[ad_1]

S&P 500 Analysis

- US indices gain on Monday, following on from Asia and Europe as sentiment eases

- S&P 500 trading within well-defined support and resistance zones

- Powell’s testimony and US non-farms to provide volatility this week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Equities Forecast

Stocks Rise but Early EPS Forecasts Suggest More Difficulty Ahead

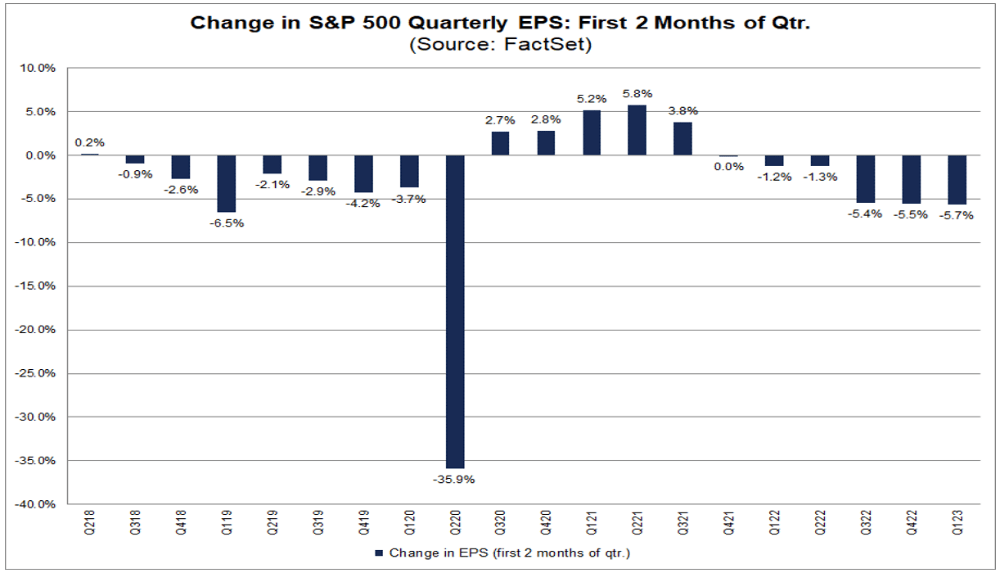

Major US equities rose in the initial hours of the US session but early data suggests that corporate earnings are likely to remain suppressed as the final month of Q1 gest underway. Rising expectations of the Federal Reserve’s target rate continue to see upward revisions via the bond market. S&P 500 rose at the end of last week as positive US PMI data prompted a wave of optimism, which continues into the start of this week.

However, US earnings remain under pressure and it is forecasted that lower EPS growth is in store once again for Q1 of 2023. This underscores the tough operating environment for firms, particularly at a time when the Fed welcomes interest rates above their initial December estimate if 5.1%. Higher rates typically have a negative effect on stocks but despite another leg higher in the ‘higher for longer’ narrative, stocks gain more ground.

EPS Forecasts Nosedive During Firsts Two Months of Q1

Source: FactSet, prepared by Richard Snow

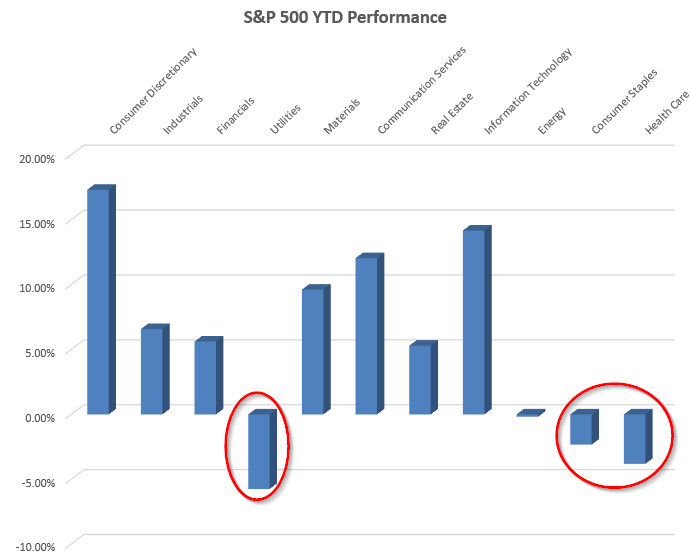

Interestingly enough, the stocks that performed fairly well during the massive 2022 decline: utilities, consumer staples and healthcare stocks are the ones under the most pressure for 2023 year-to-date. Nevertheless, the index heavyweights edge slightly higher.

US Equities Continue the Upward Momentum

The Nasdaq, S&P 500 and Dow all registered gains early on Monday, following peers in Asia and Europe where similar gains were broadly witnessed. Positive Chinese PMI manufacturing data has raised optimism particularly around the Chinese reopening and the positive knock-on effects for the rest of the globe.

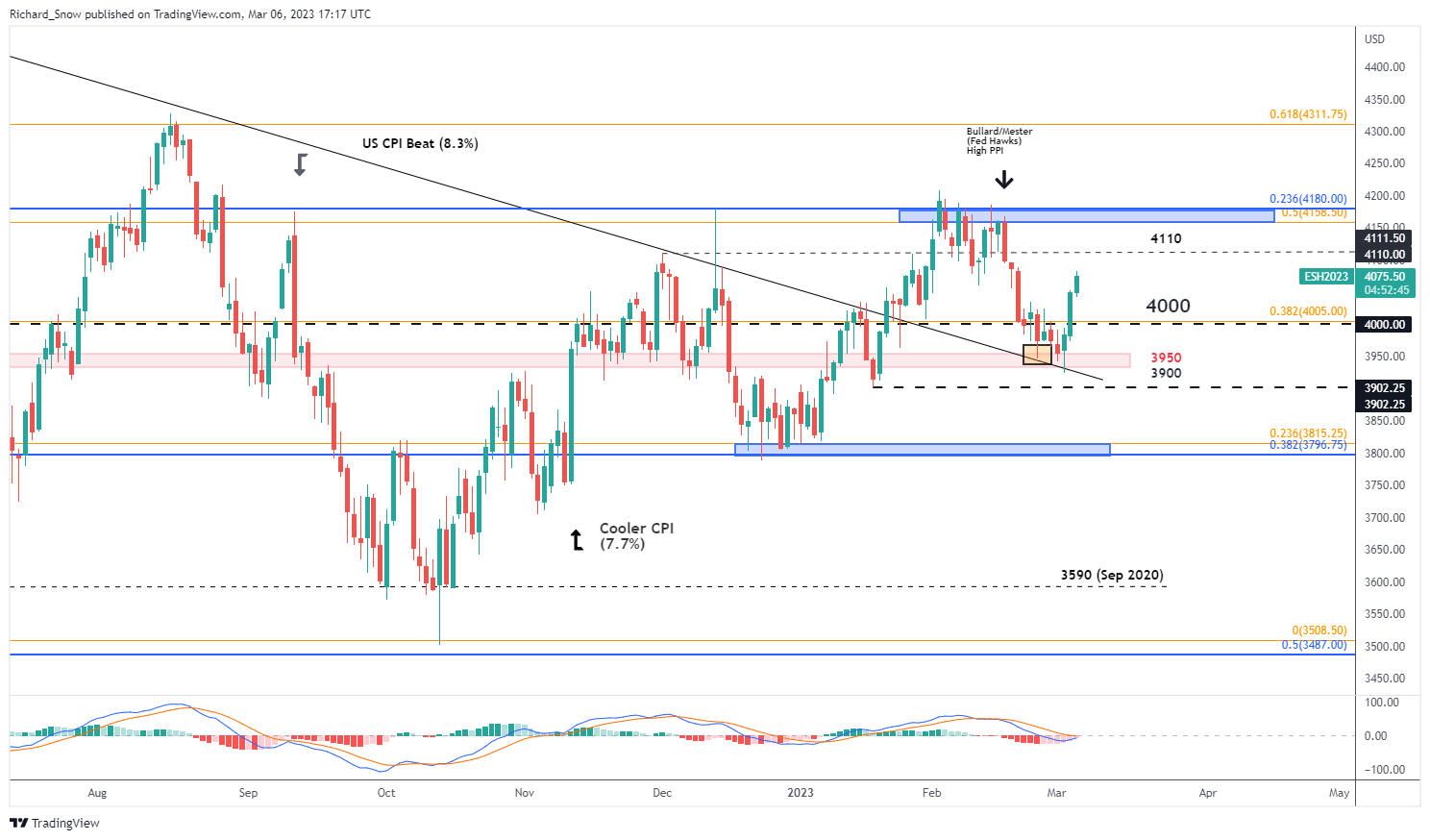

After failing to close below the 3950 confluence zone of support, the S&P 500 (via the E-Mini Futures ES1! chart) has put in quite the turnaround. The psychological importance of the 4000 level cannot be underestimated as the latest move above it, edges higher. Resistance appears at 4110 and then the zone of resistance at 4180. Support becomes 4000 followed again by the 3950/3900 zone.

ES1! (S&P 500 Futures) Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]