[ad_1]

Bitcoin and Ethereum Price Forecast:

- Bitcoin prices (BTC/USD) extend gains as Fed rate expectations ease.

- Ethereum (ETH/USD) wrestles with psychological resistance at $1,700.

- US Dollar takes strain with US 2-year yields falling to a six-month low before major CPI report.

Recommended by Tammy Da Costa

Get Your Free Bitcoin Forecast

Bitcoin and Ethereum shake off Fed fears, extending gains

Bitcoin prices jumped on Monday after the collapse of SVB triggered fear throughout the banking system. While US regulators rushed to ease fears on Sunday evening, the injection of additional liquidity and the safeguarding of client deposits drove cryptocurrency higher.

Related Article: US Dollar Grips on as SVB Fallout Brings US CPI Into View Ahead of the Fed

Although the sudden closure of Signature and New York Bank posed an additional threat to digital assets, the assurance by the US treasury, Fed and FDIC (Federal Deposit Insurance Corporation) helped boost demand for risk assets.

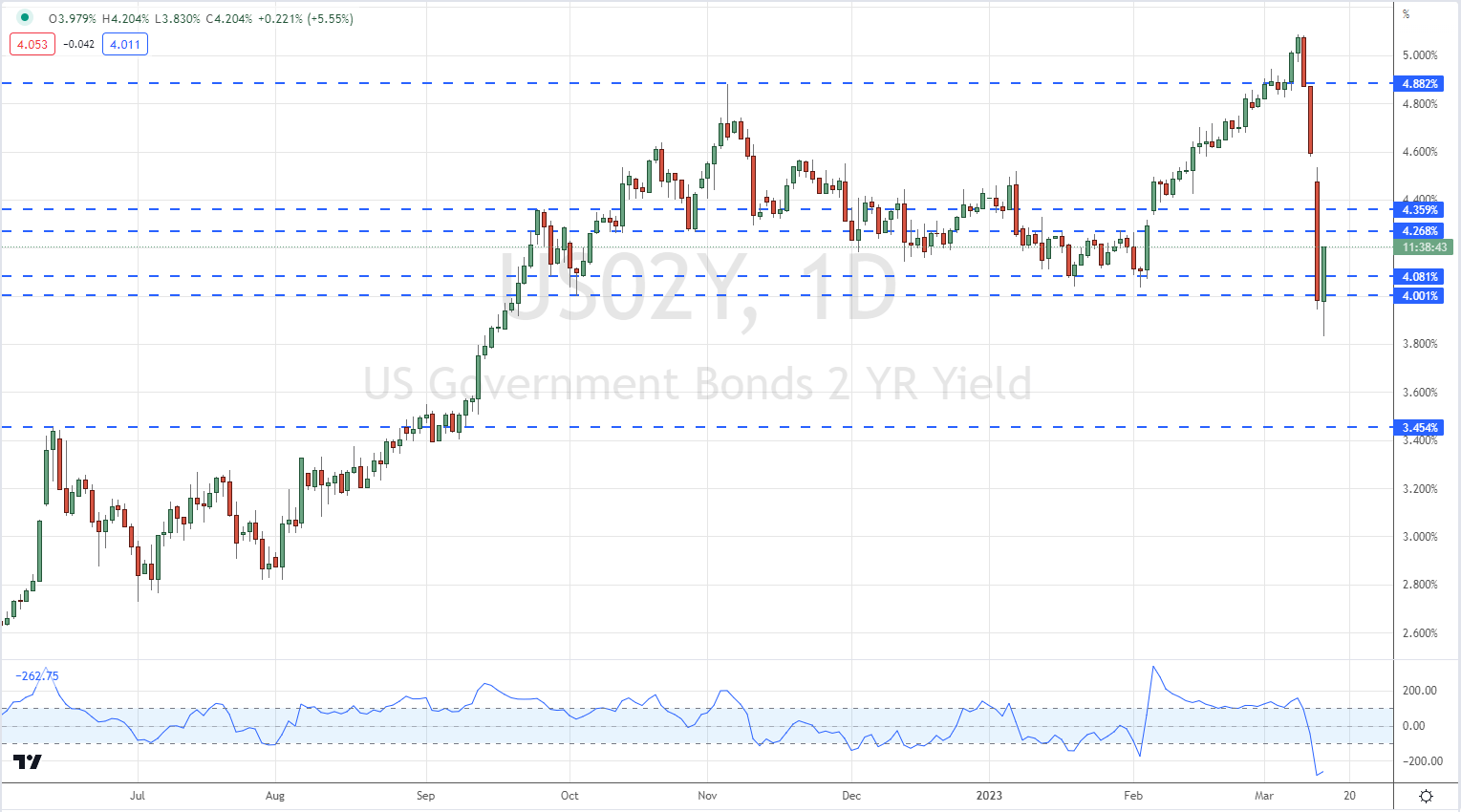

Additionally, the recent incident has reduced expectations of another aggressive rate hike at the upcoming FOMC. Because both Bitcoin and Ethereum are sensitive to rising interest rates, a shift in the narrative pushed yields 2-year yields to a six-month low, weighing on Dollar strength.

Image taken from Nick Cawley’s article: Gold Price – XAU/USD Eyes Support as CPI Nears and US Bond Yields Rebound

US 2-YEAR YIELD

Bitcoin Price Analysis

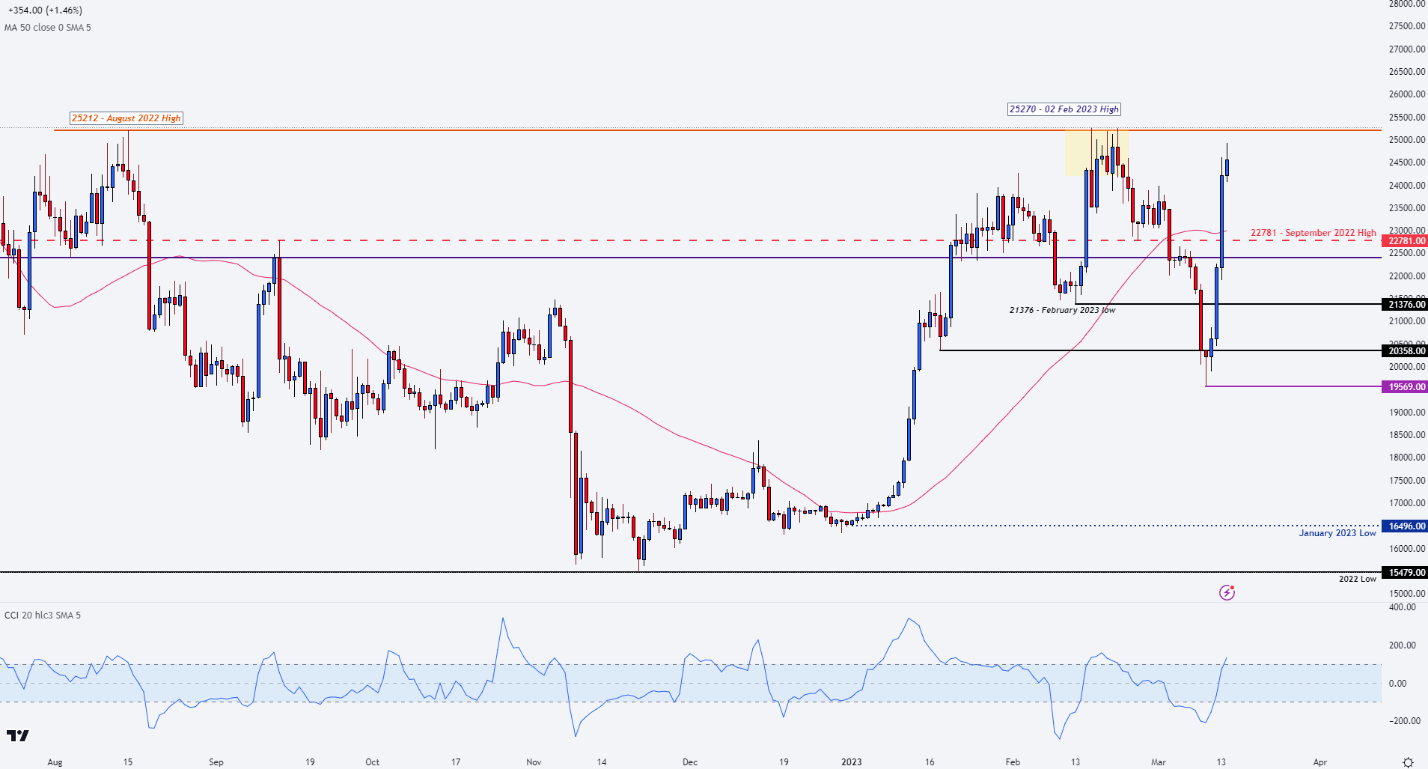

With BTC/USD progressing toward the next zone of psychological resistance at $25k, ETH/USD reached $1,700 which remains as major resistance for the imminent move. After the formation of a hammer candle on the daily chart, the aggressive move higher has seen Bitcoin rise over 20% since Friday’s close.

As the current daily high holds around the $24,917 handle, a bullish formation on the weekly chart suggests that bullish continuation may be possible if prices can clear $25,000.

Recommended by Tammy Da Costa

Building Confidence in Trading

Bitcoin (BTC/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Bitcoin Key Levels

| Support | Resistance |

|---|---|

|

|

|

|

|

Ethereum Price Analysis

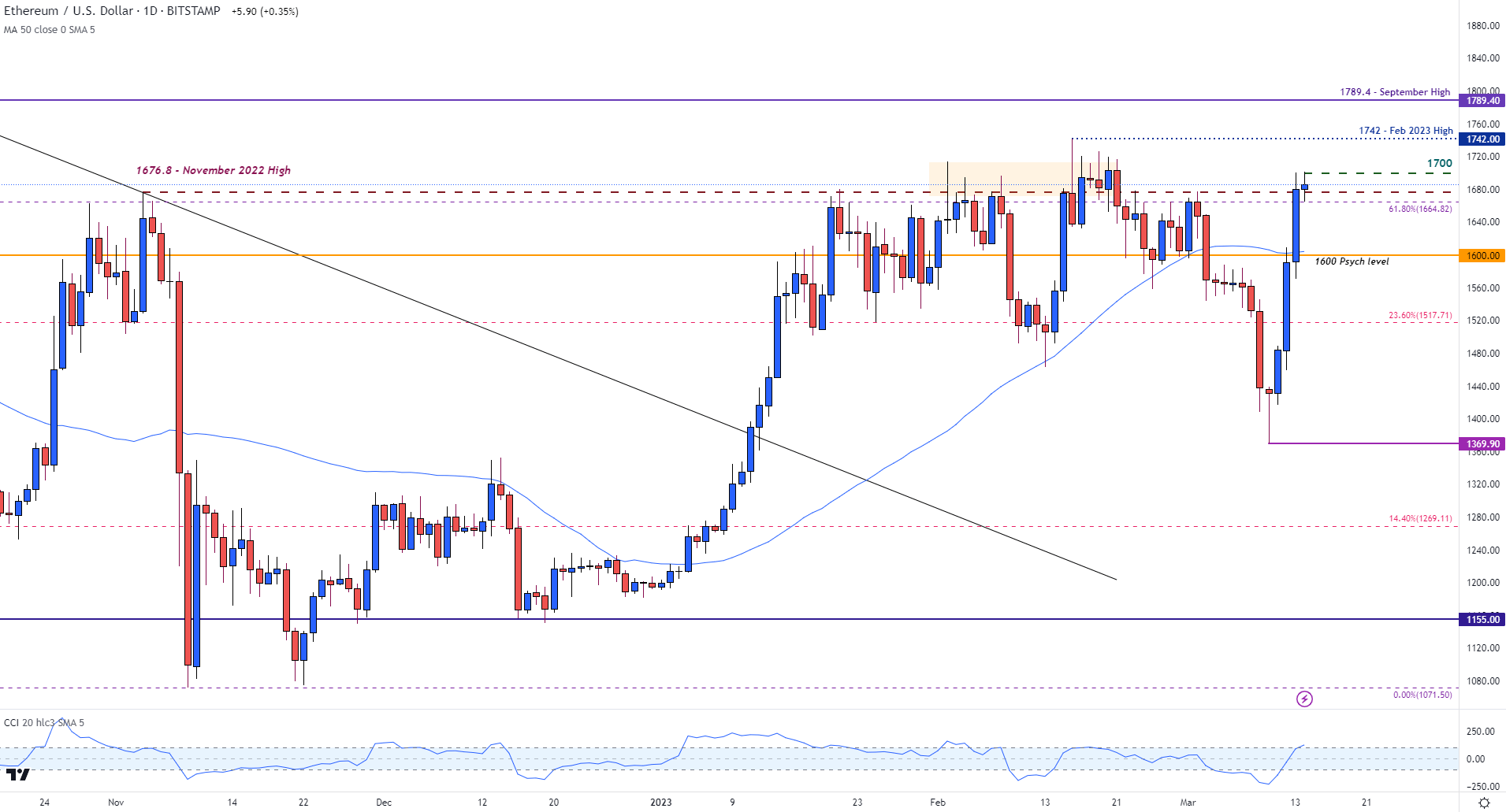

With Ethereum following its major counterpart higher, a bullish engulfing pattern formed on the daily chart, indicating a change in direction after last week’s decline. As bullish momentum increased, prices rose above the 50-day MA (moving average), promoting further gains.

However, with the CCI (commodity channel index) for both Bitcoin and Ethereum now lingering in overbought territory, buyers will need to hold above $1,700 in the hope of retesting the February high.

Ethereum (ETH/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Ethereum Key Levels

| Support | Resistance |

|---|---|

|

|

|

|

|

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]