USD/CAD FORECAST: MILDLY BULLISH

- USD/CAD advances and challenges a key technical resistance as volatility begins to pick up

- Canada’s inflation data could be an important catalyst for price action next week

- Market sentiment should also be a major driver of the Canadian dollar in the near term

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: S&P 500 Underwater but Exuberance Hasn’t Yet Cracked – What Now for Stocks?

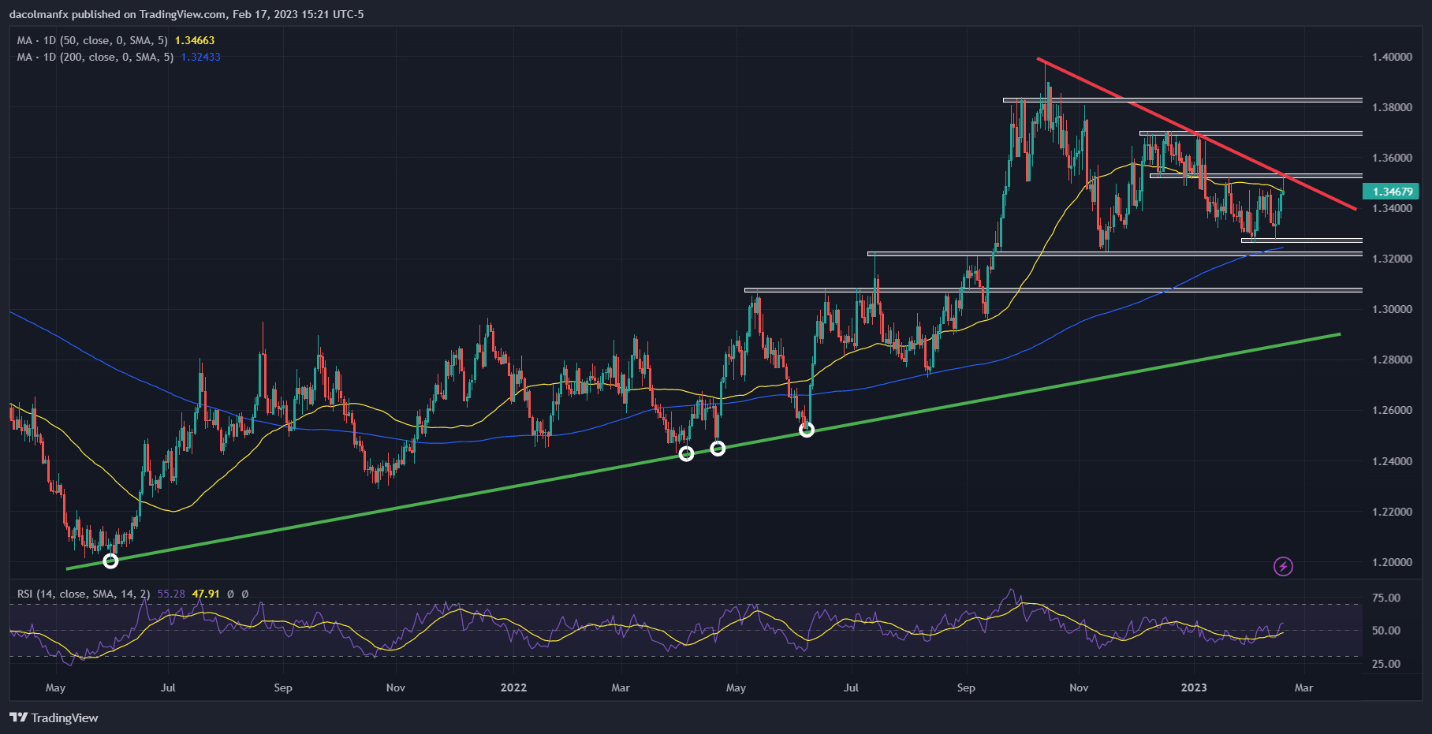

For much of the last month and a half, USD/CAD (U.S. dollar – Canadian dollar) has been rangebound, moving largely directionless between support at ~1.3280 and resistance at ~1.3530. In recent days, the pair has accelerated to the upside following a volatility surge, testing the topside of the consolidation range, but failing to break out of it decisively.

In the coming sessions, there will be several macro events that could trigger wild swings and possibly guide near-term price action, so it is important to keep an eye on the economic calendar to understand what is driving the markets. That said, the two key releases that USD/CAD traders should watch closely are Canada’s inflation report on Tuesday and the FOMC minutes on Wednesday.

Bank of Canada raised borrowing costs by 25 basis points to 4.50% at its January meeting and signaled that its aggressive tightening campaign has ended, but policymakers may reassess the outlook if inflationary forces remain stubbornly high. For that reason, traders should carefully scrutinize incoming data.

According to consensus estimates, Canadian January CPI rose 0.7% month-over-month, bringing the annual rate to 6.1% from 6.3% previously, a small but welcome directional improvement. An inline or below-forecast readout should be bearish for the Loonie, but an upside surprise would add some support insofar as the result could lead investors to discount further BoC hikes.

Why will a hotter-than-expected CPI print be only slightly positive for the Canadian dollar? Because the market is now focusing more on the U.S. side of the equation, amid increased bets that the U.S. central bank’s terminal rate will settle higher than initially anticipated in response to sticky inflation. Sentiment is now being dictated by Fed’s roadmap considerations.

The release of the FOMC minutes of the January/February meeting will provide traders with an opportunity to assess policymakers’ thinking regarding future actions, but the document is unlikely to change the prevailing narrative following hawkish Fedspeak this past week. Against this backdrop, the U.S. dollar is well-placed to extend its recovery in the coming sessions, especially if safe-haven demand emerges in earnest.

Returning to the USD/CAD to focus on technical analysis, the pair may encounter strong resistance at 1.3530, but if this ceiling is breached decisively, bulls could launch an attack on the 1.3700 psychological level. In contrast, if sellers regain the upper hand and spark a pullback, we can’t rule out a move toward the 2023 lows.

| Change in | Longs | Shorts | OI |

| Daily | -11% | -2% | -5% |

| Weekly | -39% | 29% | -7% |