EUR/USD Forecast – Prices, Charts, and Analysis

Download our Brand New Q1 2024 Euro Forecast

Recommended by Nick Cawley

Get Your Free EUR Forecast

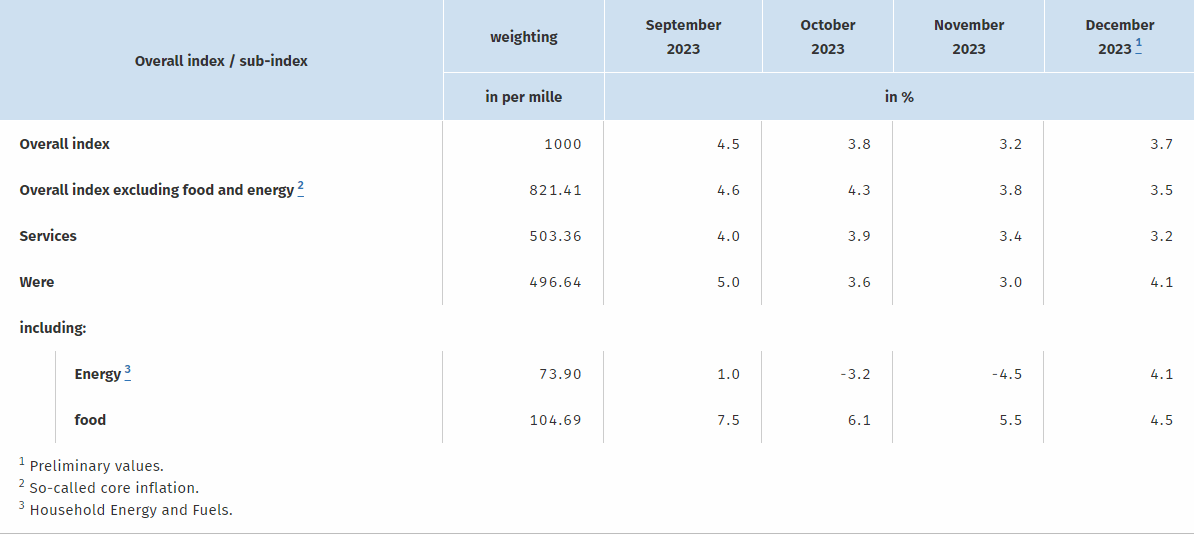

Provisional German inflation rose in December, in line with market forecasts, as last year’s subsidies rolled off the annual figures. Energy inflation also jumped to 4.1% in December after a negative 4.5% in November

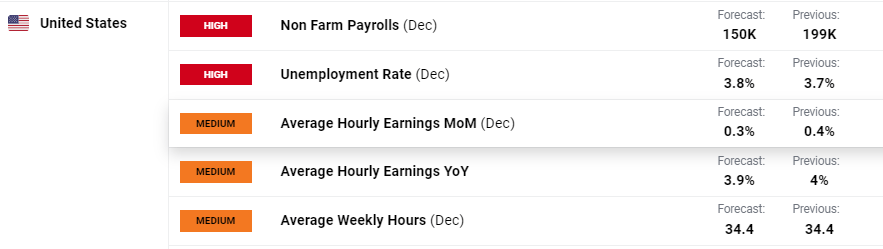

The main point of note on this week’s economic calendar however will be released on Friday, where the latest US NFP report is expected to show that 150k new jobs were created in December compared to 199k in November. Average earnings – both monthly and annual – are seen marginally lower, while the unemployment rate is expected to nudge higher to 3.8%.

For all market-moving events and data releases, see the real-time DailyFX Calendar

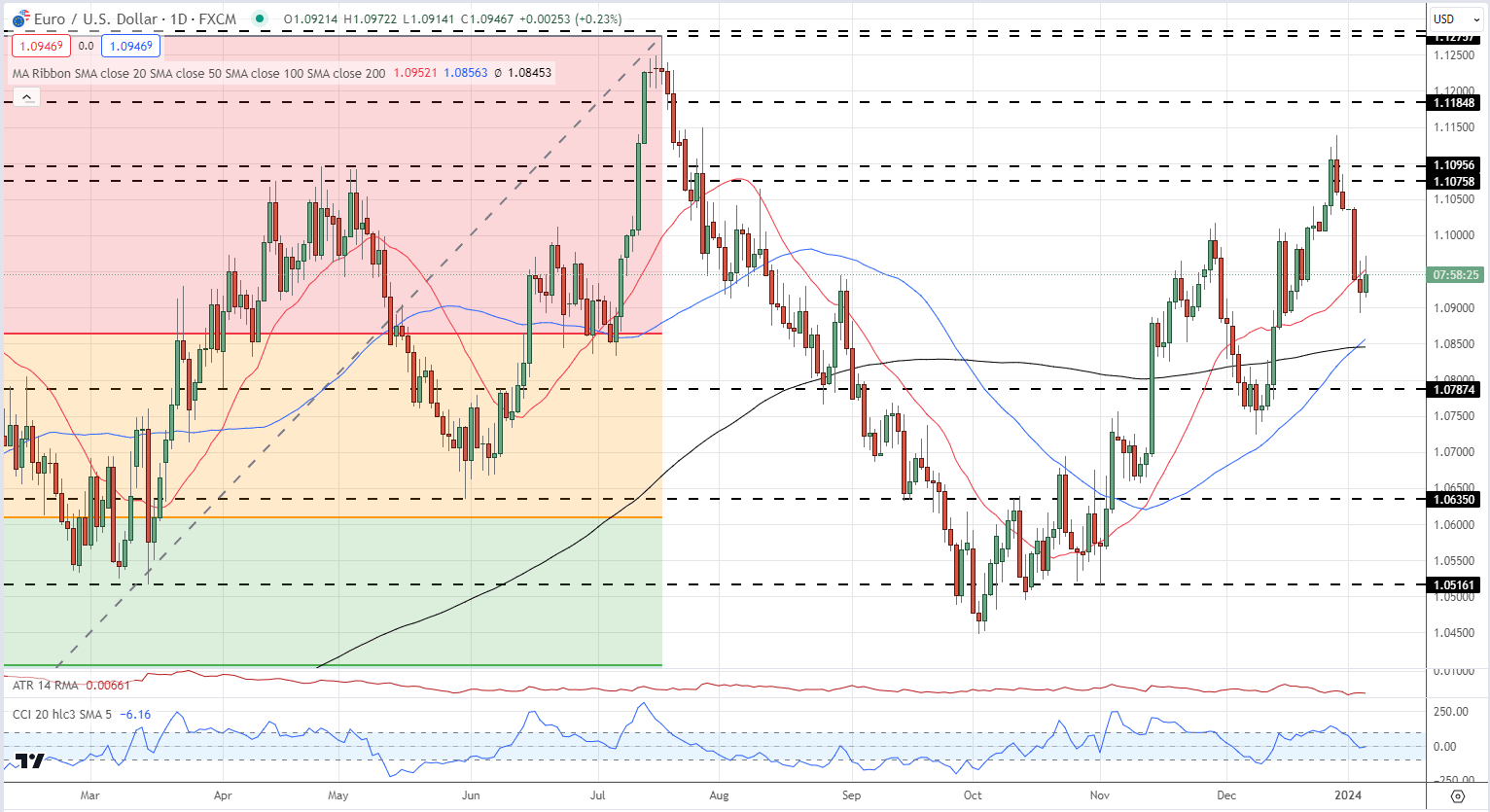

EUR/USD remains in an upward channel despite the recent sell-off. The move lower in EUR/USD has been driven by a pick-up in the US dollar as the market reassesses the punchy US rate cut expectations of late last year. The US 10-year benchmark now yields 4.00% after touching a sub3.80% multi-month low in late December, while the rate-sensitive UST 2-year is now offered at 4.385% compared to December’s 4.22% nadir. There is a cluster of recent lows around 1.0900 on the daily EUR/USD chart that should provide initial support for the pair, followed by the 23.6% Fibonacci retracement level at 1.0865. initial resistance at 1.1000. All eyes are now on tomorrow’s US Jobs Report.

EUR/USD Daily Chart

Charts Using TradingView

IG retail trader data shows 51.76% of traders are net-long with the ratio of traders long to short at 1.07 to 1.The number of traders net long is 6.87% higher than yesterday and 62.30% higher than last week, while the number of traders net short is 6.09% lower than yesterday and 30.11% lower than last week.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | 6% | -1% | 3% |

| Weekly | 39% | -24% | -3% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.