FOMC INTEREST RATE DECISION KEY POINTS

- The Federal Reserve keeps borrowing costs unchanged in their present range of 5.25% to 5.50%, in line with expectations

- The dot plot sees 75 basis points of easing in 2024, a little less than current market pricing but moving in that direction

- Gold and the U.S. dollar take different routes after the FOMC announcement hits the wires

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Nasdaq 100 Consolidates Higher After Breakout. Will the Fed End the Exuberance?

The Federal Reserve today concluded its final monetary policy gathering of 2023, voting unanimously to keep its benchmark interest rate unchanged within the current range of 5.25% to 5.50%, broadly in line with Wall Street expectations.

The decision to maintain the status quo for the third straight meeting is part of a strategy to proceed more cautiously in the later stages of the fight against inflation, as risks have become more balanced and two-sided after having already delivered 525 basis points of cumulative tightening since 2022.

Focusing on the FOMC statement, the institution downgraded its view on economic activity, acknowledging that recent indicators point to modest growth, but affirmed confidence in the labor market by noting that employment gains have been strong despite moderation since earlier in the year.

Source: DailyFX Economic Calendar

In addressing consumer prices, the communique tweaked its previous characterization, saying that “inflation remains elevated” while adding that the trend has eased over the past year, a vote of confidence in the outlook.

Shifting focus to forward guidance, the Fed retained a modest tightening bias, though the language reflected less conviction in this scenario by including the word “any” in its message of “in determining the extent of any additional policy firming that may be appropriate”. This is a sign that the tightening campaign is indeed over.

Wondering about the U.S. dollar’s prospects? Gain clarity with our latest forecast. Download a free copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

FED SUMMARY OF ECONOMIC PROJECTIONS

GDP, UNEMPLOYMENT RATE AND CORE PCE

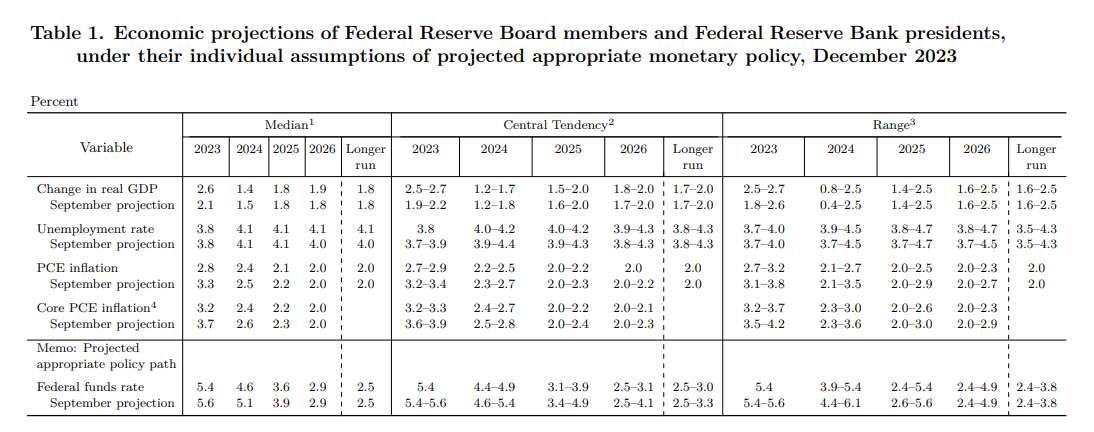

The December Summary of Economic Projections revealed important revisions compared to the quarterly estimates submitted in September.

First off, 2023 gross domestic product was revised upwards to 2.6% from 2.1% previously. For next year, the forecast was marked down modestly to 1.4% from 1.5%, signaling the economy will continue to avert a recession.

Turning to the labor market, the outlook for the unemployment rate for this and next year remained unchanged at 3.8% and 4.1%, respectively, reflecting faith in the economy’s ability to keep job losses contained.

Regarding core PCE, the Fed’s favorite inflation gauge is now seen ending the year at 3.2 %, well below the 3.7% projection issued three months earlier. In 2024, this indicator is predicted to fall to 2.4%, a bit lower than the 2.6% previous estimate.

FED DOT PLOT

The dot plot, which illustrates the expected trajectory of interest rates over several years as viewed by Federal Reserve officials, underwent several notable modifications.

In September, policymakers projected borrowing costs would end 2023 at 5.6% (5.50%-5.75%), but they are now finishing the year at 5.4% (5.25%-5.50%), with the central bank on pause over the past few meetings. Also at that point, the Fed anticipated a policy stance of 5.1% in 2024, implying 50 basis points of easing from the peak rate.

In December’s projections revealed today, officials see the target range falling to 4.6% (4.50%-4.75%). This implies 75 basis points of cuts, but from a lower terminal rate. Markets were pricing in about 106 basis points of easing over the next 12 months before today’s announcement, so the Fed’s outlook is slowly converging towards that scenario.

The following table provides a summary of the Federal Reserve’s updated macroeconomic projections.

Source: Federal Reserve

Eager to gain insights into gold’s outlook? Get the answers you are looking for in our complimentary quarterly trading guide. Request a copy now!

Recommended by Diego Colman

Get Your Free Gold Forecast

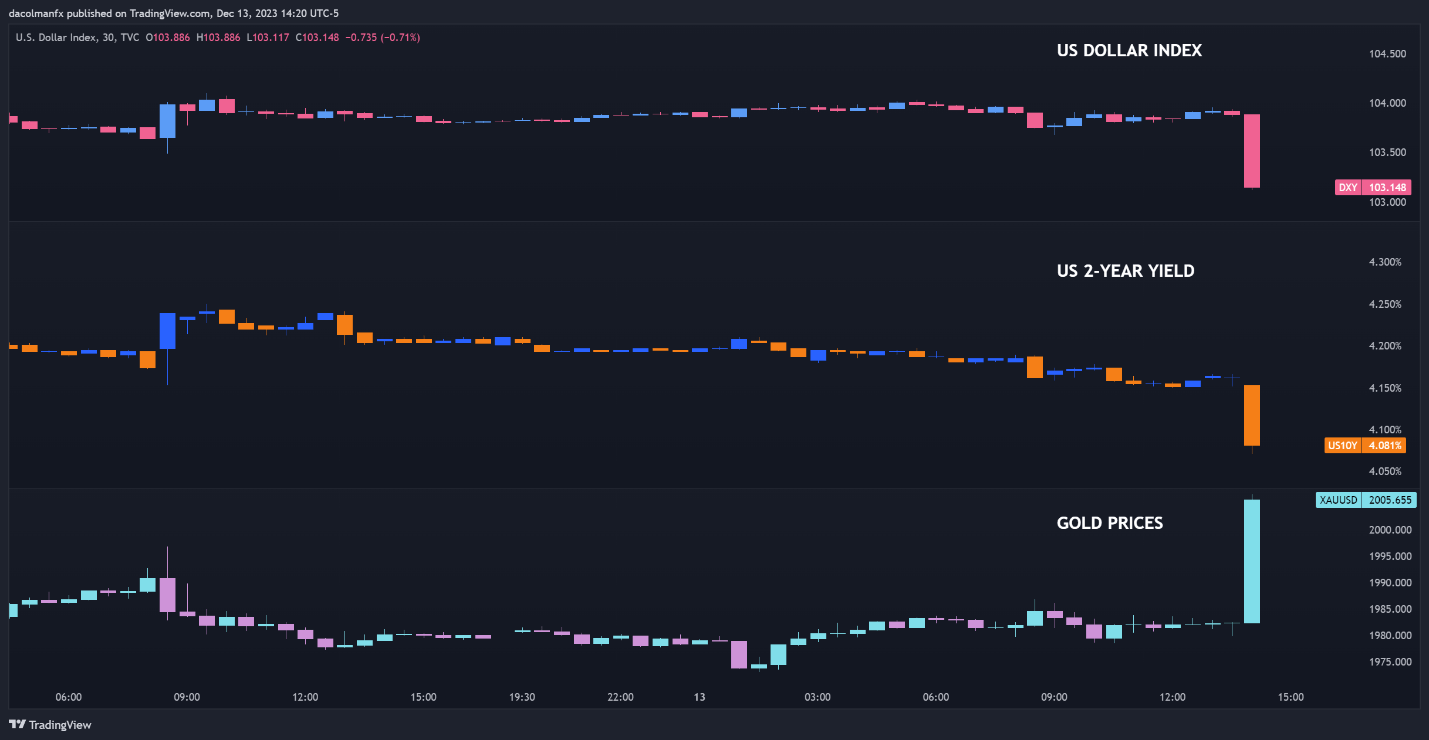

Immediately after the FOMC announcement crossed the wires, gold prices shot higher and extended their session’s advance, as yields and the U.S. dollar came under strong downward pressure as the Fed projected three interest rate cuts for next year. With the U.S. central bank starting to embrace a more dovish stance, today’s market moves could consolidate in the near term, but for greater clarity on the outlook, traders should closely follow Chairman Powell’s press conference.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Source: TradingView