[ad_1]

Looking for new strategies for 2024? Explore the top trading ideas developed by DailyFX’s team of experts

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

The Federal Reserve’s unexpected pivot at its December monetary policy meeting has significantly reduced the probability of a downturn in the coming year, making the soft-landing scenario the most likely outcome for the economy.

For context, policymakers have signaled that they will prioritize growth over inflation and indicated that they will deliver numerous rate cuts over the next 12 months, sending yields reeling in late 2023 – a situation that has eased financial conditions significantly.

The relaxation of financial conditions, in turn, has boosted stocks, steering major U.S. equity indices toward fresh records. Elevated asset values are expected to contribute to an enhanced wealth effect in the near term, helping support household spending- the main driver of U.S. GDP.

With the economic outlook stabilizing and already showing signs of improvement, small-cap stocks, which have historically thrived in times of lower market uncertainty, should fare well in Q1 2024 after lagging for much of 2023, possibly outperforming larger companies. This leaves Russell well-positioned to command strength early in the new year.

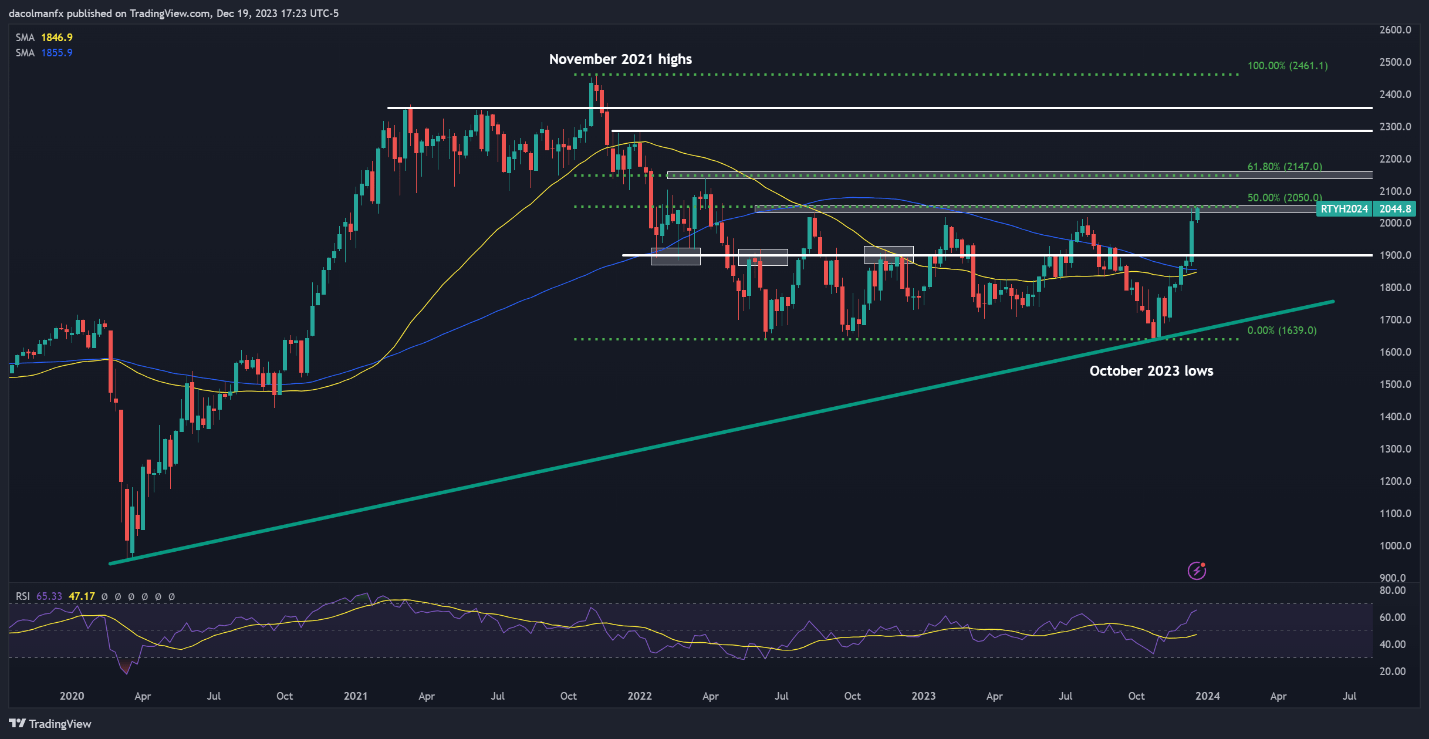

Focusing on technical analysis, the Russell 2000 experienced a surge towards the end of the fourth quarter in 2023, but encountered stiff resistance at 2,050, a key ceiling defined by the 50% Fibonacci retracement of the November 2021/October 2023 selloff.

To have more confidence in the bullish thesis, the small-cap benchmark must decisively climb and close above the 2,050 level, with a successful breakout opening the door for a rally toward 2,150. Subsequent gains could signal a possible continuation towards 2,300, followed by 2,355.

In the of event of unexpected and sustained weakness, the bullish bias would be null and void if prices dip and close below support near the psychological 1,900 level on a weekly candle.

If you’re looking for an in-depth analysis of U.S. equity indices, our first-quarter stock market trading forecast is packed with great fundamental and technical insights. Get it now!

Recommended by Diego Colman

Get Your Free Equities Forecast

Russell 200 Weekly Chart

Source: TradingView, Prepared by Diego Colman

[ad_2]