[ad_1]

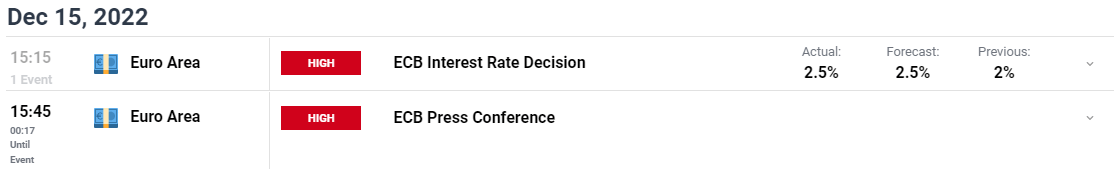

ECB Rate Decision Key Points:

The European Central Bank has raised interest rates as inflation remains sticky as 2023 approaches. The Central Bank expects to raise rates further based on a significant revision of the inflation outlook. Food price inflation and underlying price pressures have strengthened across the economy and are expected to persist for the foreseeable future. Average inflation reaching 8.4% in 2022 before decreasing to 6.3% in 2023, with inflation expected to decline markedly over the course of the year.

The Euro Area economy may contract in the current quarter as well as Q1 2023, largely due to the energy crisis, high uncertainty, weakening global economic activity and tighter financing conditions. ECB staff project that a recession should be relatively short-lived with limited growth for 2023 expected and has been revised down compared to previous projections.

For all market-moving economic releases and events, see the DailyFX Calendar

The recent rally in the EUR/USD has been largely driven by a weaker dollar and improving data out of the Euro Area. Yesterday’s decision by the US Federal Reserve hasn’t seen any long-lasting moves for the pair with today’s bps hike by the ECB expected to deliver much of the same.

***UPDATES TO FOLLOW****

Market reaction

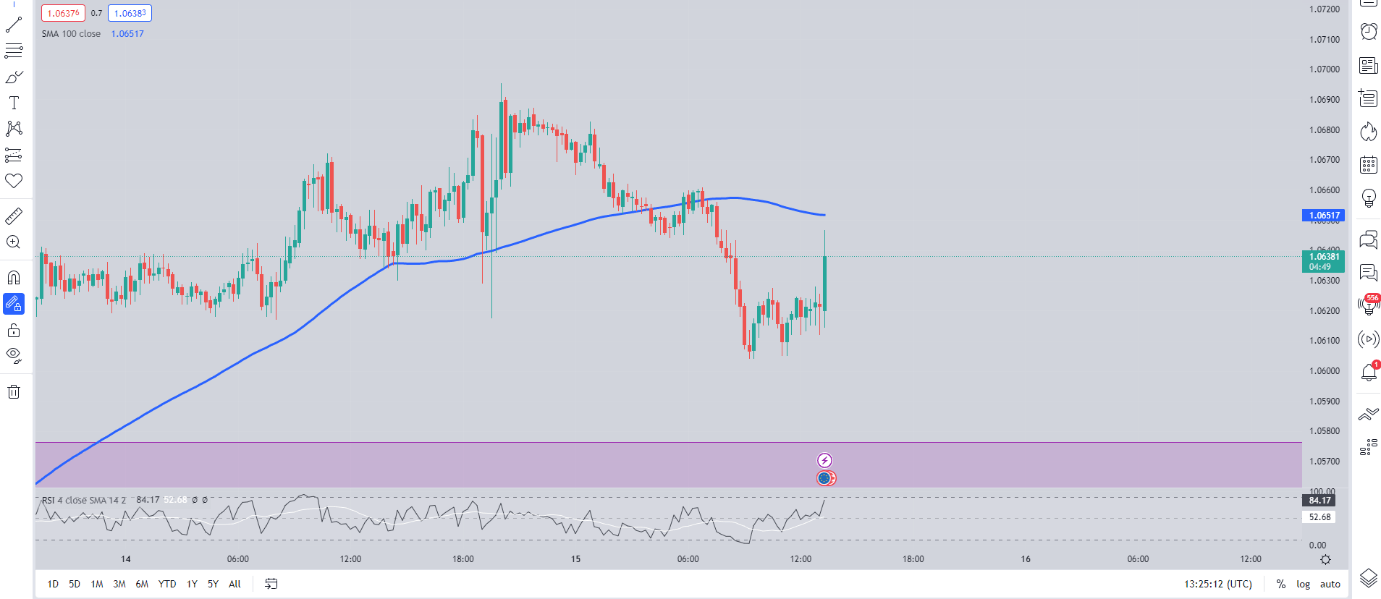

EURUSD 15M Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 30 pip spike higher. Downside pressure may come into play as the dollar index continues its move higher since yesterdays FOMC decision.

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently SHORT on EUR/USD, with 59% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that prices could EUR/USD may continue rise.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]