[ad_1]

Written by Axel Rudolph, Senior Market Analyst at IG

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

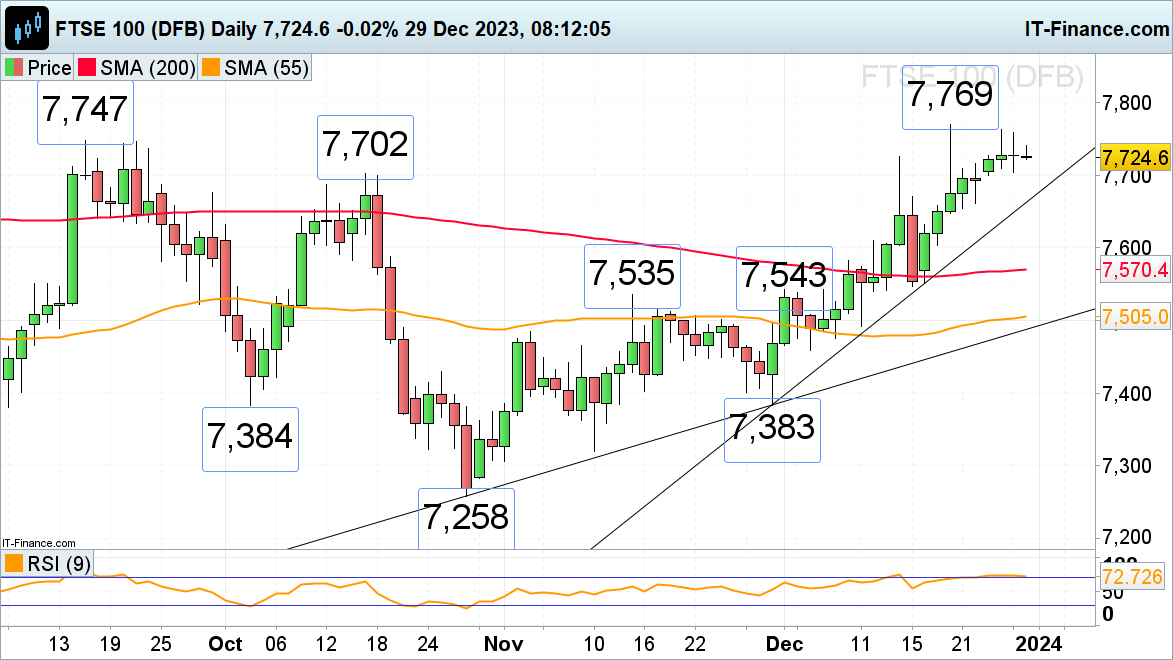

FTSE 100 consolidates below September and December highs

The FTSE 100 is expected to remain below its September and December highs at 7,747 to 7,769 on the last trading day of the year with markets closing early.

UK house prices falling more than expected in December have not had much of an impact on the index which looks bid as trading begins.

While Thursday’s low at 7,705 underpins, immediate upside pressure should be maintained with the 7,747 to 7,769 region representing upside targets ahead of the 7,800 mark.

A slip through 7,705 would likely retest the 7,702 October peak below which the November-to-December uptrend line can be spotted at 7,664.

DAILY FTSE 100 CHART

Chart Prepared by Axel Rudolph

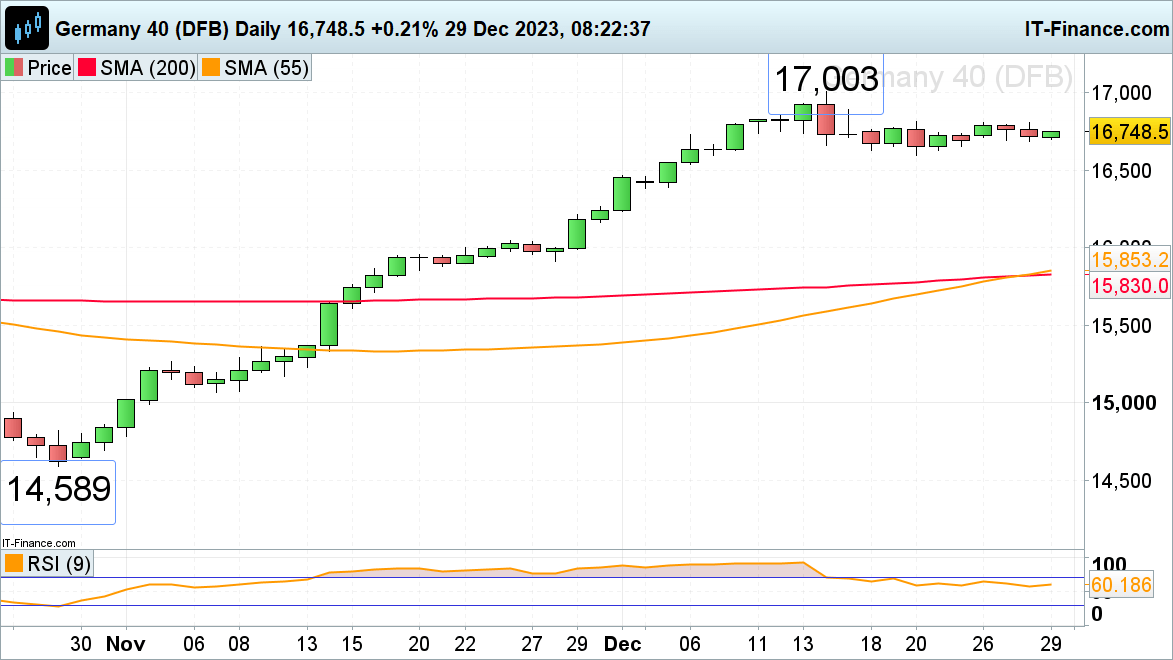

DAX 40 tries to end year on a high

The DAX 40 index, which has risen by around 19% year-to-date, is trying to finish the year on a high with it targeting last and this week’s highs at 16,809 to 16,812. If bettered, the December record high at 17,003 could be back in the pipeline.

Support below Thursday’s 16,686 lies at last week’s 15,595 low. Only if this low were to give way, would the July peak at 16,532 be back on the map but should offer support.

DAILY DAX CHART

Chart Prepared by Axel Rudolph

[ad_2]