[ad_1]

British Pound Fundamental Outlook

In the Q4 British Pound forecast we questioned whether the Bank of England (BoE) was finished hiking interest rates and if they would ease into a period of consolidation to let the raft of rate hikes work their way through the economy. This question has now been answered. It is now highly unlikely that the BoE will move rates higher again in the foreseeable future and a series of quarter-point rate cuts are now fully priced into the market. The new question is, how long will the UK central bank push back against these market expectations before they start to ease monetary policy?

This article is specifically dedicated to analyzing the fundamental factors driving the British pound. If you are interested in a detailed exploration of the technical outlook and price action dynamics, don’t miss the opportunity to download the full Q1 pound trading guide. It’s available for free!

Recommended by Nick Cawley

Get Your Free GBP Forecast

UK Inflation Takes a Sharp Turn Lower

The recently released Inflation Report saw price pressures ease sharply in November, hitting the lowest level seen in more than two years. A combination of falling fuel, food and household good prices pushed annual inflation down to 3.9% from 4.6% in October, well below market forecasts of 4.4%. This fall below 4% is in contrast to the BoE’s predications at the November MPC meeting where CPI inflation was seen falling to 4.5% in Q1 2024 and 3.75% in Q2 2024. The report suggested that inflation would fall to target (2%) in two years’ time. It looks likely that the BoE will have to revise their inflation expectations a lot lower in the next quarterly MPC Report in February.

BoE November Monetary Policy Report – Forecast Summary

The above BoE Summary also shows that UK growth is expected to flatline in 2024 before a very modest pick-up in 2025. If these projections are correct, and they may be upgraded in February, it will become increasingly hard for the BoE to ignore market calls for a series of interest rate cuts next year, and starting sooner rather than later.

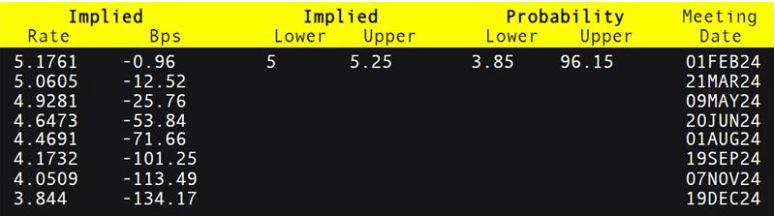

Looking at current expectations for UK interest rates next year, financial markets are already pricing in five 25 basis point rate cuts next year, with the first move lower fully priced in at the May MPC meeting.

Interested in learning how retail positioning can shape GBP/USD’s path? Our sentiment guide explains the role of crowd mentality in FX market dynamics. Get the free guide now!

| Change in | Longs | Shorts | OI |

| Daily | 12% | -9% | 0% |

| Weekly | 3% | -7% | -2% |

The difference between the Bank of England’s and the market’s expectations on the path of interest rates is set to steer the British Pound over the coming quarter. The BoE is not alone in trying to temper rate cut expectations with the US Federal Reserve and the European Central Bank also trying to talk back market expectations. The messaging from all three central banks will add volatility to GBP/USD and EUR/GBP in the coming months and will give traders a range of opportunities to trade central bank talk.

[ad_2]