[ad_1]

US INFLATION KEY POINTS:

- U.S. stocks rally at the start of the week, with the Nasdaq 100 leading gains on Wall Street

- Meanwhile, the U.S. dollar and gold prices are modestly weaker ahead of a key U.S. economic report on Tuesday

- January U.S. inflation data due for release tomorrow morning will set the trading tone for different assets

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Understanding Inflation and its Global Impact

Risks assets were bid up on Monday ahead of key U.S. economic data. In afternoon trading, the broad U.S. dollar was moderately weaker, bolstering higher beta currencies such as the euro and the British pound. Meanwhile, gold prices were subdued, while the Nasdaq 100 staged a strong rally, supported by a jump in tech stocks.

Recent market dynamics could change or become reinforced after the U.S. Bureau of Labor Statistics publishes its latest inflation report on Tuesday morning, so traders need to pay close attention to the results.

January headline CPI is forecast to have increased 0.5% in seasonally adjusted terms, bringing the annual rate to 6.2% from 6.5%. Fort its part, the core gauge, which excludes energy and food components, is seen rising 0.4% monthly and 5.5% in the last twelve months.

Tomorrow’s release will be heavily scrutinized on Wall Street for clues on the outlook for consumer prices, especially after Fed Chair Powell acknowledged the presence of disinflation numerous times at the last FOMC meeting.

For stocks to remain buoyant, incoming data must point to a meaningful downshift in inflationary forces, otherwise, traders could reprice higher the Fed terminal rate, bolstering U.S. Treasury yields and weighing on gold prices. This latter hypothesis will stand to benefit the U.S. dollar in the FX space, creating numerous challenges for the euro.

Although consumer prices have cooled rapidly of late, rising energy costs at the beginning of the year, extremely tight labor markets and seasonal adjustments by the Bureau of Labor Statistics could slow the convergence of inflation toward the Fed’s 2% target. With traders walking on eggshells, an upside CPI surprise could shatter confidence and stoke volatility across asset classes.

TECHNICAL SETUPS BEFORE US CPI DATA

Recommended by Diego Colman

Get Your Free EUR Forecast

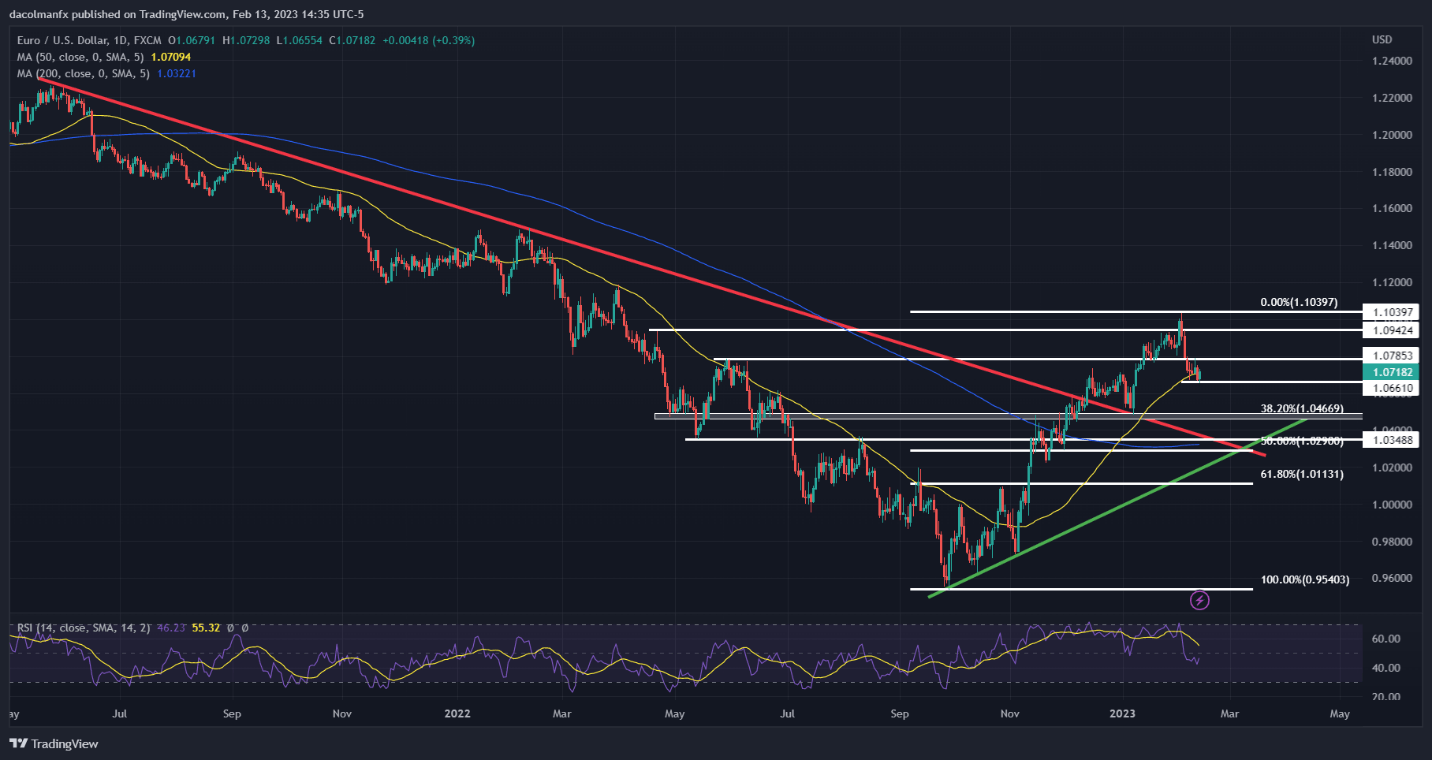

EUR/USD TECHNICAL ANALYSIS

EUR/USD has been consolidating between resistance at 1.0785 and support at 1.0661 over the past few trading sessions. If prices resolve to the downside, we could see a retest of 1.0481 in the near term. In contrast, if consolidation resolves to the upside, the pair could climb towards 1.0942. On further strength, the focus shifts to the 2023 high.

EUR/USD CHART

Recommended by Diego Colman

Get Your Free Equities Forecast

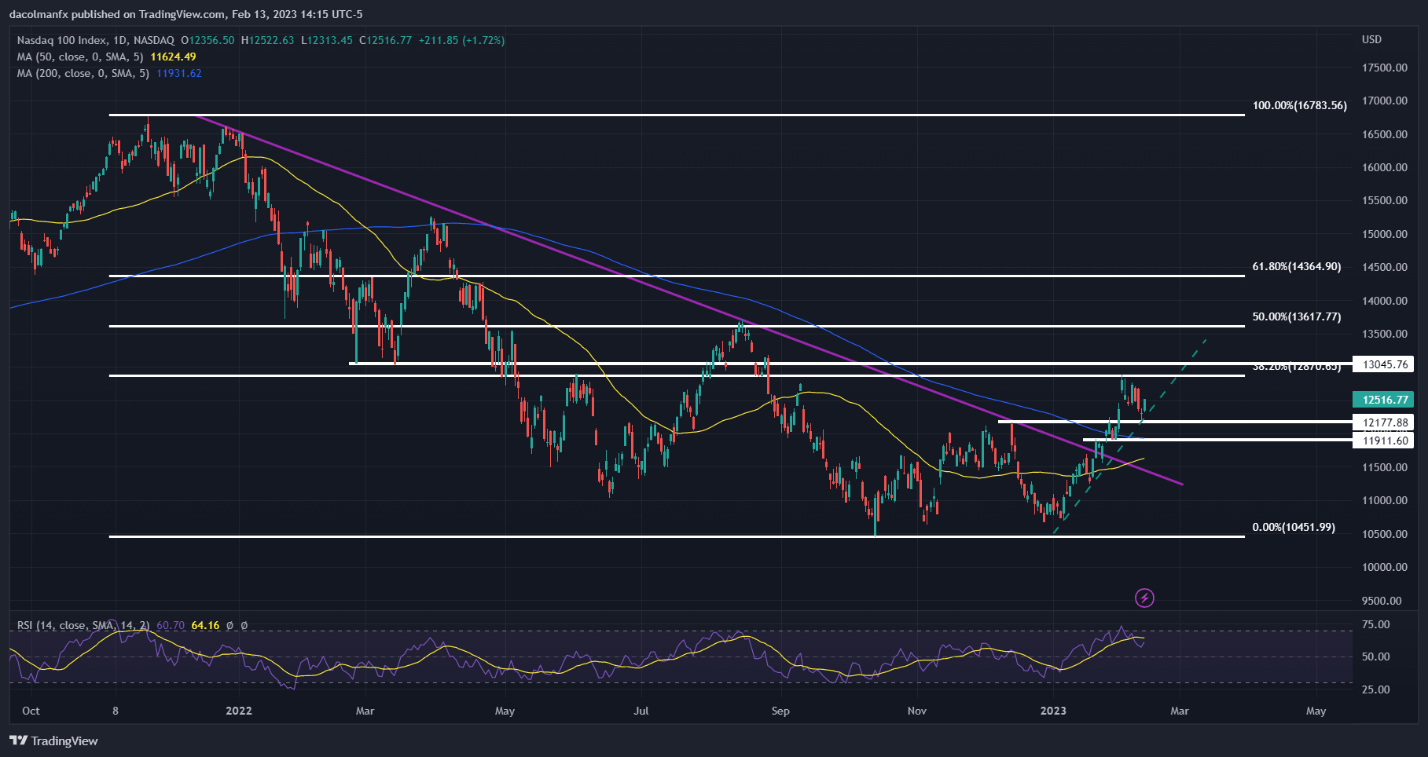

NASDAQ 100 TECHNICAL ANALYSIS

The Nasdaq 100 resumed its ascent, bouncing off short-term trendline support near 12,200 after last week’s sell-off. If bulls retain control of the market in the coming sessions, initial resistance sits around the January’s high, which also corresponds to the 38.2% Fib retracement of the 2021-2022 slump. On the other hand, if sellers resurfaced and spark a bearish reversal, support lies at 12,200 and 11,900 thereafter near the 200-day simple moving average.

NASDAQ 100 CHART

Source: TradingView

Recommended by Diego Colman

Get Your Free Gold Forecast

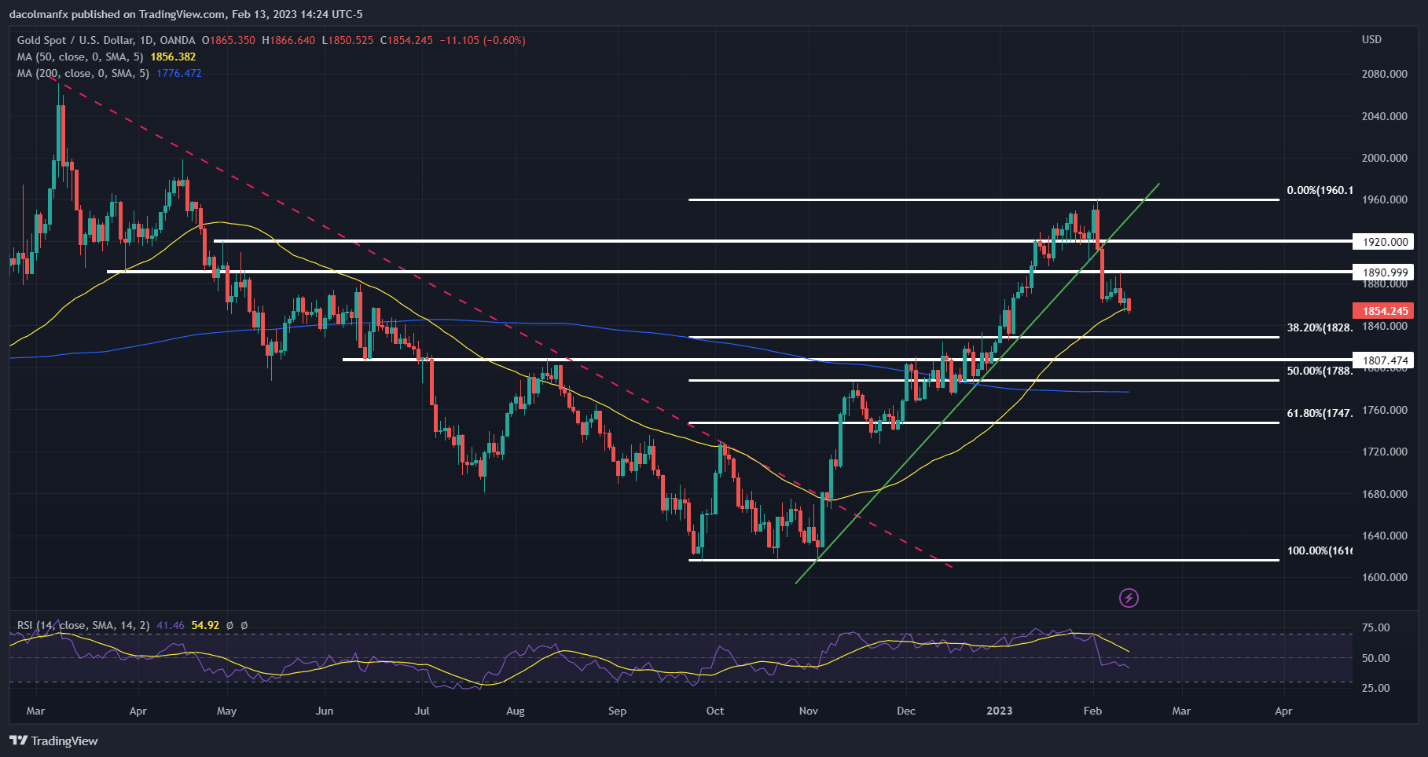

GOLD PRICES TECHNICAL ANALYSIS

Gold prices have dropped below the 50-day simple moving average at the time of writing. If this breakdown is sustained, bears could soon launch an attack on $1,828, the 38.2% Fibonacci retracement of the September 2022/February 2023 rally. On further weakness, the focus shifts to $1,805. On the flip side, if prices revert higher, the first resistance to consider rests at $1,890, followed by $1,920.

GOLD PRICES CHART

Source: TradingView

[ad_2]