[ad_1]

GOLD OUTLOOK & ANALYSIS

- Rather hawkish Powell unable to deter gold bulls.

- Incoming data this focus this week.

- XAU/USD snakes in and around 200-day MA.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

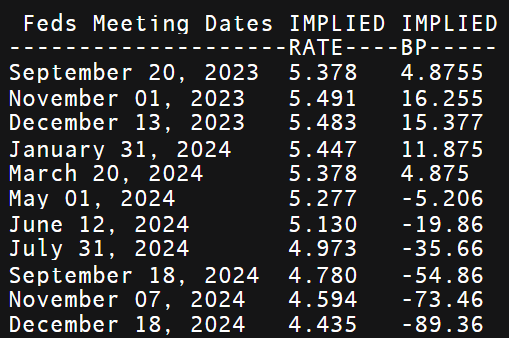

Gold prices have managed to remain elevated this Monday morning as the US dollar trades marginally lower. While Fed Chair Jerome Powell and other officials (Mester) eluded to the potential for additional monetary policy tightening if necessary, the current trajectory of economic data could see rates remain on hold for some time before cutting. Money markets (refer to table below) are now expecting the first round of rate cuts around June/July as opposed to May pre-Jackson Hole.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

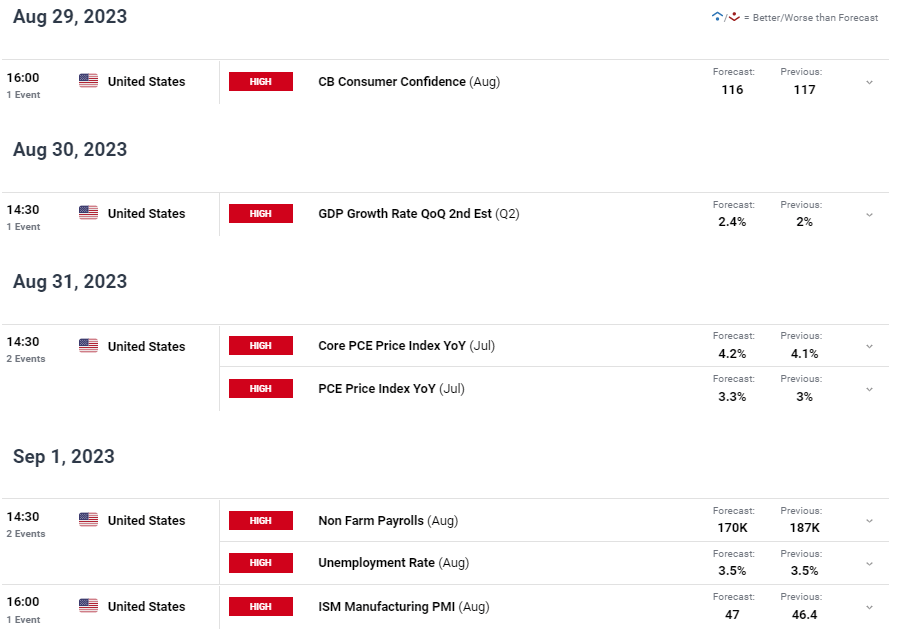

US economic data will become even more pertinent and with several key releases scheduled this week (see economic calendar below), markets will gain more clarity moving forward. Forecasts point to a resilient US economy that could weigh negatively on gold prices should actual data print in line with estimates. Core PCE and Non-Farm Payroll (NFP) numbers will be the focus as has been the case of recent. The robust US labor market has yet to show signs of significant weakness leaving pressure on core inflation.

GOLD ECONOMIC CALENDAR

Source: DailyFX

TECHNICAL ANALYSIS

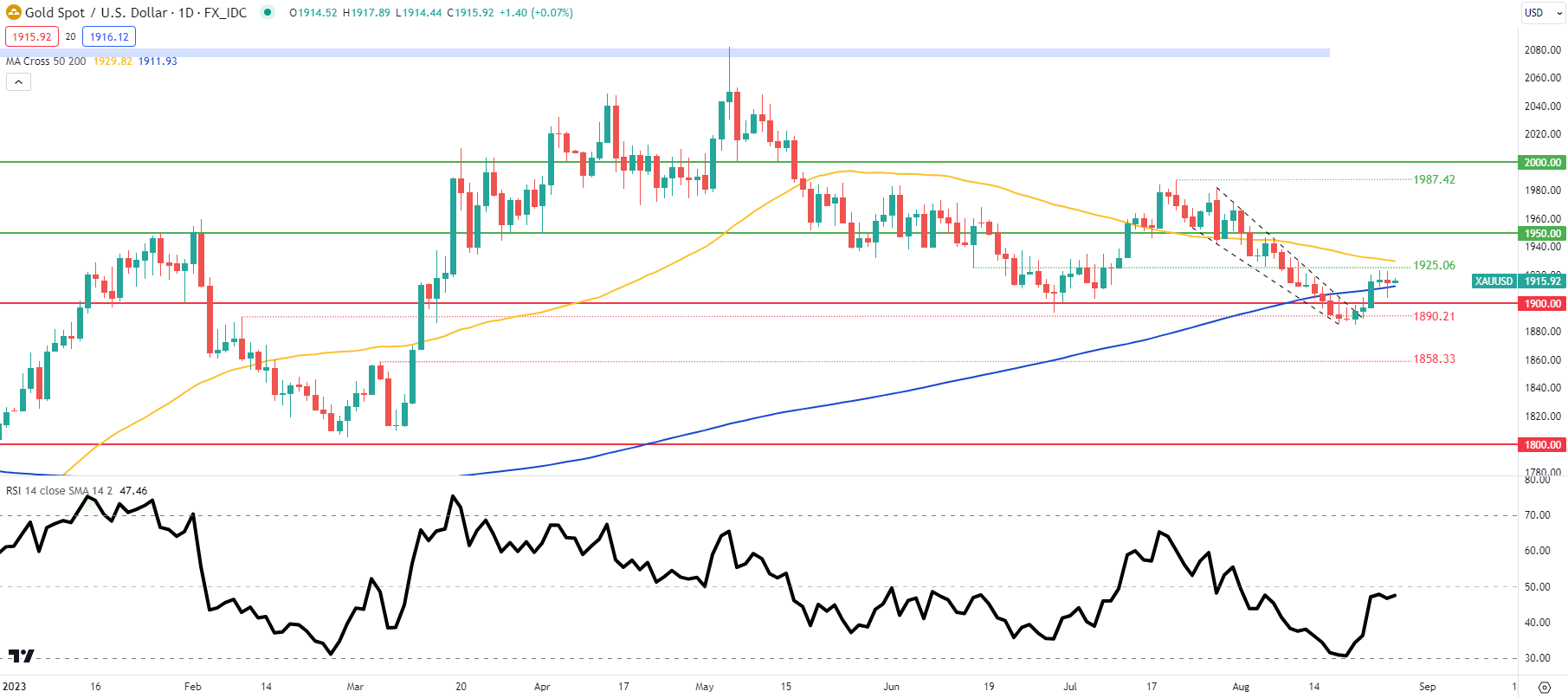

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action above has managed to stay above the 200-day moving average (blue) for now after breaking above the falling wedge chart pattern (black) last week. That being said, several recent doji candles suggest uncertainty/hesitancy as high impact economic data awaits. Gold is by no means out of the woods yet and could slump back below 1900.00 once again should incoming data demand so.

Resistance levels:

- 1950.00

- 50-day MA (yellow)

- 1925.06

Support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on gold, with 78% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

[ad_2]