[ad_1]

Gold (XAU/USD) Analysis

- Gold maintains bullish momentum after welcome CPI data

- Gold faces fresh resistance above 1900 which may pose too stern a challenge as overbought signals sound the alarm for bullish continuation plays

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Find out what’s in store for the precious metal

Gold Maintains Bullish Momentum after Welcome CPI data

Gold has enjoyed a phenomenal bull run since the early November retest of the September low and has shown little sign of slowing down. In fact, the recent steepening of the ascent provided little indication of a slow down in the trend until now (explored in detail below).

Yesterday’s 6th consecutive cooler inflation print added greater conviction to the market’s assumption that the Fed is going to hike by 25 basis points in February instead of 50 bps. General market sentiment has been pulling away from the Fed’s hawkish messaging that the fight against inflation is not done yet.

The weakening dollar certainly has buoyed gold prices at a time when treasury yields have been falling. Generally, declining yields make non interest-bearing alternatives like gold more attractive – although it must be said that treasuries still offer a relatively elevated yield when compared to 2022 despite the recent decline.

Gold Technical Analysis

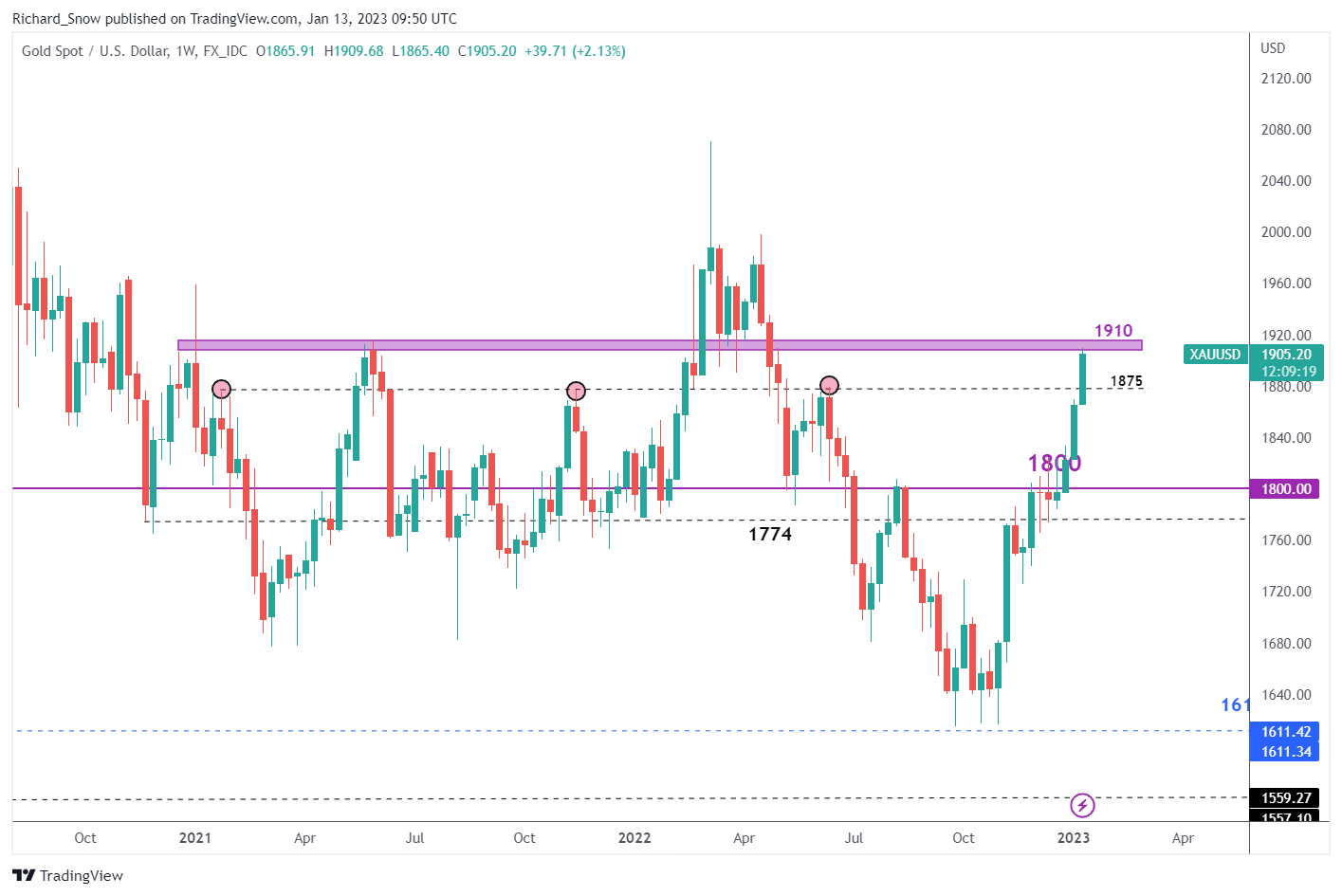

On the technical front, gold sets its sights on new resistance levels that may prove too tough to break above, for now. After breaking through 1875 and 1900 with relative ease, the focus now shifts to a zone of resistance around 1910/1915. The zone halted price appreciation in early 2021 as well as in June of the same year.

Gold (XAU/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

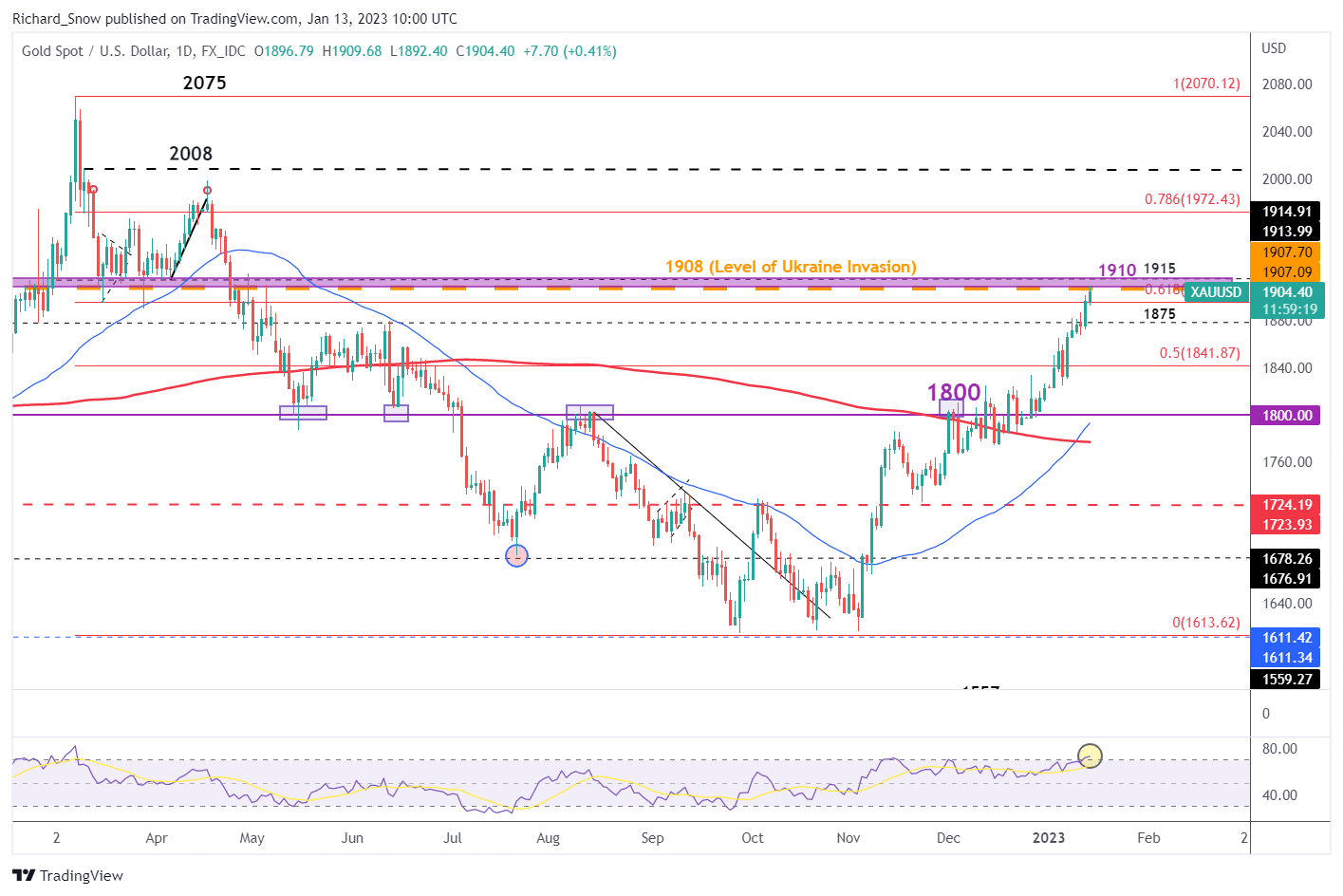

The daily chart places current price action above the 61.8% Fibonacci retracement of the major 2022 move, testing the 1908 level – which coincides with the level of the precious metal just before the Ukraine invasion which saw prices spike to the upside. 1915 also represents a key level as it propped up gold prices in March and April of last year.

While momentum is certainly in favor of the uptrend, a notion supported by the ‘golden cross’ observed via the 50 and 200 DMAs, the RSI warns that traders may soon reduce longs and cash in winners as the move appears overextended. Previous ventures into overbought territory witnessed pullbacks and therefore, such a warning ought to be taken into consideration before bullish continuation plays should be reconsidered.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Top Trading Lessons

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]