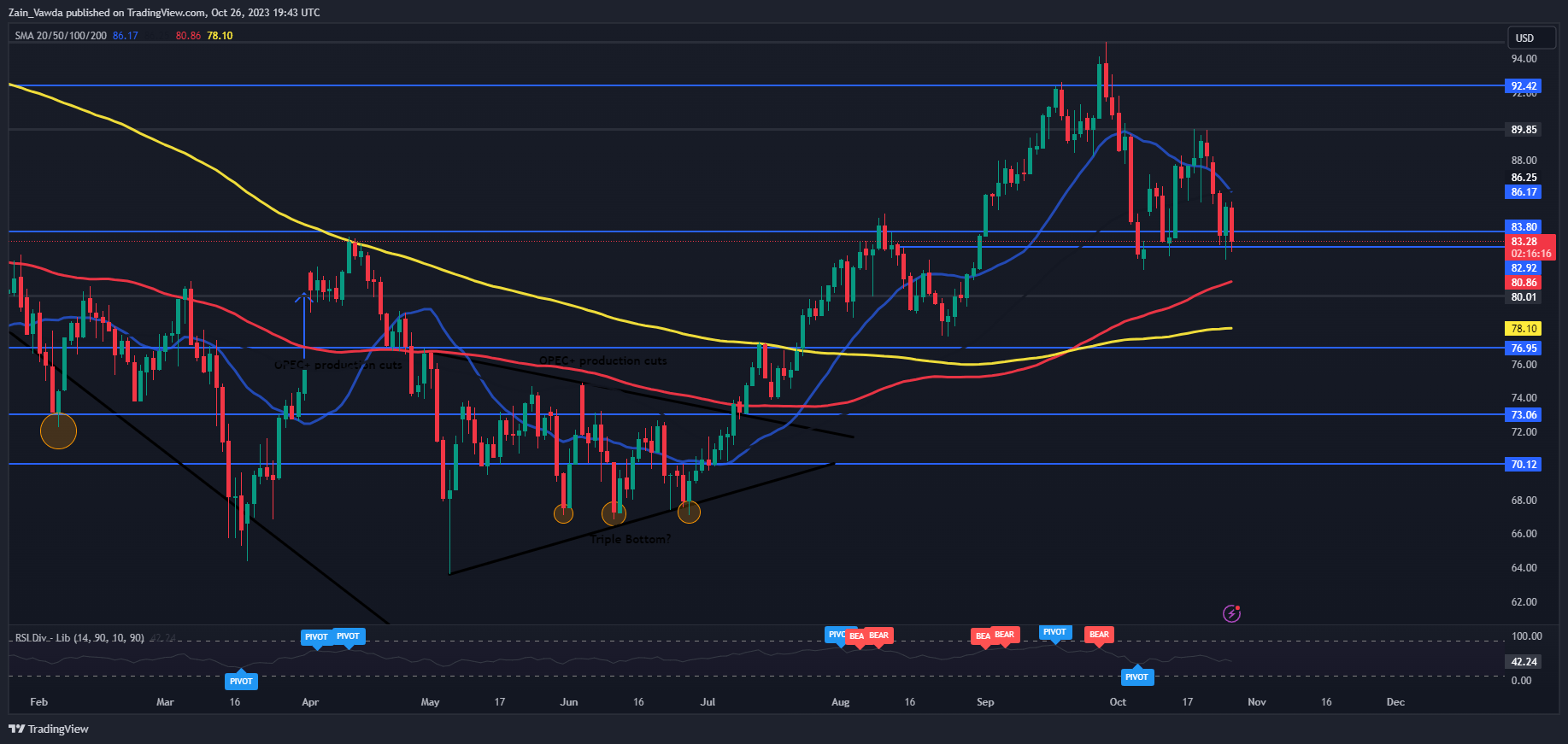

Brent Crude is a mirror image of the WTI chart at the moment. At the moment we have seen a death cross pattern develop yesterday which hints at downside ahead. An upside continuation will likely hinge on the Geopolitical developments as markets continue to fear a global slowdown in demand for Oil in Q4.

Intraday Levels to Keep an Eye On:

Support levels:

Resistance levels:

Brent Oil Daily Chart – October 26, 2023

Source: TradingView

IG CLIENT SENTIMENT

IG Client Sentiment data tells us that 76% of Traders are currently holding long positions. Given the contrarian view adopted at DailyFX, is Oil destined for a return to the psychological 80.00 mark?

For a more in-depth look at WTI/Oil Price sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -2% | 0% |

| Weekly | 12% | -28% | -2% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]