[ad_1]

Australian Dollar Vs US Dollar, China PMI – Talking Points:

- AUD rose after China manufacturing activity beat expectations.

- AUD/USD is attempting to break above key resistance.

- What are the key levels to watch in AUD/USD?

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

The Australian dollar rose briefly against the US dollar on tentative signs that China’s manufacturing activity could be reviving. China NBS manufacturing PMI rose slightly to 49.7 in August vs. 49.4 expected, and 49.3 in July. NBS non-manufacturing PMI slowed to 51.0 vs. 51.1 expected and 51.5 in July. While the manufacturing sector is still in contraction territory, the improvement provides comfort that the recent stimulus measures are spilling over the economy.

Thursday’s data is in line with the recent less-worse-than-expected China macro data, but still

broadly underwhelming, as the Economic Surprise Index shows. The China Economic Surprise Index has rebounded slightly recently, but it is not too far from mid-2020 lows (Covid levels) which has prompted analysts to downgrade growth estimates for the current year. China is Australia’s largest export destination and changes in the world’s second-largest economy tend to have implications for the Australian economy.

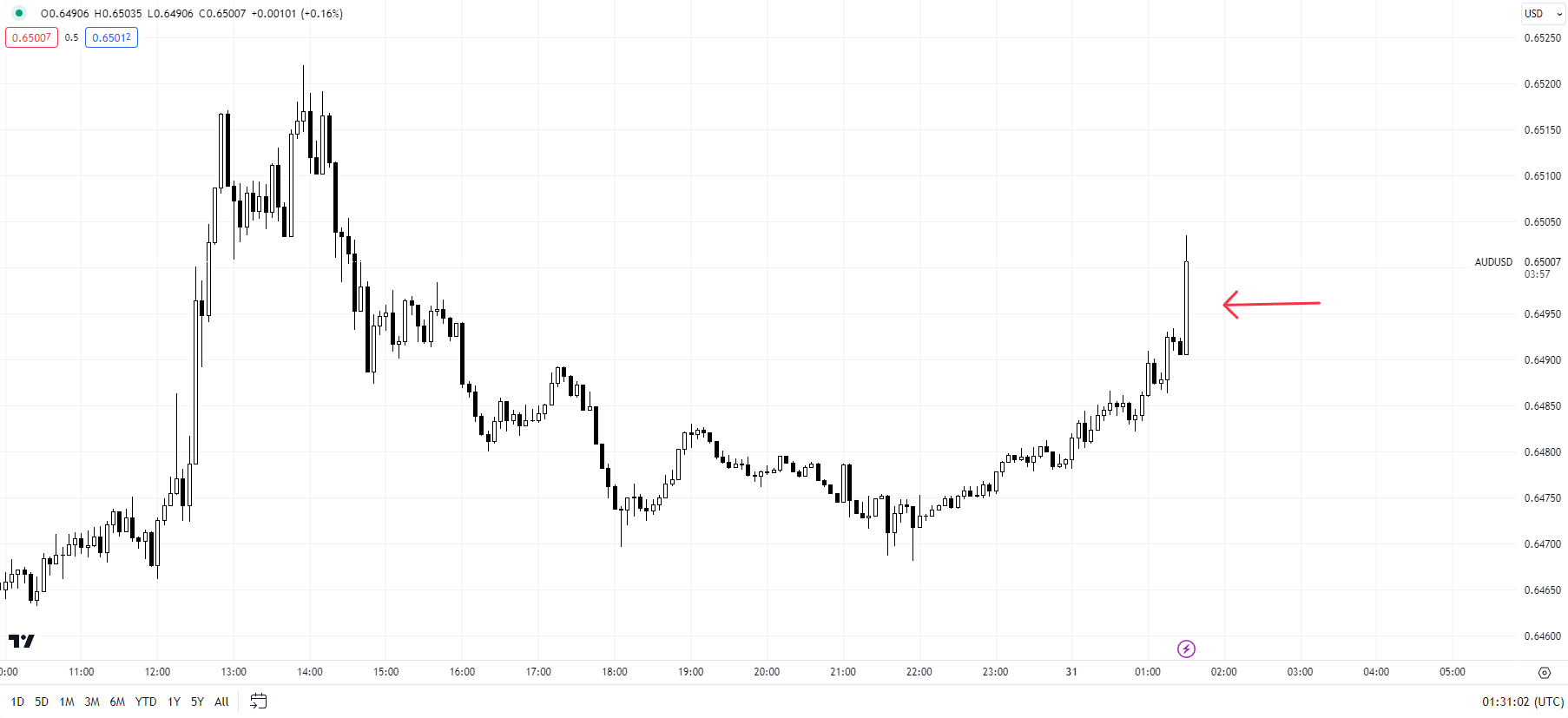

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

Chinese policymakers have responded with a spate of targeted stimulus measures in recent months in an attempt to revive the faltering post-Covid recovery and a struggling property sector. However, with a massive stimulus seemingly off the table (given the associated risks of creating imbalances within the economy), broader risk sentiment is likely to drive AUD in the interim.

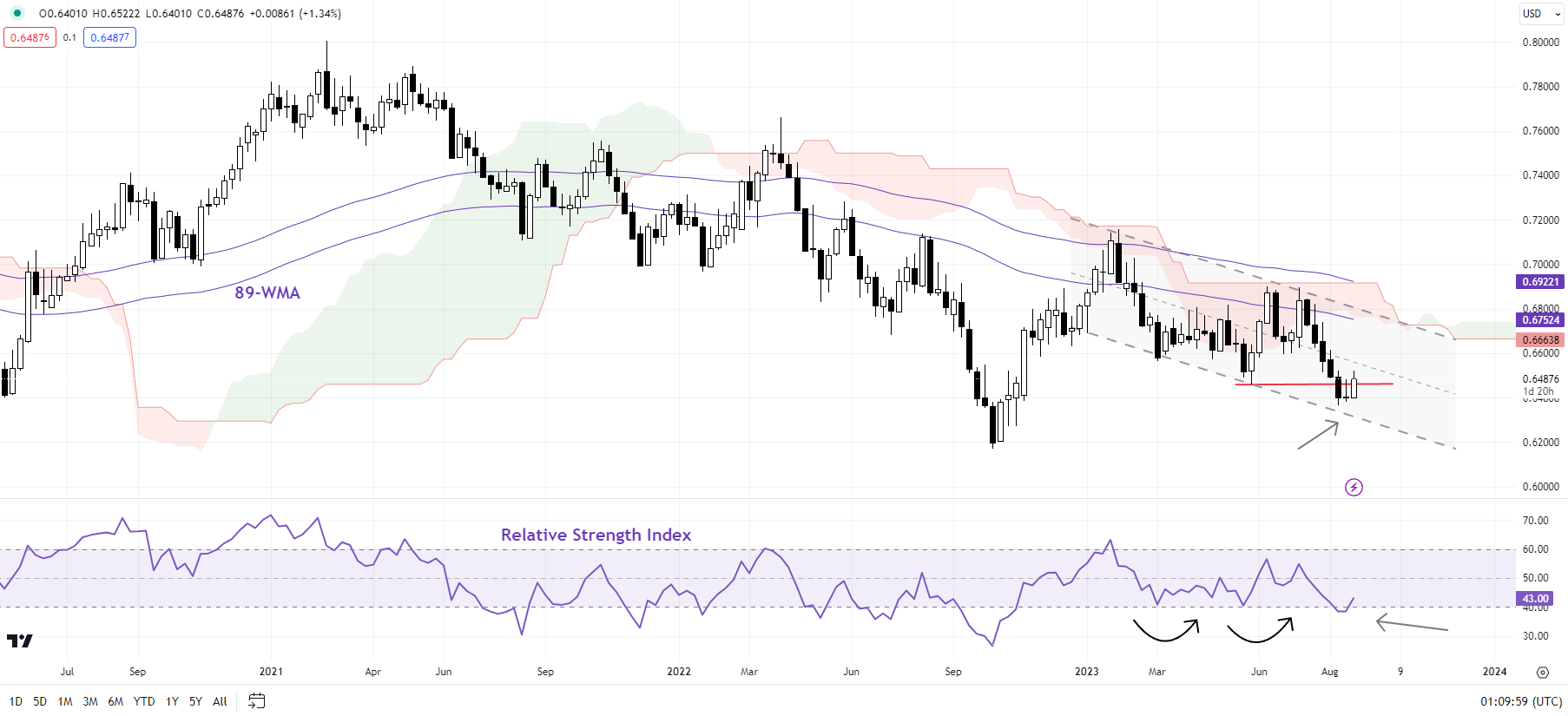

AUD/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Risk appetite has been contained for now as recent soft data doesn’t suggest a resurgence in US economic growth, capping US yields and weighing on the US dollar globally. The stabilization in risk sentiment has overshadowed the moderation in Australian inflation, lessening the need for further rate hikes by the Reserve Bank of Australia. See “Australian Dollar Falls After CPI Miss; Which Way for AUD/USD, AUD/JPY?” published August 30.

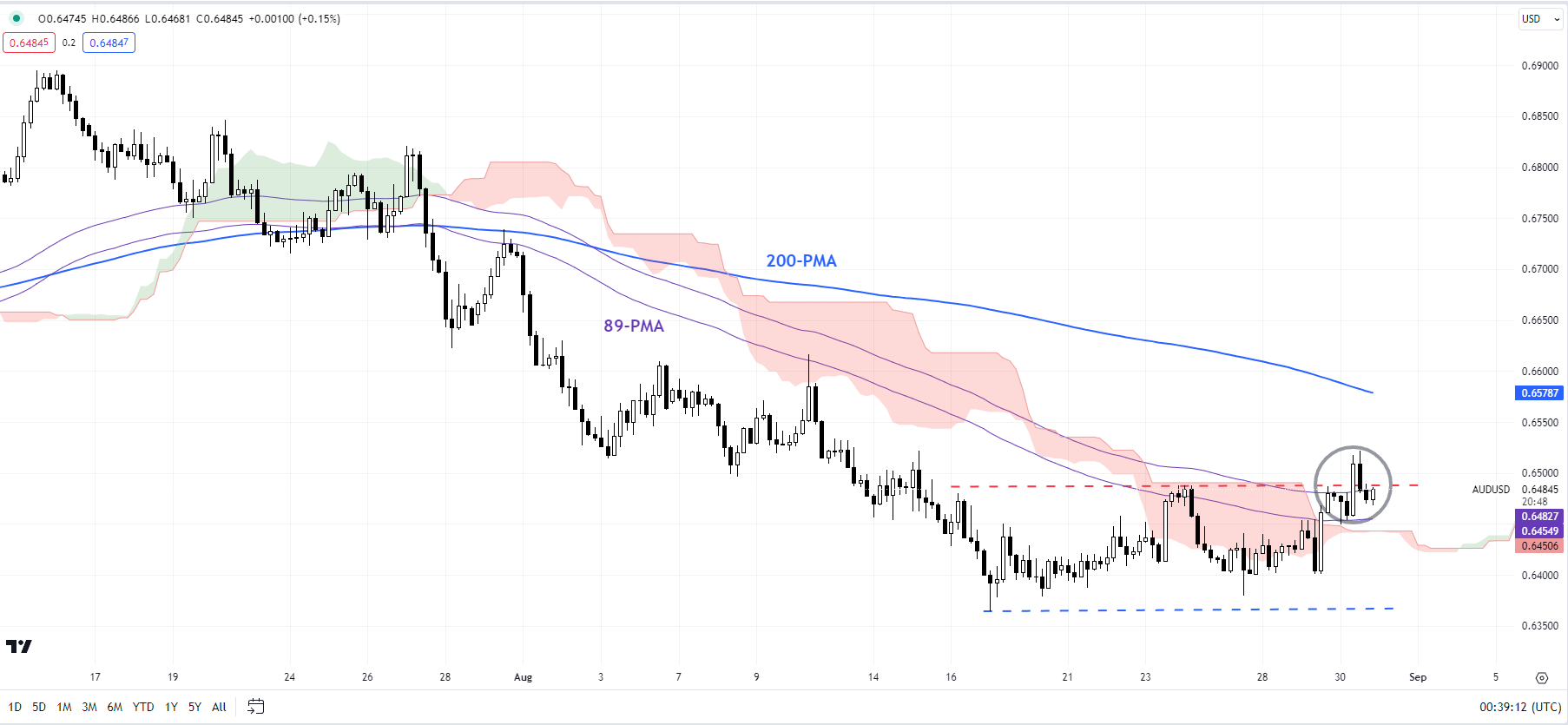

AUD/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

AUD/USD: Beginning to flex muscles

On technical charts, AUD/USD is attempting to break above a vital ceiling at last week’s high of around 0.6500. A decisive break above could pave the way toward the 200-period moving average on the 240-minute charts (now at about 0.6600).

Bearish pressure on AUD/USD has eased recently – a possibility highlighted in the previous update. See “US Dollar Flirts with Resistance After Powell; EUR/USD, GBP/USD, AUD/USD Price Action,” published August 28, and “Australian Dollar Looks to Recoup Losses Ahead of CPI; AUD/USD, AUD/NZD, AUD/JPY,” August 29.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]